Score

ProEquityMarkets

United Kingdom|1-2 years|

United Kingdom|1-2 years| https://proequitymarkets.com/

Website

Rating Index

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

ProEquityMarkets

ProEquityMarkets

United Kingdom

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

- The number of the complaints received by WikiFX have reached 4 for this broker in the past 3 months. Please be aware of the risk!

WikiFX Verification

Users who viewed ProEquityMarkets also viewed..

XM

Decode Global

FBS

MultiBank Group

ProEquityMarkets · Company Summary

| Aspect | Information |

| Company Name | ProEquityMarkets |

| Registered Country/Area | United Kingdom |

| Founded Year | 2023 |

| Regulation | Unregulated |

| Market Instruments | Forex, Metals, Cryptocurrencies, Commodity Future CFDs |

| Account Types | Mini Account, Gold Account, ECN Account, Platinum Account |

| Minimum Deposit | $300 (Mini), $1,000 (Gold), $3,500 (ECN), $10,000 (Platinum) |

| Maximum Leverage | 1:1000 |

| Spreads | From 3.3 pips (Mini), From 2.2 pips (Gold), From 1.8 pips (ECN), From 0.3 pips (Platinum) |

| Trading Platforms | MetaTrader 4 (MT4) |

| Customer Support | Email: support@ProEquityMarkets.com, Live chat |

| Deposit & Withdrawal | WebMoney, NETELLER, Perfect Money, Skrill 1-Tap, Bitcoin (No deposit fees) |

| Educational Resources | Limited |

Overview of ProEquityMarkets

ProEquityMarkets, founded in the United Kingdom in 2023, provides a diverse array of trading assets, including forex, metals, cryptocurrencies, and commodity future CFDs. Boasting a maximum leverage of 1:1000 and various account types accommodating diverse trading preferences, the platform offers flexibility for traders. The transparent fee structure, supported by the reliable MetaTrader 4 (MT4) trading platform, and multiple deposit options with no fees contribute to a user-friendly experience.

However, the absence of regulatory oversight poses potential risks associated with alleged scams, impacting user confidence. Additionally, limited educational resources and customer support contact options present challenges for users.

Is ProEquityMarkets legit or a scam?

ProEquityMarkets operates without regulatory oversight, potentially exposing users to uncertainties regarding transparency and investor protection.

The absence of regulation raises concerns about the platform's commitment to adhering to industry standards, posing potential risks for traders who rely on regulated environments for a secure and trustworthy trading experience.

Pros and Cons

| Pros | Cons |

| A diverse range of trading assets, including forex, metals, cryptocurrencies, and commodity future CFDs | Operates without regulatory oversight |

| Maximum leverage of 1:1000 | Potential risks associated with alleged scam |

| Various account types suitable for different trading preferences and expertise levels | Limited educational resources |

| Transparent fee structure | Limited customer support contact options |

| Reliable MetaTrader 4 (MT4) trading platform | |

| Various deposit options with no fees |

Pros

A diverse range of trading assets:

ProEquityMarkets offers a comprehensive selection of over 500 trading assets, spanning forex, metals, cryptocurrencies, and commodity future CFDs. This diversity allows users to explore different markets and investment avenues.

Maximum leverage of 1:1000:

ProEquityMarkets offers high leverage, allowing traders the potential for amplified profits. However, it's important to note that high leverage also increases the risk of magnified losses.

Various account types suitable for different trading preferences and expertise levels:

The platform provides diverse account types, catering to the needs of various traders, from entry-level to professional, offering options based on individual preferences and expertise levels.

Transparent fee structure:

ProEquityMarkets employs a tiered fee structure across different account types, offering flexibility and transparency in fees. This provides options for traders based on their preferences and risk exposure.

Reliable MetaTrader 4 (MT4) trading platform:

The platform relies on the widely acclaimed MT4 trading platform, known for its user-friendly interface, advanced charting tools, and support for algorithmic trading. MT4 enhances the trading experience for users.

Various deposit options with no fees:

ProEquityMarkets supports multiple deposit methods with no commission fees, providing users with a transparent and cost-efficient funding process.

