Score

GOFX

Seychelles|2-5 years|

Seychelles|2-5 years| https://www.gofx.com/en/

Website

Rating Index

MT4/5 Identification

MT4/5

Full License

GOFX-DEMO

Influence

C

Influence index NO.1

Thailand 3.80

Thailand 3.80MT4/5 Identification

MT4/5 Identification

Full License

France

FranceInfluence

Influence

C

Influence index NO.1

Thailand 3.80

Thailand 3.80Contact

Licenses

Licenses

Licensed Institution:TouchStone Markets Limited

License No.:SD118

Single Core

1G

40G

1M*ADSL

- The Seychelles FSA regulation with license number: SD118 is an offshore regulation. Please be aware of the risk!

Basic Information

Seychelles

SeychellesAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed GOFX also viewed..

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

gofx.pro

Server Location

United States

Website Domain Name

gofx.pro

Server IP

172.67.176.17

gofx.com

Server Location

Singapore

Website Domain Name

gofx.com

Website

WHOIS.ENOM.COM

Company

ENOM, INC.

Domain Effective Date

1998-11-11

Server IP

3.0.232.249

Company Summary

| Aspect | GOFX (ICDX) |

| Company Name | ICDX (GOFX) |

| Registered Country/Area | Indonesia |

| Founded Year | 2018 |

| Regulation | Unregulated |

| Minimum Deposit | $100 |

| Maximum Leverage | 1:3000 |

| Spreads | From 0.2 pips |

| Trading Platforms | MetaTrader 4 |

| Tradable Assets | Forex, commodities, indices |

| Account Types | Standard, Low Spread, Pro, Inter |

| Customer Support | 24/5 via live chat, email, and phone |

| Deposit & Withdrawal | Credit/debit cards, bank transfers, e-wallets |

| Educational Resources | Webinars, e-books, trading videos |

Overview of GOFX

GOFX is a forex and CFD broker founded in 2018. It is registered in Indonesia and regulated by the Bappebti (Indonesia Commodity and Derivatives Exchange Supervisory Agency). GOFX offers a variety of trading accounts with different spreads and commissions, as well as a variety of deposit and withdrawal methods.

GOFX's minimum deposit is $100 and its maximum leverage is 1:200. It offers spreads from 0.2 pip and supports trading on MetaTrader 4. GOFX offers a variety of tradable assets, including forex, commodities, and indices.

GOFX offers a variety of account types, including Standard, Low Spread, Pro, and Inter. GOFX offers 24/5 customer support via live chat, email, and phone. It also offers a variety of educational resources, including webinars, e-books, and trading videos.

Is GFX Securities legit or a scam?

GOFX is not regulated by any regulatory authority, which may raise concerns about the transparency and oversight of the exchange.

Unregulated exchanges lack the oversight and legal protections provided by regulatory authorities. This can lead to a higher risk of fraud, market manipulation, and security breaches. Without proper regulation, users may also face challenges in seeking recourse or resolving disputes. Additionally, the absence of regulatory oversight can contribute to a less transparent trading environment, making it difficult for users to assess the legitimacy and reliability of the exchange.

Pros and Cons

| Pros | Cons |

| 1. Competitive leverage options | 1. Lack of information about regulation |

| 2. 24/7 customer support | 2. Limited educational Resources |

| 3. User-friendly trading platform | 3. Limited market analysis and insights |

| 4. Support a variety of payment methods | 4. Deposit and withdrawal fees |

| 5. Multiple account types available | 5. Not available in some countries or regions |

Market Instruments

GOFX offers a diverse range of trading products, including:

Forex:GOFX offers a wide range of Forex products, allowing traders to participate in the foreign exchange market. This includes major currency pairs like EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic currency pairs. Traders can engage in currency trading with competitive spreads and leverage options.

Precious Metals CFDs:

Traders looking to diversify their portfolios with precious metals can do so through GOFX. They provide Precious Metals CFDs, allowing traders to speculate on the price movements of metals like gold, silver, platinum, and palladium. This provides an opportunity to trade these valuable commodities without physically owning them.

CFD Index and Others:GOFX offers Contracts for Difference (CFD) products on various indices, providing exposure to global financial markets. These CFDs are based on popular indices like the S&P 500, Dow Jones, FTSE 100, and others. Additionally, they may offer CFDs on other financial instruments, providing a diversified range of trading options.

Share CFD:

For traders interested in equities, GOFX offers Share CFDs, allowing them to speculate on the price movements of individual stocks. This provides access to a wide range of global companies without the need to purchase the actual shares. Share CFDs can include well-known companies from various industries.

Energy CFDs:GOFX provides CFDs on energy commodities, enabling traders to engage in the energy market. This category typically includes CFDs on crude oil (Brent and WTI) and natural gas. Traders can benefit from price fluctuations in the energy sector without physically handling these commodities.

Cryptocurrency:

Cryptocurrency trading has gained immense popularity, and GOFX offers traders the opportunity to trade various cryptocurrencies. This can include major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and other altcoins. Traders can speculate on the price movements of these digital assets, taking advantage of their volatility.

Account Types

| Comparison | GO-MINI | GO-STANDARD | GO-LOW SPREAD | GO-PRO | GO-INTER |

| Minimum deposit | $1 | $1 | $1 | $1 | $1 |

| Leverage | Up to 1:500 | Up to 1:3,000 | Up to 1:999 | Up to 1:100 | Up to 1:100 |

| Stop Out | ✔ | ✔ | ✔ | ✔ | ✔ |

| Minimum trading | 0.01 Lot | 0.01 Lot | 0.01 Lot | 0.1 Lot | 1 Lot |

| Maximum trading | 100 Lot | 50 Lot | 50 Lot | 50 Lot | 50 Lot |

| Maximum orders | 1,000 positions | 1,000 positions | 1,000 positions | 1,000 positions | 1,000 positions |

| Service fee | ✖ | ✖ | ✖ | ✔ | ✖ |

| Hedging allowed | ✖ | ✖ | ✖ | ✖ | ✖ |

GO-MINI: The GO-MINI account is designed for new traders looking for low-risk, high-profit opportunities. It requires a minimum deposit of $1 and offers leverage of up to 1:500. Stop Out is available, and traders can start with a minimum trading size of 0.01 Lot.

GO-STANDARD: The GO-STANDARD account is a versatile standard trading account suitable for various trading conditions. It also requires a minimum deposit of $1 and offers a higher leverage of up to 1:3,000. Stop Out is available, and the minimum trading size is 0.01 Lot.

GO-LOW SPREAD: This account is tailored for traders who prefer low-cost trading, especially for short-term speculation. It shares the same minimum deposit requirement of $1, and the leverage is up to 1:999. Stop Out is available, and the minimum trading size is 0.01 Lot.

GO-PRO: GO-PRO is a trade account designed for professional traders who require the fastest pricing with ECN (Electronic Communication Network) technology. It also has a minimum deposit of $1 but offers a lower leverage of up to 1:100. Stop Out is available, and the minimum trading size is 0.1 Lot.

GO-INTER: The GO-INTER account is intended for traders interested in international investment, particularly trading foreign stocks. Like the other accounts, it requires a minimum deposit of $1 and offers leverage of up to 1:100. Stop Out is available, and the minimum trading size is 1 Lot.

How to Open an Account?

Opening an account with GOFX is a straightforward process, here's a step-by-step guide:

Step 1: Registration

Visit the GOFX website and click on the “Sign Up” or “Register” button.

Fill in your personal information accurately, including your name, email address, and contact details.

Step 2: Verification

Upload the required identification documents for verification purposes. This typically includes a government-issued ID and proof of address.

Step 3: Account Type Selection

Choose the type of trading account that suits your needs. GOFX offers various account types with different features and minimum deposit requirements.

Step 4: Deposit Funds

Fund your GOFX account using one of the available payment methods. These include bank transfers, credit/debit cards, and popular e-wallets.

Step 5: Start Trading

Once your account is funded and verified, you can log in to the trading platform and start trading in the financial markets.

