Score

IQCent

Marshall Islands|2-5 years|

Marshall Islands|2-5 years| https://www.iqcent.com/

Website

Rating Index

Influence

Influence

A

Influence index NO.1

United States 6.84

United States 6.84Surpassed 14.80% brokers

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Disclosure

Danger

Contact number

Other ways of contact

Broker Information

More

Wave Makers LTD

IQCent

Marshall Islands

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | -- |

| Minimum Deposit | $100 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | -- |

| Minimum Deposit | $50,000 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | -- |

| Minimum Deposit | $5,000 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | -- |

| Minimum Deposit | $1,000 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed IQCent also viewed..

XM

FXCM

STARTRADER

Decode Global

IQCent · Company Summary

| Aspect | Information |

| Registered Country/Area | Marshall Islands |

| Founded Year | 2-5 years |

| Company Name | Wave Makers LTD |

| Regulation | Not regulated |

| Minimum Deposit | $10 |

| Maximum Leverage | Up to 1:500 |

| Spreads | Not specified |

| Trading Platforms | IQCent's proprietary trading platform |

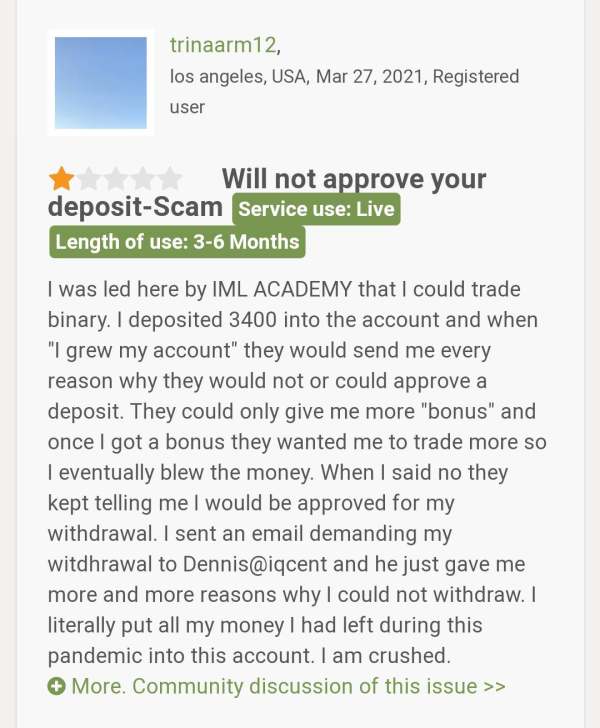

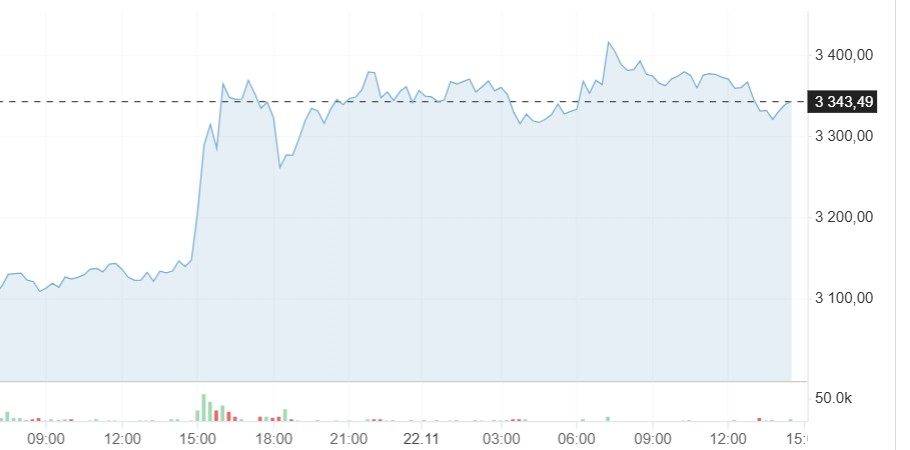

| Tradable Assets | Forex, commodities, indices, cryptocurrencies, options, CFDs |

| Account Types | Bronze, Silver, Gold |

| Demo Account | Available |

| Islamic Account | Not specified |

| Customer Support | 24/7 availability through telephone, email, live chat, and social media |

| Deposit Methods | Credit cards (VISA/MasterCard), bank wire transfer, Bitcoin, Ethereum, Altcoins |

| Withdrawal Methods | Credit cards, bank wire transfer, cryptocurrencies (Bitcoin, Ethereum, Altcoins) |

General Information

IQCent is an online trading platform operated by Wave Makers LTD. It offers a range of financial instruments, including forex, commodities, indices, cryptocurrencies, options, and CFDs. While IQCent provides diverse market opportunities, it is important to note that the broker is not regulated by any valid regulatory authority, which raises concerns about the level of investor protection.

