Score

GLO

United Kingdom|2-5 years|

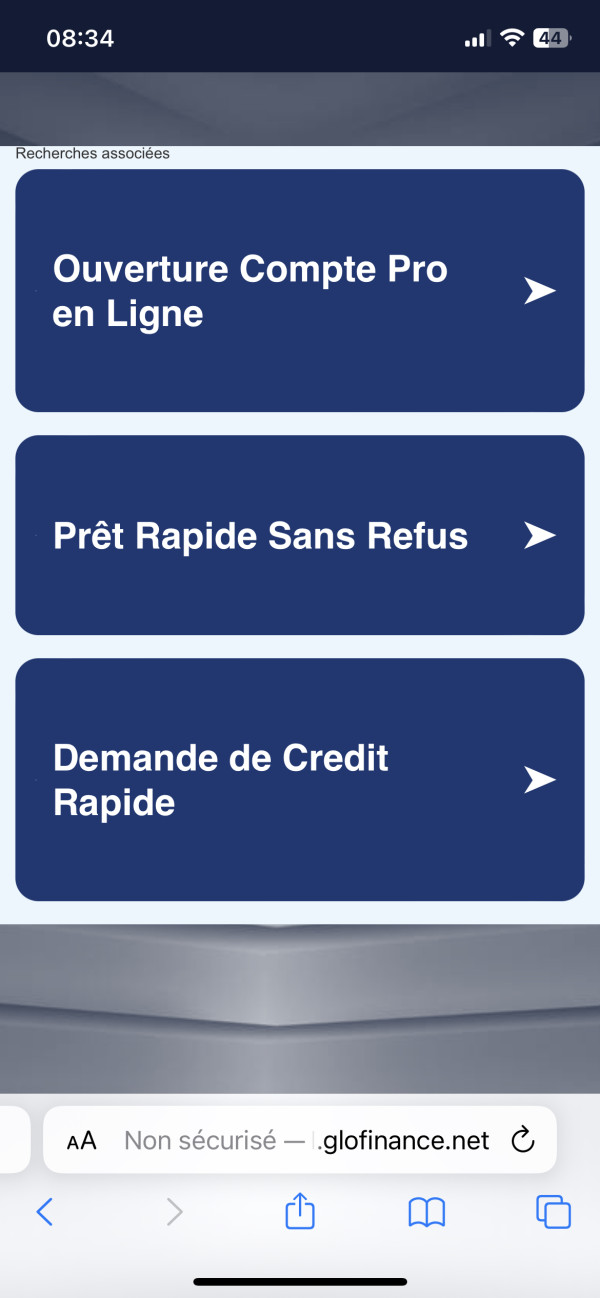

United Kingdom|2-5 years| https://en.glofinance.net/

Website

Rating Index

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

GLO

GLO

United Kingdom

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The number of the complaints received by WikiFX have reached 11 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

WikiFX Verification

Users who viewed GLO also viewed..

XM

VT Markets

MultiBank Group

MiTRADE

GLO · Company Summary

| Aspect | Information |

| Registered Country/Area | United Kingdom |

| Founded Year | 2-5 years |

| Company Name | GLO |

| Regulation | No Regulation |

| Minimum Deposit | $50 |

| Maximum Leverage | 500:1 |

| Spreads | As low as 0.0 pips for major currency pairs |

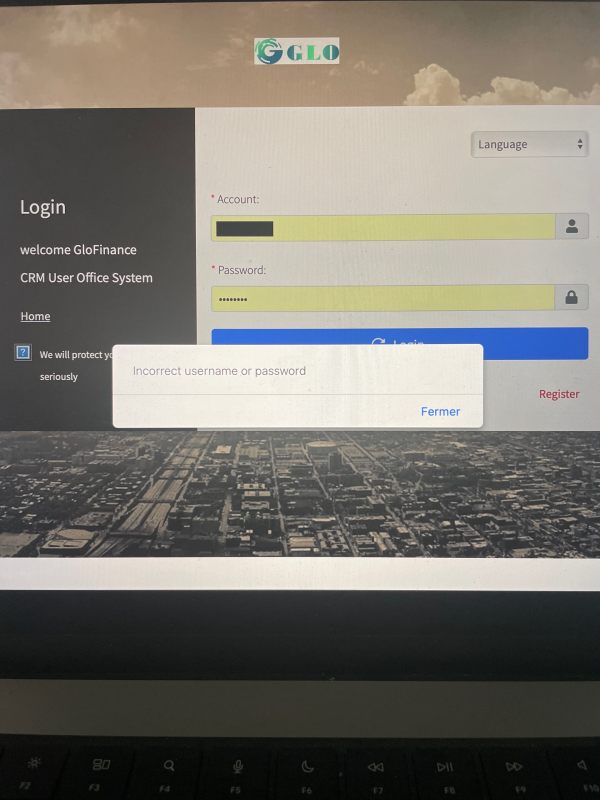

| Trading Platforms | MT5 |

| Tradable Assets | Forex pairs, indices, commodities, precious metals, energy |

| Account Types | FIX Account, MINI Account, ECN Account, RAMM Account |

| Demo Account | Not specified |

| Islamic Account | Not specified |

| Customer Support | 24/7 availability via telephone, email, and online chat |

| Payment Methods | Not specified |

| Educational Tools | Daily market updates, briefings on significant events, market experts |

