Score

MIEX

United Kingdom|5-10 years|

United Kingdom|5-10 years| https://miexglobal.com/?utm_source=fxeye&utm_medium=PC&utm_campaign=homelinkeng&utm_term=&utm_content=

Website

Rating Index

Influence

Influence

D

Influence index NO.1

Ukraine 2.48

Ukraine 2.48Surpassed 15.40% brokers

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

MIEX

MIEX

United Kingdom

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

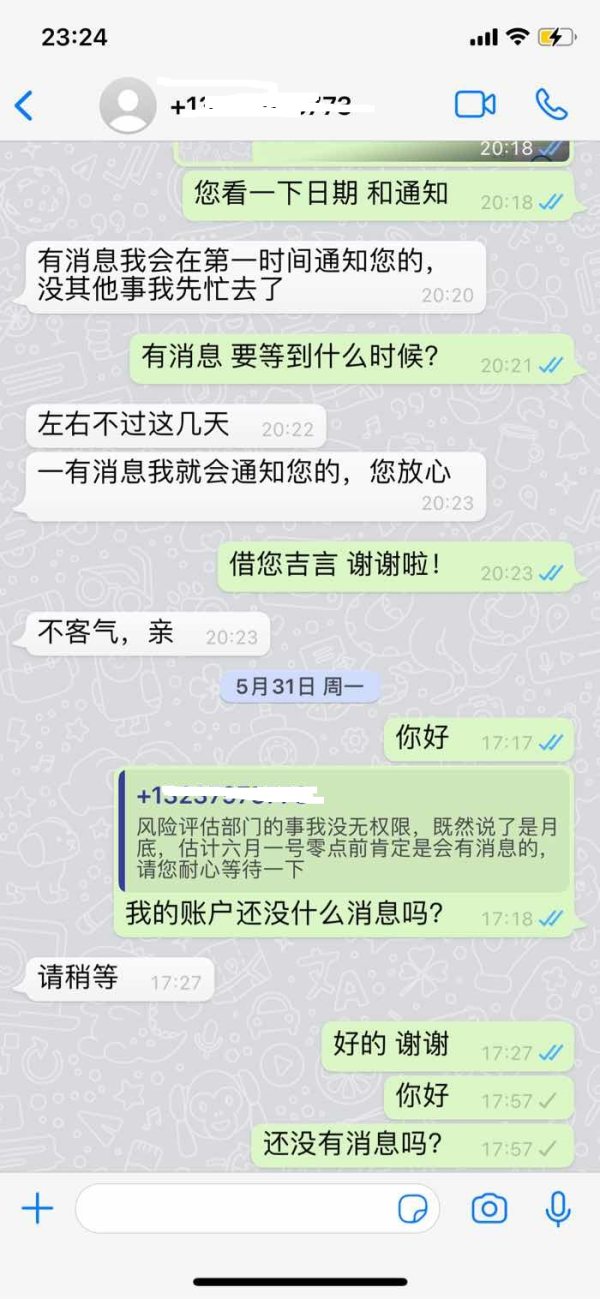

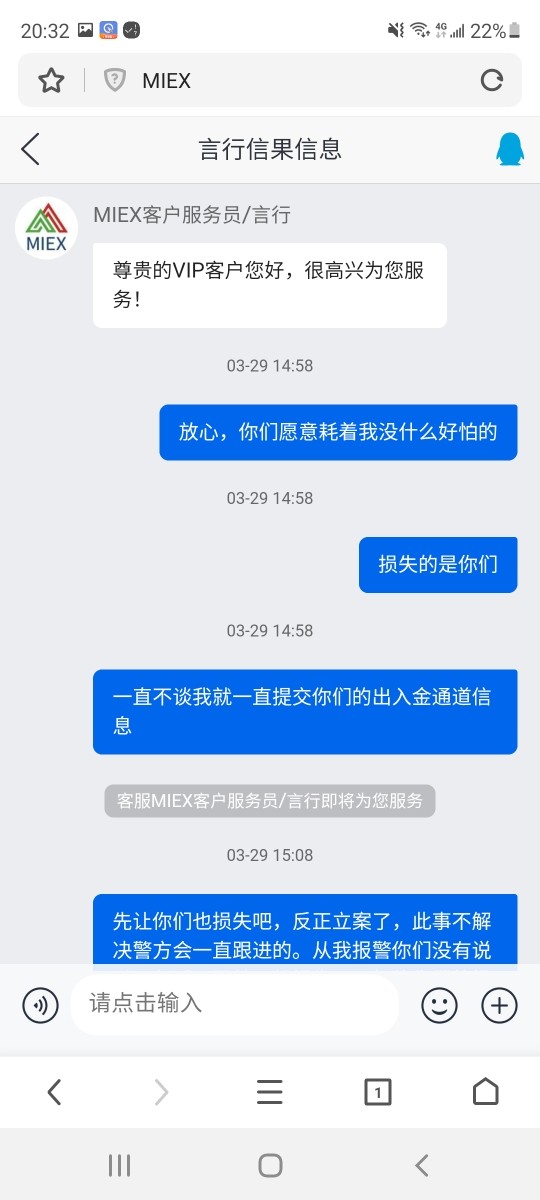

- The number of the complaints received by WikiFX have reached 32 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:400 |

| Minimum Deposit | $1000 |

| Minimum Spread | 0.35 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:888 |

| Minimum Deposit | $3000 |

| Minimum Spread | 0.25 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | 100 lot |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed MIEX also viewed..

XM

EC Markets

STARTRADER

FBS

Sources

Language

Mkt. Analysis

Creatives

MIEX · Company Summary

| MIEX | Basic Information |

| Company Name | MIEX |

| Founded | 2011 |

| Headquarters | United Kingdom |

| Regulations | Unregulated |

| Tradable Assets | Cryptocurrencies, Stocks, Indices, Forex, Commodities |

| Account Types | Standard, VIP |

| Minimum Deposit | Standard: $1000, VIP: $30,000 |

| Maximum Leverage | Standard: Up to 1:400, VIP: Up to 1:888 |

| Spreads | Standard: As low as 0.35, VIP: As low as 0.25 |

| Commission | Not explicitly provided; likely commission-based |

| Deposit Methods | Union Pay, WeChat Pay, Alipay, VISA, Mastercard, Bitcoin |

| Trading Platforms | MI Trader, MIEX MT5 |

| Customer Support | Phone: +44 7308642365, Email: cs@miexglobal.com |

| Education Resources | Product Introductions, Technical Analysis |

| Bonus Offerings | Standard Account: Regular Tickets, VIP Account: VIP Tickets (Free flight tickets and accommodation for VIP clients) |

Overview of MIEX

MIEX, established in 2011 and headquartered in the United Kingdom, is a trading platform that positions itself as a gateway to a diverse array of global markets. Offering a comprehensive range of tradable assets, MIEX caters to both seasoned and novice traders, providing opportunities to engage in cryptocurrency, stock, index, forex, and commodity trading. With a user-friendly interface and efficient transaction capabilities, MIEX facilitates seamless navigation and capitalization on the dynamic and rapidly evolving financial landscape.