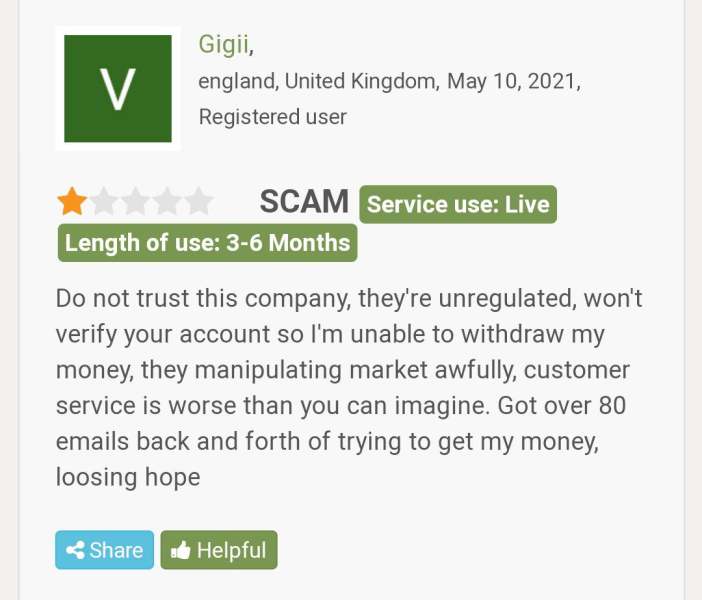

The platform offers different account types to accommodate the needs of traders. The Bronze, Silver, and Gold accounts come with varying features and benefits such as live video chat support, fast withdrawals, bonuses on trading deposits, demo accounts, copy trading tools, and educational resources. However, it is worth mentioning that IQCent has received negative feedback and complaints, including allegations of involvement in a pyramid scheme, which highlights the importance of exercising caution when considering this broker.

Opening an account with IQCent involves providing personal details, choosing the account currency and funding amount, and agreeing to the terms and risk statement. IQCent also offers high leverage options of up to 1:500 for select account holders, which can amplify trading positions but should be approached with caution due to increased risk. While IQCent does not provide clear information on spreads and commissions, it offers a small minimum order size of $0.01 and affordable minimum account balances, making it accessible for traders with different budgets.

In summary, IQCent offers a variety of market instruments, account types, and trading features. However, it is important to be aware of the lack of regulation, negative feedback, and the associated risks. Traders should carefully evaluate their options and consider alternative regulated brokers before engaging with IQCent.

Pros and Cons

Overall, IQCent presents a mixed bag of pros and cons. On the positive side, the platform offers a diverse range of market instruments, providing traders with opportunities across various asset classes. The availability of different account types caters to traders with different needs and experience levels, offering a range of features and bonuses. The low minimum order size and affordable minimum account balances make trading accessible to a wide range of investors. Additionally, the inclusion of copy trading tools and high leverage options can be beneficial for those seeking to learn from successful traders or employ more advanced trading strategies.

However, it is crucial to consider the drawbacks. IQCent operates without regulation, which raises concerns about investor protection and the overall legitimacy of the platform. Negative feedback and complaints, including allegations of involvement in a pyramid scheme, further highlight the need for caution. The lack of transparency regarding spreads and commissions is another drawback, making it challenging for traders to evaluate the cost of trading on the platform. It is essential to weigh these pros and cons carefully and consider the associated risks before deciding to engage with IQCent.

| Pros | Cons |

| Diverse range of market instruments | Lack of regulation |

| Different account types with various features | Negative feedback and allegations of involvement in pyramid scheme |

| Low minimum order size and affordable account balances | Lack of transparency on spreads and commissions |

| Copy trading tools and high leverage options |

Is IQCent Legit?

IQCent, operated by Wave Makers LTD, is a broker that is not regulated by any valid regulatory authority. This lack of regulation should raise concerns and indicate potential risks for individuals considering engaging with the broker.

The company is registered in the Marshall Islands and offers its services through its website at https://www.iqcent.com. It also maintains social media presence on platforms such as Twitter (https://twitter.com/iqcent) and Instagram (https://instagram.com/iqcent).

It is important to note that IQCent has received negative feedback and complaints, including allegations of being involved in a pyramid scheme. This further emphasizes the need for caution when dealing with this broker.

