Score

NeoProFx

China|2-5 years|

China|2-5 years| https://neoprofx.com/index.php

Website

Rating Index

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

NeoProFx

NeoProFx

China

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:100 |

| Minimum Deposit | $25000 |

| Minimum Spread | from 1 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 1 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:100 |

| Minimum Deposit | $10000 |

| Minimum Spread | from 1.5 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.50 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:500 |

| Minimum Deposit | $5000 |

| Minimum Spread | 2.5 - 2 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.10 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:1000 |

| Minimum Deposit | $1000 |

| Minimum Spread | 3.5 - 3 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.05 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

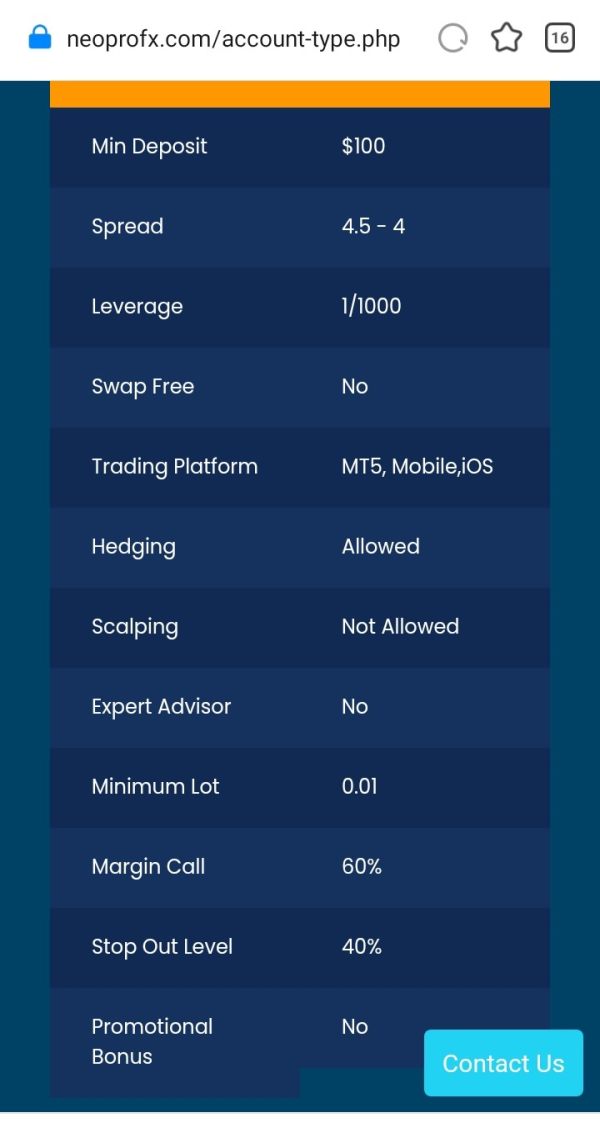

| Maximum Leverage | 1:1000 |

| Minimum Deposit | $100 |

| Minimum Spread | 4.5 - 4 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0.01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed NeoProFx also viewed..

XM

VT Markets

FBS

Vantage

NeoProFx · Company Summary

General Information & Regulation

NeoProFx is allegedly a forex and CFD broker registered in China that claims to provide retail traders with various tradable financial instruments with flexible leverage up to 1:1000 and variable spreads on the MT5 for PC, Android and iOS trading platforms, as well as a choice of five different live account types and 24/7 customer support service.

NeoProFx is a China-based forex broker that offers trading services in various financial instruments, including forex, world indices, metals, energy, future currency, and softs. The company was founded 2-5 years ago and is not regulated by any financial authority. It provides different account types, ranging from the Basic account with a minimum deposit of $100 to the VIP account with a minimum deposit of $25,000. The maximum leverage varies from 1:1000 for the Basic and Classic accounts to 1:100 for the Pro and VIP accounts.

One of the major drawbacks of NeoProFx is the lack of regulation, which poses inherent risks for traders. Regulation provides oversight and safeguards for traders, ensuring transparency, accountability, and client protection. Without regulation, there is a higher risk of fraud and financial misconduct. However, NeoProFx offers a wide range of market instruments and trading platforms, including MetaTrader 5 (MT5), to cater to the diverse needs of its clients.