General Information

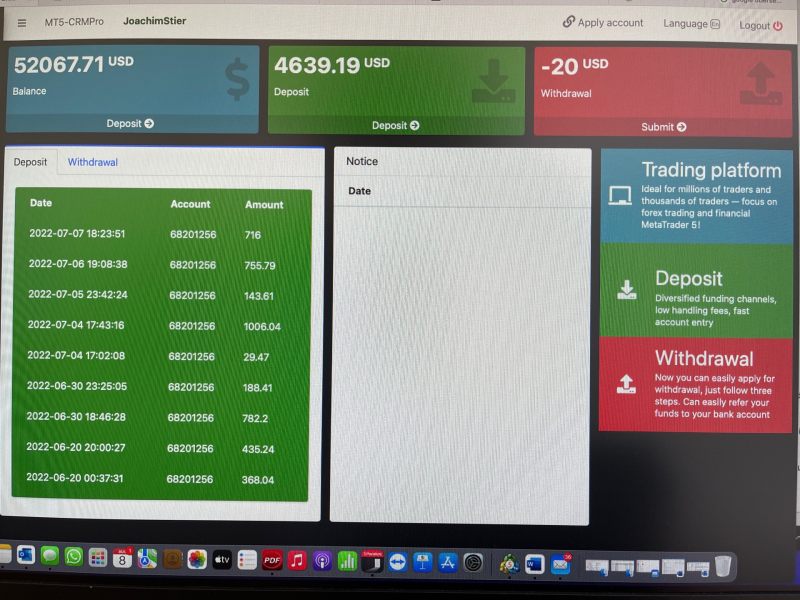

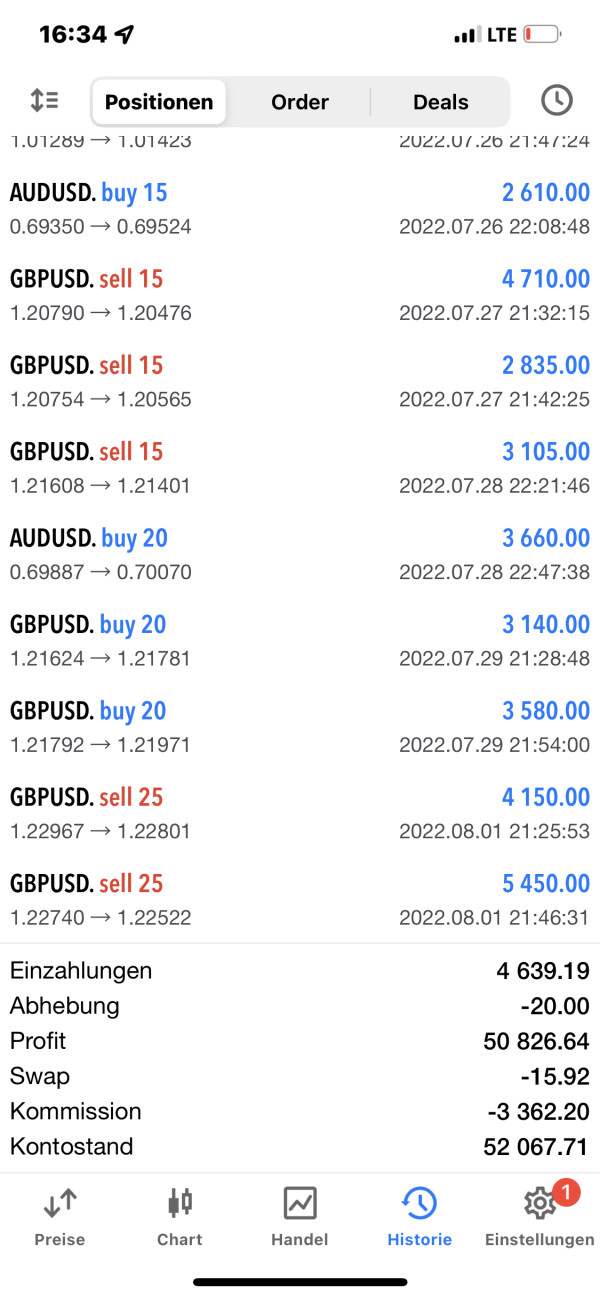

GLO is a company that is registered in the United Kingdom with the identity of the company holding it as a secret. GLO boasts that it offers more than 150 trading instruments through its MT5 trading platform, with leverage as high as 500:1, spreads as low as 0.0 pip.