Leverage

GOFX offer competitive leverage options to enhance your trading opportunities. The maximum leverage available depends on the type of account you choose and the asset you're trading. It ranges from 1:100 to 1:3000, allowing you to amplify your potential profits while considering risk management strategies.

| Account Type | Maximum Leverage |

| GO-MINI | Up to 1:500 |

| GO-STANDARD | Up to 1:3,000 |

| GO-LOW SPREAD | Up to 1:999 |

| GO-PRO | Up to 1:100 |

| GO-INTER | Up to 1:100 |

Spreads & Commissions

GOFX offers a variety of trading accounts with different spreads and commissions. The following table compares the spreads and commissions of GOFX's four most popular account types:

| Account Type | Spread | Commission |

| GO-STANDARD | 1.0 pip | $0 |

| GO-LOW SPREAD | 0.6 pip | $0 |

| GO-PRO | 0.2 pip | $3.5 per lot |

| GO-INTER | Varies | Varies |

The spreads on GOFX's Standard and Low Spread accounts are relatively competitive, especially for traders who trade small volumes. The Pro account offers the tightest spreads, but it also charges a commission per lot. The Inter account is designed for institutional traders and offers spreads and commissions that are negotiated on a case-by-case basis.

Trading Platform

The trading platform offered by GOFX is MetaTrader 4 (MT4), which is widely recognized as a leading platform in the global financial market. MT4 is renowned for its versatility and is used not only in Forex trading but also in various other financial markets due to its unique and robust features.

Key Features of MetaTrader 4 (MT4):

Global Leading Platform: MT4 is a globally renowned platform, trusted by traders worldwide. Its widespread usage in various financial markets attests to its reliability and effectiveness.

Versatility: MT4 is not limited to Forex trading; it also caters to other financial instruments. This versatility allows traders to access a wide range of assets, enhancing their trading opportunities.

Standard Platform: MT4 is considered a standard platform for online trading. It has become a benchmark for traders and brokers alike, known for its stability and user-friendly interface.

Advantages of MetaTrader 4 (MT4):

No Requotes or Order Distortions: One of the significant advantages of using MT4 is that it allows traders to execute orders without the concern of requotes or order distortions. This ensures that orders are executed as intended, contributing to a smooth trading experience.

Variety of Leverage Values: MT4 provides traders with the flexibility to choose from a variety of leverage values. This feature is crucial for risk management, allowing traders to adjust their leverage based on their risk tolerance and trading strategies.

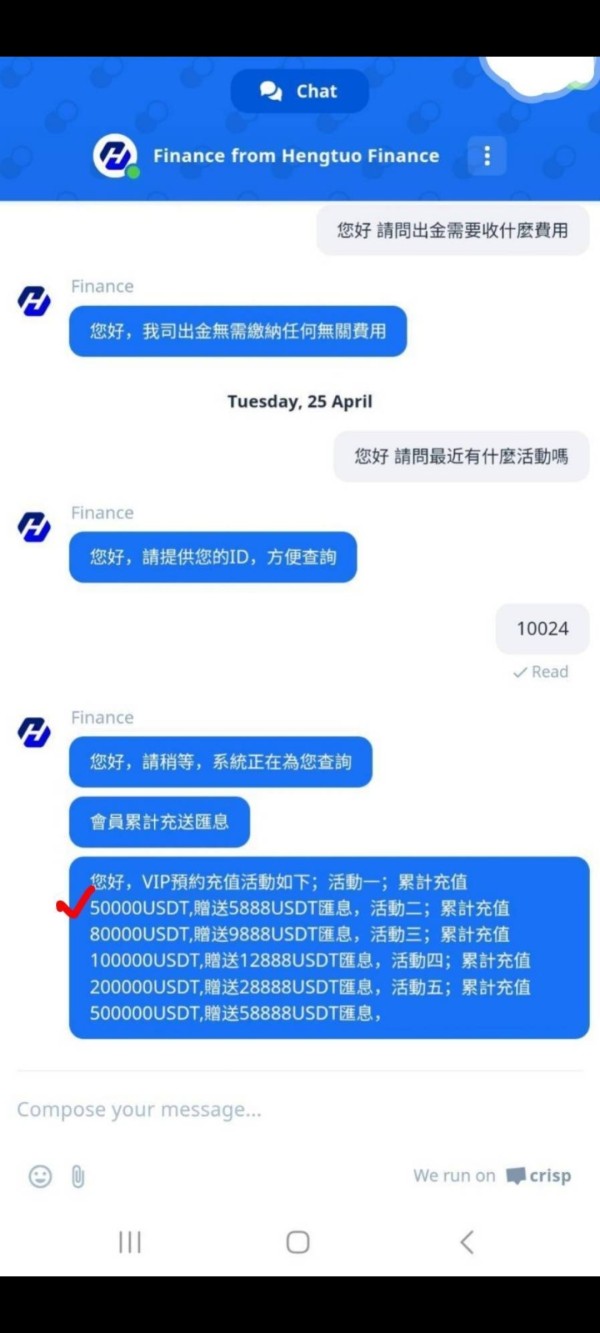

Deposit & Withdrawal

GOFX offers a variety of deposit and withdrawal methods, including:

Credit/debit cards

Bank transfers

E-wallets (Neteller, Skrill, PayPal, etc.)

Deposit and Withdrawal Fees

GOFX does not charge any deposit fees, but there may be fees associated with certain withdrawal methods. For example, there is a 3% fee for withdrawals to PayPal.

Minimum Deposit and Withdrawal Amounts

The minimum deposit and withdrawal amounts vary depending on the deposit and withdrawal method. For example, the minimum deposit amount for credit/debit cards is $100, while the minimum withdrawal amount is $50.

Other Charged Fees

GOFX charges a small inactivity fee of $5 per month for accounts that have been inactive for more than six months.

Customer Support

Here are some aspects typically associated with GOFX customer support:

Multiple Contact Channels: GOFX is likely to offer multiple channels for contacting customer support, such as email, live chat, phone support, and possibly even social media channels. This ensures traders have various ways to reach out for assistance.

24/5 Availability: Many brokers, including GOFX, often provide customer support during the trading week, which typically covers 24 hours a day from Monday to Friday. This ensures that traders can seek help even during different time zones.

Multilingual Support: To accommodate a global clientele, GOFX may offer customer support in multiple languages, ensuring that traders can communicate effectively in their preferred language.

Educational Resources

GOFX lacks educational resources, which can make it difficult for new users to learn how to use the platform and trade cryptocurrencies.

Some of the educational resources that are missing from GOFX include: a comprehensive user guide, video tutorials, live webinars, blogs and etc.

The lack of educational resources on GOFX can make it difficult for new users to learn how to use the platform and trade cryptocurrencies. This can lead to mistakes and losses, which can discourage new users from trading.

Conclusion

In conclusion, GOFX presents a trading platform with several notable advantages, including a range of account types to cater to traders with varying preferences, a global-leading trading platform in MetaTrader 4 (MT4) known for its versatility and reliability, and the provision of multiple leverage options. However, it's important to acknowledge the lack of regulation, which may leave traders with uncertainties. As such, potential clients should carefully assess their trading needs and consider conducting thorough research or seeking direct information from GOFX to make informed decisions when choosing this broker for their trading endeavors.

FAQs

Q: Can I open multiple trading accounts with GOFX?

A: Yes, you can open multiple accounts with GOFX to explore different trading strategies or asset classes.

Q: What is the minimum deposit required to start trading?

A: The minimum deposit varies depending on the type of account you choose. Please check our website for specific account requirements.

Q: Is my personal information secure with GOFX?

A: Yes, we prioritize the security of your personal information and employ advanced encryption technology to safeguard your data.

Q: How can I contact GOFX customer support?

A: You can contact our customer support team through live chat on our website, email, or by calling our dedicated support line during business hours.

Q: Does GOFX offer a demo account for practice?

A: Yes, we provide a demo account that allows you to practice trading with virtual funds before risking real capital.

Keywords

- 2-5 years

- Regulated in Seychelles

- Retail Forex License

- MT5 Full License

- White label MT4

- Regional Brokers

- Medium potential risk

- Offshore Regulated

Review 8

Content you want to comment

Please enter...