The customer support at NeoProFx is available 24/7 through email and message submission. The company supports various deposit and withdrawal methods, including cryptocurrencies, e-wallets, bank wire, and credit/debit cards. Traders should be aware of the varying spreads and commissions depending on the account type they choose. It is important for potential clients to carefully consider the risks associated with trading with an unregulated broker and conduct thorough research before making any investment decisions.

Here is the home page of this brokers official site:

Pros and Cons

NeoProFx offers a wide range of tradable assets and account types, competitive leverage ratios, and a user-friendly trading platform. The availability of Islamic accounts and extensive customer support options are also beneficial. However, the lack of regulation, high minimum deposit requirements, varying spreads based on account types, limited customer support options, and potential risk of fraud are important factors to consider. Traders should carefully assess the pros and cons before deciding to trade with NeoProFx.

| Pros | Cons |

| Wide range of tradable assets | Lack of regulatory oversight |

| Multiple account types to choose from | High minimum deposit requirements |

| Extensive customer support availability | Varying spreads based on account types |

| Availability of Islamic (swap-free) account | No information on demo account |

| User-friendly MetaTrader 5 platform | Limited customer support options |

| Diversification opportunities | Limited deposit and withdrawal options |

| Access to global markets and indices | Lack of information on fees and commissions |

Is NeoProFx Legit?

NeoProFX is a forex broker that operates without valid regulation. There is no regulatory information available for NeoProFX. The company is registered in China and its website is https://neoprofx.com/index.php.

It is important to note that trading with an unregulated broker carries inherent risks. Regulation provides oversight and safeguards for traders, ensuring that brokers adhere to certain standards and regulations to protect clients' interests. Without regulation, there is a lack of transparency and accountability, which may increase the risk of fraud, financial misconduct, and inadequate client protection.

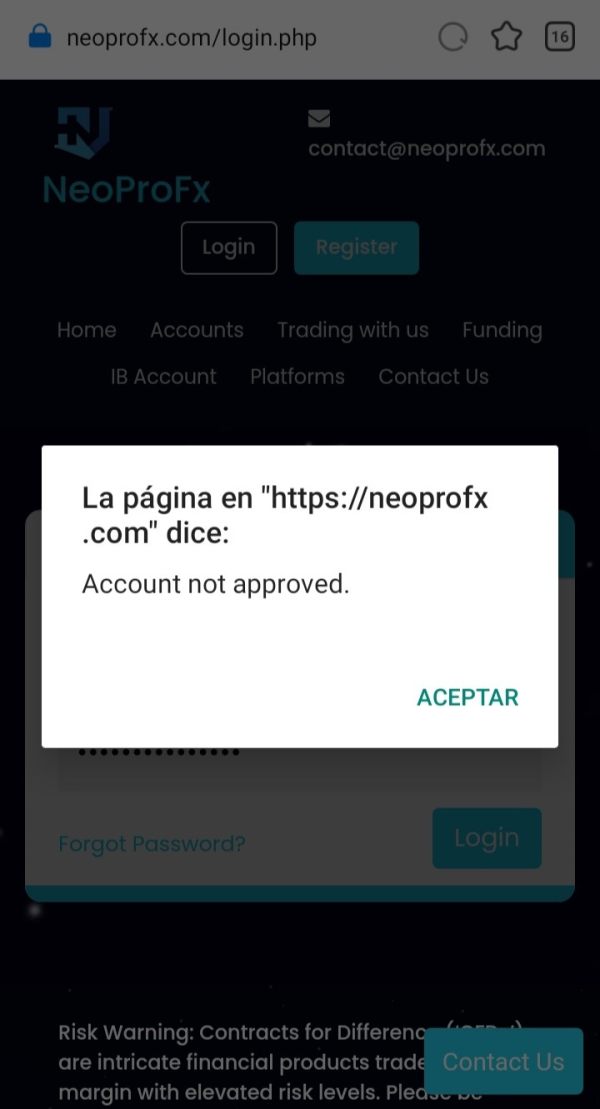

Negative Reviews

A trader shared his terrible trading experience on the NeoProFx platform at WikiFX. He said this platform is a scam and he was unable to withdraw. It is necessary for traders to read reviews left by some users before choosing forex brokers, in case they are defrauded by scams.