Cons

Operates without regulatory oversight:

ProEquityMarkets lacks regulatory oversight, potentially exposing users to uncertainties regarding transparency and investor protection.

Potential risks associated with alleged scam

Users have reported troubling experiences on the platform, including allegations of involvement in a pyramid scheme, fund recovery issues, and withdrawal restrictions. These negative experiences raise concerns about the platform's legitimacy and fair practices.

Limited educational resources:

ProEquityMarkets lacks extensive educational resources, potentially limiting support for users seeking to enhance their trading knowledge and strategies.

Limited customer support contact options:

While the platform provides email and live chat support, the available customer support contact options are limited. Expanding contact options could enhance accessibility for users seeking assistance.

Market Instruments

ProEquityMarkets provides a diverse range of trading assets, including forex, metals, cryptocurrencies, and commodity future CFDs. With a comprehensive selection of over 500 assets, traders have the opportunity to engage in various markets and explore different investment avenues.

In the realm of forex trading, users can access a wide array of currency pairs, allowing them to participate in the dynamic foreign exchange market. The inclusion of metals provides opportunities to trade commodities such as gold and silver, catering to investors interested in precious metals.

The platform extends its asset offerings to the realm of cryptocurrencies, allowing users to trade digital currencies like Bitcoin and Ethereum. This inclusion reflects the growing interest in cryptocurrency markets and provides a platform for traders seeking exposure to this asset class.

Furthermore, ProEquityMarkets encompasses commodity future CFDs, offering the chance to trade contracts based on the future prices of commodities. This addition broadens the scope for users interested in commodities beyond precious metals.

With a diverse portfolio spanning these asset classes, ProEquityMarkets provides users with a range of options to diversify their investment strategies. Traders can navigate these markets based on their preferences, risk tolerance, and market analysis.

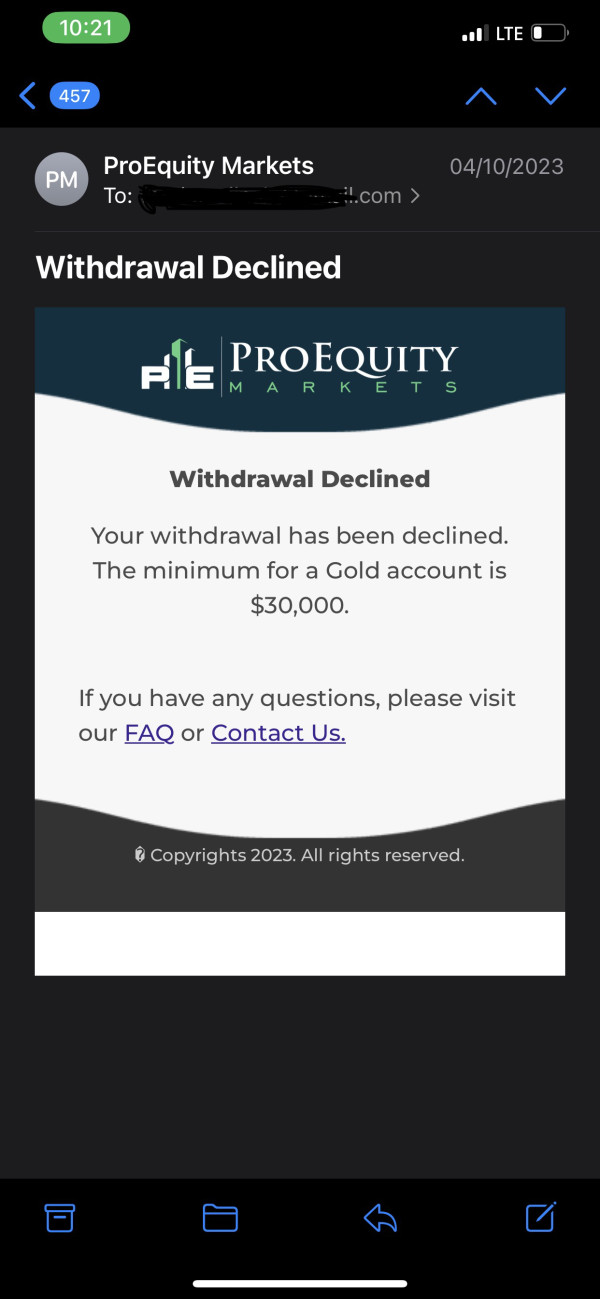

Account Types

Diverse account types are available to accommodate various trading preferences within the realm of Forex trading.

