Score

CLMFX

United Kingdom|5-10 years|

United Kingdom|5-10 years| http://www.cityoflondonmarkets.com/

Website

Rating Index

Contact

Licenses

Single Core

1G

40G

Contact number

0207 036 3881

Other ways of contact

Broker Information

More

City of London Markets

CLMFX

United Kingdom

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

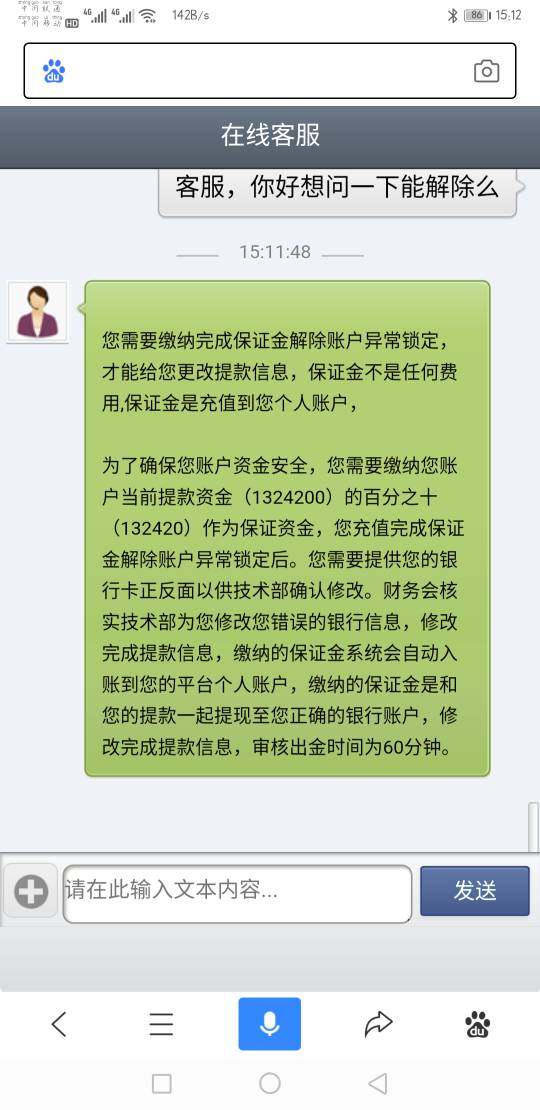

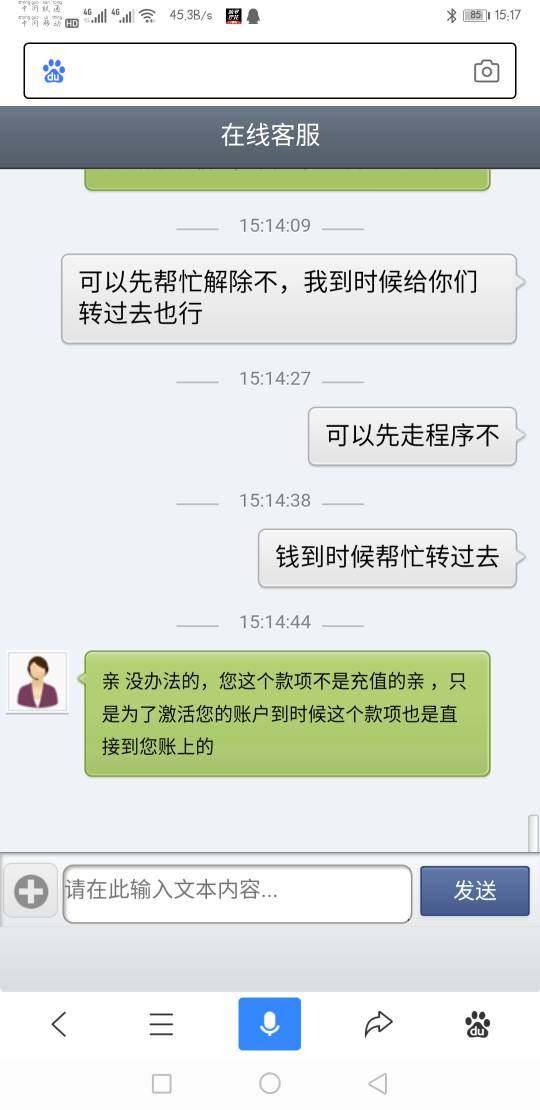

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

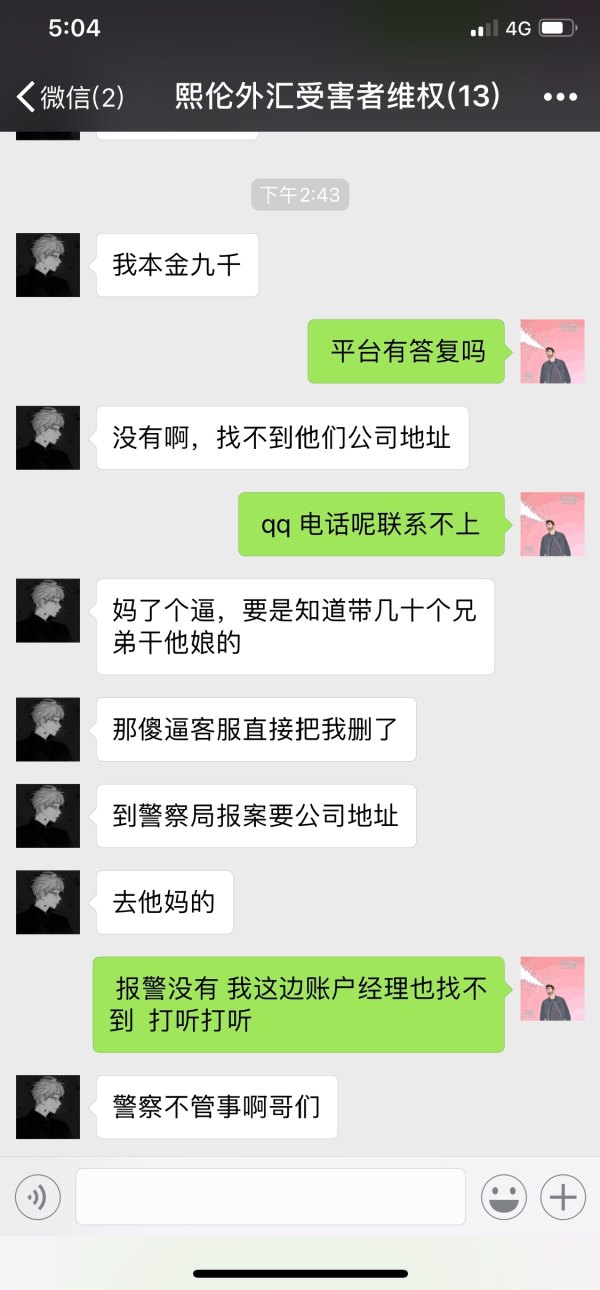

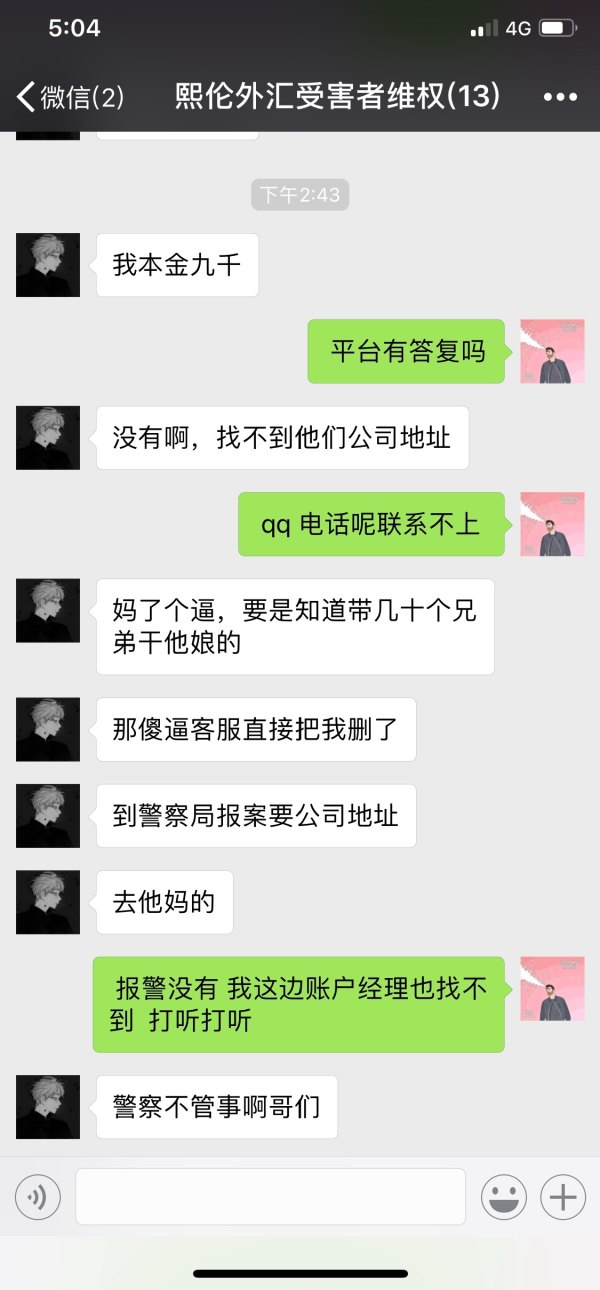

- The number of the complaints received by WikiFX have reached 11 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

- The number of this brokers's negative field survey reviews has reached 1. Please be aware of the risk and the potential scam!

- United KingdomFCA (license number: 595844) The regulatory status is abnormal, the official regulatory status is Revoked. Please be aware of the risk!

- This broker exceeds the business scope regulated by United Kingdom FCA(license number: 595844)Investment Advisory Licence Non-Forex License. Please be aware of the risk!

WikiFX Verification

Users who viewed CLMFX also viewed..

XM

Exness

MiTRADE

HFM

CLMFX · Company Summary

| Aspect | Information |

| Company Name | City of London Markets Limited (CLMFX) |