Market Instruments

NeoProFX offers a wide range of market instruments to cater to the diverse trading preferences of its clients. Here is a description of the available instruments:

1. Forex:

Clients of NeoProFX have access to the forex market, which is the most liquid market in the world. They can trade a variety of currency pairs, including major, minor, and exotic pairs. NeoProFX provides low commissions and competitive spreads for forex trading. Traders can take advantage of leverage of up to 500:1, allowing them to amplify their trading positions.

2. World Indices:

Traders can access global markets and trade world indices on NeoProFX's various trading platforms. With just one click and hassle-free registration, clients can engage in index trading, taking advantage of market movements and opportunities.

3. Metals:

NeoProFX offers the opportunity to trade in various metals, including gold, silver, platinum, and copper. Clients can trade these metals in the spot market as well as in futures contracts. Trading in metals provides diversification and the potential to profit from price movements in these commodities.

4. Energy:

Traders can participate in the energy market by trading in energy products such as crude oil and natural gas. These energy products offer opportunities to benefit from the major fluctuations in energy prices. NeoProFX enables clients to engage in energy trading and capitalize on market trends.

5. Future Currency:

NeoProFX provides various future currency contracts, allowing traders to implement and hedge risks associated with currency fluctuations. These contracts enable traders to speculate on the future movements of currency pairs and manage their exposure to currency risk.

6. Softs:

NeoProFX now offers the opportunity to trade in several agricultural products, including corn, soybean, cocoa, coffee, and more. Clients can take advantage of price fluctuations in these soft commodities, diversifying their trading portfolio and capitalizing on opportunities in the agricultural market.

Pros and Cons

| Pros | Cons |

| Wide range of market instruments | Risk associated with leveraged trading |

| Access to the forex market | Volatility and unpredictability of markets |

| Potential for profiting from price movements | Potential for losses in speculative trading |

| Opportunity for diversification | Limited availability of certain instruments |

| Ability to capitalize on market trends | Dependence on market conditions |

| Regulatory and legal risks |

Account Types

NeoProFx claims to offer five types of trading accounts, namely Basic, Classic, Standard, Pro and VIP. The minimum initial deposit amount is $100 for the Basic account, while the other four account types have much higher minimum initial capital requirements of $1,000, $5,000, $10,000 and $25,000 respectively.

1. BASIC:

The Basic account requires a minimum deposit of $100. It offers spreads ranging from 4.5 to 4 pips, providing a competitive trading environment. The leverage available is 1:1000, allowing traders to amplify their positions. The Basic account does not offer a swap-free option, but it supports the popular trading platform MT5, along with mobile and iOS platforms. Hedging is allowed, but scalping and expert advisors are not permitted. The minimum lot size is 0.01, and the margin call level is set at 60%, with a stop out level of 40%. There are no promotional bonuses available for the Basic account.

2. CLASSIC:

The Classic account requires a minimum deposit of $1000. It offers tighter spreads compared to the Basic account, ranging from 3.5 to 3 pips. The leverage is also 1:1000, providing ample trading opportunities. Similar to the Basic account, the Classic account does not have a swap-free option. Traders can use the MT5 platform, as well as mobile and iOS platforms for their trading activities. Hedging is allowed, but scalping and expert advisors are not supported. The minimum lot size for this account is 0.05. The margin call level is set at 60%, and the stop out level is 40%. No promotional bonuses are provided for the Classic account.

3. STANDARD:

The Standard account requires a minimum deposit of $5000. It offers even tighter spreads, ranging from 2.5 to 2 pips. The leverage available is 1:500, providing traders with a balanced risk-to-reward ratio. Similar to the previous accounts, the Standard account does not have a swap-free option. Traders can use the MT5 platform, as well as mobile and iOS platforms. Hedging is allowed, while scalping and expert advisors are not supported. The minimum lot size for this account is 0.10. The margin call level is set at 50%, and the stop out level is 30%. Unlike the previous two accounts, the Standard account does offer promotional bonuses.

