Score

Accumarkets

South Africa|1-2 years|

South Africa|1-2 years| https://www.accumarkets.co.za/

Website

Rating Index

MT4/5 Identification

MT4/5 Identification

White Label

South Africa

South AfricaContact

Licenses

Single Core

1G

40G

Contact number

+27 110839132

+27 127436226

Other ways of contact

Broker Information

More

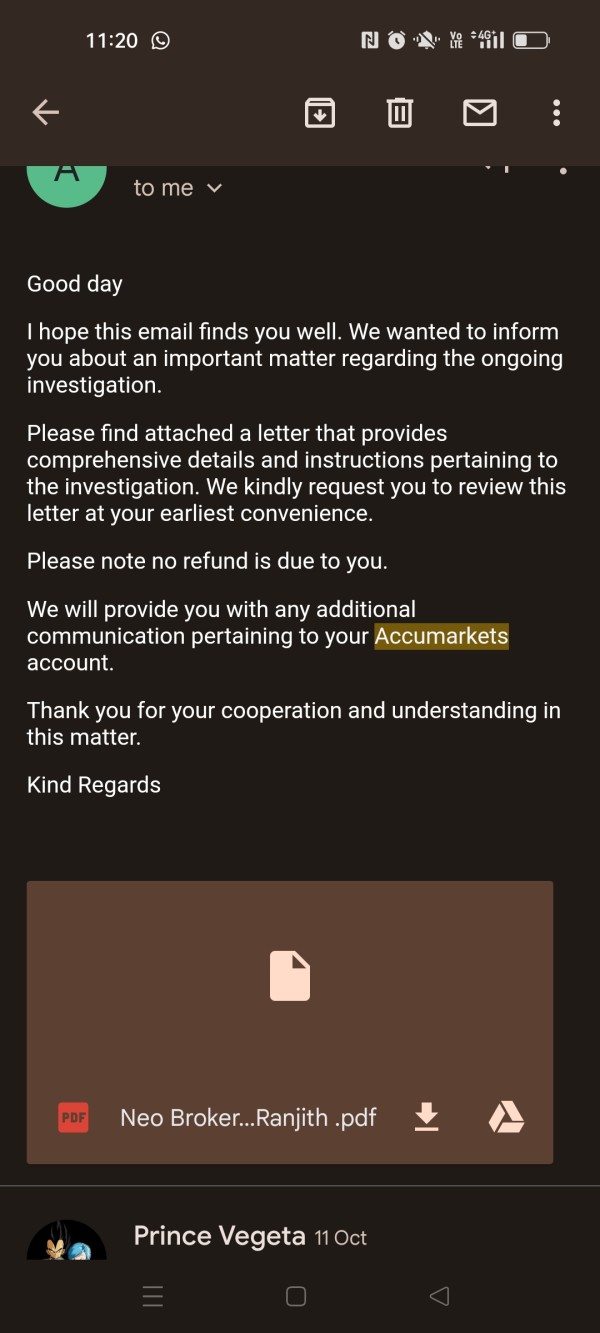

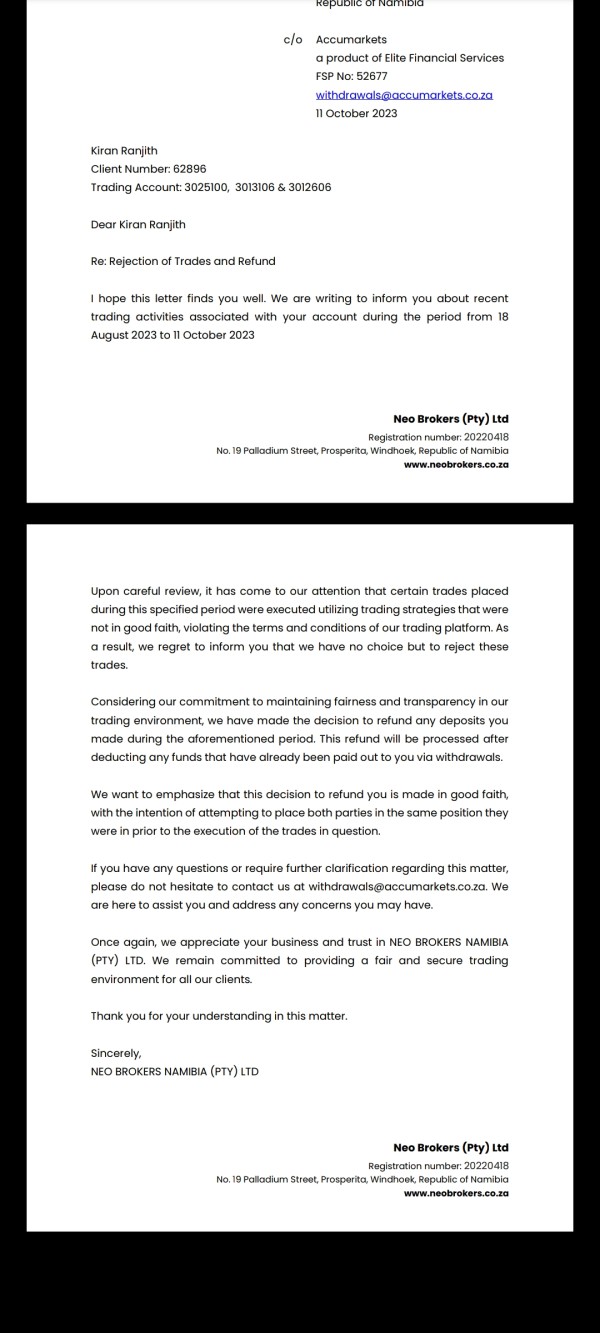

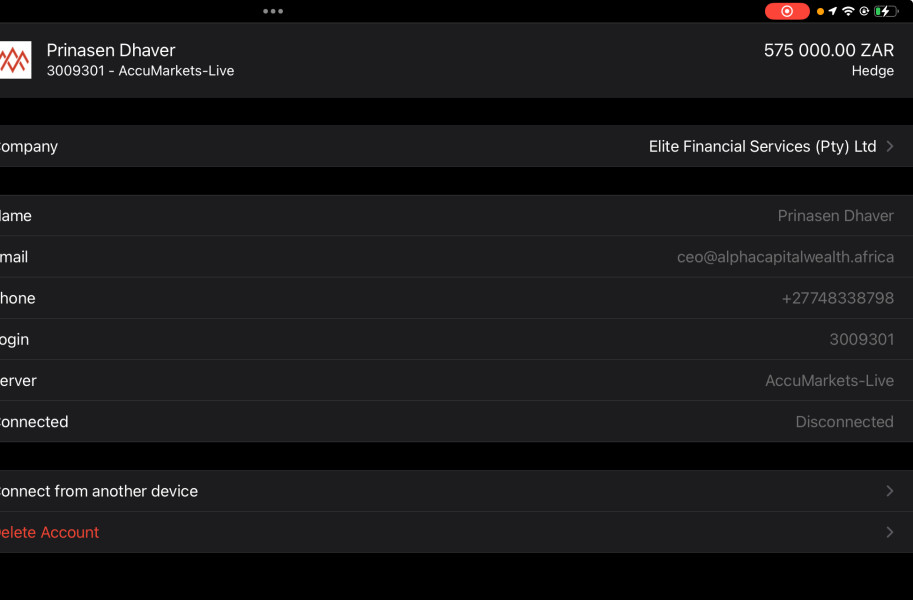

Elite Financial Services (Pty) Ltd

Accumarkets

South Africa

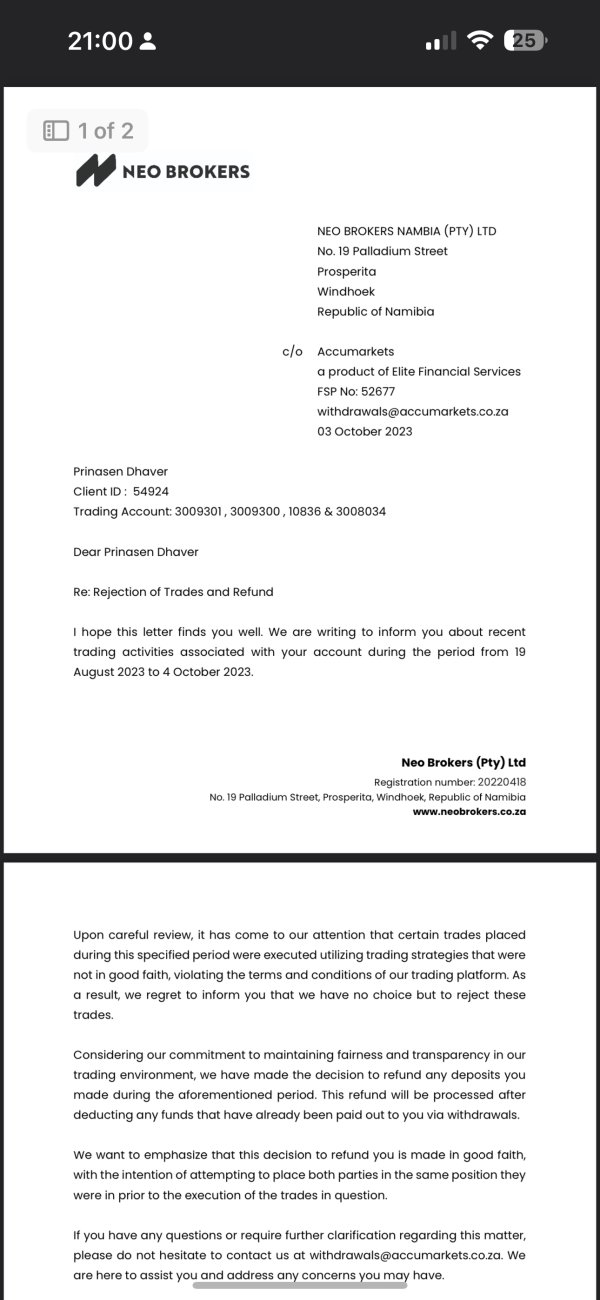