Review 8

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX2000015930

India

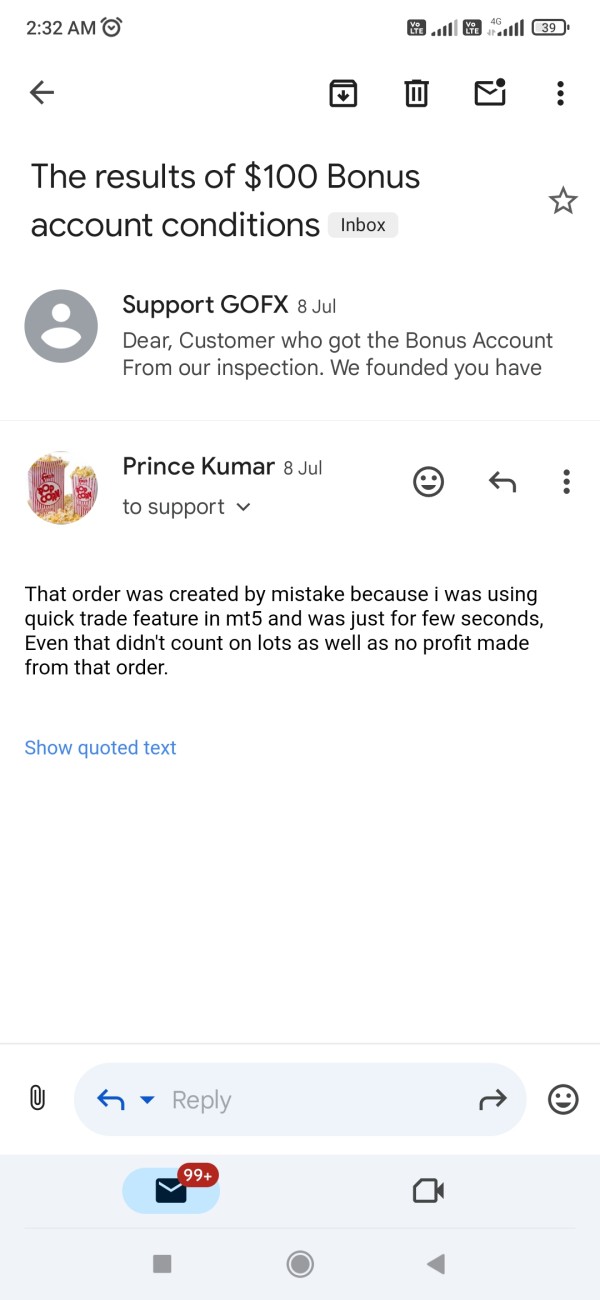

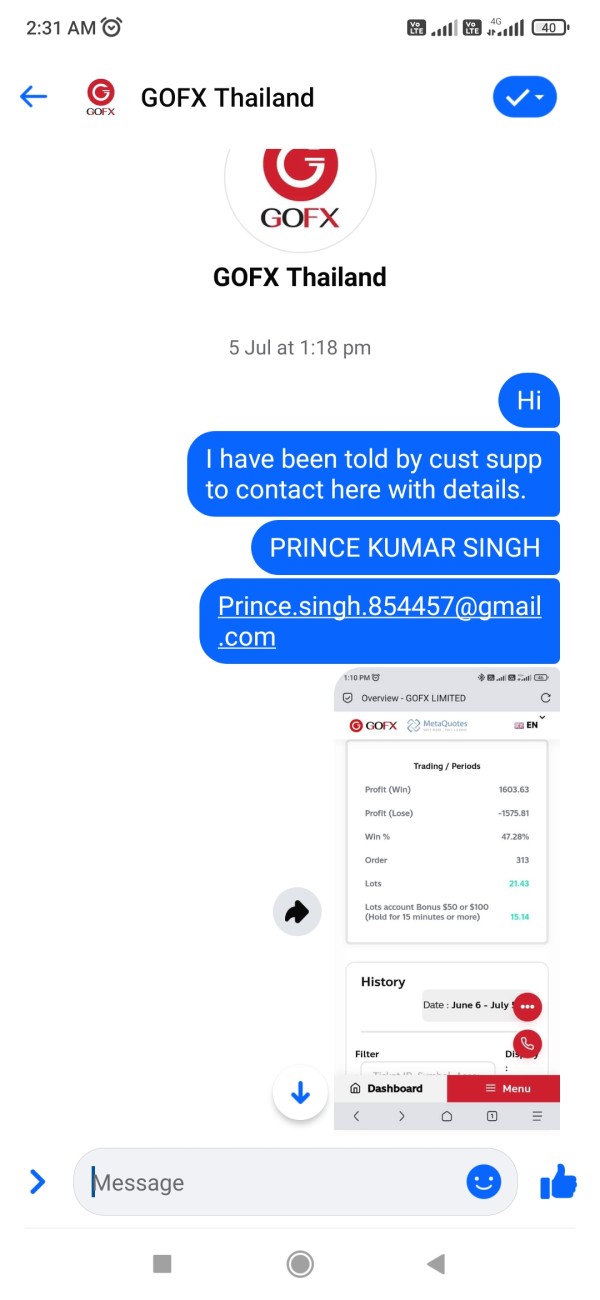

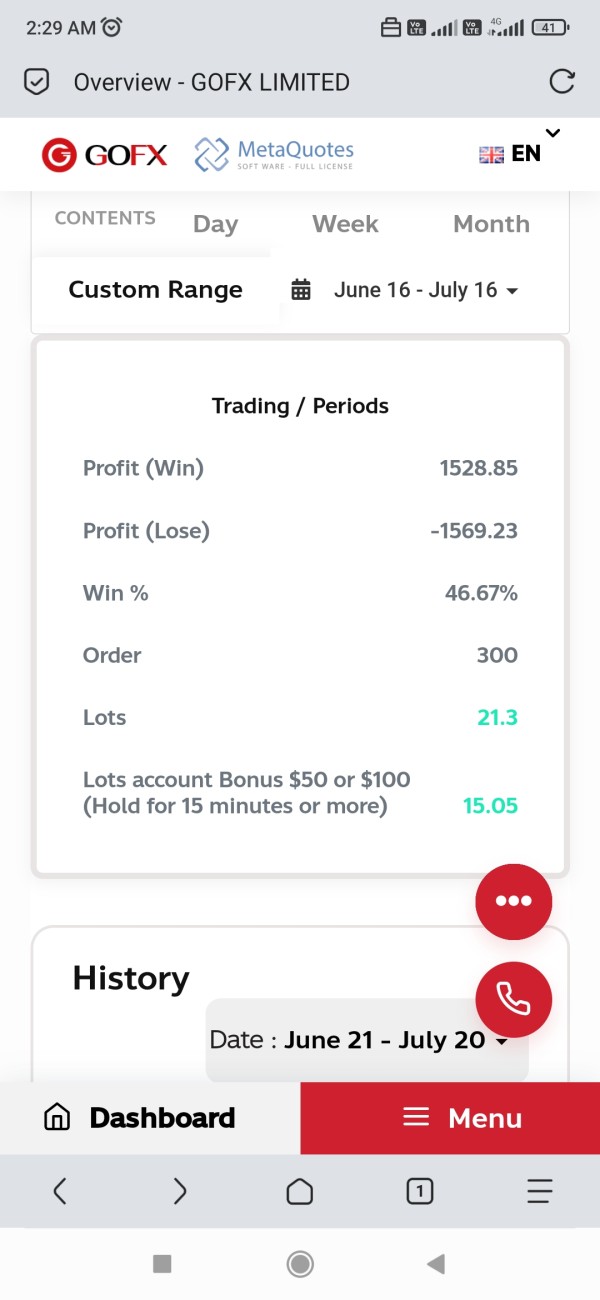

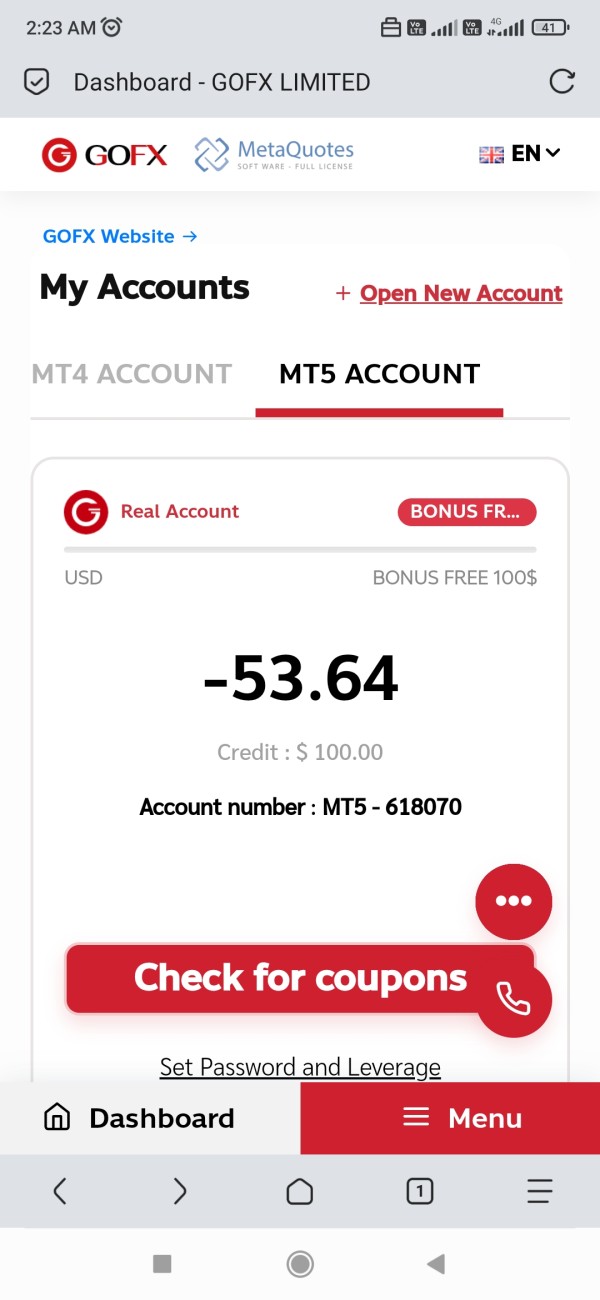

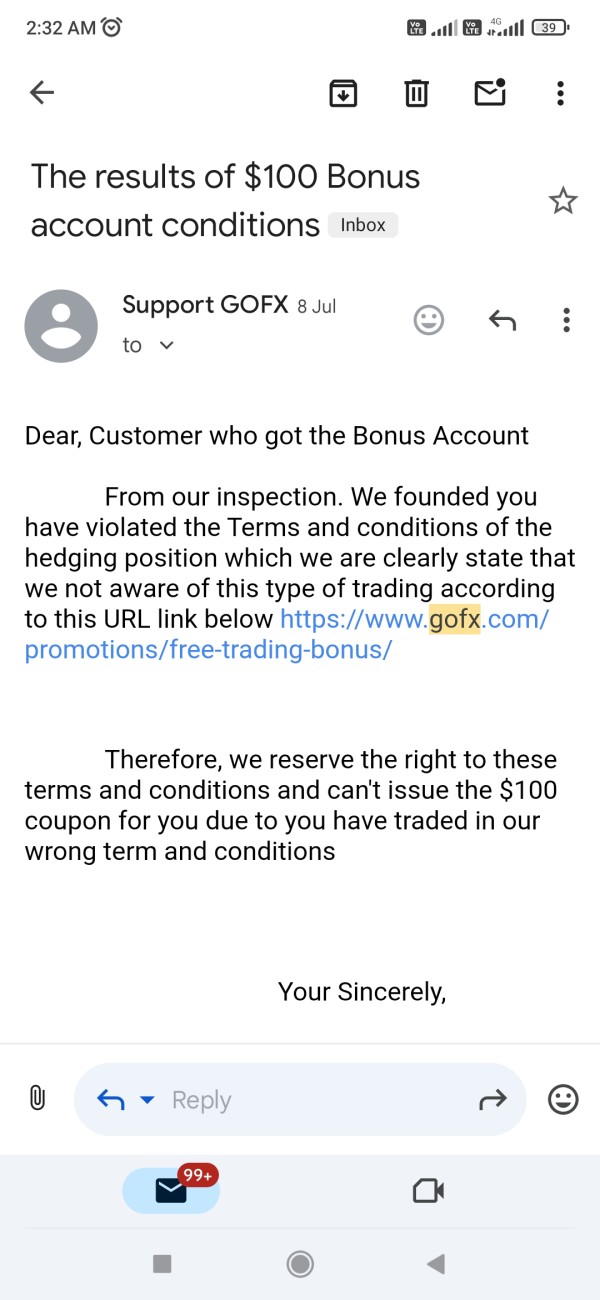

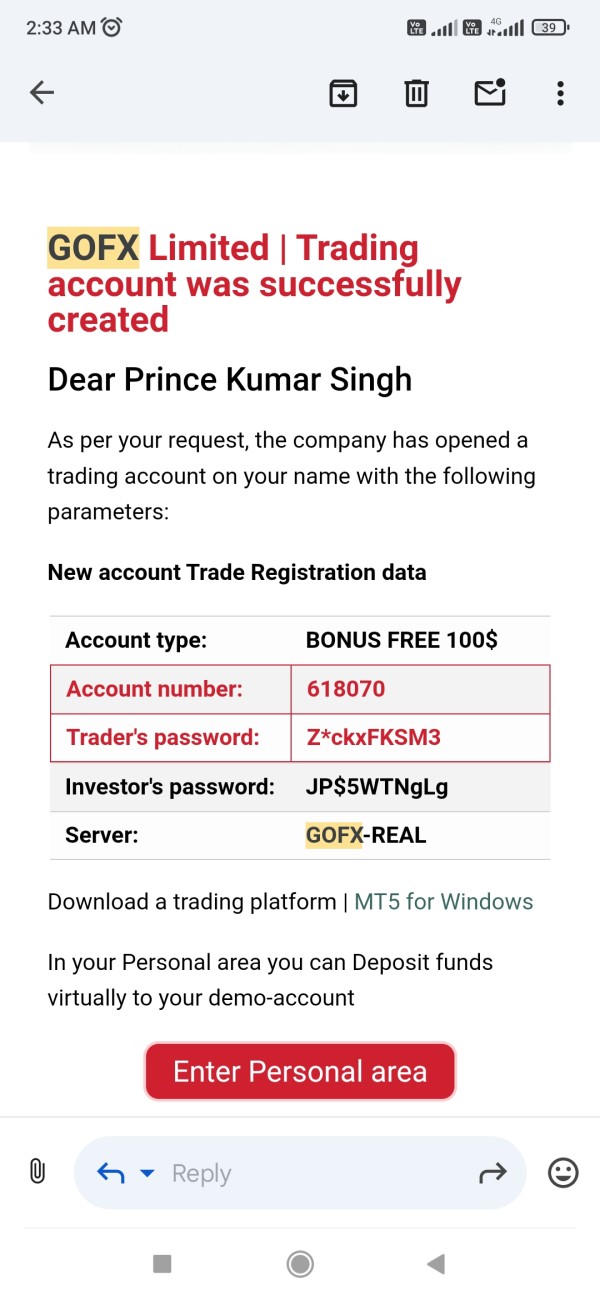

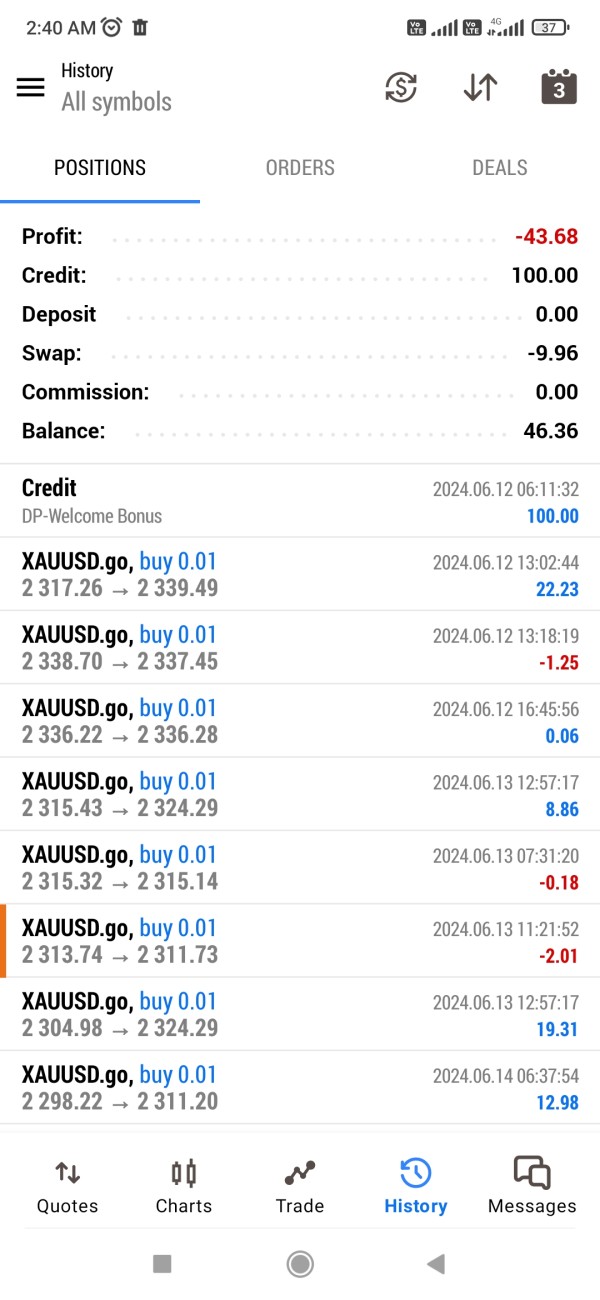

Hello everyone, I am Prince Kumar Singh. I have received $100 ndb bonus by GoFx as a new customer and completed 15 lots by holding each trade 15 min which is almost impossible to do in 30 day, Which i did trading day and night, after asked them to review and approve reward coupon of $100 as acc to t&c 15 lots in 30 calender days irrespective of any profit made or loss in xauusd pair only. This broker never intended to reward anybody just saying t&c violated as an excuse not to approve.Their cust service is very poor, never able to chat with them on website and even didnot reply on mail and also ignoring on messenger.