| Registered Country/Area | United Kingdom |

| Founded Year | 2012 |

| Regulation | Not Regulated( Exceeded) |

| Market Instruments | Forex, CFDs, Spread Betting |

| Account Types | Standard Account, VIP Account |

| Minimum Deposit | £250 |

| Maximum Leverage | Up to 1:200 |

| Spreads | Variable, starting from 0.4 pips |

| Trading Platforms | MetaTrader 4 |

| Customer Support | Phone: 0207 036 3881, Email: info@clmfx.com, info@cityoflondonmarkets.com |

| Deposit & Withdrawal | Bank transfer,Credit/debit card,E-wallets |

| Educational Resources | Limited |

Overview of CLMFX

City of London Markets Limited (CLMFX), established in 2012 and based in the United Kingdom, is a trading platform that offers a range of market instruments including Forex, CFDs, and Spread Betting. The platform provides two types of accounts: the Standard Account and the VIP Account, with minimum deposits of £250 and variable spreads starting from 0.4 pips. Operating on the widely-used MetaTrader 4 platform, CLMFX supports various deposit and withdrawal methods, including bank transfer, credit/debit cards, and e-wallets. However, their educational resources are limited.

Is CLMFX legit or a scam?

City of London Markets Limited (CLMFX), a financial entity based in the United Kingdom, operates under the Investment Advisory License number 595844. This license was effectively granted on October 1, 2013. The firm is currently regulated by the Financial Conduct Authority (FCA), a prominent regulatory body in the UK. However, it's important to note that as of the latest update, CLMFX has exceeded its regulatory status. This means that the firm has surpassed certain limitations or conditions set by the FCA. It's crucial for investors or those interested in engaging with CLMFX to be aware of this status.

Pros and Cons

| Pros | Cons |

| Offers MetaTrader 4 platform | Not regulated(exceeded) |

| Leverage up to 1:200 | Limited educational resources |

| Variable spreads starting from 0.6 pips | Not available in some countries or regions: |

| Commission-free trading in VIP Account |

Pros of CLMFX:

MetaTrader 4 Platform: CLMFX provides the MetaTrader 4 trading platform, which is widely recognized for its advanced technical analysis tools, automated trading capabilities via Expert Advisors, and customizable interface. This platform is suitable for both beginners and experienced traders due to its comprehensive features.

High Leverage Options: The service offers leverage up to 1:200, allowing traders to take larger positions in the market than their deposited funds would normally permit. This can be a significant advantage for traders looking to maximize potential profits.

