Score

City Credit Capital

Chile|2-5 years|

Chile|2-5 years| https://www.cccapital.ky/

Website

Rating Index

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

+56 2 25994599

+1 345 769 1890

+1 345 769 7486

+1 345 769 1892

Other ways of contact

Broker Information

More

City Credit Capital (Chile) LTD

City Credit Capital

Chile

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

WikiFX Verification

Users who viewed City Credit Capital also viewed..

XM

Neex

IUX

Vantage

City Credit Capital · Company Summary

| Aspect | Information |

| Company Name | City Credit Capital |

| Registered Country/Area | Chile |

| Years | 2001 |

| Regulation | Unregulated |

| Market Instruments | Forex, CFDs, Spot Metals, and Fractional Pricing (Spot Products Only) |

| Account Types | Standard |

| Minimum Deposit | $5,000 |

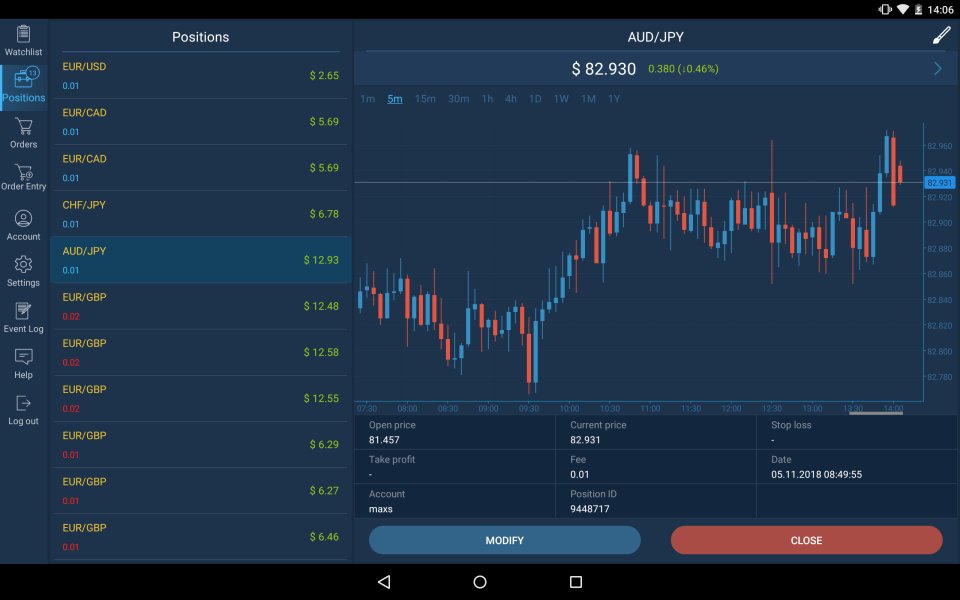

| Trading Platforms | MT4 |

| Demo Account | Yes |

| Customer Support | Phone: + 56 225994599 and Email: customerservice@cccapital.cl. |

| Educational Resources | Trends, Reversal Formations, Chart Configuration, and Technical Studies |

Overview of City Credit Capital

City Credit Capital, a company established in 2001 and based in Chile, specializes in retail derivatives trading. While City Credit Capital operates in an unregulated environment, it offers a range of market instruments, including Forex, CFDs, Spot Metals, and Fractional Pricing (limited to Spot Products).

The company provides a single account type, Standard, with a minimum deposit requirement of $5,000. Trading is facilitated through the popular MT4 platform. Customer support is available via phone and email.

Additionally, City Credit Capital offers educational resources covering various topics such as trends, reversal formations, chart configuration, and technical studies.

Regulatory Status

City Credit Capital operates as an unregulated trading platform. Unregulated institutions may engage in fraudulent activities, such as Ponzi schemes or misappropriation of funds, without fear of legal consequences.