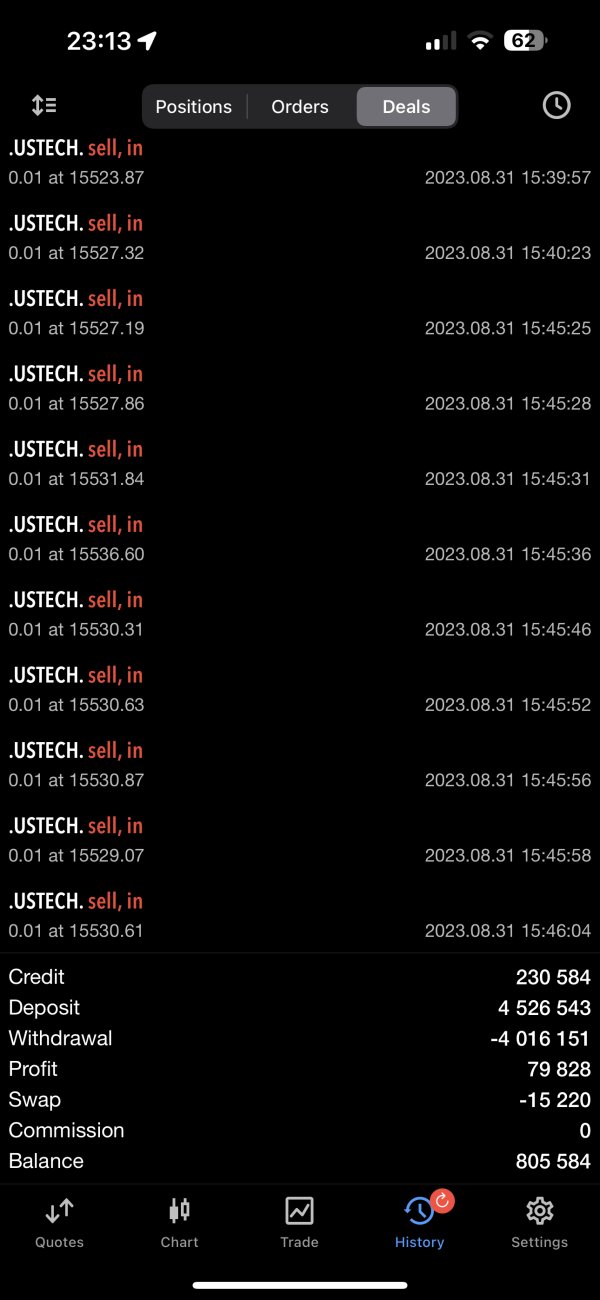

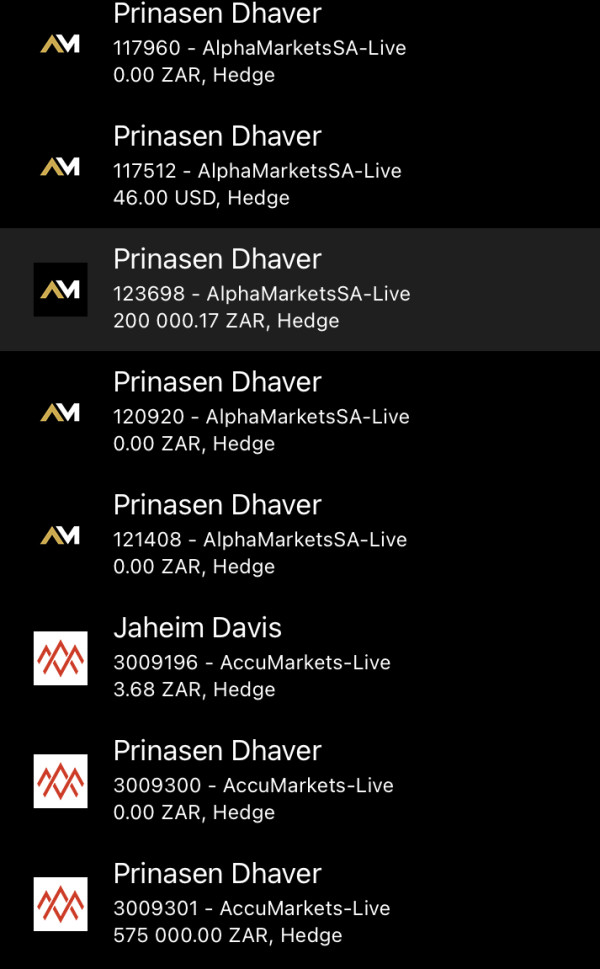

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- The number of this brokers's negative field survey reviews has reached 2. Please be aware of the risk and the potential scam!

- This broker exceeds the business scope regulated by South Africa FSCA(license number: 52677)National Futures Association-UNFX Non-Forex License. Please be aware of the risk!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | -- |

| Minimum Deposit | $5 |

| Minimum Spread | -- |

| Products | Forex, Shares, Indices |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | -- |

| Minimum Deposit | $5 |

| Minimum Spread | -- |

| Products | Forex, Shares, Indices |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | -- |

| Minimum Deposit | $5 |

| Minimum Spread | 1 |

| Products | Forex, Metals, Indices |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed Accumarkets also viewed..

XM

AUS GLOBAL

MultiBank Group

CPT Markets

Accumarkets · Company Summary

| Aspect | Information |

| Registered Country/Area | South Africa |

| Founded Year | Within 1 year |

| Company Name | Elite Financial Services (Pty) Ltd |

| Regulation | Not regulated by the Financial Sector Conduct Authority (FSCA) in South Africa |

| Minimum Deposit | $5 |

| Maximum Leverage | N/A |

| Spreads | Starting from 1 pip |

| Trading Platforms | MT5, Web Trader, Mobile Trading |

| Tradable Assets | Forex, Indices, Commodities |

| Account Types | Standard Account, 100% Bonus Account, Cent Account |

| Demo Account | N/A |

| Islamic Account | N/A |

| Customer Support | Email (support@accumarkets.co.za) and contact form on the website |