The Mini Account, requiring a minimum deposit of $300, targets entry-level traders and novices, providing a lower-risk introduction to the market. Moving up the spectrum, the Gold Account, with a $1,000 minimum deposit, aims to offer improved trading conditions and personalized support through a designated Personal Account Manager.

Designed for professionals and seasoned traders, the ECN Account, demanding a minimum deposit of $3,500, provides competitive spreads and advanced features to meet the demands of experienced market participants.

On the other end of the spectrum, the Platinum Account, requiring a $10,000 minimum deposit, caters to highly experienced traders by offering the lowest spreads available and access to a suite of sophisticated tools.

Each account type serves a distinct purpose, providing traders with options tailored to their expertise and preferences within the Forex trading landscape.

| Forex Accounts | MINI ACCOUNT | GOLD ACCOUNT | ECN ACCOUNT | PLATINUM ACCOUNT |

| Minimum Deposit | $300 | $1,000 | $3,500 | $10,000 |

| Account Design | For customers and beginners. You can experience real trading thrills at minimal risk. | For traders familiar with Forex, seeking better deals. | For professionals and experienced traders. | For experienced Forex traders. |

| Spreads | From 3.3 pips | From 2.2 pips | From 1.8 pips | From 0.3 pips |

| Leverage | 400:1 | 400:1 | 400:1 | 400:1 |

| Support | Live Chart Support | Personal Account Manager, Live Chart Support | Personal Account Manager, Live Chart Support | Personal Account Manager, Live Chart Support |

| Platforms | All Available Platforms | All Available Platforms | All Available Platforms | All Available Platforms |

| Access Tools | Access All Education Tools | Access All Education Tools | Access All Education Tools | Access All Education Tools |

| Additional | Technical Analysis Report | Technical Analysis Report, Market Update Emails | Technical Analysis Report, Market Update Emails | Market Update Emails |

How to Open an Account?

Opening an account with ProEquityMarkets involves a straightforward process. Here are the concrete steps to follow:

Visit ProEquityMarkets Website:

Start by visiting the official ProEquityMarkets website using a secure web browser.

2. Account Registration:

Look for the “Register” option on the website.

Fill in the required personal information accurately, including your name, email address, and contact details.

3. Submit Verification Documents:

After registration, the platform may require you to submit verification documents. This typically includes proof of identity (e.g., passport or ID) and proof of address (e.g., utility bill).

4. Account Type Selection:

Choose the type of trading account that suits your preferences and trading style. This may include selecting between different account tiers, each with varying features and minimum deposit requirements.

5. Deposit Funds:

Once your account is verified, proceed to deposit funds into your trading account. ProEquityMarkets usually provides various payment methods such as bank transfers or credit/debit cards.

6. Start Trading:

With a funded account, you can start trading on the ProEquityMarkets platform. Explore the available trading instruments and utilize the platform's features for analysis and execution.

It's crucial to note that specific details of the account opening process may vary, and users should always refer to the official ProEquityMarkets website or contact their customer support for the most accurate and up-to-date information.

Leverage

The maximum leverage offered by ProEquityMarkets is 1:1000.

This leverage ratio signifies that for every unit of capital invested, traders have the potential to control a position in the market that is a thousand times larger. It's important to note that while high leverage can amplify potential profits, it also increases the level of risk, as losses can be magnified similarly.

Spreads & Commissions

ProEquityMarkets offers a tiered fee structure across its Forex accounts, catering to different trader profiles.

The Mini Account, designed for customers and beginners with a minimum deposit of $300, has spreads starting from 3.3 pips.

Moving up, the Gold Account, tailored for traders familiar with Forex seeking better deals at a $1,000 minimum deposit, provides improved conditions with spreads from 2.2 pips.

The ECN Account, aimed at professionals and experienced traders requiring a $3,500 minimum deposit, offers competitive spreads from 1.8 pips.