The brokerage features two distinct account types, the Standard and VIP accounts, designed to accommodate varying trader preferences. The Standard Account, requiring a minimum deposit of $1000, emphasizes flexibility in trading volume and offers spreads starting from 0.35. On the other hand, the VIP Account, with a higher minimum deposit of $30,000, caters to a more discerning audience, providing increased leverage, lower spreads, and personalized services. VIP clients also enjoy exclusive access to promotions, including VIP tickets with complimentary flight and accommodation.

MIEX further distinguishes itself by offering two trading platforms, MI Trader and MIEX MT5, each tailored to different preferences and trading styles. The broker prioritizes comprehensive customer support, accessible through phone and email, and recognizes the importance of education, providing resources such as product introductions and technical analysis materials. While MIEX presents an enticing array of features and opportunities, it is essential for traders to exercise caution due to its unregulated status, especially in the United States, and conduct thorough due diligence before engaging in financial transactions on the platform.

Is MIEX Legit?

The regulatory status of MIEX is a cause for concern as the broker currently has no valid regulation. The absence of regulatory oversight raises potential risks for clients, as there is no recognized regulatory authority monitoring and ensuring compliance with industry standards.

Additionally, it has been noted that the regulatory status of MIEX in the United States, particularly with the NFA (license number: 0529540), is abnormal. The official regulatory status is marked as “Unauthorized,” further emphasizing the need for caution. Clients should be vigilant and informed about the regulatory landscape, and the abnormal status underscores the importance of thorough due diligence before engaging in any financial transactions with MIEX.