GLO offers a range of market instruments for trading, including forex pairs, indices, commodities, precious metals, and energy. However, given the concerns raised by users and the lack of regulation, engaging in trading with GLO may pose risks and potential financial loss. The broker provides different account types, such as FIX, MINI, ECN, and RAMM accounts, each with its own features and benefits.

GLO's trading platform is based on MT5 and offers access to various instruments, low spreads (though specific details are not provided), and over 80 technical tools for analysis and charting. The broker claims to provide educational resources and round-the-clock customer support services. However, the negative reviews and complaints regarding withdrawal issues cast doubt on the reliability and trustworthiness of GLO as a broker.

Considering the lack of regulation, numerous user complaints, and allegations of fraudulent activities, it is advisable to exercise caution and explore alternative regulated brokers with a more reputable track record.

Pros and Cons

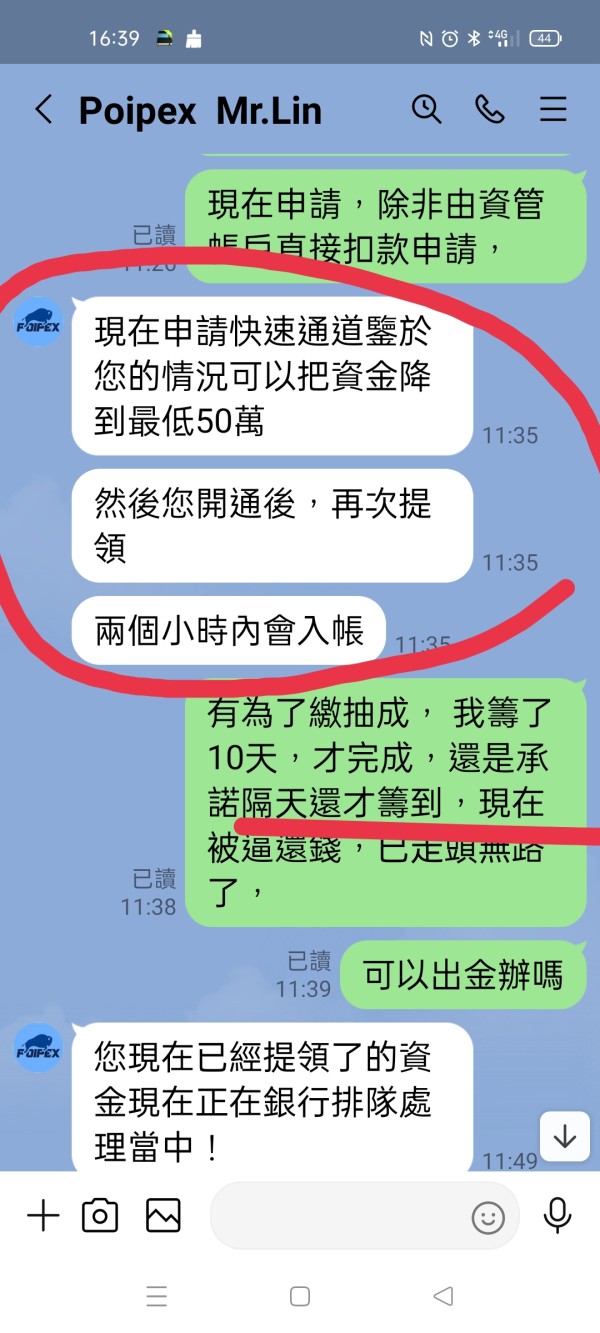

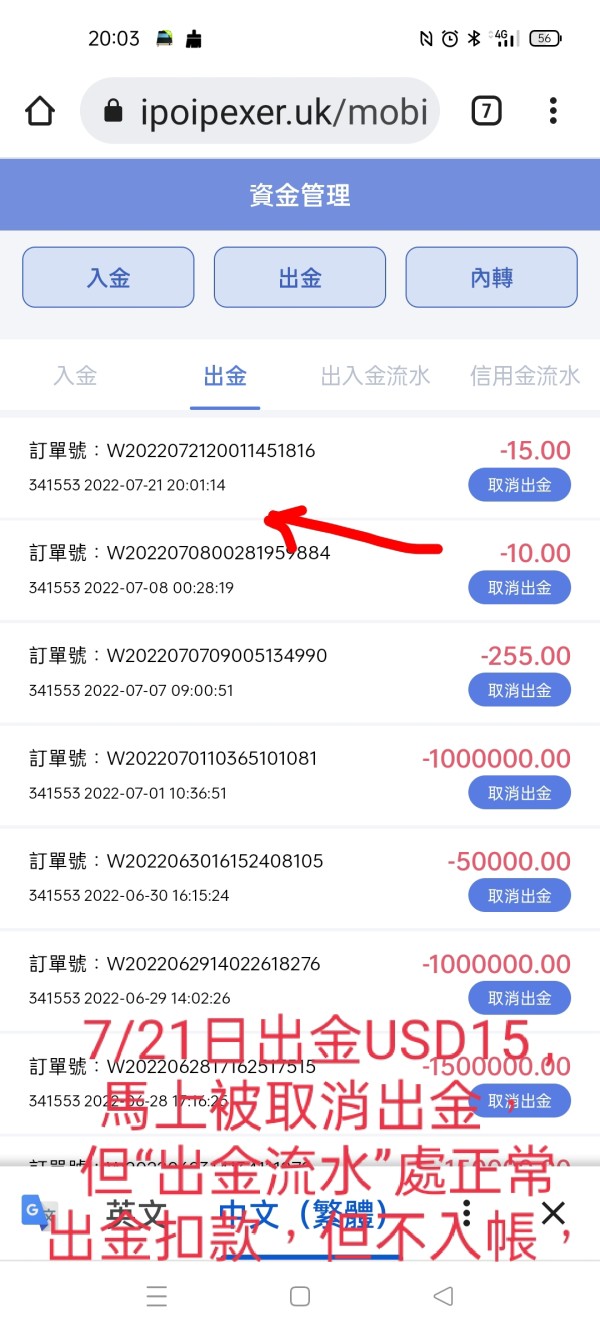

When considering the pros and cons of GLO, there are several factors to take into account. On the positive side, GLO offers a wide selection of market instruments, allowing traders to access various financial assets for trading. Additionally, the availability of multiple account types provides options to cater to different trading preferences and risk tolerances. The broker also offers a high leverage ratio of 500:1, which can be advantageous for traders looking to maximize their trading potential. Access to the MT5 trading platform further enhances the trading experience, providing a comprehensive set of features and tools. Moreover, GLO provides daily market updates and educational content to keep traders informed. Lastly, the presence of 24/7 customer support is a valuable resource for addressing any concerns or inquiries. However, there are several cons to consider as well. GLO has been reported as unauthorized by the regulatory agency, raising concerns about its legitimacy and adherence to regulatory standards. Users have complained about difficulties in withdrawing funds, indicating potential issues with the platform's withdrawal procedures. Additionally, there have been reports of requests for payment to open an express channel that were not met, potentially affecting the overall reliability of the platform. The lack of specified spreads and commissions information also leaves traders with uncertainty regarding trading costs. Negative reviews and a lack of trust among users further highlight potential risks associated with GLO. Furthermore, the official website is currently unavailable. It is essential to carefully evaluate these pros and cons before engaging with the broker to make an informed decision.

