Score

RedFinance

United Kingdom|2-5 years|

United Kingdom|2-5 years| https://redfinance.capital/

Website

Rating Index

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

Shenanigans Consulting LTD

RedFinance

United Kingdom

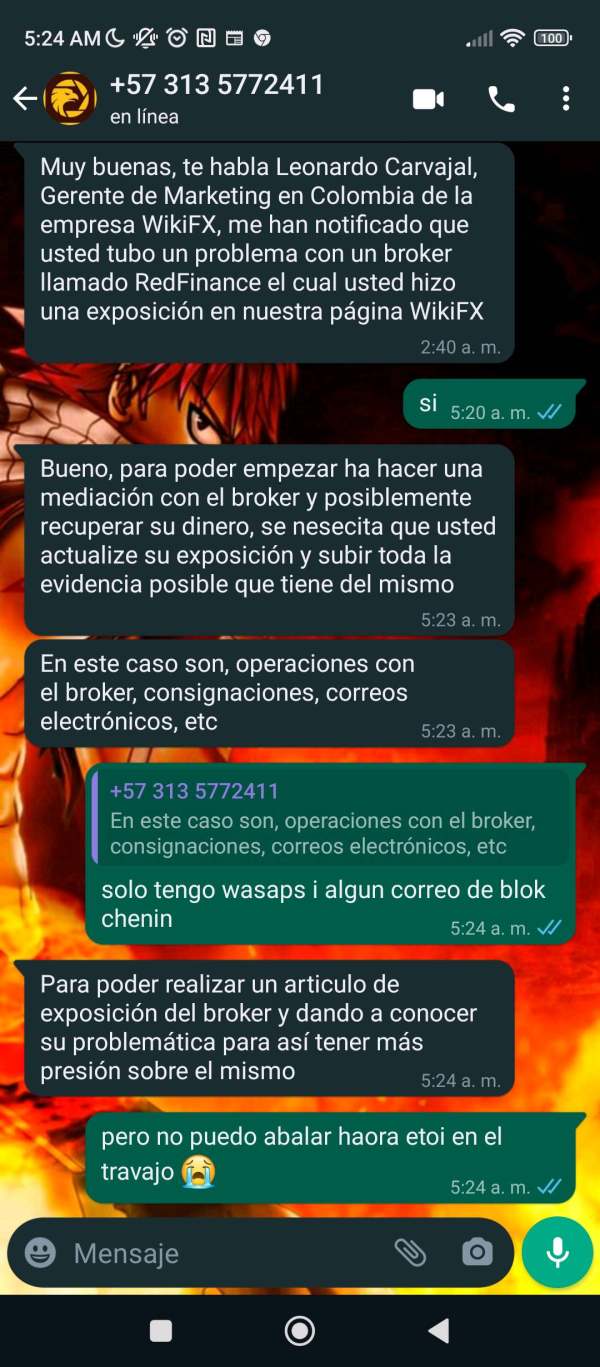

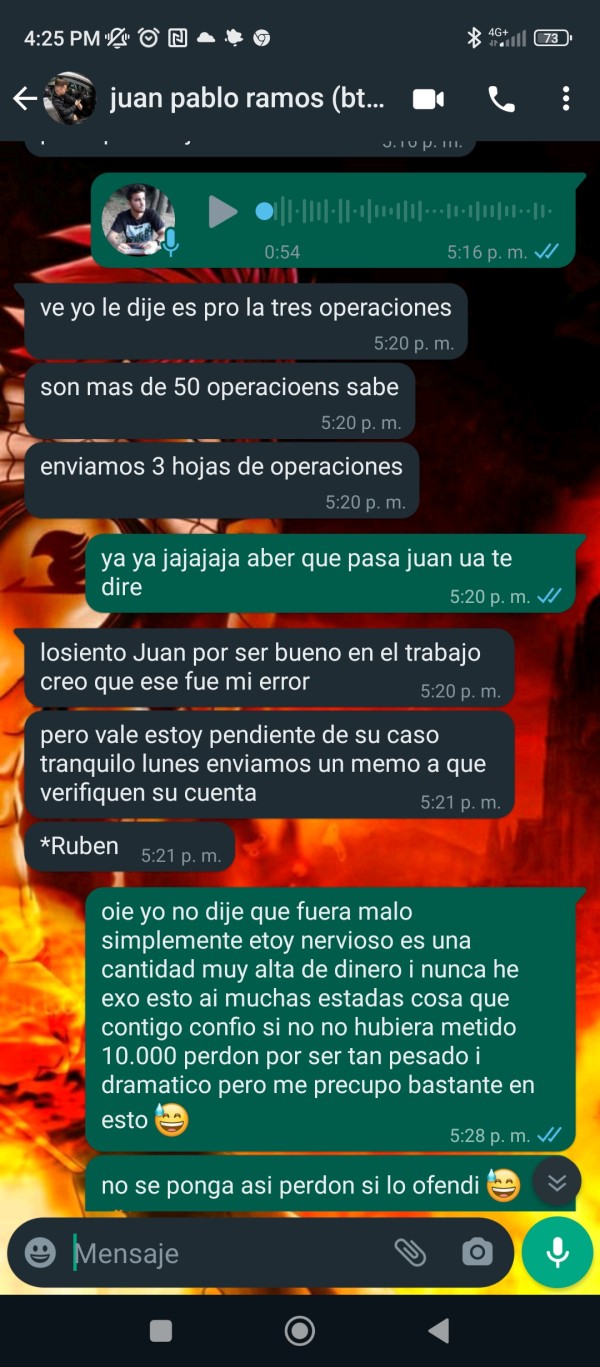

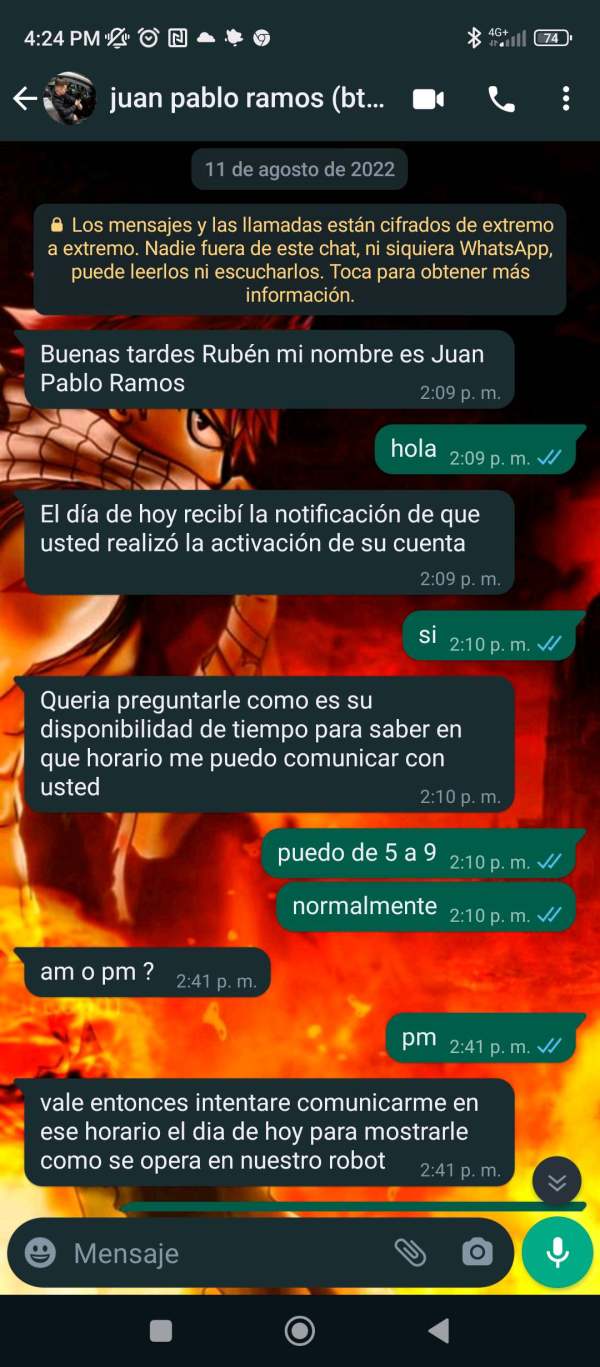

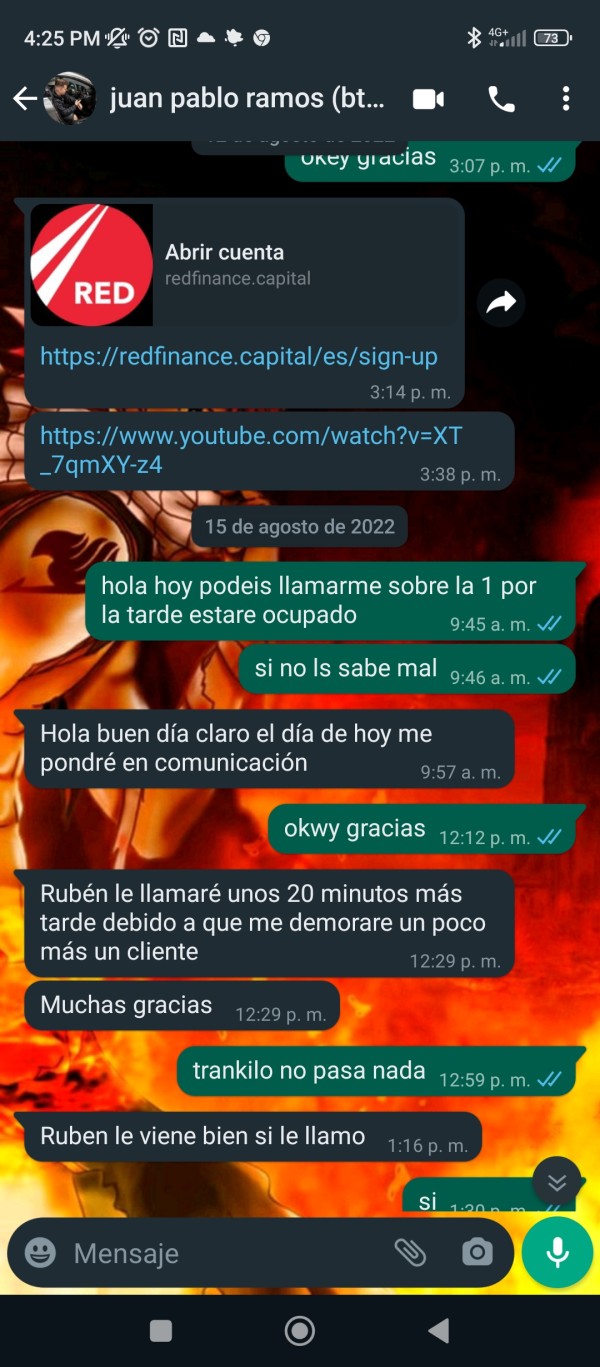

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:100 |

| Minimum Deposit | $50000 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0,01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:80 |

| Minimum Deposit | $25000 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0,01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:50 |

| Minimum Deposit | $5000 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0,01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:30 |

| Minimum Deposit | $250 |

| Minimum Spread | -- |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 0,01 |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed RedFinance also viewed..

XM

FXCM

VT Markets

HFM

RedFinance · Company Summary

| RedFinance Review Summary | |

