Score

GIC

Singapore|2-5 years|

Singapore|2-5 years| https://www.gicindonesia.com

Website

Rating Index

Influence

Influence

B

Influence index NO.1

Indonesia 7.97

Indonesia 7.97Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Singapore

SingaporeUsers who viewed GIC also viewed..

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

AvaTrade

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

Website

globalinvestacapital.com

Server Location

United States

Website Domain Name

globalinvestacapital.com

Server IP

104.21.36.46

gicindonesia.com

Server Location

United States

Website Domain Name

gicindonesia.com

Server IP

104.21.5.38

Company Summary

| GICReview Summary | |

| Founded | 2020-07-02 |

| Registered Country/Region | Singapore |

| Regulation | Unregulated |

| Market Instruments | Foreign currency pairs/Gold/Indices/Commodities |

| Demo Account | ❌ |

| Leverage | Up to 1:400 |

| Spread | Low |

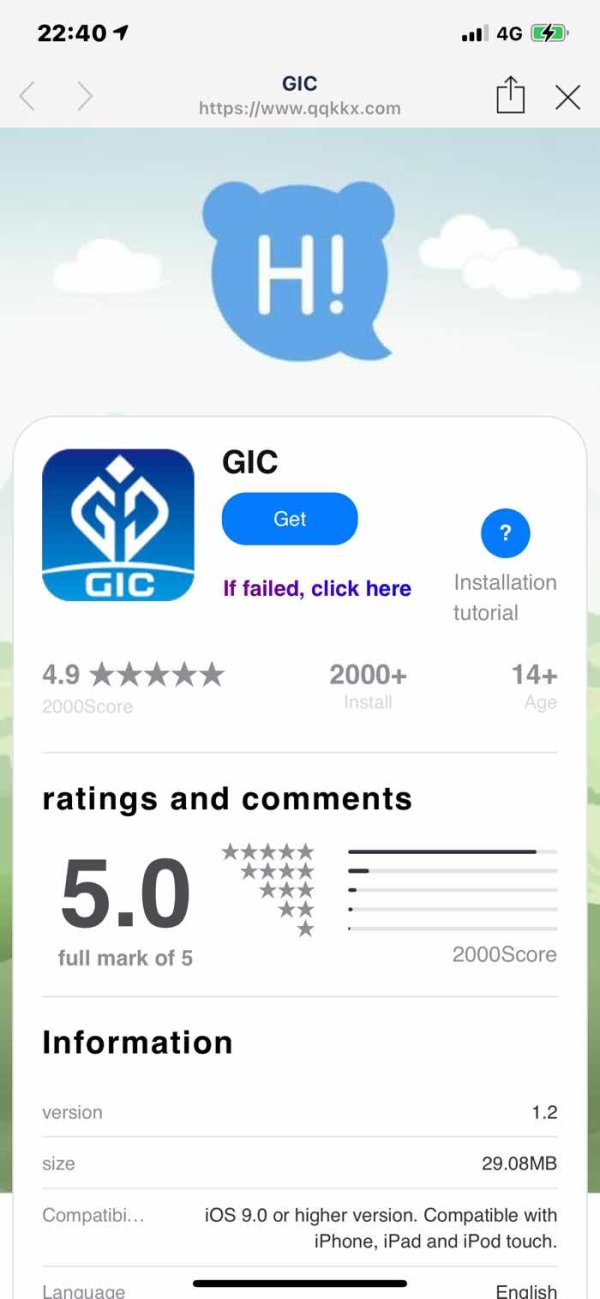

| Trading Platform | P2P Blockchain-based platform(Mobile and Windows) |

| Min Deposit | 5.000 GICT or Rp75.000.000,00 |

| Customer Support | Email: Support@gicindonesia.com |

| Email: Partnership@gicindonesia.com | |

| Tel: 0817 - 0095 - 888 | |

GIC Information

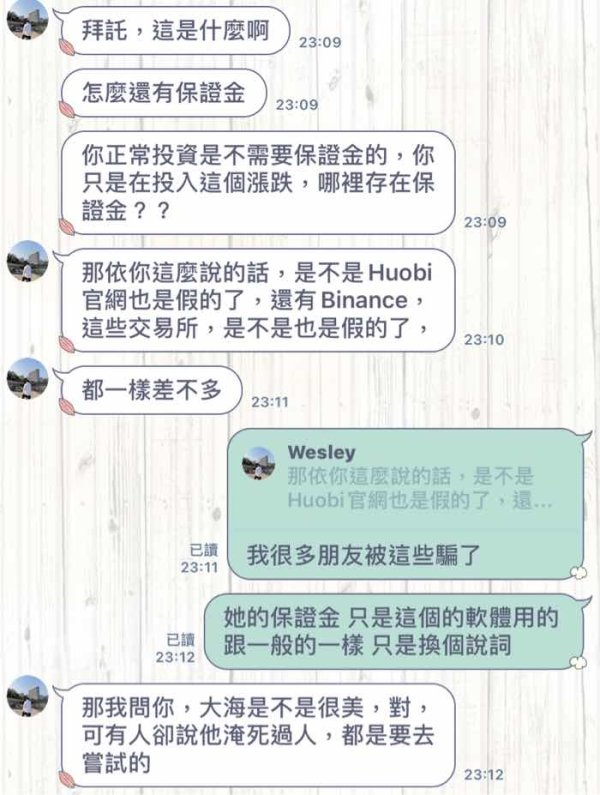

GIC has built the world's first Peer to Peer (P2P) Forex Trading Platform that enables customers to choose as Traders or Market Makers. The tradable instruments with a maximum leverage of 1:400 include foreign currency pairs, gold, indices, and commodities. The broker only provides a P2P Blockchain-based platform. GIC is still risky due to its unregulated status and bad reviews about induced fraud.

Pros and Cons

| Pros | Cons |

| Leverage up to 1:400 | Unregulated |

| Commission free | Bad review about depositing |