Variable Spreads: CLMFX offers variable spreads, starting from as low as 0.6 pips. This can be beneficial in markets with high liquidity, where spreads can tighten, potentially reducing the cost per trade for users.

Commission-Free Trading in VIP Account: For users opting for the VIP Account, CLMFX provides commission-free trading. This could be advantageous for high-volume traders, as it allows for cost savings on large numbers of transactions.

Cons of CLMFX:

Regulatory Status - Exceeded: While CLMFX is regulated and has exceeded some regulatory requirements, traders should be aware and understand the implications of this status on their trading and the protections afforded to them.

Limited Educational Resources: The platform does not offer extensive educational resources, which could be a disadvantage for new traders who are looking to learn and understand trading strategies and market dynamics.

Availability Restrictions: CLMFX is not available in certain countries or regions. This geographical limitation could restrict access for potential traders in those areas, limiting the platform's user base and diversity.

Market Instruments

City of London Markets Limited (CLMFX) offers a wide range of trading assets. Their portfolio includes Forex (Foreign Exchange), where traders can engage in the buying and selling of global currencies, taking advantage of the fluctuations in exchange rates.

Additionally, CLMFX provides opportunities in CFDs (Contracts for Difference), allowing traders to speculate on the rising or falling prices of fast-moving global financial markets. This includes indices, stocks, commodities, and more, without the need for ownership of the underlying asset.

Lastly, CLMFX offers Spread Betting, a tax-efficient way of speculating on the financial markets. This form of betting involves predicting whether the price of an asset will rise or fall, with profits and losses determined by the accuracy of the bet in relation to the actual price movement. These trading options collectively present a range of opportunities for traders with different strategies and risk appetites.

Account Types

CLMFX offers two distinct account types to accommodate the needs and strategies of different traders.

Standard Account

The Standard Account at CLMFX offers leverage up to 1:200. It features variable spreads that start from 0.6 pips. This account type comes with a commission of £3 per lot. The minimum deposit required to open a Standard Account is £250. This account is more suitable for individual retail traders, particularly those who are new to trading or prefer to start with smaller capital. Its structure allows for flexibility and accessibility, especially for those looking to explore various trading strategies without the commitment of a high initial deposit.

VIP Account

In contrast, the VIP Account provided by CLMFX also allows for leverage up to 1:200 but offers tighter spreads, starting from 0.4 pips. This account type does not charge any commission, which is appealing for traders who prefer a commission-free trading structure. The minimum deposit for a VIP Account is significantly higher, set at £2,500. This type of account is more appropriate for experienced traders or those with more capital to invest. The lower spreads combined with a commission-based structure can be advantageous for high-volume traders or those who trade frequently, as it reduces overall trading costs in certain trading scenarios.

| Account Type | Leverage | Spreads | Commission | Minimum Deposit | Suitable For |

| Standard Account | Up to 1:200 | Variable, starting from 0.6 pips | £3 per lot | £250 | Individual retail traders, beginners, those with smaller capital |

| VIP Account | Up to 1:200 | Variable, starting from 0.4 pips | £0 per lot | £2,500 | Experienced traders, high-volume traders, those with more capital |

How to Open an Account?

To open an account with CLMFX, a streamlined and straightforward process has been established, consisting of six key steps.

Visit the CLMFX Website: Start by navigating to the official CLMFX website. This is the primary platform where you can initiate the account opening process.

Choose the Account Type: Select the account type that suits your trading needs – either a Standard Account or a VIP Account. Each account has distinct features and requirements, so ensure you understand the differences before choosing.

Complete the Application Form: Fill out the online application form with your personal details. This typically includes information such as your name, address, date of birth, and contact information, as well as your employment status and trading experience.

Submit Identification Documents: As part of the Know Your Customer (KYC) process, you will be required to submit identification documents. This usually includes a government-issued photo ID (such as a passport or drivers license) and proof of address (like a utility bill or bank statement).

Wait for Account Verification: After submitting your application and documents, CLMFX will review and verify your information. This step is crucial for compliance with regulatory requirements.