| Payment Methods | Ozow, Virtual pay, Paystack, Match2Pay |

| Educational Tools | N/A |

Overview of Accumarkets

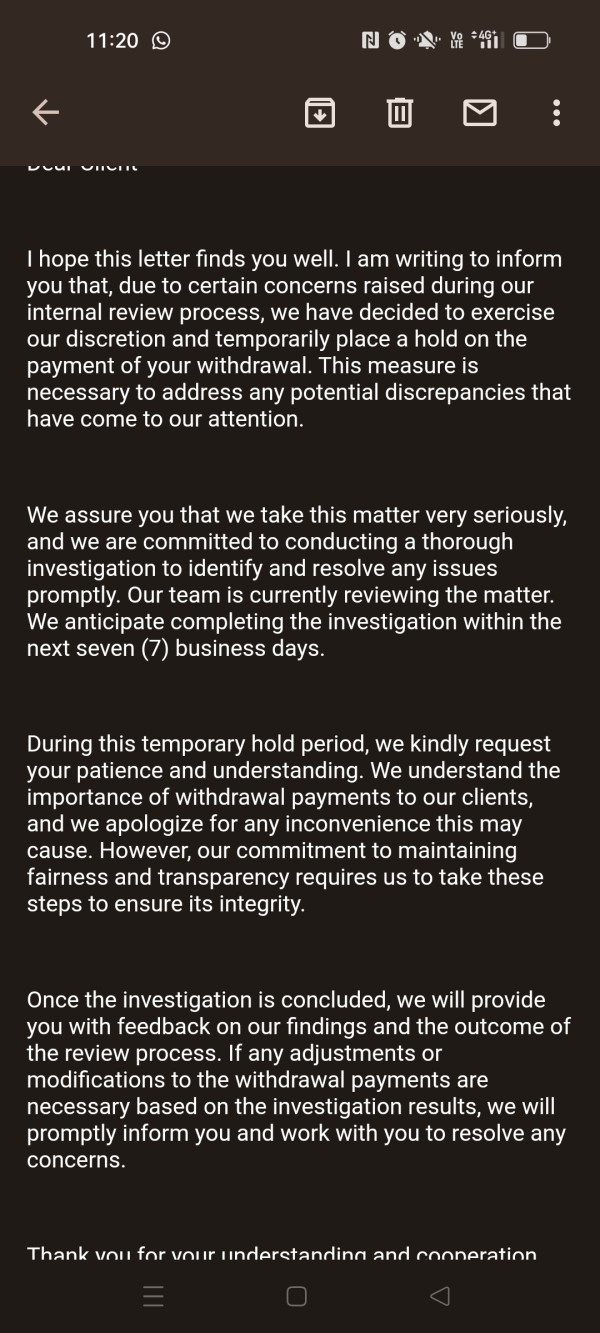

Accumarkets is a financial service corporate based in South Africa that operates without regulation from the Financial Sector Conduct Authority (FSCA). The company, associated with Elite Financial Services (Pty) Ltd, has surpassed its licensed status, raising concerns about its legitimacy. Accumarkets carries a warning indicating a low score and advises caution when engaging with the company. Suspicious activities related to its business scope further contribute to potential risks associated with Accumarkets.

The company offers a range of market instruments for trading, including forex pairs, indices, and commodities. Traders can access major and cross currency pairs in the forex category, allowing them to participate in the global foreign exchange market. Popular stock market indices from around the world are also available for trading, providing opportunities to speculate on market trends. Additionally, Accumarkets offers tradable assets in the commodities market, such as gold, silver, crude oil, natural gas, and agricultural products, where investors can take positions based on price movements.

Accumarkets provides different types of trading accounts, including the Standard Account, 100% Bonus Account, and Cent Account. Each account type requires a minimum deposit of $5, and the spreads start from 1 pip. Traders can choose from various payment options for depositing and withdrawing funds, including instant smart EFT payment services like Ozow and digital payment platforms like Virtual pay and Paystack. However, potential users should exercise caution and be aware of the potential risks associated with engaging with Accumarkets due to its lack of regulation and suspicious activities.

Pros and Cons

Accumarkets offers several advantages, such as access to a wide range of forex, indices, and commodities for trading. The availability of multiple account types allows users to choose the one that suits their needs. Additionally, Accumarkets provides various payment options, offering options for users to deposit and withdraw funds. The presence of MT5 trading platform across different device. Moreover, the minimum deposit requirement of $5 makes it accessible to traders with different budget levels.

However, there are several drawbacks to consider. Accumarkets is not regulated by the Financial Sector Conduct Authority, which may raise concerns about the safety and security of funds. The lack of information on leverage can be a disadvantage for traders who rely on leverage in their trading strategies. Additionally, Accumarkets lacks trading tools and educational resources that can help traders make informed decisions. The absence of clear terms and conditions for fund deposit and withdrawal procedures may cause confusion or uncertainty. Furthermore, there is no specific information available regarding the availability of certain market instruments or trading conditions. Lastly, Accumarkets does not offer a demo account, which could be a disadvantage for traders who prefer to practice and test their strategies before investing real money.

| Pros | Cons |

| Access to forex, indices, and commodities | Not regulated by the Financial Sector Conduct Authority |

| Multiple account types available | Lack of information on leverage |

| Various payment options | Lack of trading tools and educational resources |

| MT5 available on different devices | Lack of clear terms and conditions for fund deposit and withdrawal procedures |

| Minimum deposit of $5 | No information on the availability of specific market instruments or trading conditions. |

| Demo account is not available |

Is Accumarkets Legit?

