Score

Sage FX

Marshall Islands|5-10 years|

Marshall Islands|5-10 years| https://sagefx.com/

Website

Rating Index

Influence

Influence

B

Influence index NO.1

Netherlands 5.20

Netherlands 5.20Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Marshall Islands

Marshall IslandsUsers who viewed Sage FX also viewed..

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

sagellc.io

Server Location

Belgium

Website Domain Name

sagellc.io

Server IP

34.78.116.101

sagefx.com

Server Location

United States

Website Domain Name

sagefx.com

Server IP

104.27.174.137

Company Summary

| Sage FX Review Summary | |

| Founded | 2018 |

| Registered Country/Region | Marshall Islands |

| Regulation | Unregulated |

| Market Instruments | Forex, Commodities, Indices, Cryptos, Stocks |

| Demo Account | ✔ |

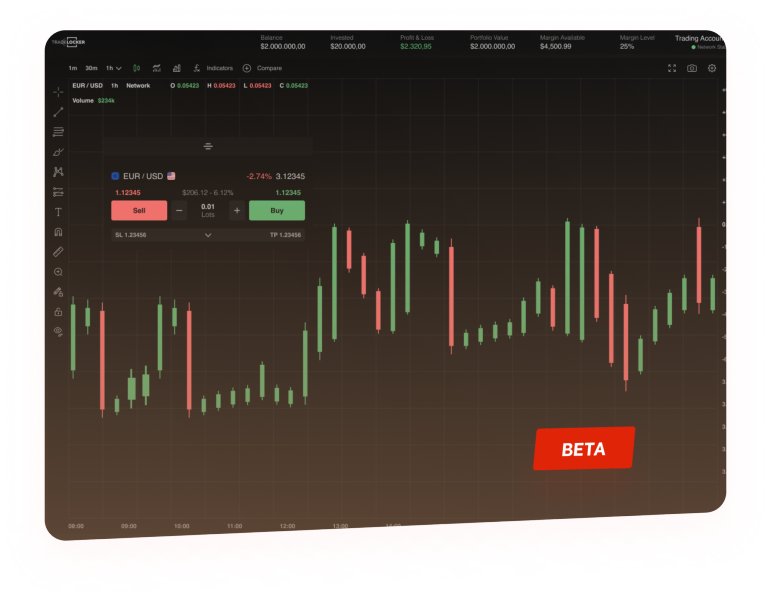

| Trading Platform | TradeLocker |

| Leverage | Up to 1:500 |

| Min Deposit | $10 |

| Customer Support | Phone:Not mentioned |

| Email:support@sagefx.com | |

| 24/7 Online Chat:Available | |

| Physical Address::Trust Company Complex, Ajeltake Road, Ajeltake Island, Majuro, Marshall Islands, MH96960 | |

Sage FX Information

Sage FX established in 2018. With a minimum deposit of $10, it gives access to Forex, cryptocurrencies, commodities, indices, and stocks. Designed to appeal to both beginners and experienced traders, the platform offers competitive spreads beginning at 0.1 pip and leverage up to 1:100.

Pros and Cons

| Pros | Cons |

| Low minimum deposit of $10 | Unregulated |

| Many trading instruments including 29 mini pairs | No detailed phone info |

| Demo accounts provided | Doesn't provide service in U.S.A |

| No Islamic account |

Is Sage FX Legit?

Sage FX is unregulated.

What Can I Trade on Sage FX?

Sage FX provides Forex(Majors, Crosses, Exotics), Indices, Commodities, Cryptos, Stocks(EU Shares and US Shares) and precious metal.

| Tradable Instruments | Supported | Details |

| Forex(Majors, Crosses, Exotics) | ✔ | EUR, USD, GBP, CAD, AUD |

| Commodities | ✔ | Oil, Natural Gas |

| Indices | ✔ | Global indices (100 Units) |

| Cryptos | ✔ | Bitcoin and other cryptocurrencies |

| Stocks(EU Shares and US Shares) | ✔ | EU/US Shares (100 Units) |

| Precious metal | ✔ | Gold, Silver |

Account Types

Sage FX offers 6 account types.

| Account Type | Minimum Deposit | Key Features |

| Standard | $10 | Standard symbols, smaller deposits |

| Pro | $500 | Spreads from 0.1 pips |

| VAR (Commission-Free) | $10 | No commissions, higher spreads |

| Mini Pairs | $10 | 29 mini pairs, suitable for smaller-scale traders |

| Islamic Account | $10 | No swap/interest adjustments, raw spreads from 0.01 pips |

| Demo Account | N/A | Test strategies with real market conditions without risking funds |

Leverage

Sage FX offers leverage up to 1:500.

Sage FX Fees

SageFX asks commissions of 8 for Forex and 1,500 BIT for Crypto on Standard and Pro accounts, with Variable accounts having 0 commissions. Mini accounts feature lower commissions( 1 for Forex and 15 BIT for Crypto).

Spreads start as low as 0.00 (RAW spreads).

| Account Type | Forex Lot Size | Bitcoin Lot Size | Shares Lot Size | Indexes Lot Size | Commission (Forex/Crypto) |

| Standard Account | 100,000 | 1,500 BIT | 100 Units | 100 Units | 8 / 1,500 BIT |

| Pro Account | 100,000 | 1,500 BIT | 100 Units | 100 Units | 8 / 1,500 BIT |

| Variable (Var) Account | 100,000 | 0 BIT | 100 Units | 100 Units | 0 / 0 BIT |

| Mini Account | 1,000 | 15 BIT | N/A | N/A | 1 / 15 BIT |

Sage FX asks for no inactivity fees.

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| TradeLocker | ✔ | Desktop, Web, Mobile | Beginner and experienced traders |

| MT4 | × | ||

| MT5 | × |

Deposit and Withdrawal

Sage FX does not charge fees for deposits, with multiple funding methods. The minimum deposit required is $10.

| Deposit Options | Min. Deposit | Fees | Processing Time |

| Crypto | $10 | 0% | Instant |

| Credit/Debit Cards | $10 | 0% | 3-5 Business Days |

| Wire Transfer | $10 | 0% | Up to 6 Business Days |

| Vload | $10 | 0% | Instant |

Also, Sage FX doesn't ask for withdrawal fees.

Keywords

- 5-10 years

- Suspicious Regulatory License

- High potential risk

Review 5

Content you want to comment

Please enter...

Review 5

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Giovanni Y

Italy

Can you believe it? Their TradeLocker platform is amazing! I think it's even better than MetaTrader, so much easier to use and it's packed with features. Really impressed!

Positive

2024-07-22

hjbsd

New Zealand

I think we have different experiences with SageFX. As for me SageFX has been great since I got to know about them. Starting from customer support to withdrawals they have been there for me. I highly recommend them to anyone out there.

Positive

2024-05-24

Thị Lan

Vietnam

I've been impressed with this broker's intuitive and user-friendly trading platform. Their customer support team is incredibly responsive, often resolving my queries within minutes. The educational resources they offer are a great asset. 👍👍👍

Positive

2024-05-22

FX1125642696

Malaysia

For me, this broker has a good spread, easy in terms of withdrawals and deposits. this is most important for a trader. this broker is among the best I have ever tried. you can try 5 stars from me.

Positive

2022-12-11

A55448

Australia

Sagefx is a good broker. Good spreads on equity indexes, forex pairs and cryptocurrencies. 24/7 customer support team are always available to help. What I truly surprised was that the BTC withdrawals are processed quickly without any fees.

Positive

2022-12-06