4. PRO:

The Pro account requires a minimum deposit of $10,000. It offers the tightest spreads of 1.5 pips, providing traders with excellent pricing. The leverage available is 1:100, offering more conservative trading conditions. The Pro account supports swap-free trading for those who follow Islamic principles. Traders can use the MT5 platform, as well as mobile and iOS platforms. Hedging is allowed, while scalping and expert advisors are also supported. The minimum lot size for this account is 0.50. The margin call level is set at 40%, and the stop out level is 20%. Promotional bonuses are available for the Pro account.

5. VIP:

The VIP account is designed for high-net-worth individuals and requires a minimum deposit of $25,000. It offers the tightest spreads of 1 pip, providing the best pricing available. The leverage available is 1:100, similar to the Pro account. The VIP account also offers swap-free trading for those who follow Islamic principles. Traders can use the MT5 platform, as well as mobile and iOS platforms. Hedging is allowed, and both scalping and expert advisors are supported. The minimum lot size for this account is 1. The margin call level is set at 40%, and the stop out level is 20%. Like the Pro account, the VIP account offers promotional bonuses.

Pros and Cons

| Pros | Cons |

| Multiple trading platforms supported | No swap-free option available |

| Access to financial markets | Scalping and expert advisors not permitted in some accounts |

| Various account options to cater to traders' needs | Higher minimum deposits for some accounts |

| Hedging allowed in most accounts | Limited promotional bonuses |

| Limited leverage options |

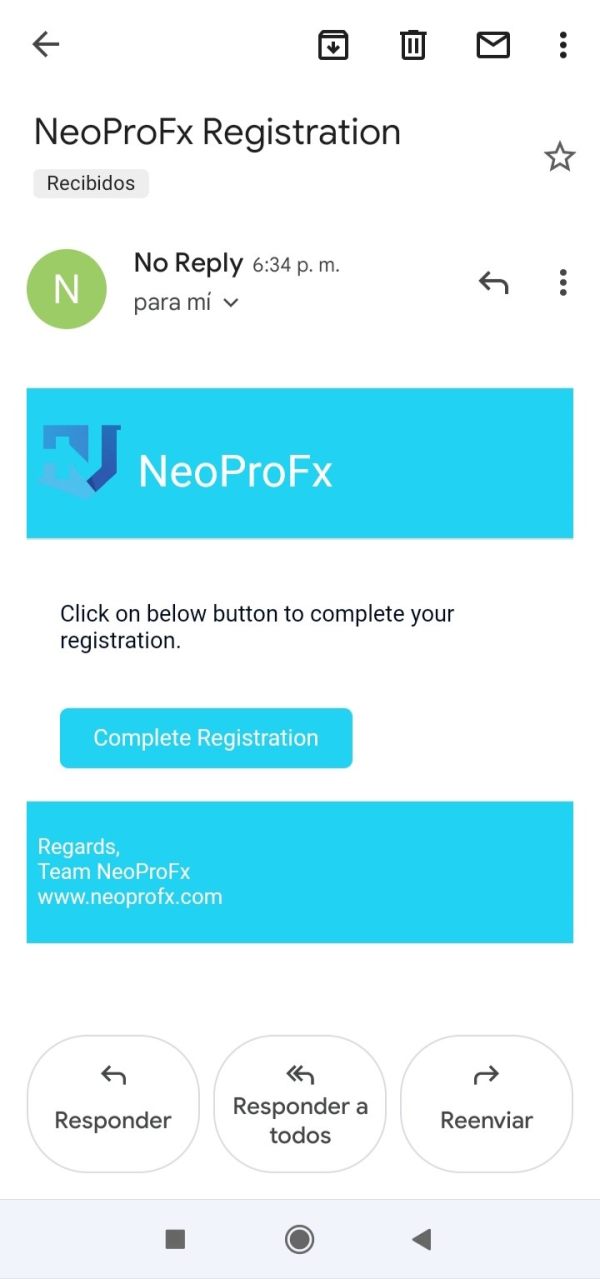

To open a live trading account with NeoProFX, follow these steps:

1. Visit the NeoProFX website: Go to the NeoProFX website using a web browser of your choice.

2. Click on “Open Live Account”: Look for the “Open Live Account” or similar button/link on the website's homepage or in the main navigation menu. Click on it to proceed with the account opening process.