Accumarkets is not regulated by the Financial Sector Conduct Authority in South Africa. The license type associated with Accumarkets is “Financial Service Corporate,” but it has exceeded its current status. The licensed institution, Elite Financial Services (Pty) Ltd, is associated with Accumarkets, but it is important to note that Accumarkets has a warning indicating a low score and advising people to stay away. There is a previous detection indicating that Accumarkets exceeds the business scope regulated by South Africa FSCA and the National Futures Association-UNFX Non-Forex License. Additionally, it is mentioned that Accumarkets does not have a trading software. This information suggests that there may be risks associated with engaging with Accumarkets, and caution should be exercised.

Market Instruments

Accumarkets offers a range of market instruments to trade, including forex pairs, indices, and commodities.

Forex: In the forex category, traders can access major currency pairs such as EUR/USD, GBP/USD, and USD/JPY, as well as cross pairs like EUR/GBP and GBP/JPY. These currency pairs allow traders to participate in the global foreign exchange market and potentially profit from fluctuations in exchange rates.

Indices: When it comes to indices, Accumarkets provides access to popular stock market indices from around the world. Traders can trade on the performance of indices like the S&P 500, Dow Jones Industrial Average, FTSE 100, DAX 30, and Nikkei 225. These indices represent the overall performance of specific markets and can provide opportunities for traders to speculate on the direction of stock market trends.

Commodities: In the commodities market, Accumarkets offers a range of tradable assets such as gold, silver, crude oil, natural gas, and agricultural products. Trading commodities allows investors to take positions on the price movements of these physical goods, which are influenced by factors such as supply and demand dynamics, geopolitical events, and economic conditions.

| Pros | Cons |

| Access to major currency pairs in the forex market | Limited market instruments |

| Opportunity to trade on popular stock market indices | No information on the availability of specific market instruments or trading conditions |

Account Types

Standard Account: The Standard Account offered by Accumarkets has a minimum deposit requirement of $5. The spread for this account type ranges from 1 pip. Traders using the Standard Account have access to a variety of instruments, including Forex, Indices, and Metals. The trading platform provided for this account type is MT5. Withdrawals from the Standard Account are processed instantly.

100% Bonus Account: Accumarkets also offers a 100% Bonus Account, which requires a minimum deposit of $5. Similar to the Standard Account, the spread for this account type ranges from 1 pip. Traders can engage in trading Forex, Indices, and Metals. The platform provided for this account type is MT5. Additionally, the 100% Bonus Account comes with a bonus offer of 100%. However, hedging is not allowed with this account type. Withdrawals from the 100% Bonus Account are processed instantly.

Cent Account: Accumarkets provides a Cent Account, which requires a minimum deposit of $5. The spread for this account type ranges from 1 pip. Traders can access Forex, Indices, and Metals instruments. The platform offered for the Cent Account is MT5. Similar to the 100% Bonus Account, hedging is not permitted with this account type. Withdrawals from the Cent Account are processed instantly.

| Pros | Cons |

| Low minimum deposit requirement of $5 | Lack of information on leverage |

| Access to a variety of instruments (Forex, Indices, Metals) | Demo account not available |

| Instant withdrawals for all account types |

How to Open an Account?

To open an account with Accumarkets, follow these steps:

Visit the Accumarkets website and click on the “TRADE NOW” button to begin the registration process.

2. Fill in the required registration details, including your title, first name, last name, country, phone number, and email address.

3. Confirm that you have read, understood, and agreed to the Privacy Policy, AML Policy, Bonus Terms and Conditions, and Trading Terms and Conditions.

4. Click on the “Continue” button to proceed with the registration.

5. Check your email inbox for a confirmation PIN sent by Accumarkets.

6. Enter the PIN in the designated field on the registration page.

7. Once you have entered the PIN, click on the appropriate button to confirm the registration

Spreads

Accumarkets offers spreads starting from 1 pip for all their trading account types, including the Standard Account, 100% Bonus Account, and Cent Account.

