What is Etora Grand?

Etora Grand, a brokerage registered in the United Kingdom, offers a versatile trading experience across various financial markets, including forex, equities, indices, and commodities. With a focus on client satisfaction and safety, Etora Grand advertises free educational opportunities, tight spreads, and reliable trading platforms.

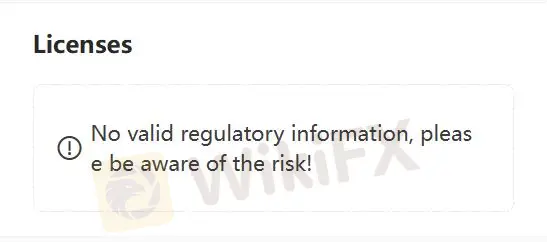

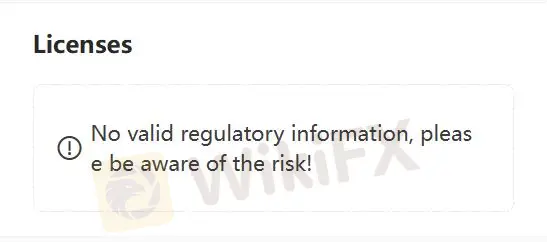

However, a key concern with Etora Grand is the lack of regulation.

Pros & Cons

Pros:

Versatile Trading Experience: Etora Grand offers a wide range of financial instruments, including forex, equities, indices, and commodities, providing traders with diverse investment opportunities.

Educational Opportunities: The brokerage offers free educational resources, enabling traders to enhance their trading knowledge and skills.

Account Security: Etora Grand keeps client funds separate from company assets in reputable UK banks, ensuring the safety of client funds.

Multiple Trading Platforms: Etora Grand supports MetaTrader 4, Webtrader, and a Mobile Trading App, offering flexibility and convenience for traders.

Cons:

Lack of Regulation: Etora Grand is not regulated, which impacts trader trust and confidence in the security of their funds.

Limited Information: There is limited information available about Etora Grand's trading conditions, fees, and other important details.

Is Etora Grand Safe or Scam?

While Etora Grand offers some features that can be seen as positive indicators, including a demo account and multiple trading platforms, it cannot be definitively labeled safe due to the red flag of lacking regulation. The lack of regulation means that Etora Grand operates without the oversight of a regulatory authority, which exposes traders to risks such as fund mismanagement or fraudulent activities.