Fund Your Account: Once your account is verified, you can proceed to fund it. The minimum deposit amount depends on the account type chosen. Funding can typically be done via various methods such as bank transfer, credit/debit card, or other payment services offered by CLMFX.

Leverage

The maximum leverage offered by CLMFX is 1:200. This leverage ratio allows traders to increase their trading position size beyond the initial capital they deposit. For instance, with a 1:200 leverage, a trader can hold a position worth up to 200 times their original investment, magnifying both potential profits and losses.

This high level of leverage can be particularly attractive to traders who wish to maximize their exposure to the market with a relatively small amount of capital. However, it's important to note that while higher leverage can increase the potential for gains, it also raises the risk of significant losses, especially in volatile market conditions.

Spreads & Commissions

CLMFX provides two main account types, each with distinct spread and commission structures tailored to different kinds of traders.

The Standard Account at CLMFX offers leverage up to 1:200, with variable spreads starting from 0.6 pips. This account charges a commission of £3 per lot. The combination of higher spreads and a commission fee makes this account type a reasonable option for traders looking to explore various trading strategies without needing a large initial deposit.

Conversely, the VIP Account features more favorable conditions with tighter spreads, beginning at 0.4 pips, and no commission charges. This structure is more attractive to traders who prefer a commission-free model. The benefits of lower spreads without the added cost of a commission fee can be particularly advantageous for high-volume traders or those who frequently engage in trading, potentially leading to reduced overall trading costs.

Trading Platform

CLMFX utilizes MetaTrader 4 (MT4) as its trading platform. MT4 is widely recognized in the online trading community for its comprehensive features and tools. The platform provides a range of functionalities suitable for traders of different experience levels, from beginners to advanced users.

Key features of MT4 include a user-friendly interface that allows traders to navigate and manage their trades efficiently. The platform offers advanced charting capabilities, enabling users to analyze market trends and patterns with various technical indicators and graphical objects. MT4 also supports automated trading through Expert Advisors (EAs), allowing for the implementation of custom trading strategies and algorithms.

Additionally, MT4 provides access to historical data, which can be vital for backtesting trading strategies. The platform's execution speeds are generally considered reliable, contributing to its popularity among day traders and those who employ fast-paced trading tactics.

One of the notable aspects of MT4 is its customizability, as it allows traders to tailor the platform to their specific trading preferences and requirements. This includes the ability to create and install custom indicators, scripts, and EAs.

Deposit & Withdrawal

City of London Markets Limited (CLMFX) offers a variety of deposit and withdrawal methods to suit the needs of its clients. These methods include:

Bank transfer: This is a traditional method of transferring funds, and it is typically the most secure option. However, bank transfers can take several days to process, depending on the bank and the country.

Credit/debit card: CLMFX accepts deposits from most major credit and debit cards. This is a quick and convenient way to fund your account, but there are fees associated with card transactions.

E-wallets: CLMFX supports a number of popular e-wallets, such as Skrill and Neteller. These can be a quick and easy way to deposit funds, but there are limits on the amount you can deposit and withdraw.

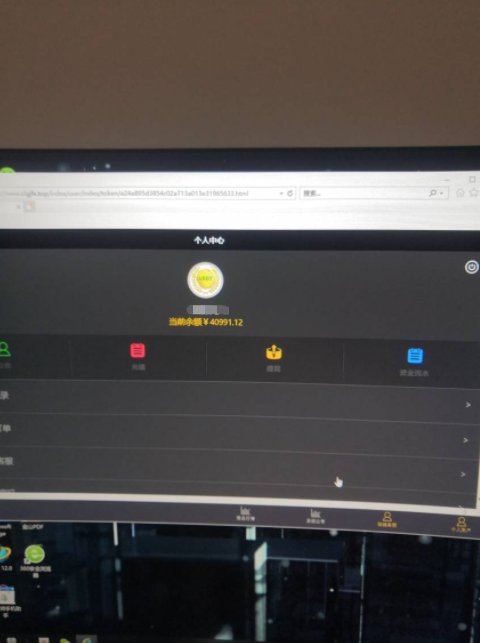

Minimum Deposit:

The minimum deposit amount at CLMFX varies depending on the account type you choose. The standard account requires a minimum deposit of £250, while the VIP account requires a minimum deposit of £2,500.