Minimum Deposit

Accumarkets requires a minimum deposit of $5 for all its trading accounts, including the Standard Account, 100% Bonus Account, and Cent Account.

Deposit & Withdrawal

Deposit & Withdraw: Accumarkets offers several payment options for depositing and withdrawing funds. One of these options is Ozow, which is an instant smart EFT payment service. It enables users to make online payments directly into their Accumarkets trading account. Another option is Virtual pay, a digital payment platform that offers simple transactions through various payment solutions worldwide. Paystack is also available as a fast solution for digital payments. Moreover, Match2Pay allows users to make fast payments, supporting multiple cryptocurrencies.

| Pros | Cons |

| Instant smart EFT payment service (Ozow) | Lack of clarity on deposit and withdrawal terms and conditions |

| Digital payment platform (Virtual pay) | Limited payment methods available |

| Limited information on fees or charges associated with deposits and withdrawals |

Trading Platforms

Accumarkets offers a diverse range of trading platforms for its users. The first option is MT5, a powerful and popular multi-asset platform chosen by successful traders worldwide for Forex, exchange instruments, and futures trading. Additionally, CFD trading is available, allowing users to diversify their investments by speculating on the price movements of various financial instruments like stocks, indices, commodities, and cryptocurrencies.

Accumarkets provides a web-based trading platform known as Web Trader. It offers a user-friendly interface, real-time charts, and analysis tools accessible from any device with an internet connection. Traders who prefer to trade on the go can utilize the Mobile Trading platform, enabling them to execute trades, monitor positions, and receive market updates directly on their smartphones or tablets.

| Pros | Cons |

| MT5 platform offers a powerful and popular multi-asset trading experience | Lack of advanced trading features or tools |

| Web Trader provides a user-friendly interface and real-time charts | Limited customization options for trading platform |

| Mobile Trading platform allows trading on the go and access to market updates | Lack of comprehensive educational resources or research tools |

Customer Support

Accumarkets provides customer support through various channels, including email and a contact form on their website. Users can reach out to their support team by sending an email to support@accumarkets.co.za. The contact form requires customers to fill in their first name, last name, email address, cellphone number, and a message. There is also an option to receive communication about new products, feature updates, and forex insights.

The physical address of Accumarkets is located at 51 Shannon Road, Noordheawel, Krugersdorp, Gauteng, 1739. They also have registered and operating addresses at Kockstreet 117, Miederpark, Potchefstroom, Northwest, 2531, and 36 Wierda Road, Wierda Valley, Johannesburg, respectively.

Conclusion

In conclusion, it is important to exercise caution when considering Accumarkets as a trading platform. While they offer a range of market instruments such as forex pairs, indices, and commodities, it is worth noting that Accumarkets is not regulated by the Financial Sector Conduct Authority in South Africa. Additionally, there are warnings indicating potential risks associated with the company, including exceeding regulated business scopes and the absence of a trading software. Before engaging with Accumarkets, thorough research and careful consideration of the risks involved are advised.

FAQs

Q: Is Accumarkets regulated in South Africa?

A: No, Accumarkets is not regulated by the Financial Sector Conduct Authority in South Africa.

Q: What is the risk associated with Accumarkets?

A: Accumarkets has a medium potential risk, and there are suspicions about its scope of business and overrun.

Q: What market instruments can I trade with Accumarkets?

A: Accumarkets offers forex pairs, indices, and commodities for trading.

Q: How can I open an account with Accumarkets?

A: Visit the Accumarkets website, fill in the required details, confirm the registration, and enter the confirmation PIN.

Q: What are the spreads offered by Accumarkets?

A: Accumarkets offers spreads starting from 1 pip for all account types.

Q: What is the minimum deposit required by Accumarkets?

A: The minimum deposit required by Accumarkets is $5 for all account types.

Q: What payment options are available for depositing and withdrawing funds?

A: Accumarkets offers payment options like Ozow, Virtual pay, Paystack, and Match2Pay.

Q: What trading platforms does Accumarkets offer?

A: Accumarkets offers MT5, Web Trader, and a Mobile Trading platform.

Q: How can I contact Accumarkets customer support?

A: You can contact Accumarkets customer support via email at support@accumarkets.co.za or through the contact form on their website.

News

Review 5

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now