3. Fill in the required information: You will be directed to a registration form. Fill in your first name, last name, mobile number, and email address. Select your country from the provided options.

4. Complete the registration process: Follow the on-screen instructions to complete the registration process. This may involve providing additional personal information, such as your address and date of birth. Make sure to review the terms and conditions before proceeding.

5. Account verification: Once you have completed the registration, you may be required to verify your identity and address. NeoProFX may request specific documents, such as a copy of your identification document (e.g., passport or driver's license) and proof of address (e.g., utility bill or bank statement).

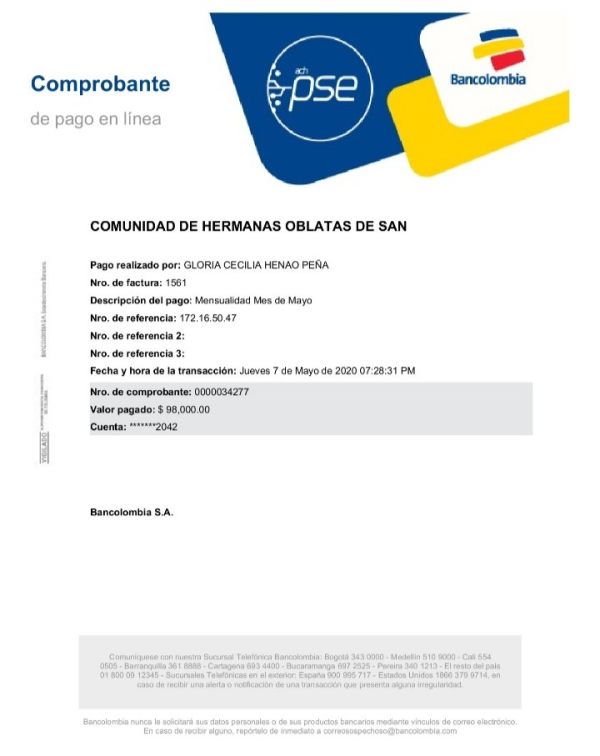

6. Fund your trading account: After your account is verified, you will need to fund your trading account with the required minimum deposit. NeoProFX offers various deposit methods, such as bank wire transfers, credit/debit cards, and electronic payment processors. Choose the method that suits you best and follow the instructions provided.

7. Start trading: Once your trading account is funded, you can log into the trading platform provided by NeoProFX and start trading in the available financial instruments.

Leverage

NeoProFX offers varying leverage ratios based on the chosen account types. The Basic and Classic accounts have a maximum leverage of 1:1000, the Standard account offers 1:500, and the Pro and VIP accounts provide 1:100 leverage. Traders should be aware that higher leverage increases both profit potential and the risk of losing deposited capital. It is important to use leverage wisely and implement risk management strategies to protect against potential losses.

Spreads & Commissions

NeoProFx offers different spreads and commission structures based on the account types available. Here is a brief description of the spreads and commissions offered:

Spread Variations by Account Type:

NeoProFx provides varying spreads for different account types. For the Basic account, the spread typically floats around 4.5-4 pips. The Classic account offers a narrower spread range of 3.5-3 pips. The Standard account further tightens the spreads to approximately 2.5-2 pips. Clients on the Pro account can enjoy even tighter spreads starting from 1.5 pips, while VIP account holders benefit from spreads as low as 1 pip. These variations in spreads across account types allow traders to choose an account that aligns with their trading preferences and objectives.

Forex Account Types and Commissions:

NeoProFx offers two main forex account types, each with its own commission structure. The Standard account does not charge any commissions. This account type is suitable for those who are new to trading or prefer holding positions over longer periods.

On the other hand, the Razor 0.0 account is tailored for scalpers or algorithmic traders who require the tightest spreads available. This account offers spreads starting from 0.0 pips, providing traders with institutional-grade pricing. However, a commission of AUD€7 per lot is charged for trades executed on the Razor 0.0 account.