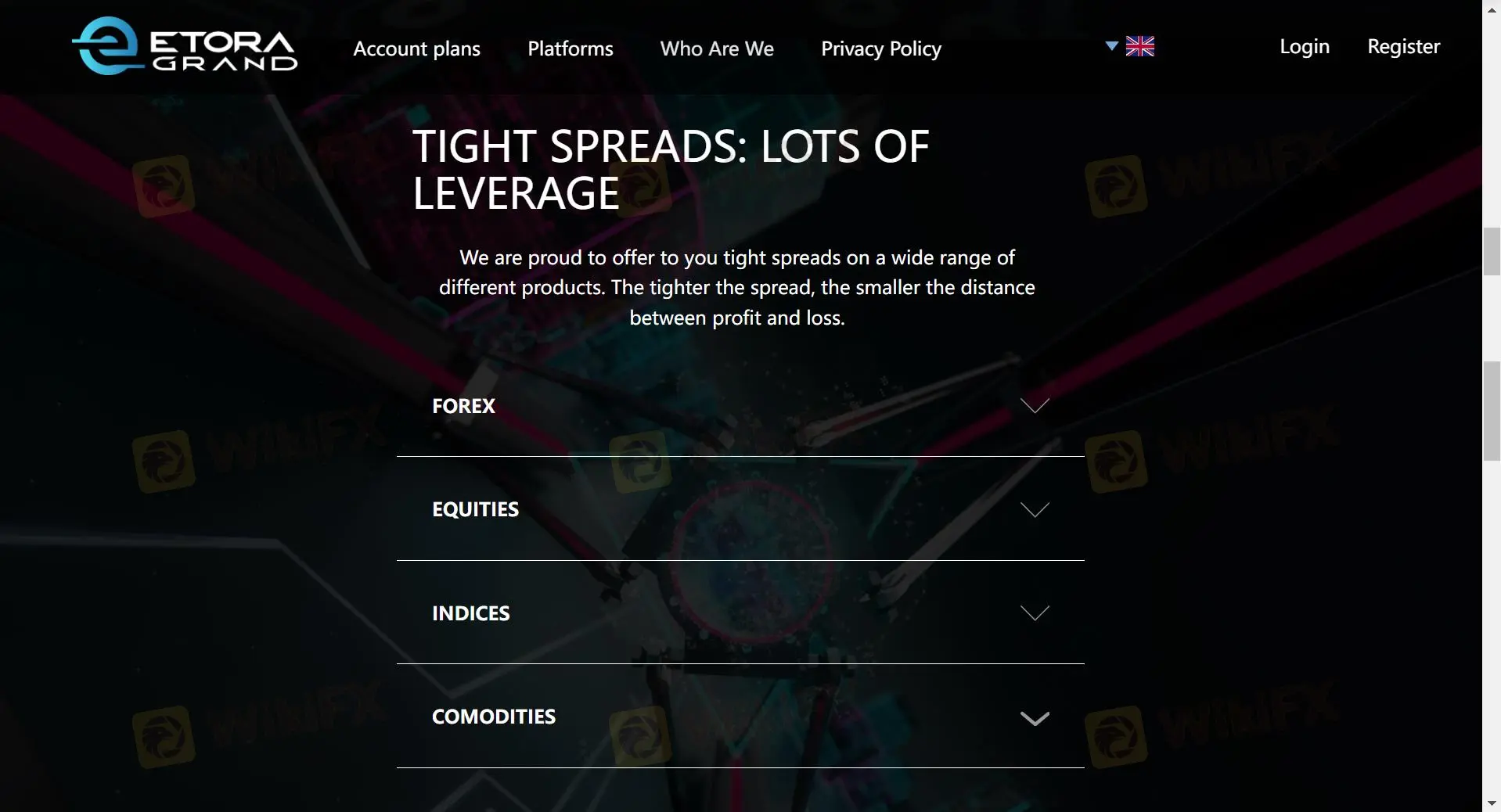

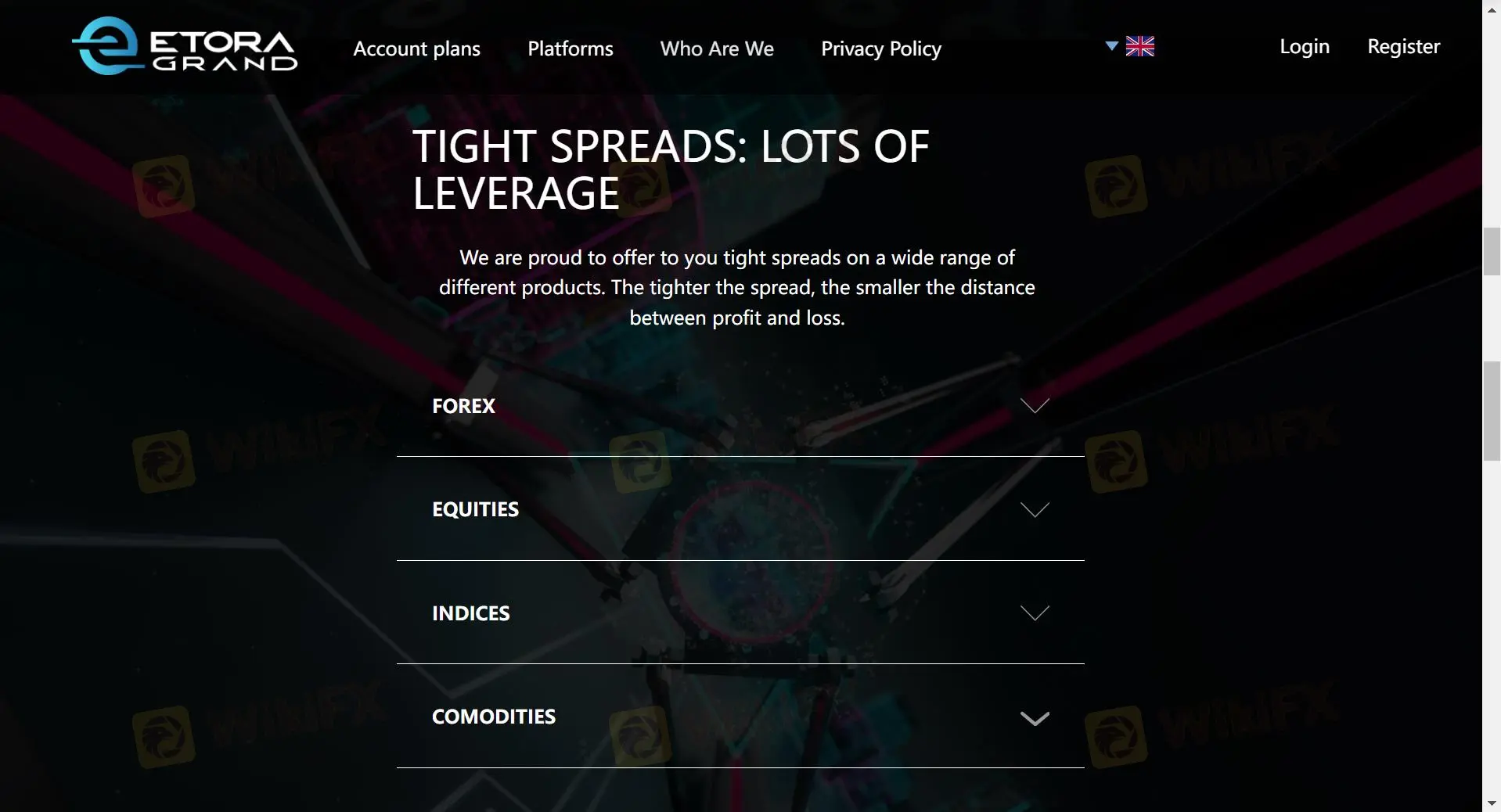

Market Instruments

Etora Grand offers a variety of market instruments for traders to choose from, providing access to different asset classes and trading opportunities.

Forex: Traders can trade a wide range of currency pairs, including major, minor, and exotic pairs. This allows traders to take advantage of fluctuations in exchange rates between different currencies.

Indices: Etora Grand offers trading on major stock indices from around the world. Trading indices allows traders to speculate on the performance of a group of stocks from a particular region or industry.

Commodities: Traders can trade commodities such as gold, silver, oil, and natural gas. Trading commodities can be a way to diversify a trading portfolio and hedge against inflation or geopolitical risks.

Shares: Etora Grand provides access to trading shares of major companies listed on stock exchanges around the world. Trading shares allows traders to invest in individual companies and potentially benefit from their performance.

CFDs: Contract for Difference (CFD) trading allows traders to speculate on the price movements of various financial instruments without actually owning the underlying asset. This enables traders to profit from both rising and falling markets.