To gather more information about IQCent, one can download the respective app or utilize services provided by WikiFX. However, it is worth noting that WikiFX has indicated a low score for this broker, reinforcing the warning to stay away due to the associated risks.

Market Instruments

IQCent provides traders with a diverse range of market instruments to trade. With access to over 100 financial instruments, traders can engage in various asset classes, including forex (foreign exchange), commodities, indices, cryptocurrencies, options, and CFDs (contracts for difference). This broad selection allows traders to explore different markets and potentially find opportunities that align with their trading strategies and preferences.

Account Types

IQCent offers different account types to cater to the varying needs of traders. Here are the descriptions of the account types provided by IQCent:

1. Bronze Account:

The Bronze account is the basic account type offered by IQCent. It provides traders with access to several features, including 24/7 live video chat support, withdrawals processed within 1 hour, a bonus of 20% on the total trading deposit, a demo account for practice, and a copy trading tool to replicate the trades of other traders. This account type is suitable for traders looking for a simple trading experience.

2. Silver Account:

The Silver account is a step up from the Bronze account and offers additional features. Along with all the features of the Bronze account, the Silver account provides traders with a bonus of 50% on the total trading deposit. Traders with a Silver account also gain access to a master class, which includes web sessions for enhanced learning and trading knowledge. The Silver account is suitable for traders who desire more advanced trading tools and educational resources.

3. Gold Account:

The Gold account is the highest-tier account offered by IQCent and provides traders with premium features. In addition to the features available in the Bronze and Silver accounts, Gold account holders enjoy a bonus of 100% on the total trading deposit. They also receive the benefits of a personal success manager who can provide tailored guidance and support. The Gold account is designed for experienced traders or those seeking a more personalized trading experience.

Pros and Cons

| Pros | Cons |

| Different account types to cater to varying needs | Lack of detailed information on specific account requirements and features |

| Access to 24/7 live video chat support | Limited information on the educational content and quality of the master class |

| Withdrawals processed within 1 hour | Lack of transparency on the qualifications and capabilities of personal success managers |

| Bonuses on trading deposits (20% - Bronze, 50% - Silver, 100% - Gold) |

Opening an account with IQCent is a straightforward process. Here are the steps to open an account:

1. Visit the IQCent website: Go to the IQCent website (https://www.iqcent.com) using a web browser.

2. Click on “Open an account”: Look for the “Open an account” button or a similar option on the website's homepage and click on it. This will take you to the account registration page.

3. Fill in the required information: On the account registration page, you will be asked to provide certain details. Fill in the following information:

- Email (login): Enter a valid email address that will be used as your login for accessing your account.

- Password: Create a secure password for your account.

- Name: Enter your first name.

- Surname: Enter your last name.

- Phone number: Provide a valid phone number where you can be reached.

4. Select account currency and funding amount: Choose the account currency you prefer to use (e.g., USD) and the funding amount. IQCent has a minimum funding requirement, typically set at $500. Ensure you meet the minimum funding requirement.

5. Review and agree to the terms and risk statement: Read the Terms and Risk statement provided by IQCent. If you agree to the terms, check the box or tick the appropriate checkbox indicating your agreement.

6. Optional: If you have a promo code, enter it in the designated field.

7. Complete the registration: Once you have filled in all the required information and agreed to the terms, click on the “Open an account” or similar button to complete the registration process.

After completing these steps, your account with IQCent will be created. It is important to note that IQCent is an unregulated broker, so it is essential to be aware of the associated risks and exercise caution when trading with them.

Leverage

IQCent offers high leverage options to select account holders, with leverage ratios of up to 1:500. Leverage allows traders to enter positions that exceed their account balance, potentially amplifying the impact of their trades. It is important to note that high leverage levels come with increased risk, and they may not be suitable for inexperienced traders. However, experienced investors who understand the risks involved may find the availability of high leverage options beneficial to their trading strategies.

Spreads & Commissions

IQCent does not provide clear information regarding spreads and commissions. The specific spreads on currency pairs like EUR/USD are not specified, unlike many other brokers who offer spreads ranging from 1 pip to 1.5 pips. However, IQCent does offer a small minimum order size of just $0.01, which can benefit traders interested in lower-value assets or those who prefer placing smaller trades.

IQCent also offers affordable minimum account balances, typically starting from $500, although this may vary depending on the region. Funding your account with up to $1,000 may qualify you for a trading bonus, enhancing your trading opportunities.

Furthermore, IQCent provides no-commission trades, allowing traders to execute trades without incurring additional commission charges. The low trade minimums of $0.01 make the platform suitable for traders employing short-term trading strategies that involve multiple small trades throughout the day.