By providing varying spreads and commission structures, NeoProFx aims to accommodate different trading styles and preferences, ensuring that traders have options to suit their specific needs. Traders can select the account type that best aligns with their trading strategies and cost considerations.

| Pros | Cons |

| Varying spreads to cater to different trading preferences and objectives | Commission charges on Razor 0.0 account |

| Accommodation of different trading styles and cost considerations | Commission-free trading on Standard account |

| Institutional-grade pricing on Razor 0.0 account | Higher spreads for Basic and Classic accounts |

| Options for scalpers and algorithmic traders with tight spreads |

Trading Platform Available

Platforms available for trading at NeoProFx are MT5 for PC, Android and iOS. In any case, we recommend using MT4 or MT5 for your trading platform. Forex traders praise MetaTrader's stability and trustworthiness as the most popular forex trading platform. Expert Advisors, Algo trading, Complex indicators, and Strategy testers are some of the sophisticated trading tools available on this platform. There are currently 10,000+ trading apps available on the Metatrader marketplace that traders can use to improve their performance. By using the right mobile terminals, including iOS and Android devices, you can trade from anywhere and at any time through MT4 and MT5.

Deposit & Withdrawal

NeoProFX provides options for depositing and withdrawing funds. Here is a description of the deposit and withdrawal process:

Funding Your Account:

NeoProFX offers a variety of quick and secure methods for funding your trading account. You can choose from options such as Bitcoin, Ethereum, Litecoin, Ripple, Neteller, Perfect Money, Payeer, Skrill, Advcash, Bank Wire, and Credit/Debit Card.

Third-Party Deposits:

NeoProFX does not accept third-party deposits. It is important to ensure that all deposits come from an account in the same name as your NeoProFX trading account. This policy helps maintain security and prevent potential fraudulent activities.

Fees:

NeoProFX does not charge fees to process deposits. However, it is worth noting that you may incur fees from international banking institutions and payment processors when depositing funds. It is advisable to check with your bank or payment processor regarding any applicable fees before initiating a deposit.

Withdrawal Process:

The withdrawal process at NeoProFX follows the same mode as the deposit. This means that the funds will be withdrawn using the same method that was used for the deposit. It ensures convenience and simplifies the process for clients.

Responsibility for Funds:

NeoProFX does not assume responsibility for funds sent via traditional mail. It is important to use the designated deposit methods to ensure a secure transfer of funds. Additionally, funds will be considered available for trading only after they have been deposited, cleared, and credited to your trading account.

| Pros | Cons |

| Variety of options for funding | Potential fees from international banking institutions or payment processors |

| No fees for processing deposits | No responsibility for funds sent via traditional mail |

| Multiple cryptocurrency options for deposits | |

| Funds considered available for trading after deposit, clearance, and crediting |

Trading Platform

NeoProFx offers its clients the widely acclaimed MetaTrader 5 (MT5) trading platform for their forex trading activities. Considered a preferred choice among professional traders, MT5 is known for its convenience and functionality. It has become an industry standard in online forex trading.

The desktop version of MetaTrader 5 provides traders with the utmost freedom to implement their trading strategies. It supports the use of expert advisors (EAs), and traders worldwide have developed a vast number of EAs for this terminal. Clients of NeoProFx can easily adapt and utilize these EAs effectively when trading on NeoProFx servers. The MT5 desktop platform is available for traditional desktop computers, ensuring a seamless trading experience.

For traders who prefer the convenience of trading on mobile devices, NeoProFx offers the MT5 mobile application for Android-based smartphones. This mobile solution enables clients to monitor the market, execute trades, and take advantage of advanced features while on the go. The Android Trader solution ensures that forex trading is fast, straightforward, and secure on mobile devices.

Additionally, NeoProFx provides an MT5 iOS application for traders who use iPhones or iPads. Forex traders using iPhone 2G, 3G, 3Gs, or 4G can download the MetaTrader 5 application free of charge from Apple's App Store. The iOS application offers a fingertip trading experience, allowing traders to access the markets and manage their trades from their Apple devices.