| Swap free | Unspecific fees information |

Is GIC Legit?

GIC is not regulated, even though it claims to be regulated. However, an unregulated broker is not as safe as a regulated one.

What Can I Trade on GIC?

GIC offers access to foreign currency pairs, gold, indices, and commodities.

| Tradable Instruments | Supported |

| Foreign currency pairs | ✔ |

| Commodities | ✔ |

| Gold | ✔ |

| Indices | ✔ |

| Stocks | ❌ |

| Precious Metals | ❌ |

| Shares | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

GIC Fees

The swap and commission are free.

Leverage

The maximum leverage is 1:400 meaning that profits and losses are magnified 400 times.

Trading Platform

GIC offers a P2P Blockchain-basedtrading platform available in Mobile and Windows versions. MT5 is also used.

| Trading Platform | Supported | Available Devices |

| P2P Blockchain-based platform | ✔ | Mobile and Windows |

| MT5 | ✔ | - |

Deposit and Withdrawal

Deposit a minimum of 5.000 GICT or Rp75.000.000,00.

Customer Support Options

GIC provides Monday - Friday (09.00 - 17.00) customer support. Traders can communicate via email and phone.

| Contact Options | Details |

| Phone | 0817 - 0095 - 888 |

| Live Chat (Whatsapp) | 08170095888 |

| Support@gicindonesia.com | |

| Partnership@gicindonesia.com | |

| Supported Language | Indonesian/English |

| Website Language | Indonesian/English |

| Physical Address | 89 Tagore LnSingapore 787531Mons Space Building, 3rd Floor131 Kol. Yos Sudarso StMedan, North Sumatera 20138Sahid Sudirman Center, Floor 20A86 Jend. Sudirman StCentral Jakarta 10220 |

Keywords

- 2-5 years

- Suspicious Regulatory License

- High potential risk

Review 1

Content you want to comment

Please enter...

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now