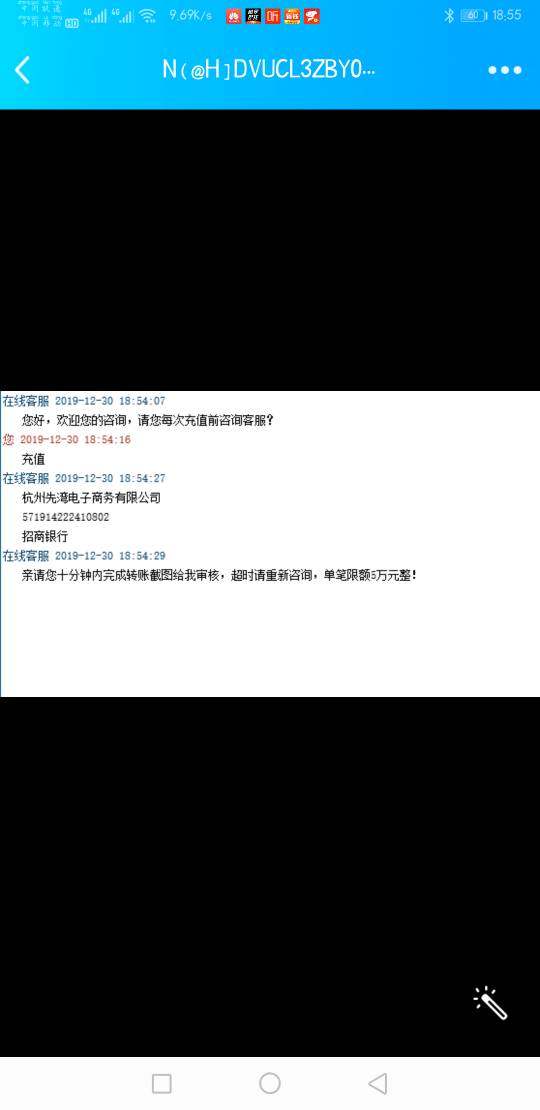

Customer Support

CLMFX offers customer support primarily through two channels: telephone and email. Clients can reach their support team by calling the contact number 0207 036 3881, where assistance is provided in English. This offers a direct and immediate way for clients to address their queries.

Additionally, email support is available, with two email addresses provided: info@clmfx.com and info@cityoflondonmarkets.com. Email communication allows for detailed inquiries and can be convenient for those who prefer not to communicate over the phone. It also provides a record of correspondence, which can be useful for future reference or follow-up queries.

Conclusion

In conclusion, CLMFX presents several notable advantages for its users. The platform's utilization of the MetaTrader 4 trading system stands out as a significant benefit, offering a range of advanced tools and features for both novice and experienced traders. The high leverage of up to 1:200 can be particularly appealing to those looking to maximize potential returns, while the variable spreads starting from 0.6 pips offer competitive trading conditions. Furthermore, the VIP Account's commission-free trading model is an attractive option for high-volume traders, providing a cost-effective solution for frequent trading activities.

On the flip side, CLMFX does have some drawbacks. The platform's regulatory status, although compliant, requires clear understanding from traders about the protections and implications involved. The lack of extensive educational resources poses a challenge for beginners who seek comprehensive learning materials to enhance their trading skills. Additionally, the geographical restrictions on the platform's availability could limit access for traders in certain regions, potentially narrowing the field of users. These factors should be carefully considered by potential clients when evaluating the suitability of CLMFX for their trading needs.

FAQs

Q: What trading platform does CLMFX offer?

A: CLMFX provides the MetaTrader 4 platform, known for its comprehensive trading tools and user-friendly interface.

Q: What is the maximum leverage available at CLMFX?

A: CLMFX offers a maximum leverage of up to 1:200.

Q: Are there any commission fees for trading on CLMFX's VIP Account?

A: The VIP Account at CLMFX offers commission-free trading.

Q: What is the minimum deposit required to open a Standard Account with CLMFX?

A: The minimum deposit to open a Standard Account with CLMFX is £250.

Q: Does CLMFX provide educational resources for traders?

A: CLMFX offers limited educational resources.

Q: Are there any geographic restrictions for using CLMFX's services?

A: Yes, CLMFX's services are not available in some countries or regions.

Review 12

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now