Note: VCML' official website: https://www.visioncapital.com.bd is currently inaccessible normally.

VCML is a financial firm operating in Bangladesh. Customer groups include employees with stock compensation, Gen X, Nike employees, nonprofits, individuals undergoing life transitions, professionals, and women seeking female financial advisors. It provides services such as risk-based asset allocation, equity, and fixed-income strategies, backed by the entire Vision Capital team, and comprehensive financial planning. However, they are under unregulated status and their website is not available.

Pros and Cons

Is VCML Legit?

No, VCML currently operates as an unregulated trading platform. The absence of regulatory oversight increases the risk of fraudulent activities and scams within the institution.

Customer Groups

Employees With Stock Compensation: VCML is experienced in handling various stock compensation types, such as ISOs, NSOs, and RSUs. They regularly review these contracts to manage tax impacts and risks, especially when a significant portion of your pay is tied to company stock.

Gen X: VCML supports Gen X clients with their unique financial challenges, from saving for education and upgrading homes to managing inheritances and rebalancing 401(k)s.

Women Seeking Female Financial Advisors: VCML understands the unique challenges women face in investing, such as career breaks or unequal pay, and aims to provide supportive, personalized financial guidance.

Services

VCML provides strategic asset allocation with an active and dynamic approach. Enjoy personalized investment strategies through active equity and fixed-income management, optimized to enhance your outcomes.

VCML also offers financial planning to help you define goals and achieve financial serenity, including transparent assessments, 529 college savings insights, and support in transitioning to retirement.

For nonprofits, VCML manages resources responsibly, balancing risk, funding needs, and organizational values.

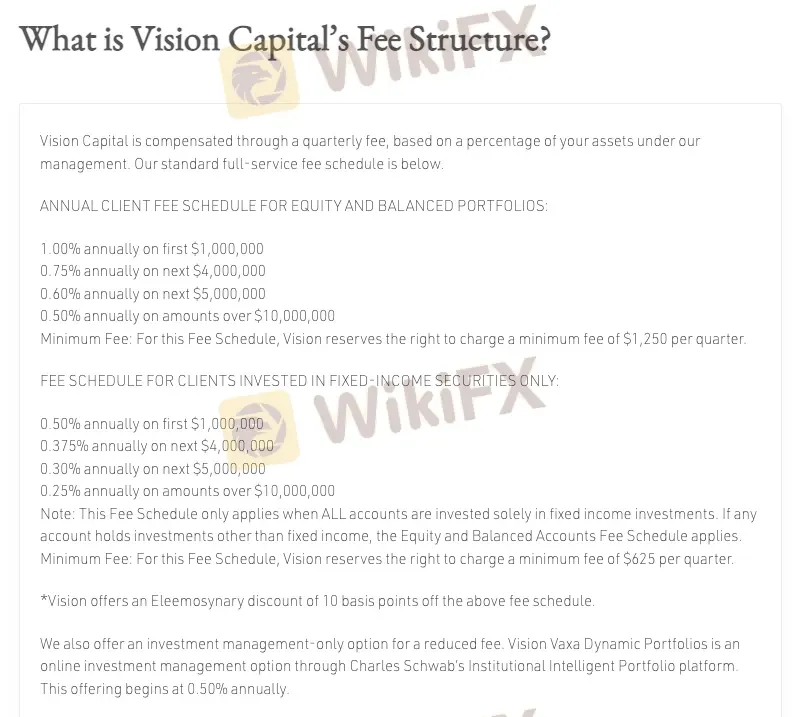

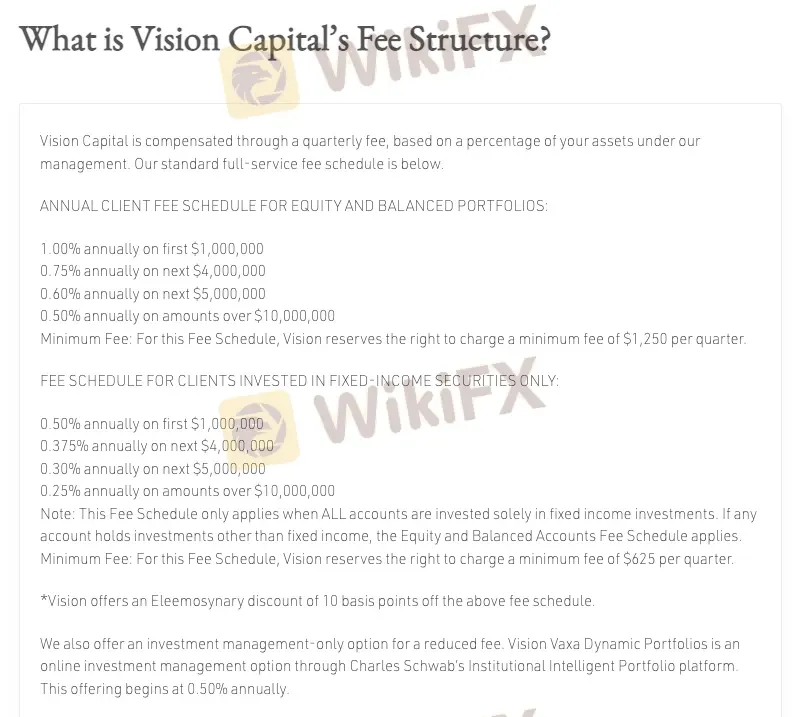

VCML Fees

VCML's fee structure is calculated quarterly as a percentage of managed assets.

For Equity and Balanced Portfolios, the annual fee is 1.00% on the initial $1,000,000, decreasing to 0.50% for amounts exceeding $10,000,000, with a quarterly minimum fee of $1,250.

Clients with exclusively Fixed-Income Securities have a distinct fee schedule, beginning at 0.50% annually for the first $1,000,000 and decreasing for higher amounts, with a minimum quarterly fee of $625. This schedule applies only when all accounts are invested solely in fixed-income securities.

VCML provides a 10 basis points discount for Eleemosynary clients and offers a reduced fee option for investment management through Vision Vaxa Dynamic Portfolios, starting at 0.50% annually.