Score

Investizo

Saint Vincent and the Grenadines|5-10 years| Benchmark D|

Saint Vincent and the Grenadines|5-10 years| Benchmark D|https://investizo.com/

Website

Rating Index

Benchmark

Benchmark

D

Average transaction speed (ms)

MT4/5

Full License

Investizo-Real

United Kingdom

United KingdomInfluence

C

Influence index NO.1

United Arab Emirates 3.40

United Arab Emirates 3.40Benchmark

Speed:D

Slippage:B

Cost:D

Disconnected:C

Rollover:AA

MT4/5 Identification

MT4/5 Identification

Full License

United Kingdom

United KingdomInfluence

Influence

C

Influence index NO.1

United Arab Emirates 3.40

United Arab Emirates 3.40Surpassed 21.30% brokers

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

+996 700495212

Other ways of contact

Broker Information

More

Investizo LTD

Investizo

Saint Vincent and the Grenadines

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

WikiFX Verification

| Benchmark | D |

|---|---|

| Maximum Leverage | 1:1000 |

| Minimum Deposit | $ 10 |

| Minimum Spread | from 1.5 |

| Products | Currencies, Cryptocurrencies, Metals, Energy, CFDs, Indices |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | From $ 5.00 |

| Benchmark | D |

|---|---|

| Maximum Leverage | 1:1000 |

| Minimum Deposit | $ 10 |

| Minimum Spread | from 0.1 |

| Products | Currencies, Cryptocurrencies, Metals, Energy, CFDs, Indices |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | From $ 5.00 |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed Investizo also viewed..

XM

ATFX

FP Markets

GO MARKETS

Investizo · Company Summary

| Aspect | Information |

| Company Name | Investizo |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded Year | 2-5years |

| Regulation | Not regulated |

| Minimum Deposit | Starts at $10 |

| Maximum Leverage | Up to 1:500 |

| Spreads | Floating spreads, specifics not provided |

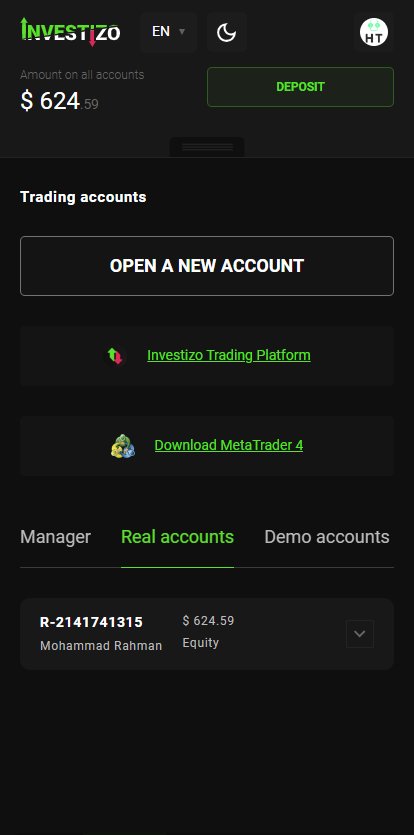

| Trading Platforms | MetaTrader 4, Investizo Trading Platform |

| Tradable Assets | Forex, cryptocurrencies, commodities, stocks, indices |

| Account Types | ECN,Standard Account |

| Customer Support | Limited support through email and phone |

| Deposit & Withdrawal | Multiple methods |

| Educational Resources | Lack of comprehensive resources |

Overview of Investizo

Investizo, headquartered in Saint Vincent and the Grenadines, has been operating for an estimated 2 to 5 years. Notably, the platform functions without regulation from governing authorities. With a low minimum deposit starting at $10, Investizo caters to traders seeking entry at a minimal cost, offering a substantial maximum leverage of up to 1:500. While the platform supports a diverse range of tradable assets like Forex, cryptocurrencies, commodities, stocks, and indices, specific details regarding spreads are not explicitly outlined. Traders can access trading activities via the widely utilized MetaTrader 4 platform and the bespoke Investizo Trading Platform. Investizo presents account types including ECN and a Standard Account to accommodate varying trading preferences. However, users might encounter limitations with customer support, primarily accessible through email and phone. The platform facilitates deposits and withdrawals through multiple methods.