| Pros | Cons |

| Wide selection of market instruments | Reported as unauthorized by regulatory agency |

| Multiple account types available | Users complain about difficulty in withdrawing funds |

| Hight leverage 500:1 | Requests for payment to open express channel not met |

| Access to the MT5 trading platform | Lack of specified spreads and commissions information |

| Daily market updates and educational content | Official website unavailable |

| 24/7 customer support | Potential risks and concerns regarding reliability |

Is GLO Legit?

GLO FINANCE, which operates with license number 0546995, is regulated by the National Futures Association (NFA) in the United States. However, the current status of GLO FINANCE is reported as unauthorized by the regulatory agency. It is important to note that this information is provided with a warning about a low score and the suggestion to stay away from the broker. Additionally, WikiFX has received 11 complaints about this broker in the past 3 months, indicating potential risks and a potential scam. Furthermore, the broker is reported to exceed the business scope regulated by the NFA and lacks trading software.

Market Instruments

With GLO, traders can get access to an extensive range of trading instruments, totally including the following five classes:

Forex pairs- more than 55 global currency pairs;

Indices-Major global indices;

Commodities-sugar, cocoa, wheat, and more;

Precious metals gold, silver, palladium, and more;

Energy-crude oil, natural gas, and all primary energy;

Account Types

FIX Account: GLO offers FIX accounts, which have a fixed spread size that remains unchanged regardless of market conditions. This account type provides traders with stability and predictability in terms of their trading costs, as the spread size remains constant.

MINI Account: GLO also provides MINI accounts, which come with reduced margin requirements that are 100 times lower than standard accounts. This account type allows traders to trade with a smaller initial investment, making it more accessible for those with limited capital.

ECN Account: GLO offers ECN accounts, which feature a floating spread. Unlike fixed spreads, the spread size in ECN accounts can vary depending on market conditions. This account type is suitable for traders who prefer dynamic spreads and are comfortable with potential fluctuations in trading costs.