Pros and Cons

MIEX presents a mix of features that traders should carefully consider before engaging with the platform. On the positive side, the broker offers a diverse range of trading instruments, including cryptocurrencies, stocks, indices, forex, and commodities, catering to a wide spectrum of investor preferences. The availability of two account types, Standard and VIP, allows for flexibility, with the VIP account providing enhanced benefits and personalized services. The inclusion of educational resources, such as product introductions and technical analysis materials, demonstrates MIEX's commitment to supporting traders' knowledge and skills. Additionally, the provision of two trading platforms, MI Trader and MIEX MT5, offers versatility for users with different preferences.

However, the absence of regulatory oversight is a significant concern, as MIEX is currently unregulated. Regulatory status is crucial for ensuring the security and integrity of financial transactions, and the abnormal regulatory status in the United States adds an extra layer of caution. Moreover, the lack of explicit information on commission rates raises transparency questions, and traders should be vigilant about potential costs associated with transactions. It is imperative for users to weigh these pros and cons carefully and conduct thorough due diligence before deciding to trade on MIEX.

| Pros | Cons |

|

|

|

|

|

|

|

Trading Instruments

MIEX provides a comprehensive range of trading instruments, catering to diverse investment preferences and strategies. Traders on the MIEX platform can access an extensive selection of financial assets, including over 50 types of cryptocurrencies, allowing them to capitalize on the dynamic and rapidly evolving crypto market. This diverse offering covers major cryptocurrencies, offering opportunities for both seasoned and novice crypto traders.

In addition to cryptocurrencies, MIEX offers a broad spectrum of traditional financial instruments, comprising over 500 types of stocks, indices, forex pairs, commodities, and energy products. The inclusion of stocks from the United States and Hong Kong broadens the scope for equity trading, providing investors with exposure to renowned companies and markets.

The availability of forex trading on the MIEX platform allows participants to engage in currency pairs, taking advantage of fluctuations in global currency markets. Furthermore, MIEX offers trading opportunities in precious metals, energy resources, agricultural commodities, and various equity indices, enabling traders to diversify their portfolios and explore different asset classes.

Overall, MIEX positions itself as a platform where traders can seamlessly navigate and capitalize on a myriad of global markets, fostering a dynamic environment for exploring endless trading opportunities across various asset classes.

Account Types

MIEX presents traders with a nuanced selection of account types to suit diverse preferences and trading styles. The Standard Account, requiring a minimum deposit of $1000, appeals to those seeking flexibility in trading volume without a specific monthly requirement. This account features leverage of up to 1:400, spreads starting from 0.35, and immediate order processing. With negative balance protection and round-the-clock customer service, the Standard Account is designed to provide a reliable and accessible trading environment, ensuring a standard level of trade rewards and participation in regular promotions and events.

On the other hand, the VIP Account, requiring a higher minimum deposit of $30,000, caters to traders with a more discerning approach. This account type introduces a minimum monthly trading size of 100, offering enhanced benefits such as increased leverage up to 1:888, lower spreads starting from 0.25, and immediate order processing. VIP clients enjoy the added advantage of personalized service, with a dedicated account manager available 24/7. The VIP Account also provides an elevated trade reward of 1.5x, reflecting MIEX's commitment to recognizing and rewarding the commitment of its premium clients. Moreover, VIP Account holders gain exclusive access to special promotions and events, including VIP tickets that offer complimentary flight tickets and accommodation. For those seeking a managed trading experience, the VIP Account also opens the door to MAM/PAMM services.

In essence, MIEX's array of account types reflects a strategic approach to accommodate a broad spectrum of traders, acknowledging the diverse needs within the trading community. Whether traders prioritize flexibility or are drawn to a more exclusive and feature-rich environment, MIEX seeks to provide tailored solutions that align with individual preferences and trading aspirations.

How to Open an Account?

To open an account with MIEX, follow these steps.

Visit the MIEX website. Look for the “Register” button on the homepage and click on it.

2. Sign up on websites registration page.

3. Receive your personal account login from an automated email

4. Log in

5. Proceed to deposit funds to your account

6. Download the platform and start trading

Leverage

MIEX provides leverage options for traders to manage their market positions. The Standard Account offers a maximum leverage of up to 1:400, enabling traders to control larger positions with a relatively smaller capital outlay. This feature can be appealing for those seeking to magnify potential returns, although it also entails an increased level of risk.

For traders with a higher risk appetite, the VIP Account at MIEX offers even more substantial leverage, allowing for up to 1:888. This heightened leverage level provides traders with the opportunity to take larger positions, potentially amplifying both gains and losses. However, it's crucial for traders to approach higher leverage with caution and carefully assess the associated risks.

