Score

SK markets

United States|1-2 years|

United States|1-2 years| https://www.skmarketsfx.net/

Website

Rating Index

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

+1 617 798 0330

Other ways of contact

Broker Information

More

SK markets

SK markets

United States

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

WikiFX Verification

Users who viewed SK markets also viewed..

XM

IUX

FXCM

AUS GLOBAL

SK markets · Company Summary

| SK markets Review Summary | |

| Founded | 2010 |

| Registered Country/Region | United States |

| Regulation | Unregulated |

| Market Instruments | 11,000+, Forex, Indices, ETFs & ETNs, Options, Commodities, Stock CFDs |

| Leverage | Up to 1:30 (for Retail Traders) |

| Up to 1:200 (for Professional Traders) | |

| Trading Platforms | WebTrader, Tradingweb Mobile App |

| Minimum Deposit | $500 |

| Payment Methods | Visa, Mastercard, Skrill, Nasdaq, Cboe, Cloudflare |

| Customer Support | Phone: +1 617 798 0330 |

| Email: support@skmarketsfx.com | |

SK markets Information

SK markets is an unregulated online brokerage established in 2010. It offers a user-friendly trading experience through its WebTrader and Tradingweb Mobile App, accepting various payment methods including Visa, Mastercard, Skrill, Nasdaq, Cboe, and Cloudflare. SK markets prioritizes client experience with features like direct exchange access for zero markups and 24/5 multilingual customer support.

Pros & Cons

| Pros | Cons |

| Diverse Assets Selection | Unregulated |

| App Available | Minimum Deposit Requirement |

| Security Measures to Ensure Fund Safety |

Is SK markets Legit or a Scam?

SK markets is unregulated by any regulatory authorities.

Market Instruments

The most popular trading assets over 11,000 in the forex world are accessible at SK Markets, including Forex, Index, ETF and ETN, Options, Commodity, and stock CFDs.

Clients can trade major, minor, and exotic currency pairs in the Foreign Exchange market.

For equity exposure, the platform offers CFDs on major indices like the S&P 500 and DAX30.

To diversify portfolios, traders can invest in ETFs and ETNs representing a basket of assets.

Options trading allows for complex strategies based on underlying stocks, indices, and commodities.

Commodity traders can access precious metals, energy, and agricultural products.

Finally, stock CFDs enable speculation on individual share prices without owning the underlying shares.

Account Types

SK markets offers different account types to suit different needs, among which the multi-asset trading account is the most common, designed to enhance customers' trading experiences by enabling them to trade multiple assets through a single account. This account, accessed through the SK markets Platform, operates with the base currency of USD. In this account, there are five different plans for different levels of traders.

Bronze Plan: The Bronze plan is an entry-level account, requiring a minimum deposit of $500. It charges a fee of $0.01 per share traded, with a minimum fee of $1.50. This plan is suitable for traders who are starting and prefer to trade in smaller volumes.

Silver Plan: The Silver plan requires a minimum deposit of $5,000. It offers a lower fee per share of $0.008 compared to the Bronze plan, with the same minimum fee of $1.5. This plan is suitable for traders who trade in slightly higher volumes and want a lower per-share fee.

Gold Plan: The Gold plan requires a minimum deposit of $10,000. It offers a further reduced fee per share of $0.007, with the same minimum fee of $1.50. This plan is suitable for traders who trade more frequently and in higher volumes.

Platinum Plan: The Platinum plan requires a minimum deposit of $25,000. It offers a fee per share of $0.006, which is lower than the previous plans, with a reduced minimum fee of $1.25. This plan is suitable for experienced traders who trade in significant volumes.

Diamond Plan: The Diamond plan is the highest tier, requiring a minimum deposit of $50,000. It offers the lowest fee per share of $0.005, with a minimum fee of $1. This plan is suitable for professional traders and institutions who trade in large volumes and require the lowest possible fees.

Leverage

SK markets offers varying leverage rates depending on whether you are a retail trader or a professional trader. A retail investor who meets certain criteria may request to be treated as a professional client. This is a regulatory classification which defines investors that possess the experience and knowledge to make their own investment decisions and properly assess risks.

For retail traders, the leverage rates are more conservative, with a maximum of 1:30 for major currency pairs and lower rates for other instruments like stocks and commodities. This means that for every dollar in your trading account, you can control up to $30 worth of a major currency pair.

On the other hand, professional traders are offered higher leverage rates, ranging from 1:5 to 1:200 depending on the instrument. This allows professional traders to control larger positions with a relatively smaller amount of capital.

Spreads & Commissions

SK markets offers two types of trading accounts on the Tradingweb Platform: Spread-based plans and Commission-based plans. For details on real-time spreads and commissions, please visit the website: https://www.skmarketsfx.com/pricing1.html.