While the lack of clear information on spreads and commissions may be a concern, the low minimum order size and affordable account balances can make IQCent appealing to traders looking for flexibility and accessibility in their trading activities.

Trading Platform Available

IQCent offers a proprietary trading platform that is packed with different chart types, including the Tick chart and candlestick chart, instead of the industry-recognized MT4 or MT5 trading platform.

Trading Tools

IQCent offers some trading tools for an enhanced trading experience, including the copy trading tools that allow traders to copy the trades of other traders.

Deposit & Withdrawal

IQCent offers options for both depositing and withdrawing funds from your trading account. Here's a brief description of the deposit and withdrawal process:

Deposit: IQCent allows users to fund their trading accounts using various methods, including credit cards, debit cards, Bitcoin, cryptocurrencies, and PerfectMoney. The minimum deposit amount required by IQCent is just $10, making it accessible for traders with different budget levels. This low minimum deposit requirement enables traders to start trading with a relatively small amount of capital.

Withdrawal: When it comes to withdrawals, IQCent specifies that there is a 5% commission charged by the payment system for withdrawals made via credit and debit cards. It is important to note that this commission is applied by the payment system and not by IQCent. The withdrawal process is typically efficient, with IQCent aiming to process withdrawals within up to 1 hour after confirmation.

Pros and Cons

| Pros | Cons |

| Multiple funding options including credit cards, debit cards, Bitcoin, cryptocurrencies, and PerfectMoney | 5% commission charged for credit and debit card withdrawals by the payment system, not by IQCent |

| Low minimum deposit requirement of $10, making it accessible for traders with different budgets | |

| Withdrawal process with withdrawals processed within up to 1 hour after confirmation |

IQCent provides traders with its proprietary trading platform. This platform is equipped with a variety of chart types, including the Tick chart and candlestick chart.

It is important to note that IQCent's platform is not the industry-recognized MetaTrader 4 (MT4) or MetaTrader 5 (MT5) trading platforms commonly used by many brokers. Traders using IQCent's platform have access to unique features and functionality specifically designed by IQCent for their trading needs.

Trading Tools

IQCent provides traders with a selection of trading tools to enhance their trading experience. One notable tool offered by IQCent is the copy trading feature. This tool enables traders to replicate the trades of other traders, allowing them to benefit from the expertise and strategies of successful traders. By copying trades, traders can potentially improve their own trading results and gain insights into profitable trading approaches.

Payment Methods

IQCent offers a range of payment methods to fund your trading account. Here are the available funding methods provided by IQCent:

1. Credit Cards (VISA/MasterCard): IQCent accepts payments through major credit cards such as VISA and MasterCard. This method allows for fast and reliable transfers. However, it is important to note that a transfer fee of 5% may be charged by the payment system, not the broker. The funding time for credit card payments is typically instant, ensuring your funds are available in your trading account without delay. Withdrawals via credit cards are processed within up to 1 hour after confirmation.

2. Bank Wire Transfer: IQCent supports bank wire transfers for funding your trading account. Bank wire transfers are a secure and widely accepted payment method. However, specific details regarding transfer fees and funding times are not provided in the given information.

3. Cryptocurrencies (Bitcoin, Ethereum, Altcoins): IQCent allows funding your account using popular cryptocurrencies such as Bitcoin, Ethereum, and Altcoins. Transfers made through cryptocurrencies are generally fee-free, meaning there are no transfer fees imposed by IQCent. Funding using cryptocurrencies is typically instant, ensuring your funds are quickly available for trading. Withdrawals via cryptocurrencies are processed within up to 1 hour after confirmation.

It is important to note that IQCent emphasizes secure processing, as indicated by their SSL certification of 256-bit encryption. Additionally, they mention funds safety in European banks, providing an extra layer of assurance for traders.Please keep in mind that while IQCent may not charge transfer fees, third-party fees may still apply. Funding and withdrawal times may vary, and during weekends and public holidays, there may be delays in the funding process.

As payment methods can be subject to change or updates, it is recommended to verify the latest information on the IQCent website or contact their customer support for the most accurate and up-to-date details regarding funding your trading account.

Pros and Cons

| Pros | Cons |

| Acceptance of major credit cards (VISA/MasterCard) for fast transfers | Transfer fee of 5% for credit card payments |

| Support for secure bank wire transfers | Lack of specific details on transfer fees and funding times for bank wire transfers |

| Option to fund with popular cryptocurrencies (Bitcoin, Ethereum, Altcoins) with no transfer fees | Funding and withdrawal times may vary, with potential delays on weekends and holidays |

| Emphasis on secure processing and funds safety in European banks | Third-party fees may apply, payment methods subject to change |

Customer Support

IQCent prioritizes customer support and provides assistance to traders whenever needed. Their customer support team is available round the clock, 24/7, to address any inquiries or concerns that traders may have.