RAMM Account: GLO provides a unique account type called RAMM account, which is designed for copying trades of successful traders. With a RAMM account, traders can automatically replicate the trading strategies and positions of experienced traders, allowing them to potentially benefit from their expertise and performance.

| Pros | Cons |

| Variety of account types to choose from | Fixed spread may not be as competitive as floating spreads |

| Reduced margin requirements for small traders | Smaller trading size may limit profit potential |

| Ability to automatically replicate the trading strategies of experienced traders | Spreads may fluctuate, which can increase trading costs |

| Not suitable for traders who want to have complete control over their trading |

Spreads & Commissions

The website mentions that the spreads can be as low as 0.0 pips for major currency pairs. However, the specific spreads for individual instruments, including the benchmark EUR/USD pair, are not specified. In terms of commissions, the information available states that there is a commission of $4 per lot, but it does not provide further elaboration or specify the lot size.

Minimum Deposit

The minimum deposit requirement for GLO FINANCE is $50. This amount represents the minimum sum of money that an individual needs to deposit in order to open an account with the broker.

Leverage

Concerning trading leverage offered by GLO, it is considered generous, reaching up to 500:1. Leverage do allow you to start you forex trading journey with a small amount of fund, however, if you use too high leverage, you losses will be magnified.

Spreads & Commissions

On the GLO website, we get the information that it seems to offer super competitive spreads, as low as 0.0 pips on major currency pairs. However, it doesnt specify spreads on particular instruments, even the benchmark EUR/USD pair. Still, commissions applied are not mentioned, either.

Swap Fees

GLO claims to provide competitive swap and transparent overnight interest. Currently, overnight interest is only charged on spot commodities. In the case of commodities, there is only an expiration date and no overnight interest.

Trading Platform Available

In terms of trading platforms available, GLO gives traders the access to various trading instruments on MT5, suitable for PC, Mac, and various mobile devices. Some of the MT5 features including the following:

1000 traded commodities, including foreign exchange, precious metals, and energy;

Log in 7 platforms with one account

Spreads as low as 0.0 pips

One-click transaction

Over 80 technical tools

| Pros | Cons |

| Access to the MT5 trading platform | No specified spreads and commissions information |

| Compatibility with PC, Mac, and various mobile devices | Lack of trust and negative reviews from users |

| Wide variety of tradable instruments | Potential risks and concerns regarding the withdrawal process |

| Over 80 technical tools for comprehensive analysis and charting capabilities | Reported as unauthorized by regulatory agency |

| Low spreads, with rates as low as 0.0 pips |

Educational Resources

GLO's educational resources aim to keep its clients informed and updated on market trends and key events that may impact global markets. Through their research and educational center, they provide daily updates on major trading hours and offer briefings on significant events. Additionally, GLO has a team of 20 market experts who deliver educational content to their customers in various languages.

Customer Support

GLO provides customer support services that are available round the clock. They offer various channels through which customers can reach out to them, including telephone, email, and online chat. The telephone number provided is +4473603253281, and the email address is finance@glofinance.net. It is worth noting that GLO's customer support operates 24/7 based on Greenwich Mean Time (GMT). Customers can utilize these communication channels to seek assistance or address any queries they may have.