Pros and Cons

| Pros | Cons |

| Different Market Instruments | Lack of Regulatory Oversight |

| MT4 Trading Platform Available | Potential Higher Risk due to Unregulated Status |

| Availability of Demo Account | Limited Account Types |

| Dedicated Customer Support | Operational Risk |

| / | High Minimum Deposit Requirement |

Pros:

Different Market Instruments: City Credit Capital offers a wide range of market instruments including Forex, CFDs, and Spot Metals, providing traders with trading opportunities and the ability to diversify their portfolios.

MT4 Trading Platform Available: The availability of the MetaTrader 4 (MT4) trading platform provides traders with a familiar and robust platform known for its advanced charting tools, automated trading capabilities, and extensive range of technical indicators.

Availability of Demo Account: City Credit Capital offers a demo account, allowing traders to practice trading strategies and familiarize themselves with the platform's features and market conditions without risking real money.

Dedicated Customer Support: The provision of dedicated customer support through phone and email ensures that traders have access to assistance whenever they need it, enhancing the overall trading experience.

Cons:

Lack of Regulatory Oversight: Being an unregulated financial institution, City Credit Capital operates without the oversight and protection provided by regulatory authorities, potentially exposing investors to higher risks.

Potential Higher Risk Due to Unregulated Status: The absence of regulatory oversight may increase the risk of fraudulent activities, market manipulation, and operational failures, posing risks to investors' funds and the integrity of the trading environment.

Limited Account Types: City Credit Capital offers only one account type, which may not suit the needs and preferences of different types of traders, limiting their choices and flexibility.

Operational Risk: As an unregulated entity, City Credit Capital may lack the stringent operational standards and risk management practices required by regulated financial institutions, increasing the likelihood of operational failures, cybersecurity breaches, or data leaks.

High Minimum Deposit Requirement: The minimum deposit requirement, $5,000, is not competitive in some respects, it may be considered high for traders with limited starting capital, potentially excluding a portion of the market.

Market Instruments

City Credit Capital offers a range of market instruments including Forex, CFDs (Contracts for Difference), Spot Metals, and Fractional Pricing (limited to Spot Products Only).

Forex: Traders can access the foreign exchange market, where they can trade currencies against each other. This allows for speculation on currency pairs' price movements, providing opportunities for profit based on exchange rate fluctuations.

CFDs (Contracts for Difference): CFDs enable traders to speculate on the price movements of various financial instruments, including stocks, commodities, indices, and cryptocurrencies, without owning the underlying asset. This allows for leveraged trading and potential profit from both rising and falling markets.

Spot Metals: City Credit Capital facilitates trading in precious metals such as gold, silver, platinum, and palladium. Spot metal trading involves buying or selling these metals for immediate delivery, providing traders with opportunities to hedge against inflation or diversify their investment portfolios.

Fractional Pricing (Spot Products Only): This feature allows traders to trade fractional units of spot products, which typically include commodities like gold and silver. Fractional pricing enables traders to invest in these assets with smaller amounts of capital, making them accessible to a broader range of investors.

Account Types

City Credit Capital offers a single account type, known as the Standard account, providing comprehensive trading services.

With a minimum first deposit of $5,000, the account supports Forex, CFDs, and Spot Metals trading, with a minimum FX lot size of 100,000 and an initial FX margin starting from 1%. Maximum leverage is variable, allowing for flexible trading strategies.

Additionally, traders benefit from fractional pricing, particularly for Spot Products. The platform offers essential tools for traders, including a Dow Jones News Feed, professional charting, 24-hour customer service, daily market commentary, and a dedicated relationship manager.