Exposure

2024-07-20

raka257

Indonesia

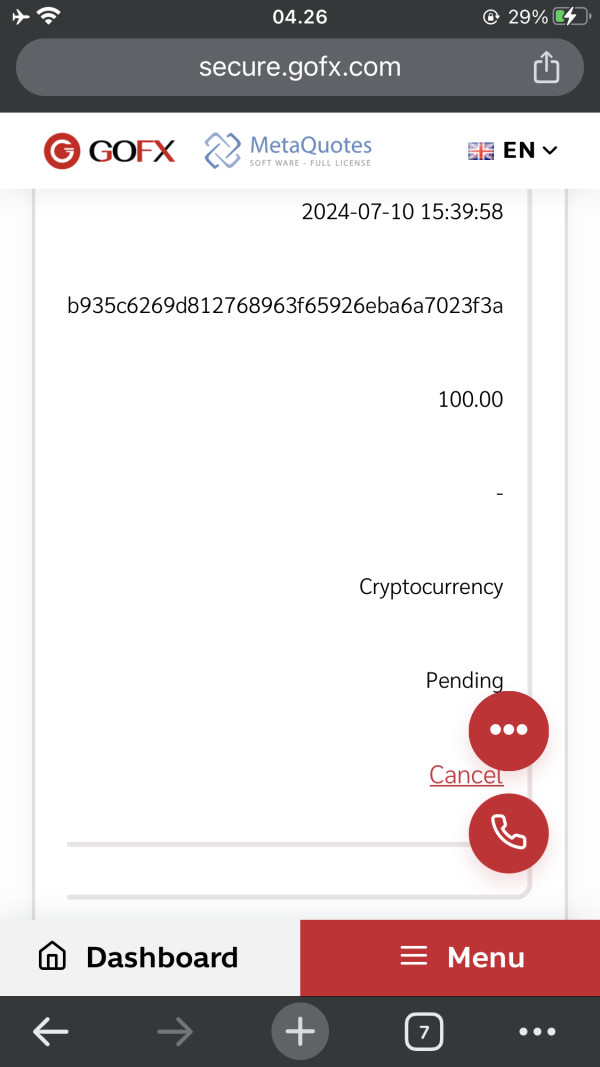

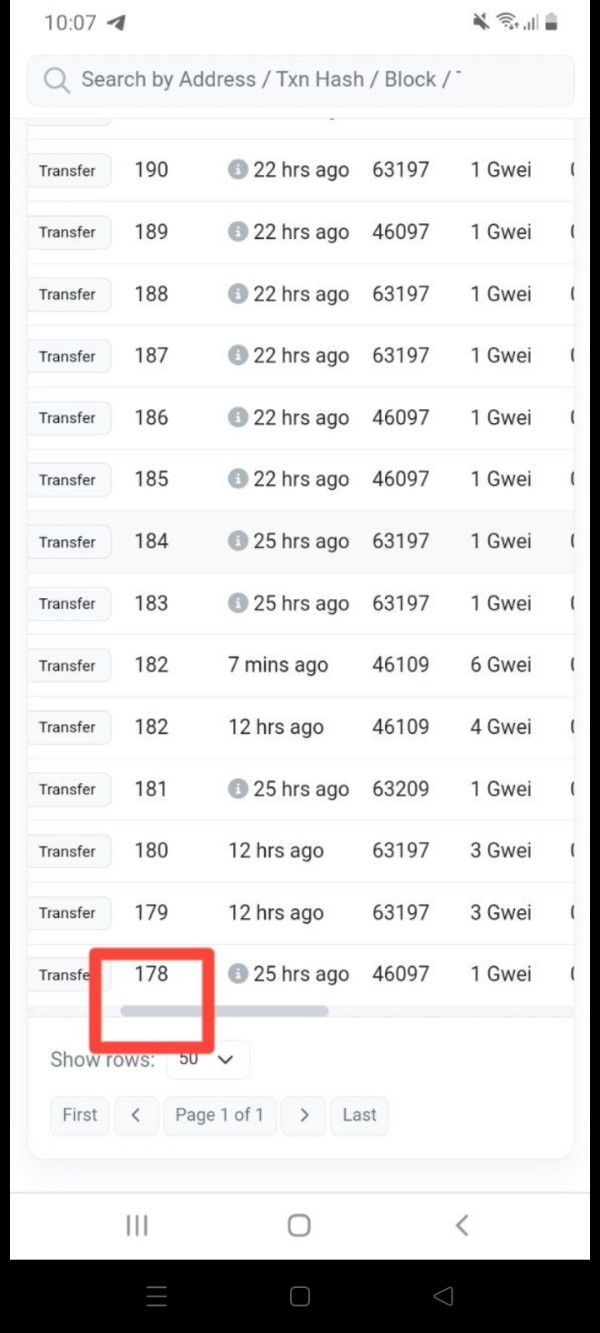

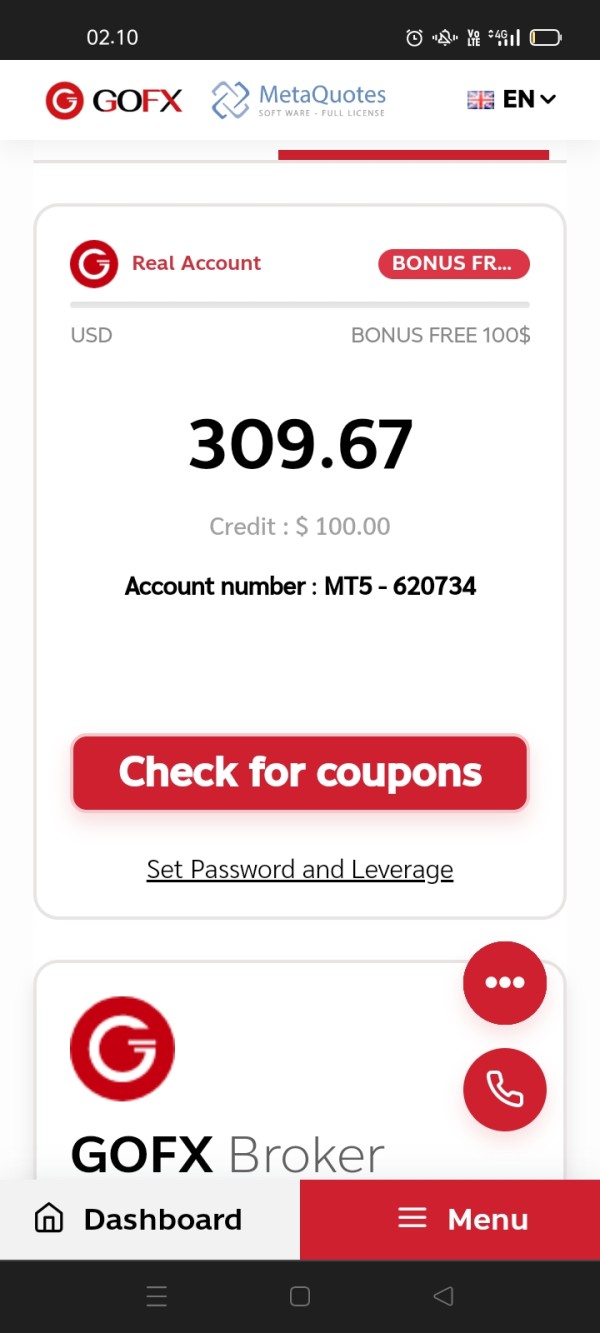

I make a withdrawal on 07-10-2024 and I haven't received it until now

Exposure

2024-07-17

FX1689221982

Indonesia

Last month, Gofx held an NDB promo with various conditions. If the customer meets the requirements, the customer is entitled to a $100 coupon. Gofx stated that the $100 coupon is made for 7 days and can only