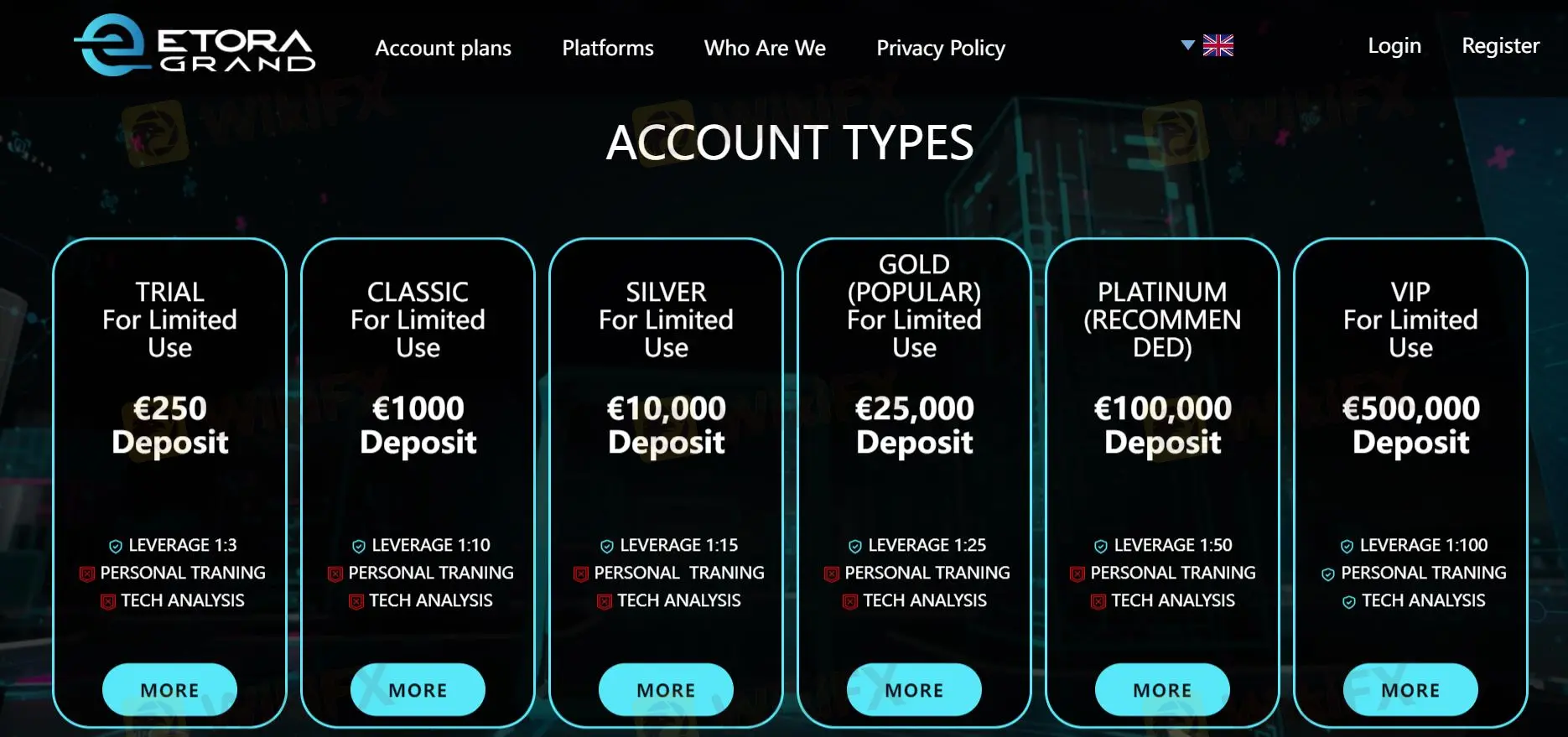

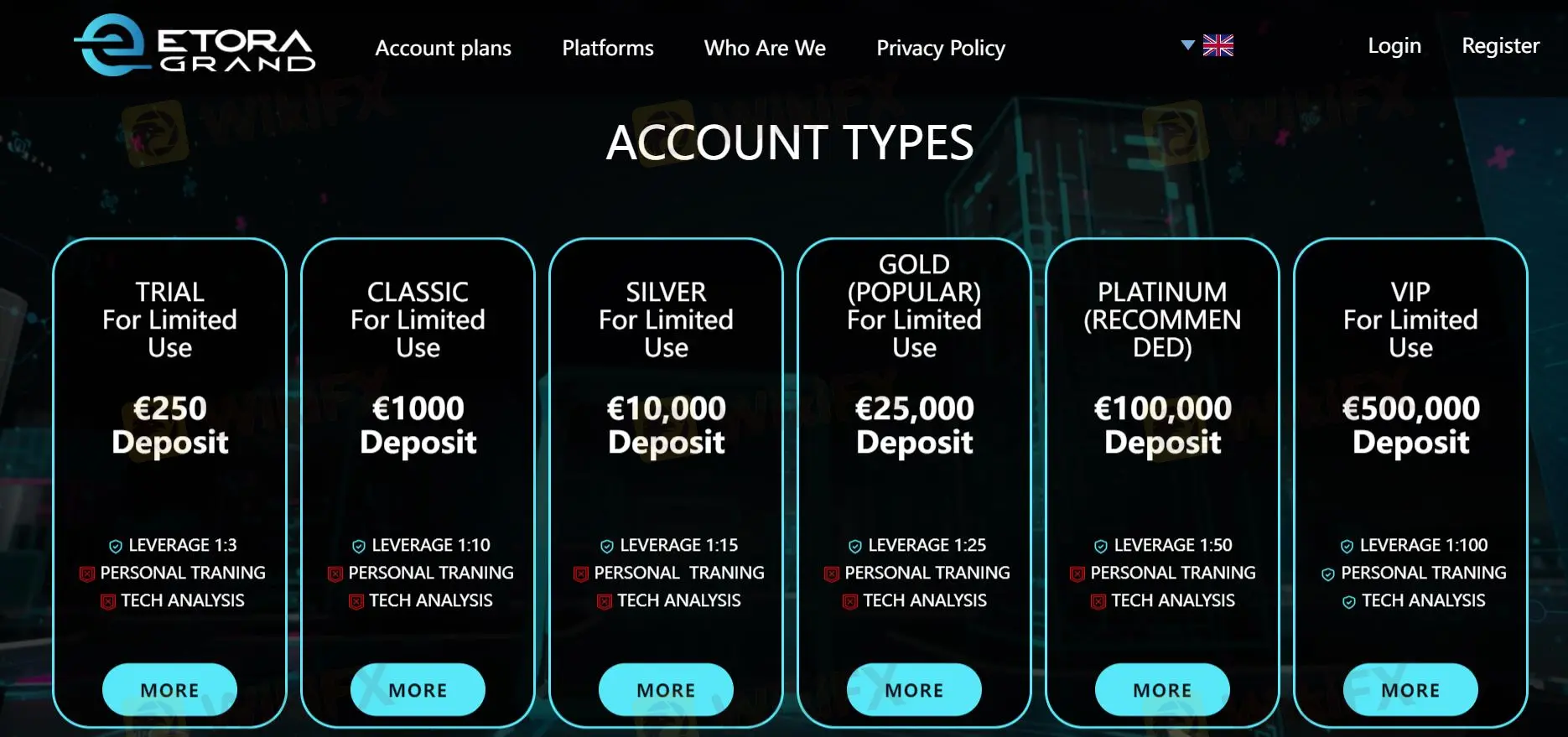

Account Types

Etora Grand offers six different account types to cater to the varying needs and preferences of traders.

Basic (Trial) Account: The Basic Account is designed for new traders and those who prefer to trade with smaller volumes. The minimum deposit requirement is EUR 250.

Classic Account: Similar to the Basic Account, the Classic Account is suitable for new traders and those trading with smaller volumes. The account requires a slightly higher minimum opening deposit of EUR 1000.

Silver Account: The Silver Account is another option for traders new to the forex market or trading with smaller volumes. The account requires a minimum opening deposit of EUR 10,000.

Gold Account: The Gold Account is designed for traders with a higher risk tolerance and a larger trading capital. The account requires a minimum opening deposit of EUR 25,000.

Platinum Account: The Platinum Account is tailored for experienced traders with substantial trading capital. The account requires a minimum opening deposit of EUR 100,000.

VIP Account: The VIP Account is designed for experienced traders who require fixed spreads and specific trading conditions. The account requires a minimum opening deposit of EUR 500,000.

Leverage

Leverage is a key feature in forex and CFD trading that allows traders to control a larger position size with a relatively small amount of capital. Etora Grand offers varying levels of leverage depending on the account type.

The Basic, Classic, Silver, Gold, and Platinum accounts offer leverage up to 1:100.

The VIP account offers higher leverage, up to 1:200.

The maximum leverage for every account offered by Etora Grand can vary based on clients' appropriate assessment. This means that the broker may adjust the maximum leverage available to a client based on factors such as the client's trading experience, risk tolerance, and financial situation. And the maximum leverage offered by Etora Grand is 1:400.

Spreads & Commissions

In general, Etora Grand offers competitive spreads and commission structures across its range of accounts. The Basic, Classic, Silver, Gold, and Platinum accounts all feature spreads from 1 pip with no commission, making them suitable for traders looking for straightforward pricing without additional fees per trade.