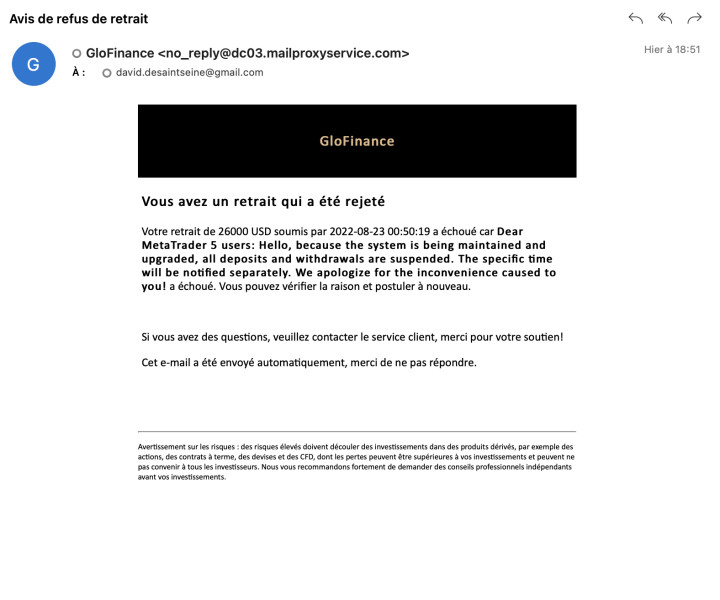

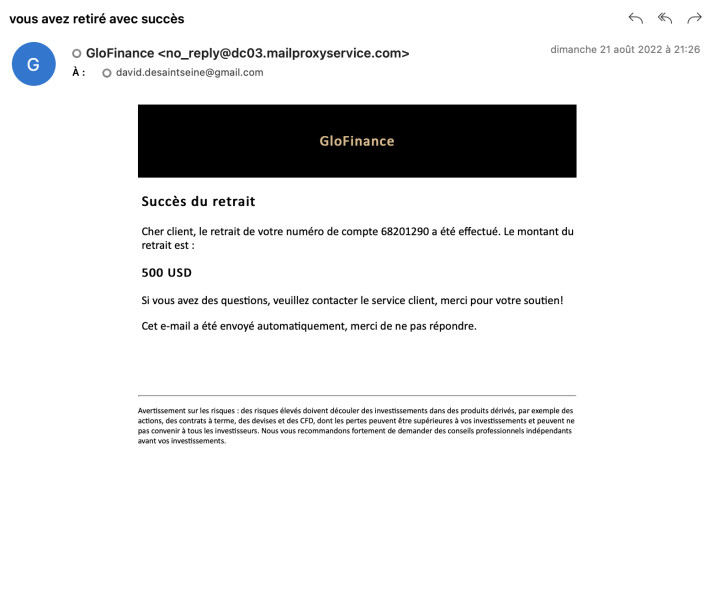

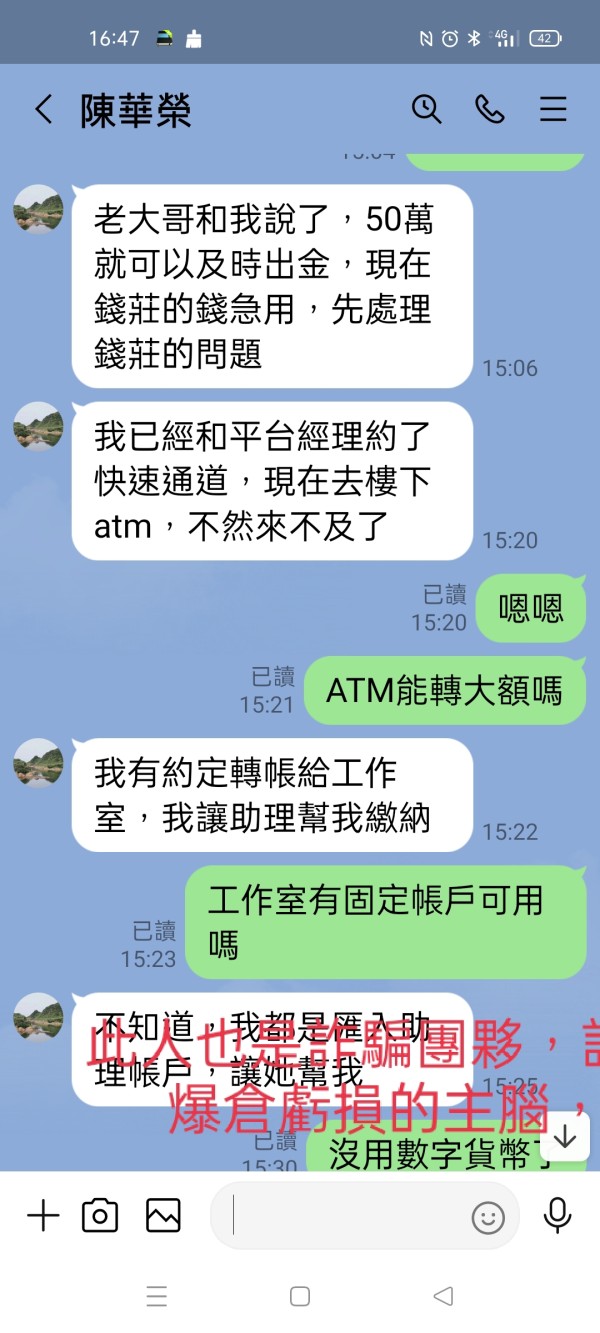

Reviews

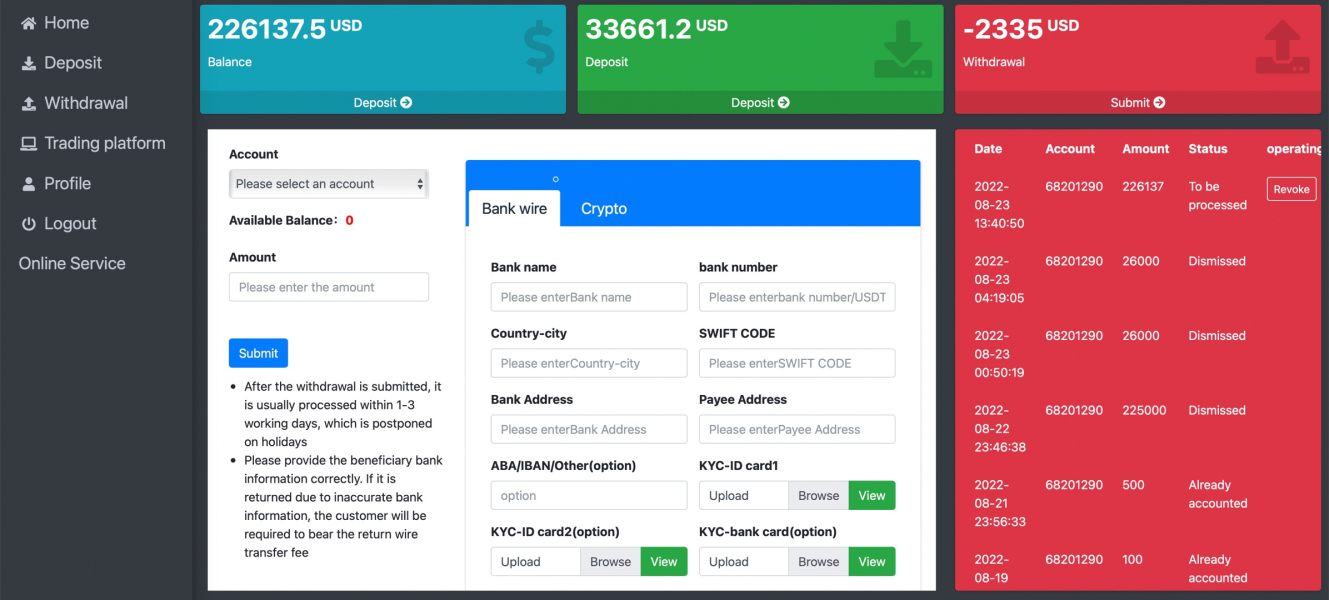

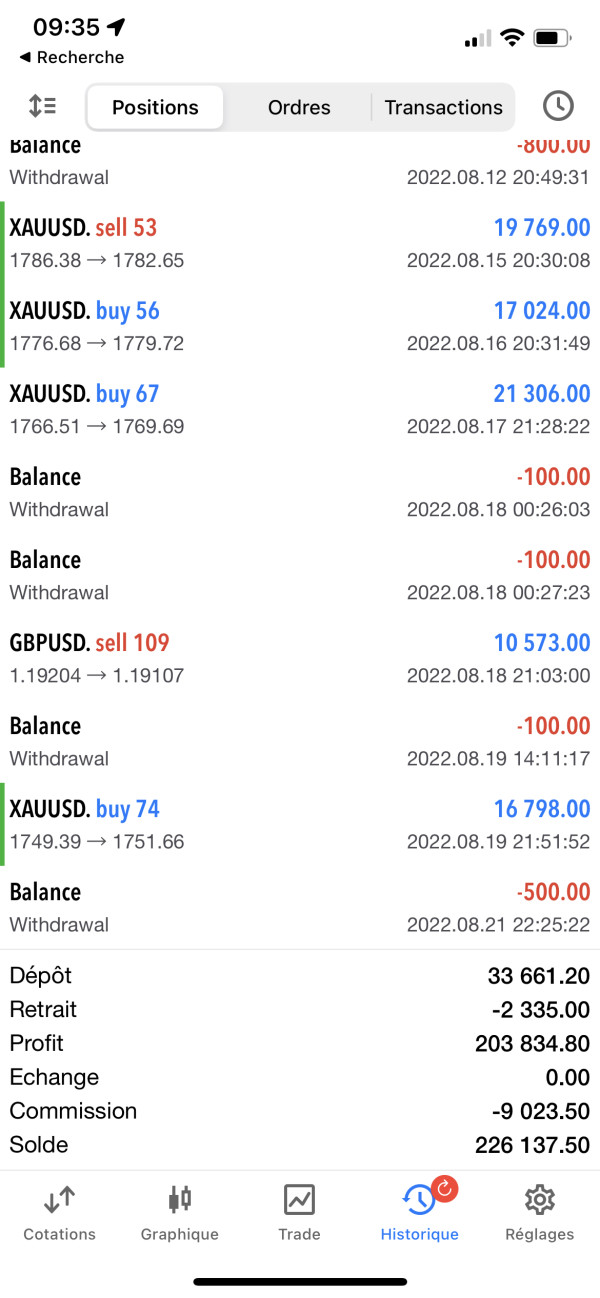

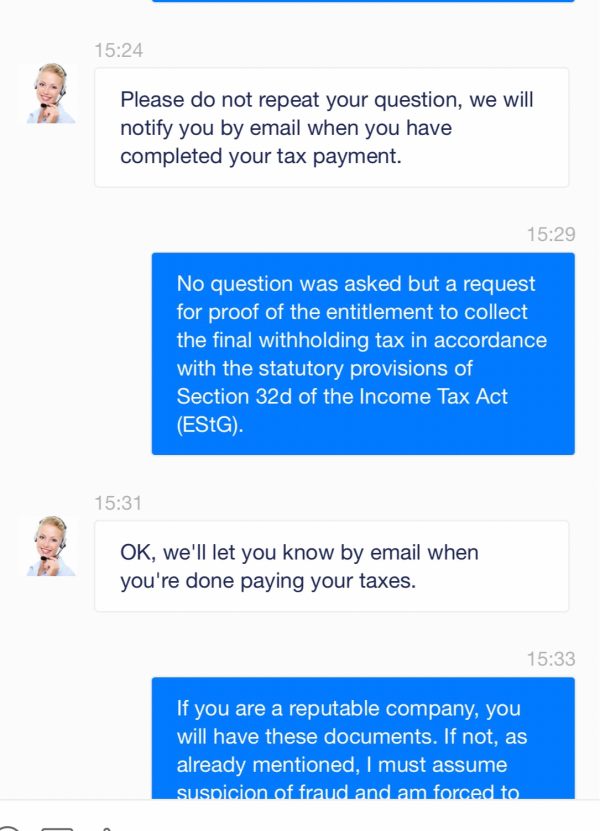

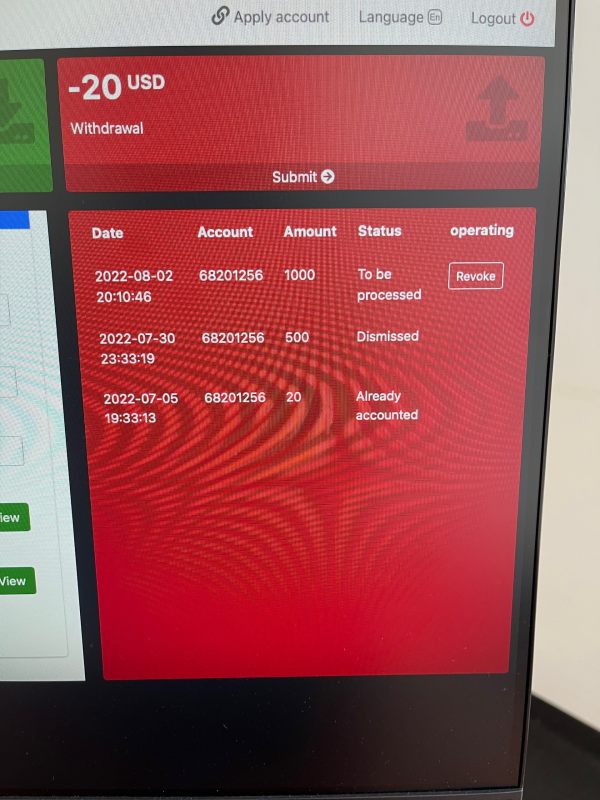

The reviews of GLO on WikiFX highlight various issues and concerns raised by users. Several reviewers have complained about their inability to withdraw funds from the platform, describing GLO as a fraud or scam platform. One user mentioned that despite making a substantial profit, they encountered difficulties in withdrawing their funds and suspected the platform of fraudulent activities. Additionally, there were complaints about obstacles and delays in the withdrawal process, as well as requests for payment to open an express channel that never materialized. These reviews indicate a lack of trust and dissatisfaction among users regarding GLO's withdrawal procedures and overall reliability.

Conclusion

GLO is a broker that operates with a regulatory license from the National Futures Association (NFA) in the United States, but the current status of GLO is reported as unauthorized by the regulatory