Is Investizo legit or a scam?

Investizo operates without regulation from any governing authority, raising concerns about transparency and oversight within the exchange. Unregulated platforms lack the legal protections and oversight offered by regulatory bodies, amplifying risks of fraud, market manipulation, and security breaches. The absence of proper regulation may present challenges for users in resolving disputes or seeking recourse in case of issues. Moreover, this lack of oversight contributes to a less transparent trading environment, complicating users' ability to assess the exchange's legitimacy and reliability.

Pros and Cons

| Pros | Cons |

| Diverse tradable assets | Lack of educational resources |

| Multiple payment methods | Absence of regulatory oversight |

| User-friendly interfaces | Limited customer support options |

| Low minimum deposit |

Pros:

Diverse Tradable Assets: Investizo offers a wide array of tradable assets, including Forex, cryptocurrencies, commodities, stocks, and indices. This diversity enables traders to create diversified portfolios and explore various markets.

2. Multiple Payment Methods: The platform supports multiple payment methods, facilitating convenience for traders to fund their accounts. Options like bank transfers, credit/debit cards, and electronic payment systems offer flexibility for users based on their preferences.

3. User-Friendly Interfaces: Investizo provides user-friendly interfaces and trading platforms, ensuring a seamless and intuitive trading experience for users. These interfaces are designed to be easily navigable, aiding traders, especially those new to the platform.

4. Low Minimum Deposit: The platform maintains a low minimum deposit requirement, typically starting at $10. This low entry point allows users with different budget constraints to start trading and access the platform's services.

Cons:

Lack of Educational Resources: Investizo lacks comprehensive educational resources such as tutorials, guides, webinars, and blogs. This absence limits new users' ability to learn about trading strategies, market analysis, and platform functionalities, potentially hindering their trading success.

2. Absence of Regulatory Oversight: The platform operates without regulation from any governing authority, leading to concerns about transparency and user protection. Regulatory oversight is crucial for ensuring adherence to industry standards and providing a level of trust and security for traders.

3. Limited Customer Support Options: Investizo offers limited customer support avenues. Traders might face challenges in obtaining immediate or varied assistance, affecting the responsiveness and accessibility of support services when needed.

Market Instruments

Investizo offers an extensive range of trading assets spanning various markets:

Forex (FX): Investizo provides access to the Forex market, allowing traders to engage in currency pairs such as EUR/USD, GBP/JPY, or AUD/CAD. This enables speculation on the fluctuations in exchange rates between different currencies.

2. Cryptocurrencies (BTC): The platform includes cryptocurrencies like Bitcoin (BTC), offering opportunities for traders to participate in the crypto market and speculate on the price movements of digital currencies.

3. Metals: Investizo may offer trading opportunities in precious metals such as gold (XAU), silver (XAG), platinum, or palladium. Traders can speculate on the price movements of these metals.

4. Energy: The platform might provide trading options in energy commodities like crude oil (WTI and Brent) and natural gas. Traders can take positions based on price fluctuations in the energy markets.

5. Contracts for Difference (CFDs): Investizo could offer CFDs on various instruments, allowing traders to speculate on price movements without owning the underlying asset directly. This might include CFDs on stocks, indices, commodities, or cryptocurrencies.

6. Indices (Ind): Investizo may offer trading in stock indices, representing the performance of a group of stocks from a particular market or sector, such as the S&P 500, NASDAQ, or FTSE 100. Traders can speculate on the overall performance of these indices.

These trading assets across FX, cryptocurrencies, metals, energy commodities, CFDs, and indices provide traders with a diverse array of options to build portfolios and engage in various markets based on their trading strategies and preferences.

Account Types

Investizo offers access to distinct account types, each designed to cater to specific trading preferences and needs.

REAL ECN Account: This account type requires a minimum deposit of $10. It operates on a commission-based structure, with commissions starting from $5.00 per trade. The account features floating spreads, starting from as low as 0.1, allowing traders access to competitive pricing. Investors using the REAL ECN account can trade using the industry-standard MetaTrader 4 (MT4) platform across desktop and mobile devices, including iOS and Android.