For highly experienced traders, the Platinum Account, with a $10,000 minimum deposit, provides the lowest spreads from 0.3 pips.

In comparison, the fees associated with each account type reflect a nuanced approach. The Mini Account is suitable for those looking for minimal risk exposure, while the Gold Account enhances trading conditions. The ECN Account is designed for professionals seeking competitive spreads, and the Platinum Account, with its lowest spreads, targets highly experienced Forex traders.

Trading Platform

ProEquityMarkets relies on the MetaTrader 4 (MT4) trading platform, renowned for its user-friendly interface and comprehensive features. MT4 is acclaimed for its advanced charting tools, technical analysis capabilities, and a wide array of built-in indicators. Traders at ProEquityMarkets benefit from real-time price quotes, customizable charts, and an intuitive order execution process.

Additionally, the platform supports algorithmic trading through its MQL4 network, allowing traders to create, test, and deploy Expert Advisors (EAs). This feature empowers users to automate their trading strategies, providing efficiency and precision in executing trades based on predetermined criteria.

MT4's mobile compatibility further enhances accessibility, enabling traders to monitor and manage their portfolios on-the-go. While the platform is widely praised for its reliability, traders are encouraged to consider their individual preferences and requirements when evaluating the suitability of MT4 for their trading needs.

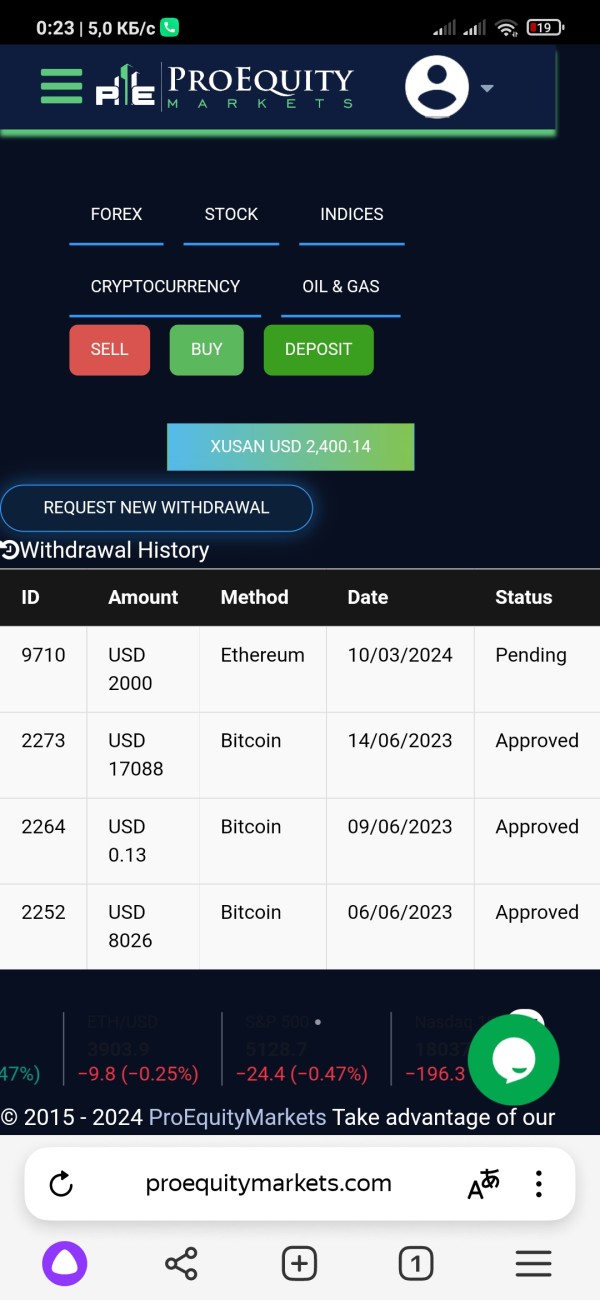

Deposit & Withdrawal

ProEquityMarkets facilitates the funding and withdrawal of trading accounts through various payment methods. Users can make deposits using WebMoney, NETELLER, Perfect Money, Skrill 1-Tap, and Bitcoin. Each method supports different currencies, offering flexibility to traders in choosing their preferred currency for transactions.