be sent to customers who meet the conditions. This is the problem. It's been more than 7 days since Gofx hasn't sent the coupon, not just 1 or 2, but many customers haven't received the coupon.

Exposure

2024-07-16

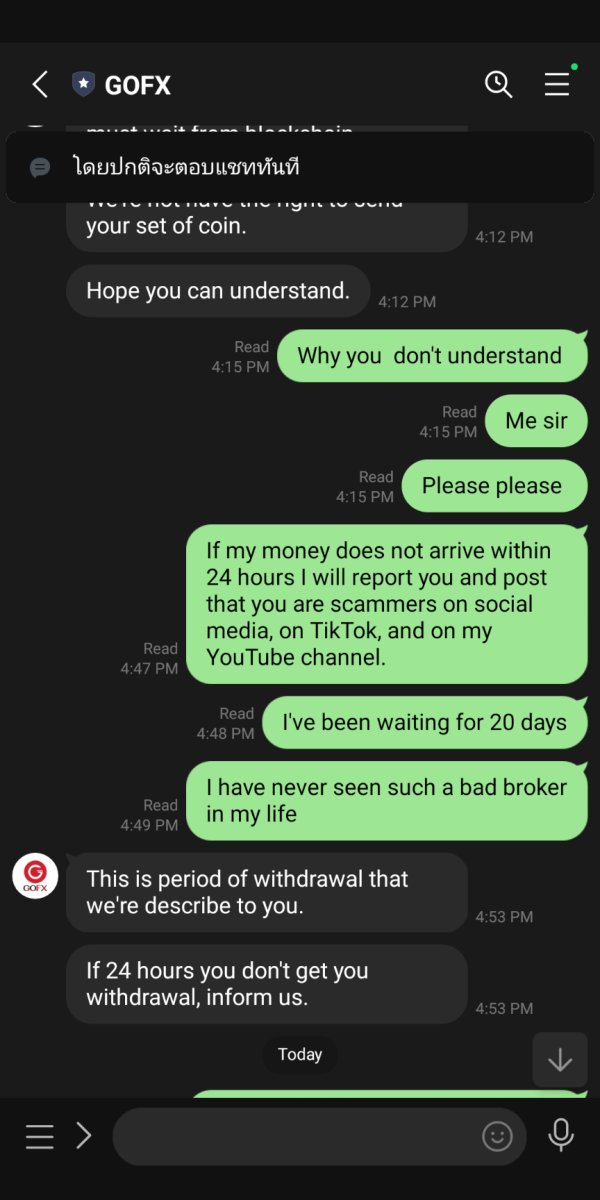

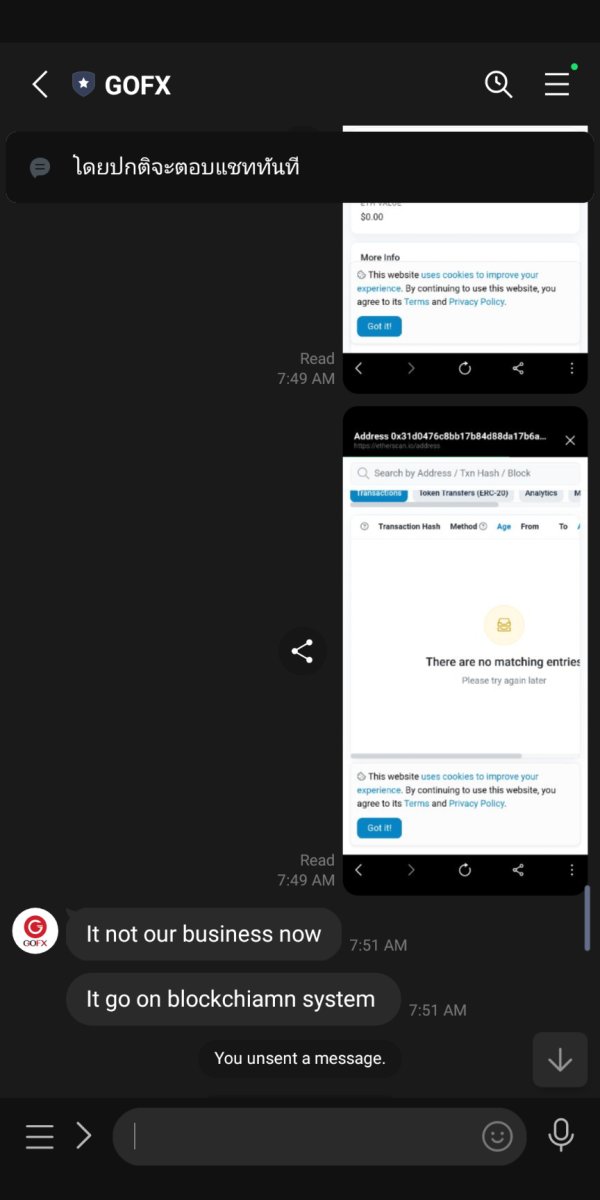

FX4206525456

Algeria

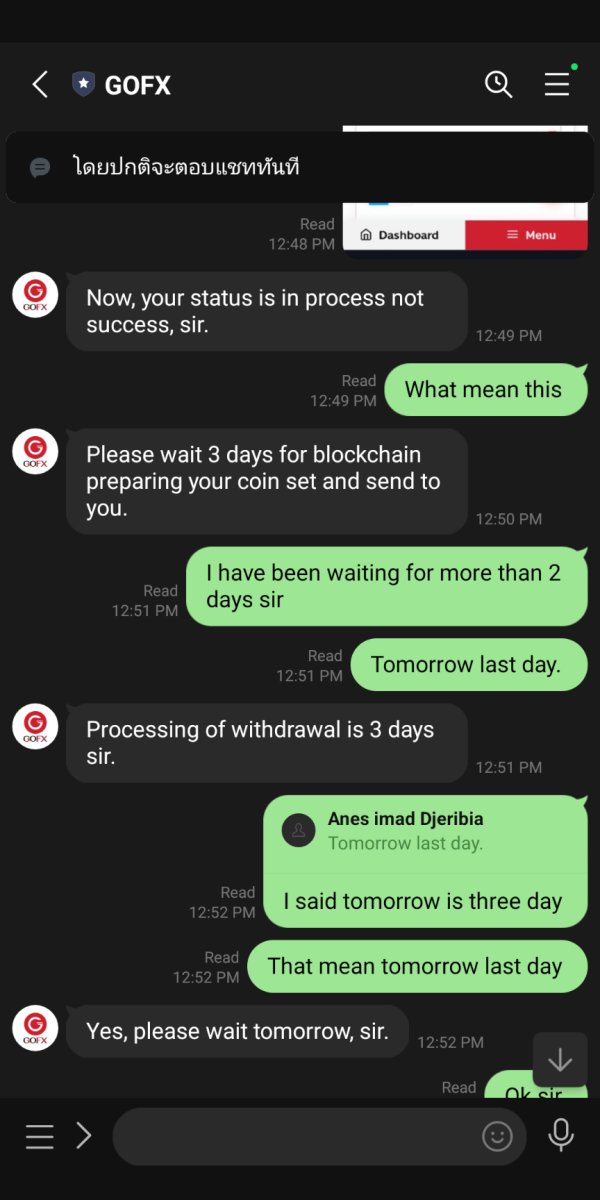

Scammers beware. I couldn't withdraw my money and whenever I spoke to support, they always waste my time and make me wait.