| Registered Country/Area | United Kingdom |

| Founded Year | 2011 |

| Company Name | Shenanigans Consulting LTD |

| Regulation | Unregulated |

| Market Instruments | Derivatives, Equities, Fixed Income, Cash, Commodities, FX |

| Account Types | VIP, Classic, Standard, Mini |

| Maximum Leverage | VIP: 1:100, Classic: 1:80, Standard: 1:50, Mini: 1:30 |

| Spreads | 1-5 pips for major currency pairs, 10-20 pips for minor currency pairs |

| Minimum Deposit | Mini: $250, Standard: $5,000, Classic: $25,000, VIP: $50,000 |

| Trading Platforms | Web Platform (desktop and mobile), Mobile App (iOS and Android) |

| Customer Support | Address: Suite 305, Griffith Corporate Center, Kingstown, P.O. Box 1510, St. Vincent and the Grenadines |

| Email: compliance.eng@redfinance.capital | |

Note: RedFinance's official website:https://redfinance.capital/ is currently inaccessible normally.

Red Finance Information

RedFinance, established in the United Kingdom in 2011, provides various market instruments, including derivatives such as interest rate swaps, currency swaps, credit default swaps, and equity swaps. It also offers equities, fixed income options, cash investments, commodities, and foreign exchange services. However, the company operates without regulation.

Pros and Cons

| Pros | Cons |

| Offers 6 financial instruments | Unregulated |

| 4 account types | Leverage up to 1:100 |

| Web and mobile trading platforms | High minimum deposit |

| Low minimum deposit for some accounts |

Is RedFinance Legit?

RedFinance operates without regulatory oversight. Its domain was registered on January 28, 2011, and is set to expire on January 28, 2025.

What Can I Trade on RedFinance?

RedFinance offers a total of six product categories: derivatives (including swaps and options), equities (common and preferred shares, ETFs), fixed income (government and corporate bonds), cash investments (money market instruments), commodities (energy, metals, and agricultural products), and foreign exchange (spot and forward FX).

| Tradable Instruments | Supported |

| Derivatives | ✔ |

| Equities | ✔ |

| Fixed income | ✔ |

| Cash investments | ✔ |

| Commodities | ✔ |

| Foreign exchange | ✔ |

Account Types

RedFinance offers four types of live trading accounts, but does not provide demo or Islamic accounts.