Notably, City Credit Capital's Standard account does not involve re-quotes and ensures no slippage on stop-loss orders, enhancing the trading experience for its clients.

| Standard | |

| Category | Details |

| Minimum First Deposit | $5,000 |

| Minimum FX Lot Size | 100,000 |

| Initial FX Margin | From 1% |

| Maximum Leverage | Variable |

| Forex | Yes |

| CFDs | Yes |

| Spot Metals | Yes |

| Fractional Pricing | (Spot Products Only) |

| Dow Jones News Feed | Yes |

| Professional Charting | Yes |

| 24 hour Customer Service | Yes |

| Daily Market Commentary | Yes |

| Dedicated Relationship Manager | Yes |

| Requotes | No |

| Slippage on Stop Loss Orders* | No |

How to Open an Account?

Opening an account with City Credit Capital is a straightforward process that can be completed online in a matter of minutes. Here's a breakdown of the steps involved:

Visit the City Credit Capital website and click “Account Opening.”

Fill out the online application form: The form will request your personal information Be sure to have your identification documents (passport or ID card) and proof of address handy for uploading.

Fund your account: City Credit Capital offers various deposit methods, including bank transfers, credit/debit cards, and e-wallets. Choose your preferred method and follow the instructions to complete the deposit.

Verify your account: Once your account is funded, you'll need to verify your identity and address. This typically involves submitting scanned copies of your ID documents and proof of address.

Start trading: Once your account is verified, you're ready to explore the City Credit Capital trading platform and start making trades.

Trading Platform

City Credit Capital employs the MetaTrader 4 (MT4) trading platform, a popular choice among traders worldwide. MT4 offers a user-friendly interface and a wide range of advanced trading tools, making it suitable for both novice and experienced traders. With features such as customizable charts, technical indicators, and automated trading capabilities, MT4 provides traders with the flexibility and functionality to execute their trading strategies effectively. Additionally, MT4's compatibility with various devices allows traders to access their accounts and trade on the go, ensuring convenience and accessibility.

Customer Support

City Credit Capital offers dedicated customer support services to assist traders with their inquiries and concerns. Traders can reach out to City Credit Capital's customer support team via phone at +56 225994599 or through email at customerservice@cccapital.cl.

Educational Resources

City Credit Capital provides a comprehensive range of educational resources to support traders in their journey toward mastering the financial markets. These resources cover essential topics such as trends, reversal formations, chart configuration, and technical studies.

Trends: Traders can learn how to identify and analyze trends in market movements, enabling them to make informed decisions on whether to buy, sell, or hold assets based on prevailing market trends.

Reversal Formations: City Credit Capital educates traders on recognizing reversal patterns in price movements, empowering them to anticipate potential trend reversals and capitalize on market opportunities.

Chart Configuration: Traders are guided on how to configure charts effectively to visualize market data and identify key price levels, support, and resistance zones, facilitating better decision-making in their trading activities.

Technical Studies: City Credit Capital offers insights into various technical analysis tools and indicators, equipping traders with the knowledge and skills to interpret market data, identify trading signals, and develop effective trading strategies.

Conclusion

City Credit Capital offers various trading options like Forex, CFDs, and Spot Metals, which can help traders diversify and grow their portfolios. They use the MT4 trading platform, which is easy to use and has many useful features. They also provide a demo account for practice and have helpful customer support.

However, since they aren't regulated, there might be risks like operational problems or concerns about their reputation. Also, they only offer one type of account and require a minimum deposit of $5,000, which might not suit everyone.

FAQs

Question: What is a Market order?

Answer: A Market order is an instruction to buy or sell at the current market price.

Question: What are Limit and Stop orders?

Answer: A Limit or Stop order is an instruction to buy or sell if the market price reaches a pre-defined level.

Question: Is my money safe?

Answer: Clients' funds are held in segregated client accounts with Tier 1 banks and kept completely separate from the operating funds of City Credit Capital (Chile).

Question: What does city credit capital do?

Answer: City Credit Capital provides online FX and CFD trading services to individual investors, traders, fund managers, and other financial institutions.

Question: What types of partnerships do you provide?

Answer: City Credit Capital provides affiliate partnerships, introducing broker, partial white label and full white label programs.

News

Review 3

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now