agency. WikiFX has received numerous complaints about the platform, suggesting potential risks and a potential scam. Users have expressed concerns about their inability to withdraw funds, encountering obstacles, and delays in the withdrawal process. Some reviewers suspect fraudulent activities and describe GLO as a fraud or scam platform. While GLO offers a wide range of market instruments and account types, its lack of transparency and negative user experiences regarding withdrawals raise significant concerns about the platform's reliability and trustworthiness.

FAQs

Q: Is GLO a legitimate broker?

A: GLO FINANCE is regulated by the National Futures Association (NFA) in the United States, but its current status is reported as unauthorized. There have been numerous complaints about the broker, indicating potential risks and a possible scam.

Q: What instruments can I trade on GLO?

A: GLO offers a range of trading instruments, including over 55 forex currency pairs, major global indices, commodities such as sugar and wheat, precious metals like gold and silver, and energy resources such as crude oil and natural gas.

Q: What types of accounts does GLO offer?

A: GLO provides FIX accounts with fixed spreads, MINI accounts with reduced margin requirements, ECN accounts with floating spreads, and RAMM accounts for copying successful traders' strategies.

Q: What leverage does GLO offer?

A: GLO offers significant leverage with a maximum ratio of 500:1. However, high leverage should be used with caution due to the potential for amplified losses.

Q: What are the minimum deposit requirements for GLO?

A: The minimum deposit required to open an account with GLO FINANCE is $50.

Q: What trading platform does GLO provide?

A: GLO offers the MT5 trading platform, which is compatible with PC, Mac, and mobile devices. It features low spreads, one-click transactions, and over 80 technical tools for analysis and charting.

Q: Does GLO provide educational resources?

A: GLO offers educational resources, including daily market updates and briefings on significant events. They have a team of market experts who provide educational content to customers in various languages.

Q: How can I contact GLO's customer support?

A: GLO's customer support is available 24/7 via telephone, email (finance@glofinance.net), and online chat.

Review 12

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now