Bonuses & Fees

NeoProFx claims to offer a promotional bonus on the Standard, Pro and VIP account types, yet we cannot be sure if the bonus can be withdrawn without any limitation.

In any case, you should be very cautious if you receive a bonus. First of all, bonuses aren't client funds, they're company funds, and fulfilling the heavy requirements that are usually attached to them can prove a very daunting and difficult task. Remember that brokers who are regulated and legitimate do not offer bonuses to their clients.

Customer Support

NeoProFX provides customer support services to assist traders with their inquiries, concerns, and issues. Here are the key features of NeoProFX's customer support:

Contact Options:

Traders can reach out to NeoProFX's customer support team through email. They can send their queries or requests to the provided email addresses, such as contact@neoprofx.com or info@neoprofx.com. By emailing their concerns, traders can initiate communication with the support team and expect a response.

Message Submission:

NeoProFX offers a message submission option on their website. Traders can fill out a form with their name, email address, and the message they want to convey. This allows them to directly communicate their questions or issues to the professional team at NeoProFX. Submitting the form ensures that traders' inquiries are received and addressed promptly.

Customer Support Availability:

NeoProFX's customer support team is available 24/7, indicating their commitment to providing assistance at any time. Whether traders have questions about trading, account management, technical issues, or any other concerns, they can rely on NeoProFX's support team to be available round the clock.

Professional Assistance:

The customer support team at NeoProFX consists of professionals who are trained to provide knowledgeable and prompt assistance. They are equipped to answer questions, provide guidance, and resolve problems to ensure a pleasant and successful trading experience for clients.

Risk Warning

Online trading involves a significant level of risk and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

Conclusion

In conclusion, NeoProFX is an unregulated forex broker registered in China. While the company offers a wide range of tradable assets and account types to cater to different trading preferences, its lack of regulation poses significant risks to traders. Trading with an unregulated broker can lead to a lack of transparency and accountability, increasing the potential for fraud and inadequate client protection. Additionally, NeoProFX's minimum deposit requirements vary based on account type, and its leverage ratios and spreads also differ. The company provides the popular MetaTrader 5 trading platform and offers customer support 24/7 via email and message submission. However, traders should carefully consider the disadvantages and potential risks associated with trading with an unregulated broker before engaging with NeoProFX.

FAQs

Q: What market instruments can I trade on NeoProFX?

A: NeoProFX offers various market instruments, including forex, world indices, metals, energy products, future currency contracts, and soft commodities.

Q: What are the different types of live trading accounts offered by NeoProFX?

A: NeoProFX offers several live trading account types: Basic, Classic, Standard, Pro, and VIP. Each account type has different features and minimum deposit requirements.

Q: What are the pros and cons of trading on NeoProFX?

A: Pros of trading on NeoProFX include access to a wide range of market instruments, spreads, and leverage options. Cons may include potential risks associated with trading and market volatility.

Q: How do I open an account with NeoProFX?

A: To open an account with NeoProFX, visit their website, click on “Open Live Account,” fill in the required information, complete the registration process, verify your identity, fund your trading account, and start trading.

Q: What is the leverage offered by NeoProFX?

A: The leverage ratios offered by NeoProFX vary based on the chosen account type, ranging from 1:1000 to 1:100. Higher leverage increases profit potential but also comes with higher risk.

Q: What are the spreads and commissions on NeoProFX?

A: NeoProFX offers varying spreads based on the account types, ranging from 4.5-4 pips to as low as 1 pip. The commission structure depends on the account type and trading activity.

Q: How can I deposit and withdraw funds on NeoProFX?

A: NeoProFX provides various deposit and withdrawal methods, including bank wire transfers, credit/debit cards, and electronic payment processors. The funds will be withdrawn using the same method used for the deposit.

Q: What trading platforms are available on NeoProFX?

A: NeoProFX offers the MetaTrader 5 (MT5) trading platform, which is available as a desktop version for traditional computers and as mobile applications for Android and iOS devices.

Q: How can I contact customer support at NeoProFX?

A: You can contact NeoProFX's customer support team through email or by submitting a message on their website. The support team is available 24/7 to assist you with any inquiries or issues you may have.

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now