Traders can reach out to IQCent's customer support team through various contact channels, including:

1. Telephone: Traders can contact IQCent's customer support by phone to receive real-time assistance and support.

2. Email: IQCent provides an email address, support@iqcent.pro, where traders can send their questions or concerns. The customer support team will respond to these inquiries via email.

3. Live Chat: IQCent offers a live chat feature, allowing traders to communicate with customer support representatives in real-time. This can be a convenient and efficient way to seek immediate assistance or clarification.

4. Social Media: IQCent also utilizes social media platforms to engage with their customers. Traders can potentially connect with the customer support team through social media channels to seek support or stay updated with the latest information.

Conclusion

Overall, IQCent offers a range of trading opportunities with a diverse selection of market instruments across different asset classes. The availability of different account types allows traders to choose an account that suits their needs, and the option for high leverage ratios can be beneficial for experienced traders. The low minimum order size and no-commission trades make it accessible for traders with varying capital levels. However, IQCent's lack of regulation and negative feedback raise concerns about its legitimacy and potential risks. The absence of clear information on spreads and commissions is a drawback, and traders should exercise caution when considering IQCent as their trading platform. It is advisable to conduct thorough research, evaluate the associated risks, and explore regulated alternatives before engaging with IQCent.

FAQs

Q: Is IQCent a regulated broker?

A: No, IQCent is not regulated by any valid regulatory authority, which raises concerns about potential risks associated with trading through this broker.

Q: What market instruments are available on IQCent?

A: IQCent offers access to over 100 financial instruments, including forex, commodities, indices, cryptocurrencies, options, and CFDs.

Q: What are the different account types offered by IQCent?

A: IQCent provides three account types: Bronze, Silver, and Gold. Each account type offers different features and benefits to cater to the varying needs of traders.

Q: How can I open an account with IQCent?

A: To open an account with IQCent, visit their website, click on the “Open an account” button, fill in the required information, select the account currency and funding amount, review and agree to the terms and risk statement, and complete the registration process.

Q: Does IQCent offer leverage?

A: Yes, IQCent offers high leverage options to select account holders, with leverage ratios of up to 1:500. However, it is important to consider the associated risks and suitability for your trading strategy.

Q: What are the spreads and commissions on IQCent?

A: IQCent does not provide clear information about spreads and commissions. However, the platform offers a small minimum order size of $0.01 and no-commission trades, making it suitable for traders interested in lower-value assets and those who prefer smaller trades.

Q: What payment methods are available on IQCent?

A: IQCent supports various payment methods, including credit cards (VISA/MasterCard), bank wire transfer, Bitcoin, Ethereum, and Altcoins. Specific details regarding transfer fees and funding times may vary.

Q: How can I contact IQCent's customer support?

A: IQCent's customer support is available 24/7. You can contact them via telephone, email (support@iqcent.pro), live chat on their website, or through their social media channels.

News

ExposureIQCent Broker Review: Can We Trust It?

IQCent, a broker registered in the Marshall Islands and operated by Wave Makers LTD, has been in the trading industry for 2 to 5 years. Despite offering a wide variety of market instruments and account types, it has received a low score of 1.46/10 on WikiFX, raising questions about its reliability. This article aims to provide an in-depth review of IQCent and determine if it can be trusted by traders.

WikiFX

WikiFX

NewsWikiFX announces new functions : powerful tools that can enhance your trading results

The scientific data analysis of forex tools provides a certain reference value for your capital management. In this article, we will introduce you to Pivot Points Calculator, Pips Calculator, Fibonacci Calculator, Position Quantity Calculator, and Trader Comparison.

WikiFX

WikiFX

NewsEXPERTS GIVE SOLUTIONS TO STRENGTHEN THE NAIRA IN THE FACE OF NAIRA DEPRECIATION

The naira confronts a greater degree of economic reduction than the country has witnessed in recent decades as a result of reduced foreign exchange, dwindling foreign capital, rising political risk, and reported poor performance.

WikiFX

WikiFX

NewsIs forex trading a safe investment for South African Traders?

There is a major concern today regarding the security of the capital invested into the forex market by the majority of South African traders. Many tend to ask if the funds are safe with the brokers while others seek some guarantee for profits over invested capital. However, there are two major considerations that determine the degree of security offered to investors' funds. These two factors which border on regulations and the type of broker involved have been discussed fully in this work.

WikiFX

WikiFX

Review 24

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now