On the other hand, the VIP Account offers fixed spreads for Forex trading, providing traders with greater certainty over trading costs.

Trading Platforms

Etora Grand offers a variety of trading platforms to cater to the needs of its traders.

MetaTrader 4 (MT4): MT4 is a popular and widely used platform in the forex and CFD trading industry. It offers a user-friendly interface, advanced charting tools, technical analysis indicators, and automated trading capabilities through Expert Advisors (EAs).

Webtrader: Etora Grand provides a web-based trading platform that allows traders to access their accounts and trade directly from their web browsers. This platform is convenient for traders who prefer not to download additional software.

Mobile Trading App: Etora Grand offers a mobile trading app compatible with iPhone and Android devices. The mobile app allows traders to access their accounts, trade on the go, and manage their positions from anywhere with an internet connection.

Customer Service

For any inquiries or assistance, you can reach Etora Grand's customer support team via email at support@etoragrand.com.

Conclusion

While Etora Grand boasts a variety of features that might appeal to traders, from a wide range of instruments to multiple account options, a single red flag overshadows everything else: the lack of regulation. Without regulatory oversight, there's a chance your funds could be mismanaged or even worse, involved in a scam.

We advise you to prioritize safety and look for a reputable broker that's regulated by a well-known authority.

Frequently Asked Questions (FAQs)

Q: Is Etora Grand regulated?

A: No, Etora Grand operates without regulation.

Q: What markets can I trade with Etora Grand?

A: Etora Grand offers trading in forex, indices, commodities, shares, and CFDs.

Q: What trading platforms does Etora Grand offer?

A: Etora Grand offers MetaTrader 4, Webtrader, and a Mobile Trading App.

Q: What is the minimum deposit required to open an account with Etora Grand?

A: The minimum deposit required to open an account with Etora Grand is EUR 250.

Q: Does Etora Grand offer a demo account?

A: Yes, Etora Grand offers a demo account.

Q: What leverage is available at Etora Grand?

A: Etora Grand offers leverage up to 1:400.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.