Spread-based plans: In these plans, the spread is incorporated into the quoted buy and sell prices. The spread is the difference between the Bid and Ask prices of a certain instrument. SK markets provides average spread information for different currency pairs under various account plans such as Bronze, Silver, Gold, and Platinum. For example, in the Bronze plan, the spread for the AUDUSD pair is 0.00042, and the long and short SWAP rates are also provided. The spread varies based on market conditions and the times of trading.

Commission-based plans: In these plans, traders pay a fee on the execution of a transaction in addition to the spread. These plans are structured with a tighter spread. SK markets offers commission-based plans like Basic, Standard, VIP, and Premium VIP. For example, in the Basic plan, the commission for the AUDUSD pair is $14.5 per lot, and the spread is 0.00013. The long and short SWAP rates are also provided for each instrument.

Trading Platforms

SK markets offers two trading platforms for its clients: WebTrader and Tradingweb Mobile App. Both offer a range of tools and features to cater to your needs, whether you are a beginner or an experienced professional.

WebTrader: This platform is accessible through web browsers, allowing traders to access their accounts from any device with an internet connection. WebTrader provides a user-friendly interface and a range of features to help traders analyze the markets and execute trades. It supports trading in a variety of instruments, including forex, indices, commodities, and cryptocurrencies.

Tradingweb Mobile App: The Tradingweb Mobile App is designed for traders who prefer to trade on the go. It is available on Google Play and Apple Store, offering powerful functionality for trading Forex anytime and anywhere in the world. The app provides complete control over a trading account, allowing traders to execute trades, view trade history, and access interactive charts with various timeframes and technical indicators.

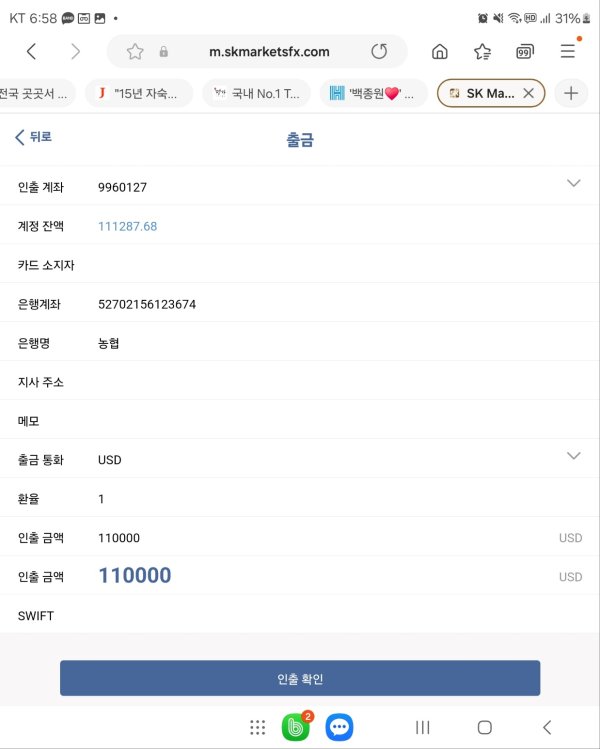

Deposits & Withdrawals

Deposits and withdrawals with SK markets are straightforward processes, but they come with certain guidelines and fees. When making a deposit, you can do so through various payment methods, including Visa, Mastercard, Skrill, Nasdaq, Cboe, and Cloudflare.

There is no charge for incoming wire transfers, making it convenient for clients to fund their trading accounts without incurring additional fees. For withdrawals, the process is also simple but involves fees. The first withdrawal of the month, if it's less than $500, is free. However, subsequent withdrawals or withdrawals exceeding $500 incur a fee of $40 per wire (or 30 EUR for Euro-based accounts).

Customer Service

To give SK markets' users more convenience to connect with the customer support team, they give email support anytime. However, for those who attach importance to responding timely, you can only chat with them +1 617 798 0330 from 9:00 a.m. to 6:00 p.m. U.S time.

What's more, if you are near their offline office, you can contact their staff face to face.

Conclusion

SK markets presents itself as a well-equipped broker, offering a diverse selection of assets, user-friendly platforms, and security measures. Their account tiers cater to different trading styles and volumes, and the mobile app provides flexibility for on-the-go trading.

Frequently Asked Questions (FAQs)

What trading platforms does SK markets provide?

SK markets offers two user-friendly trading platforms: WebTrader and Tradingweb Mobile App.

What is the minimum deposit required to start trading with SK markets?

The minimum deposit required to open an account with SK markets is $500.

How can I fund my SK markets account?

SK markets offers deposit options like incoming wire transfers (free of charge) and potentially other methods such as Visa, Mastercard, and Skrill.

Are there any fees associated with withdrawing funds from SK markets?

While the first withdrawal per month is free (under $500), subsequent withdrawals or those exceeding $500 incur a $40 fee (or €30 for Euro accounts).

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors.

Review 4

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now