Exposure

2024-07-12

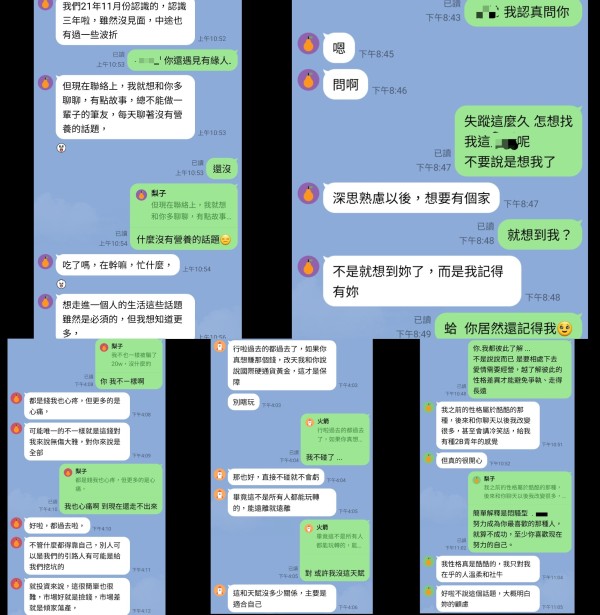

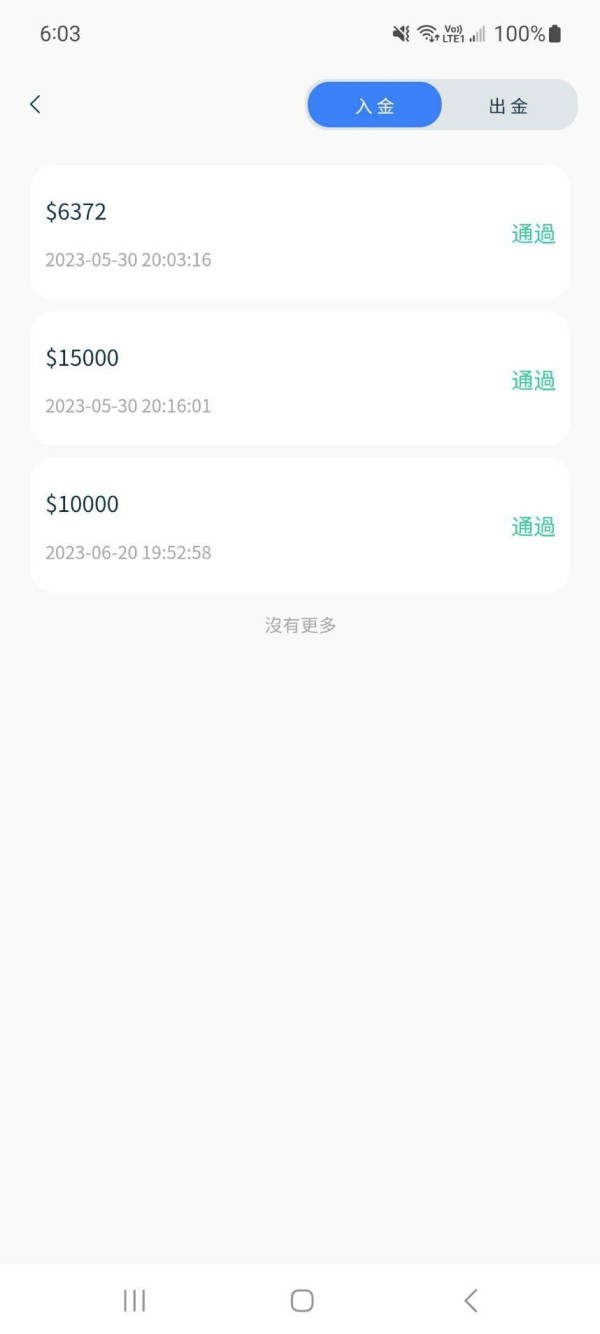

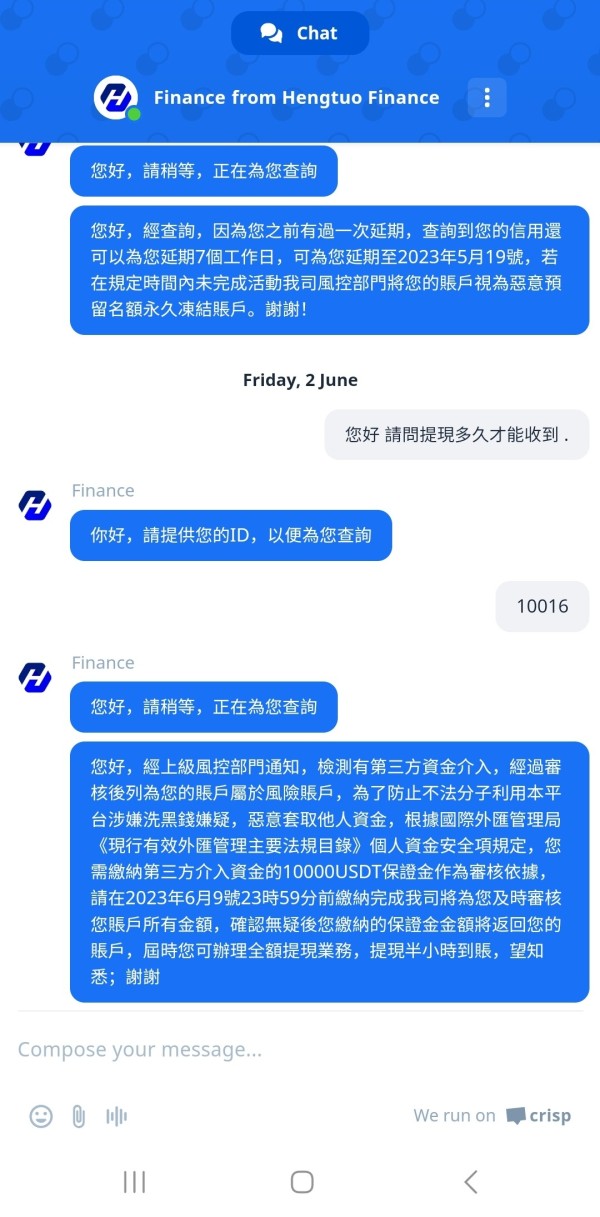

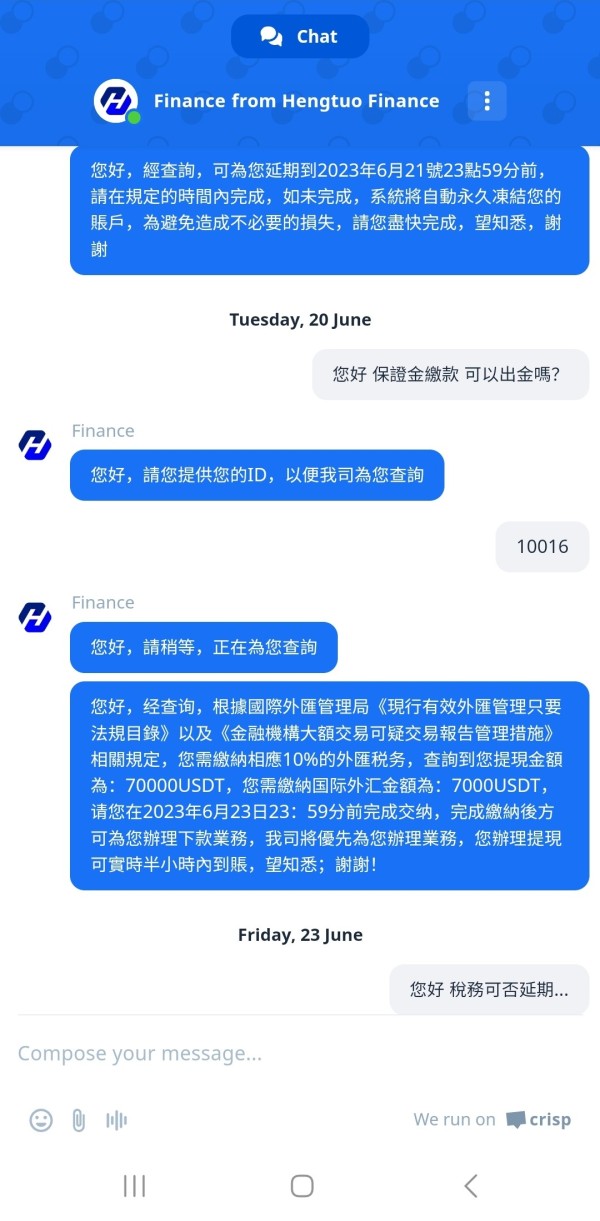

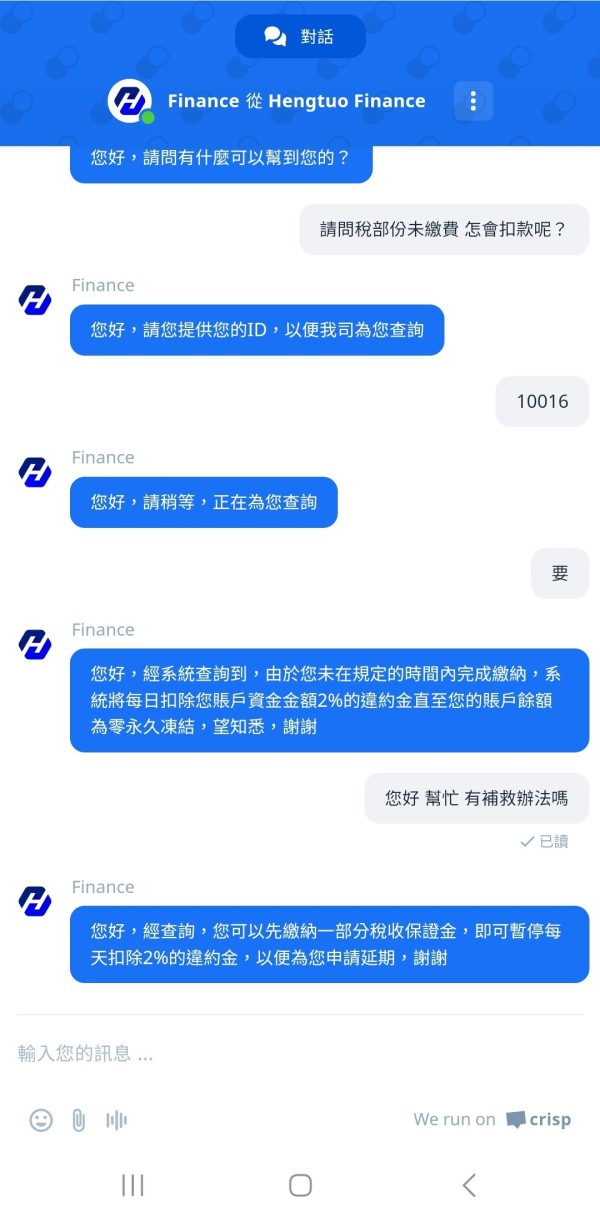

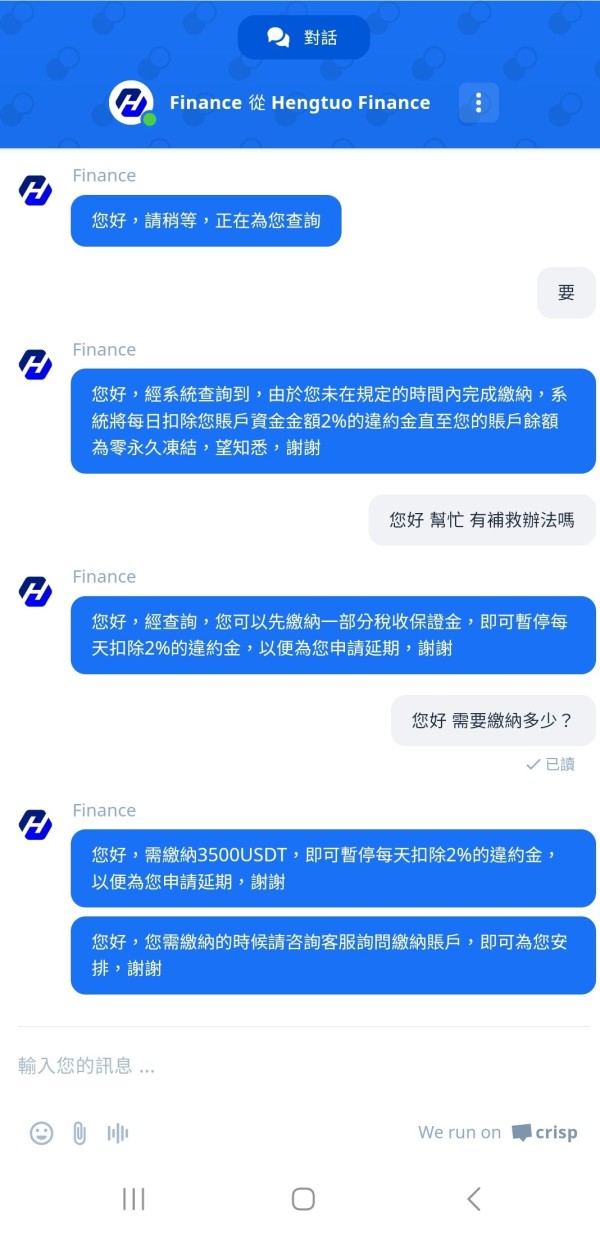

晴漾

Taiwan

IG has known him for three years. The contact was cut off for a year. In the end, the contact has warmed up from friend to love recently. There are a lot of care and greetings every day. He said that more income will be better for him in the future. You can try. But Don't overdo it. I also said that you need to know the importance of money... I said that I have been cheated before. I don't want to touch investment... I started to make a small investment and made a profit. Later, I was very opposed to and angry when I was encouraged to sign up for an event and deposit.. . A friend said, to be brave within the tolerance range? Be bold? Take that step. You are so worried and afraid. I will help you if you have unnecessary doubts. Because of this matter, there are loans and mistakes. I am also impatient... He finally helped me with a part of the money. It took a month for the activity to be completed. It was hard to withdraw money. After asking customer service, a bunch of people refused to withdraw money under my name... We had to pay a third-party intervention fund deposit. Finally got together and paid a lot of deposits. There is also foreign exchange tax. I really can't pay it. The customer service also said that 2% will be deducted every day, and the liquidated damages will be paid out. Then it will be reset to zero and permanently frozen! ! !

Exposure

2023-07-10

LaLa123

Netherlands

My experience with GOFX has been quite an interesting journey. One of the main positives are the low spreads, starting from 0.2 pips, and a range of tradable assets that includes Forex, commodities, and indices. The available account types have been diverse, catering to different traders.

Neutral

2023-12-13

Jacob Wilson Duke

Australia

Initially, ZIVEST's high leverage, up to 3000x and low minimum deposit, made me suspicious. However, after using their platform for 6 months, I am sure this one is a good broker.

Positive

2024-06-28

Mr. Dong25218

Malaysia

Very pleasant and willing support, thanks to the GOFX initiative I got my account in order. You can see that they care about their customers.

Positive

2024-06-20