In summary, MIEX's leverage options cater to different trader preferences. While it offers flexibility, traders should exercise prudence and implement effective risk management strategies to navigate the inherent uncertainties and potential downsides associated with trading on margin.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | MIEX | FxPro | VantageFX | RoboForex |

| Maximum Leverage | 1:888 | 1:200 | 1:500 | 1:2000 |

Spreads and Commissions (Trading Fees)

MIEX presents varying spreads and commissions across its account types. In the Standard Account, traders encounter spreads as low as 0.35, a factor that can impact the overall cost of trading. While this spread is relatively competitive in the market, traders should consider the potential impact on their profitability, especially when engaging in frequent or large-volume trades. Additionally, the absence of a specified minimum deposit requirement for the Standard Account may be advantageous for those looking to start with a lower initial investment.

On the other hand, the VIP Account offers potentially tighter spreads, with rates as low as 0.25. This could be appealing to traders who prioritize lower transaction costs and seek a more cost-effective trading environment. However, it's crucial to note that the VIP Account necessitates a higher minimum deposit of $30,000, which may influence the accessibility of this account type for certain traders.

Regarding commissions, MIEX employs a commission-based structure, where traders may incur charges per transaction. The exact commission rates are not explicitly provided, so traders should carefully evaluate the cost implications of commissions, particularly if engaging in high-frequency trading or executing a significant volume of trades.

Deposit & Withdraw Methods

MIEX offers a variety of payment methods for both deposit and withdrawal transactions, providing flexibility for traders to choose the option that best suits their preferences and convenience. The supported payment services include Union Pay, WeChat Pay, Alipay, VISA, Mastercard, and Bitcoin Deposit.

Traders using MIEX's Standard Account can initiate deposits with a minimum amount of $1000. This minimum deposit requirement allows accessibility to a broad range of traders who may be looking for an entry point into the platform. The inclusion of widely used payment methods, such as credit cards and popular digital payment services, enhances the convenience for users funding their Standard Accounts.

On the other hand, MIEX introduces a higher minimum deposit requirement for VIP Account holders, setting it at $30,000. This elevated threshold is characteristic of VIP or premium accounts, typically designed for traders with more significant capital and potentially higher trading volumes. The VIP Account offers enhanced features and benefits, and the higher minimum deposit reflects the exclusivity and privileges associated with this account type.

Traders should be mindful of the specific terms and conditions related to deposits, including any associated fees and processing times. Additionally, understanding the distinctions between the Standard and VIP Accounts, both in terms of deposit requirements and account features, is crucial for individuals considering MIEX as their trading platform.

Here is a comparison table of minimum deposit required by different brokers:

| Broker | MIEX | RoboForex | Pocket Option | Tickmill |

| Min deposit | $1000 | $10 | $50 | $100 |

Trading Platforms

MIEX offers two distinct trading platforms, catering to the diverse preferences and needs of traders: MI Trader and MIEX MT5.

MI Trader:

Designed for ease of use and multifunctionality, MI Trader provides traders with a user-friendly interface and efficient transaction capabilities. The platform offers complete and customizable icon layouts, allowing users to tailor their trading environment to suit individual preferences. MI Trader is known for its effectiveness and efficiency in executing transactions, contributing to a seamless trading experience. Notably, the platform supports PAMM (Percentage Allocation Management Module), MAM (Multi-Account Manager), and Copy Trade functionalities, providing options for traders interested in various trading strategies. MI Trader is accessible through web trading, offering flexibility for traders who prefer browser-based platforms.

MIEX MT5:

MIEX MT5 stands as one of the most popular trading platforms globally, valued for its safety and stability. Similar to MI Trader, MIEX MT5 offers complete and customizable icon layouts, providing traders with a tailored trading experience. One notable feature of MIEX MT5 is its enhanced variety on the axis of time, contributing to improved accuracy in analyzing market trends and making informed trading decisions. The platform supports Expert Advisors (EAs), allowing for automated trading strategies. MIEX MT5 is available for download on iOS and Android devices, and users can also access it on PCs. The platform's versatility makes it suitable for a wide range of traders, from beginners to experienced professionals.

Traders can choose between MI Trader and MIEX MT5 based on their preferences, trading styles, and the level of functionality they seek in a trading platform. The availability of both platforms reflects MIEX's commitment to providing diverse and accessible tools for traders in their financial endeavors.