REAL STANDARD Account: Similarly, the REAL STANDARD account also necessitates a minimum deposit of $10. Unlike the REAL ECN, this account operates on a commission-free model, with no charges per trade. However, it features slightly wider floating spreads, commencing from 1.5, providing a more accessible option for traders seeking a different fee structure. Like the REAL ECN, the REAL STANDARD account utilizes the versatile MetaTrader 4 (MT4) platform, available on desktop, iOS, and Android devices.

How to Open an Account?

Here's a step-by-step guide on how to open an account with Investizo:

Visit the Website: Access Investizo's official website and locate the “Open Account” or “Sign-Up” section. This is often prominently displayed on the homepage.

2. Choose Account Type: Select the preferred account type based on your trading preferences—REAL ECN or REAL STANDARD.

3. Fill out the Application: Complete the online application form with accurate personal information. Provide details such as name, contact information, and any necessary identification documents as required by the platform. Ensure the information is correct for smooth verification.

4. Verification Process: Submit the necessary verification documents, such as identification (ID, passport), proof of address (utility bill, bank statement), and any additional documents requested by Investizo. The platform typically verifies these documents to adhere to regulatory standards.

5. Deposit Funds: Once your account is verified, proceed to fund your account. Follow the instructions provided by Investizo to deposit the required minimum amount or more, depending on the chosen account type and your trading goals. Common payment methods may include bank transfers, credit/debit cards, or online payment systems.

6. Start Trading: Upon successful funding, access the trading platform provided by Investizo, usually the MetaTrader 4 (MT4) platform. Familiarize yourself with the interface, tools, and available assets. Begin trading and managing your investments according to your strategy and risk preferences.

By following these steps, you can efficiently open an account with Investizo, ensuring compliance with their requirements while gaining access to their trading platform and services.

Leverage

Investizo provides a maximum leverage of up to 1:500 for trading, allowing users to control positions up to 500 times the amount of their initial investment. This leverage level can amplify both potential profits and losses, depending on market movements and trading decisions. Traders should carefully consider and manage leverage, ensuring it aligns with their risk tolerance and trading strategies when engaging in trading activities through Investizo's platform.

Spreads & Commissions

Here's a table summarizing the spreads and commissions for the REAL ECN and REAL STANDARD accounts at Investizo:

| Account Type | Minimum Deposit | Commission | Spread |

| REAL ECN | $10 | Starts from $5.00 | Floating, starts from 0.1 |

| REAL STANDARD | $10 | No commission | Floating, starts from 1.5 |

The REAL ECN account operates on a commission-based structure, where traders pay a commission starting from $5.00 per trade. It offers competitive floating spreads starting as low as 0.1, providing favorable pricing options. Conversely, the REAL STANDARD account operates on a commission-free model, making trading accessible without charges per trade. However, it features slightly wider floating spreads starting from 1.5, presenting an alternative fee structure for traders seeking a different pricing model.

Trading Platform

Investizo offers two primary trading platforms, providing traders with a choice based on their preferences and needs.

MetaTrader 4 (MT4): Renowned as a leading exchange trading platform, MetaTrader 4 (MT4) stands as a robust tool with numerous features catering to millions of traders worldwide. It seamlessly merges modern technologies with a user-friendly interface, equipping traders with advanced technical analysis tools, a flexible trading system, and advisors. The platform's mobile trading apps ensure accessibility on the go. MT4 boasts 3 chart types, 30 technical indicators, 23 analytical objects, and an extensive library of 1700 trading robots, empowering traders with diverse tools for analysis and decision-making.

Investizo Trading Platform: Additionally, Investizo introduces its exclusive Investizo Trading Platform, designed to enhance trading experiences further. This platform offers compatibility across devices and delivers buy or sell signals based on an indicator summary. Traders benefit from an economic calendar, touch-optimized interface, and comprehensive trading instrument details. Notably, this platform includes 5 chart types (Candles and Bars, Area and Line, Baseline, Empty Candles, Heiken Ashi), over 50 charting tools, 80+ technical indicators, and 3 price scales for varied technical analysis approaches (linear, percentage, logarithmic scales). Moreover, it enables traders to create price alerts, enhancing real-time monitoring and decision-making capabilities.