ProEquityMarkets emphasizes a fee-free approach for deposits, fostering a transparent and straightforward process for users. No commission fees are applied when depositing funds through WebMoney, NETELLER, Perfect Money, Skrill 1-Tap, or Bitcoin. The absence of deposit fees contributes to a seamless and cost-efficient funding experience for traders.

Deposits are processed instantly when no additional verification is required. However, users should be aware that ProEquityMarkets is not liable for any transfer delays that may occur due to disruptions in the payment processor's system. Bank office transfers, a separate payment method, follow standard business hours, ensuring processing during specified weekdays. It's advisable for users to consider these processing times when planning their financial activities on the platform.

Customer Support

ProEquityMarkets offers customer support through email at support@ProEquityMarkets.com, providing users with an additional channel for inquiries and assistance.

Additionally, the platform features live chat support, enabling real-time communication for immediate queries or concerns.

The availability of both email and live chat options enhances accessibility, allowing users to choose the mode of contact that best suits their preferences and urgency.

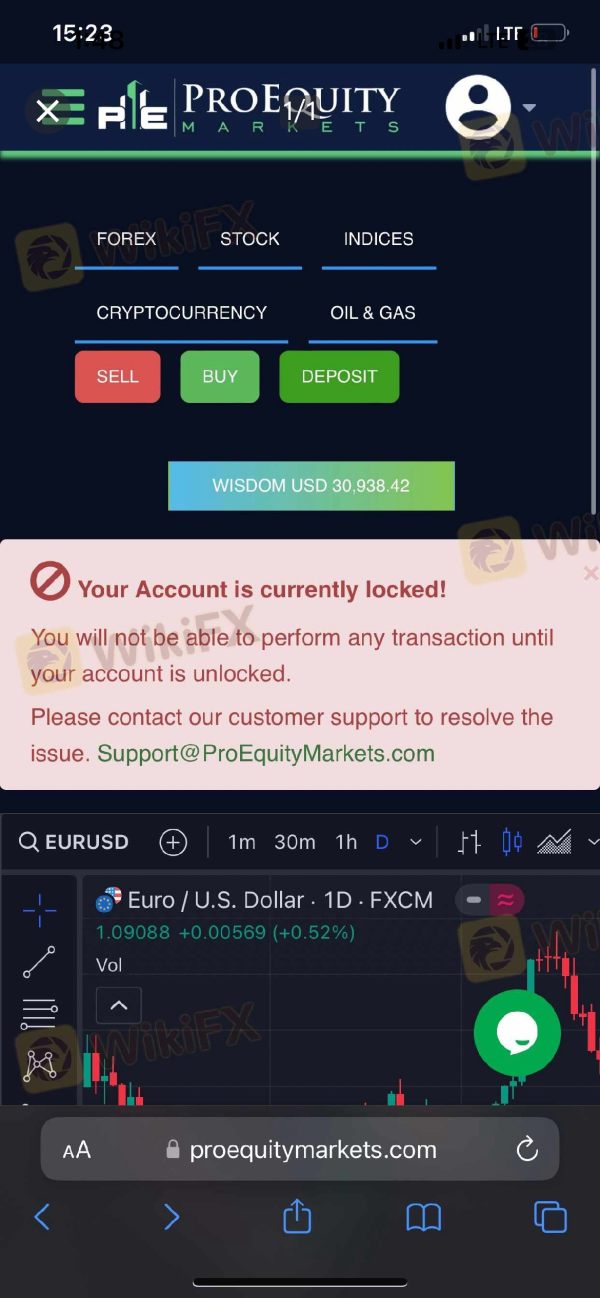

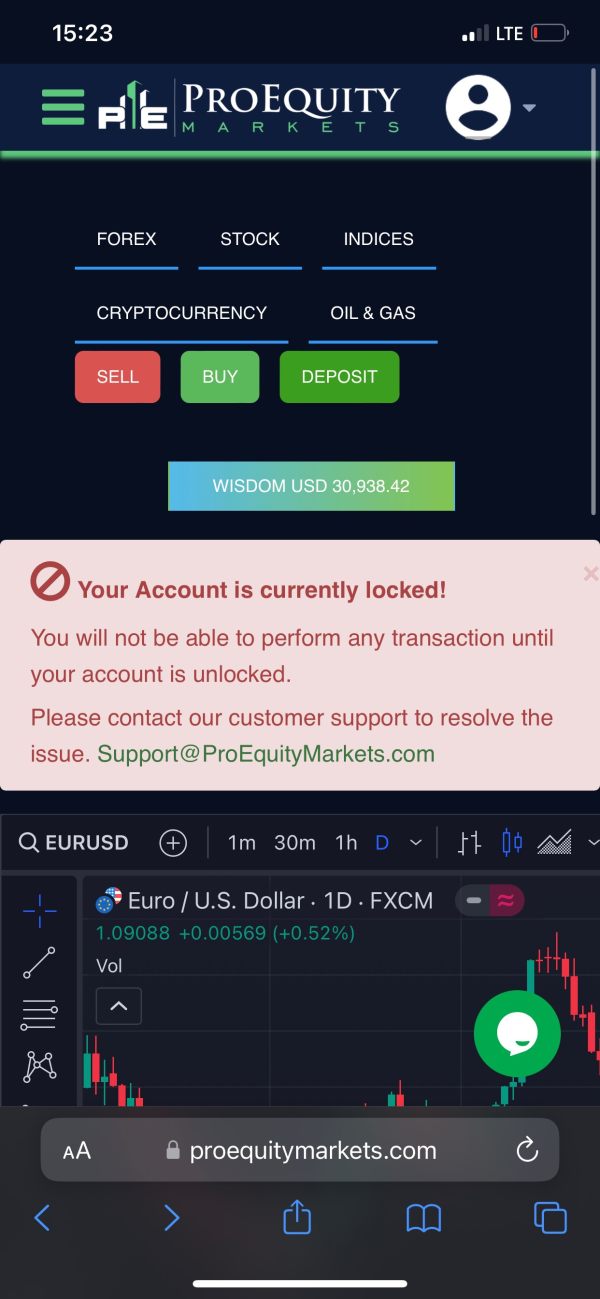

Exposure

Users have reported troubling experiences on the ProEquityMarkets platform, with allegations ranging from involvement in a pyramid scheme to issues related to fund recovery and withdrawal restrictions.

The platform is accused of blocking users after profitable trades and imposing unexpected account upgrades, creating skepticism about its legitimacy. These exposures suggest potential risks for traders, impacting their trust in ProEquityMarkets and raising concerns about the platform's transparency and fair practices. Such reports can influence the trading environment negatively, deterring users from engaging in transactions on a platform with alleged questionable practices and creating an atmosphere of doubt and uncertainty among the trading community.