Customer Support

MIEX prioritizes comprehensive and responsive customer support services to assist traders throughout their journey. The support team at MIEX can be reached via phone at +44 7308642365, offering a direct line of communication for traders seeking assistance or information. Additionally, for written inquiries, traders can reach out to the customer support team through the email address cs@miexglobal.com.

While the specific operating hours of MIEX's customer support are not mentioned, the inclusion of both phone and email contact options demonstrates a commitment to offering multiple channels for users to seek assistance based on their preferences. The responsiveness of customer support is crucial in providing a positive trading experience and addressing any concerns or inquiries that traders may have.

Educational Resources

MIEX recognizes the importance of providing educational resources to empower traders with the knowledge and skills needed for successful trading. The broker offers a range of educational materials, including product introductions and technical analysis.

1. Product Introduction:

MIEX understands that a well-informed trader is a successful trader. To facilitate this, the broker provides comprehensive product introductions. These materials likely cover various financial instruments offered by MIEX, including indices, cryptocurrencies, metals, and more. Traders can benefit from understanding the features, characteristics, and potential risks associated with each type of financial product, allowing for more informed investment decisions.

2. Technical Analysis:

MIEX places importance on equipping its traders with the skills to analyze markets effectively. Technical analysis is a crucial aspect of trading, involving the study of historical price charts and market indicators to predict future price movements. By offering educational resources on technical analysis, MIEX enables traders to enhance their ability to identify trends, potential entry and exit points, and overall market behavior. This knowledge is invaluable for those looking to make data-driven decisions in their trading activities.

Bonus

MIEX offers varying promotional incentives based on the type of account, with distinctions between the Standard Account and the VIP Account.

Standard Account:

For traders operating under the Standard Account, MIEX provides regular tickets as part of its promotions and events. These promotional offers could encompass a range of benefits or activities, but the details of the regular ticket promotions are not explicitly outlined. Traders utilizing the Standard Account may need to refer to MIEX's promotional communications or contact customer support for specific information on these regular ticket promotions.

VIP Account:

In contrast, MIEX extends more exclusive benefits to VIP clients. VIP Account holders are entitled to VIP Tickets, which include complimentary flight tickets and accommodation. This elevated promotional offering is designed to provide additional perks to high-tier clients who qualify for VIP status. The provision of free flight tickets and accommodation aims to enhance the overall trading experience for VIP clients, potentially serving as an incentive for traders seeking premium treatment and exclusive rewards.

It's essential for traders considering these promotional incentives to carefully review the terms and conditions associated with the VIP program, including the eligibility criteria and any limitations on the use of VIP Tickets. Understanding the full scope of these promotions ensures that traders can make informed decisions based on their preferences and expectations. Additionally, traders should evaluate other aspects of the broker, such as regulatory status and trading conditions, to make comprehensive assessments.

Conclusion

In conclusion, MIEX presents a mixed landscape for traders with both advantages and notable drawbacks. On the positive side, the platform offers a diverse range of trading instruments, encompassing over 50 cryptocurrencies and 500 traditional financial assets, providing ample opportunities for investors with varying preferences. The inclusion of two account types, Standard and VIP, caters to different trader profiles, offering flexibility and exclusive benefits for high-tier clients. Educational resources, including product introductions and technical analysis materials, aim to empower traders with knowledge. However, the major concern lies in MIEX's unregulated status, raising potential risks for clients, particularly given the abnormal regulatory standing with the NFA in the United States. The lack of transparency on commission rates adds to the apprehension. While MIEX provides enticing promotional incentives, traders are advised to approach with caution and conduct thorough due diligence.

FAQs

Q: Is MIEX a regulated broker?

A: No, MIEX operates without valid regulation, raising concerns about the absence of regulatory oversight.

Q: How can I deposit funds into my MIEX account?

A: MIEX supports various payment methods, including Union Pay, WeChat Pay, Alipay, VISA, Mastercard, and Bitcoin.

Q: What trading platforms are available on MIEX?

A: MIEX offers two platforms: MI Trader, known for its user-friendly interface, and MIEX MT5, a globally popular and stable platform supporting Expert Advisors.

Q: Are there educational resources provided by MIEX?

A: Yes, MIEX offers educational materials, including product introductions and technical analysis, to enhance traders' knowledge and skills.

Q: What is the minimum deposit for the Standard Account on MIEX?

A: The minimum deposit for the Standard Account is $1000.

Review 39

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now