Both platforms, MetaTrader 4 and Investizo Trading Platform, offer a rich array of features, technical tools, and accessibility options, ensuring traders have versatile options to execute trades and analyze markets according to their preferences.

Deposit & Withdrawal

Payment Methods:

Investizo typically offers various payment methods for depositing funds into trading accounts. These methods often include bank transfers, credit/debit cards (Visa, Mastercard), and electronic payment systems. Additionally, some platforms might facilitate cryptocurrency deposits. Traders can select the most convenient payment method that aligns with their preferences and geographic location.

Minimum Deposit:

Investizo commonly stipulates a minimum deposit requirement for traders to fund their accounts. This minimum deposit amount is typically set at $10, offering traders a relatively low entry point to initiate trading activities on the platform. This low minimum requirement caters to traders with different budget constraints and preferences.

Payment Fees:

Investizo might maintain a transparent fee structure, detailing any fees associated with deposit transactions. Generally, the platform strives to offer deposit options with minimal or no fees. However, it's crucial for traders to verify any potential fees incurred during deposits, particularly related to bank transfers, currency conversions, or payment processor charges that might apply.

Payment Processing Time:

The processing time for deposits into Investizo trading accounts may vary depending on the chosen payment method. Usually, deposits via credit/debit cards or electronic payment systems tend to be processed instantly or within a short timeframe. However, bank transfers might take longer due to bank processing times and international transactions, potentially ranging from a few hours to several business days. It's advisable for traders to consider these processing times when funding their accounts, especially if they require immediate access to funds for trading purposes.

Customer Support

Investizo provides customer support through multiple channels, ensuring traders have access to assistance when needed. The platform offers support via phone and email:

Phone Support: Traders can reach out to Investizo's customer support team by dialing +996700495212. Phone support provides a direct and immediate means of communication for urgent inquiries or assistance needed during trading activities.

Email Support: Additionally, traders can contact Investizo's support team via email at support@investizo.com. Email support offers a written record of communication, allowing users to detail their queries comprehensively. It's an effective channel for less urgent inquiries or when detailed explanations or attachments are necessary.

Investizo aims to provide responsive and helpful customer support to address queries related to account management, technical issues, trading assistance, or general inquiries. However, the availability of customer support hours or specific response times for phone or email queries is not explicitly mentioned. Traders might need to verify the operational hours or expected response times for these support channels directly through Investizo's platform.

Educational Resources

Investizo faces a deficit in educational resources, posing challenges for new users aiming to navigate the platform and delve into cryptocurrency trading. Among the absent resources are a comprehensive user guide, instructional video tutorials, live webinars, and informative blogs, creating a void in fundamental learning tools for users.

This scarcity of educational materials on Investizo can significantly hinder the onboarding process for newcomers, hampering their ability to grasp the platform's functionalities and understand the nuances of cryptocurrency trading. Consequently, this dearth of guidance may result in missteps and financial losses, potentially discouraging novice traders from further engagement in the trading arena.

Conclusion

Investizo presents an array of advantages such as diverse tradable assets, multiple payment methods, user-friendly interfaces, and a low minimum deposit, offering accessibility and versatility to traders.

However, the platform faces significant drawbacks, notably the lack of comprehensive educational resources, absence of regulatory oversight, and limited customer support options. These disadvantages can hinder user learning, transparency, and access to immediate assistance, potentially impacting user trust and overall trading experience on the platform. Traders should consider these factors while navigating Investizo's offerings.

FAQs

Q: What are the available payment methods on Investizo?

A: Investizo offers various payment options including bank transfers, credit/debit cards, and electronic payment systems.

Q: Does Investizo provide educational resources for traders?

A: Unfortunately, Investizo lacks comprehensive educational materials like tutorials, webinars, and guides.

Q: Is Investizo regulated by any governing authority?

A: No, Investizo operates without regulatory oversight

Q: What is the minimum deposit required to start trading on Investizo?

A: The minimum deposit typically starts at $10, providing a low entry point for traders.

Q: How diverse are the tradable assets on Investizo?

A: Investizo offers a wide range of assets including Forex, cryptocurrencies, commodities, stocks, and indices.

Q: What customer support options are available on Investizo?

A: Investizo offers limited customer support, primarily through email or phone contact.

News

Review 11

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now