Conclusion

In conclusion, ProEquityMarkets offers a range of trading assets, including forex, metals, cryptocurrencies, and commodity future CFDs. The platform distinguishes itself with a maximum leverage of 1:1000, catering to traders with diverse preferences.

Despite a transparent fee structure and reliable MetaTrader 4 (MT4) trading platform, the absence of regulatory oversight is a significant drawback, potentially exposing users to risks and uncertainties associated with scam allegations. The various account types, accommodating traders of different expertise levels, provide flexibility, but the customer support contact options hinder the overall trading experience.

FAQs

Q: Is ProEquityMarkets regulated?

A: No, ProEquityMarkets operates without regulatory oversight.

Q: What are the advantages of the various account types?

A: Different account types cater to traders with varying expertise levels, offering flexibility and personalized trading conditions.

Q: How can I deposit funds on ProEquityMarkets?

A: You can deposit funds using various methods, including WebMoney, NETELLER, Perfect Money, Skrill 1-Tap, and Bitcoin, with no deposit fees.

Q: Does ProEquityMarkets offer educational resources?

A: The platform has limited educational resources, and users may need to seek supplementary learning from external sources.

Q: What is the maximum leverage on ProEquityMarkets?

A: ProEquityMarkets provides a maximum leverage of 1:1000.

Q: Is there live chat support available?

A: Yes, ProEquityMarkets offers live chat support for real-time assistance.

News

Review 4

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now