VIP: This account type is suitable for high-capital investors, providing a maximum leverage of 1:100 with a minimum deposit requirement of $50,000.

Classic: Aimed at intermediate traders, the Classic account offers a maximum leverage of 1:80 and requires a minimum deposit of $25,000.

Standard: This account is designed for regular traders, featuring a maximum leverage of 1:50 and a minimum deposit requirement of $5,000.

Mini: The Mini account caters to beginner traders, offering a maximum leverage of 1:30 with a minimum deposit of $250.

| Account Type | Maximum Leverage | Minimum Deposit | Suitable For |

| VIP | 1:100 | $50,000 | High-capital investors |

| Classic | 1:80 | $25,000 | Intermediate traders |

| Standard | 1:50 | $5,000 | Regular traders |

| Mini | 1:30 | $250 | Beginner traders |

Leverage

RedFinance offers varying leverage levels: 1:100 for VIP accounts, 1:80 for Classic accounts, 1:50 for Standard accounts, and 1:30 for Mini accounts.

RedFinance Spreads

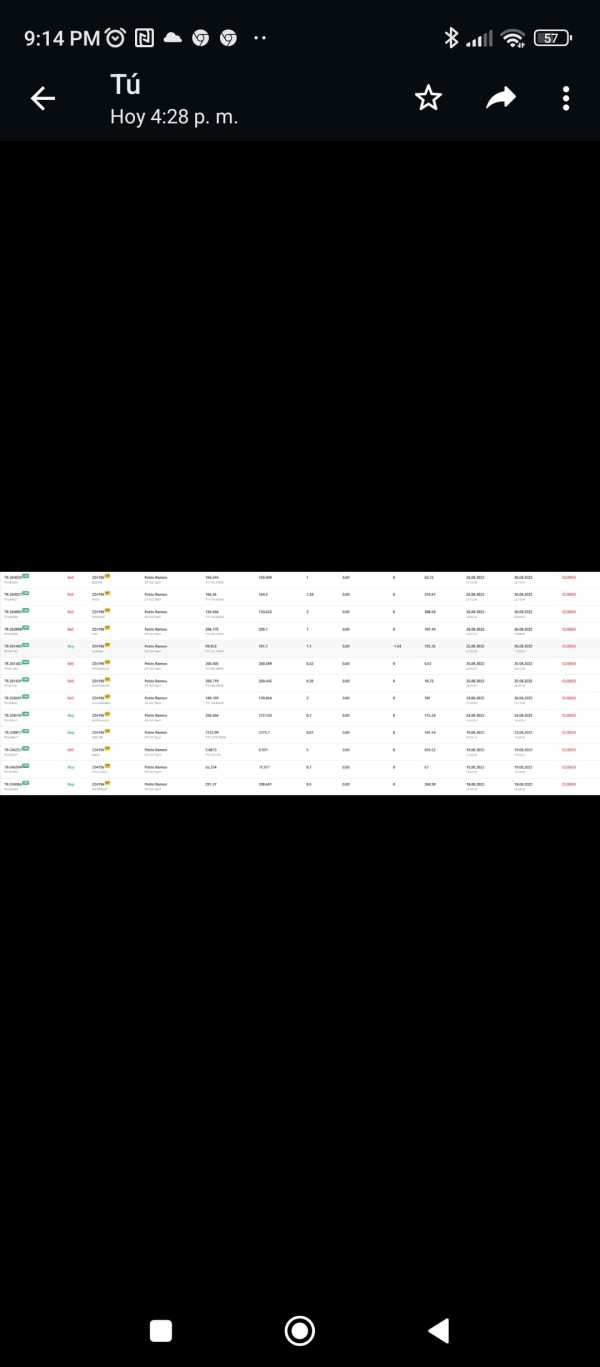

RedFinance spreads are typically 1-5 pips for major currency pairs and 10-20 pips for minor currency pairs. Commissions are flat fees of $0.09 per side for US equities and $0.01 per share for US ETFs.

Deposit and Withdrawal

RedFinance has a minimum deposit of $250, with deposits processed instantly via bank transfer. Withdrawals can be made through bank transfer or cryptocurrency, with a minimum withdrawal amount of $50. There are no fees for deposits or withdrawals.

Trading Platforms

RedFinance offers a trading platform compatible with Windows, web browsers, Android, macOS, and iOS, suitable for casual traders and professionals seeking flexibility.

| Trading Platform | Supported | Available Devices | Suitable for |

| Tradingweb Platform | ✔ | Windows, Web Browser, Android, MAC, iOS | High-volume Traders, Scalpers, and Robots |

| MT4 | ❌ | Mobile and Desktop(Windows & macOS) | Beginner |

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now