Score

JSS Investment

United Kingdom|1-2 years|

United Kingdom|1-2 years| https://www.jss-investment.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

United Kingdom

United KingdomUsers who viewed JSS Investment also viewed..

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

AUS GLOBAL

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

IronFX

- 15-20 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

jss-investment.com

Server Location

United States

Website Domain Name

jss-investment.com

Server IP

172.67.169.181

Company Summary

| Aspect | Information |

| Company Name | JSS Investment |

| Registered Country/Area | United Kingdom |

| Founded Year | 2023 |

| Regulation | Not regulated |

| Market Instruments | Currencies, Metals, Stocks, Commodities, Indices, Cryptocurrencies |

| Account Types | N/A |

| Minimum Deposit | N/A |

| Maximum Leverage | 1:500 |

| Spreads | N/A |

| Trading Platforms | Unavailable |

| Customer Support | 24/7 available via support@www.jss-investment.com and +447520637389 |

| Deposit & Withdrawal | N/A |

Overview of JSS Investment

JSS Investment, founded in 2023 in the United Kingdom, offers a range of trading assets, including currencies, metals, stocks, commodities, indices, and cryptocurrencies.

Despite boasting high leverage (1:500) and 24/7 customer support, its unregulated status poses significant risks due to potential fraud and lack of investor protection. The lack of transparency in its fee structure further undermines trust, while the absence of educational resources and a proprietary trading platform limits user experience and knowledge.

With its recent establishment and regulatory ambiguity, JSS Investment's credibility and reliability as a trading platform remain questionable.

Regulatory Status

JSS Investment operates without regulatory oversight.

This means there are no rules or checks enforced by any authority to ensure their practices comply with standards. Their investments are not safeguarded by regulatory measures, leaving them vulnerable to losses without recourse or protection.

Pros and Cons

| Pros | Cons |

| Various Asset Options Including Currencies, Metals, Stocks, Commodities, Indices, and Cryptocurrencies | Lack of Regulatory Oversight |

| High Leverage Ratio (1:500) | Lack Transparency in Fee Structure |

| 24/7 Customer Support | No Educational Resources |

| No Trading Platform | |

| Established within 1 Year |

Pros

Various Asset Options: JSS Investment provides a wide range of trading assets, including currencies, metals, stocks, commodities, indices, and cryptocurrencies.

High Leverage Ratio (1:500): The platform offers a high leverage ratio of 1:500, allowing traders to control larger positions with a smaller amount of capital. This can potentially amplify profits, enabling traders to maximize their returns on successful trades.

24/7 Customer Support: JSS Investment offers round-the-clock customer support to assist users with any queries or issues they may encounter.

Cons

Lack of Regulatory Oversight: One significant drawback of JSS Investment is the lack of regulatory oversight.

Lack Transparency in Fee Structure: Another risk is the lack of transparency in the fee structure. Without clear and detailed information about the fees charged for various services, investors may face unexpected costs that can eat into their profits.

No Educational Resources: JSS Investment does not offer educational resources or materials to help users improve their trading skills and knowledge.

No Trading Platform: The absence of a proprietary trading platform is a notable limitation of JSS Investment. Without a reliable and user-friendly trading platform, traders may struggle to execute trades efficiently and capitalize on market opportunities.

Established within 1 Year: Established within one year, the platform lacks a track record of long-term performance and may not have built a strong reputation in the industry. Investors may hesitate to trust their funds with a relatively new company with limited operational experience.

Market Instruments

JSS Investment offers a range of trading assets across various markets to its users. These assets include:

Currencies: Trading pairs involving major global currencies, providing opportunities for forex trading.

Metals: Precious metals such as silver, palladium, nickel, and gold are available for trading. These assets often serve as a hedge against inflation or geopolitical uncertainty.

Stocks: Shares of publicly traded companies are offered for trading, allowing investors to participate in the equity markets.

Commodities: Various commodities, including agricultural products, energy resources, and raw materials, are available for trading, enabling diversification and exposure to different sectors.

Indices: Trading opportunities based on the performance of market indices, representing baskets of stocks from specific exchanges or sectors.

Cryptocurrencies: Digital currencies like Bitcoin, Ethereum, and others are included.

How to Open an Account?

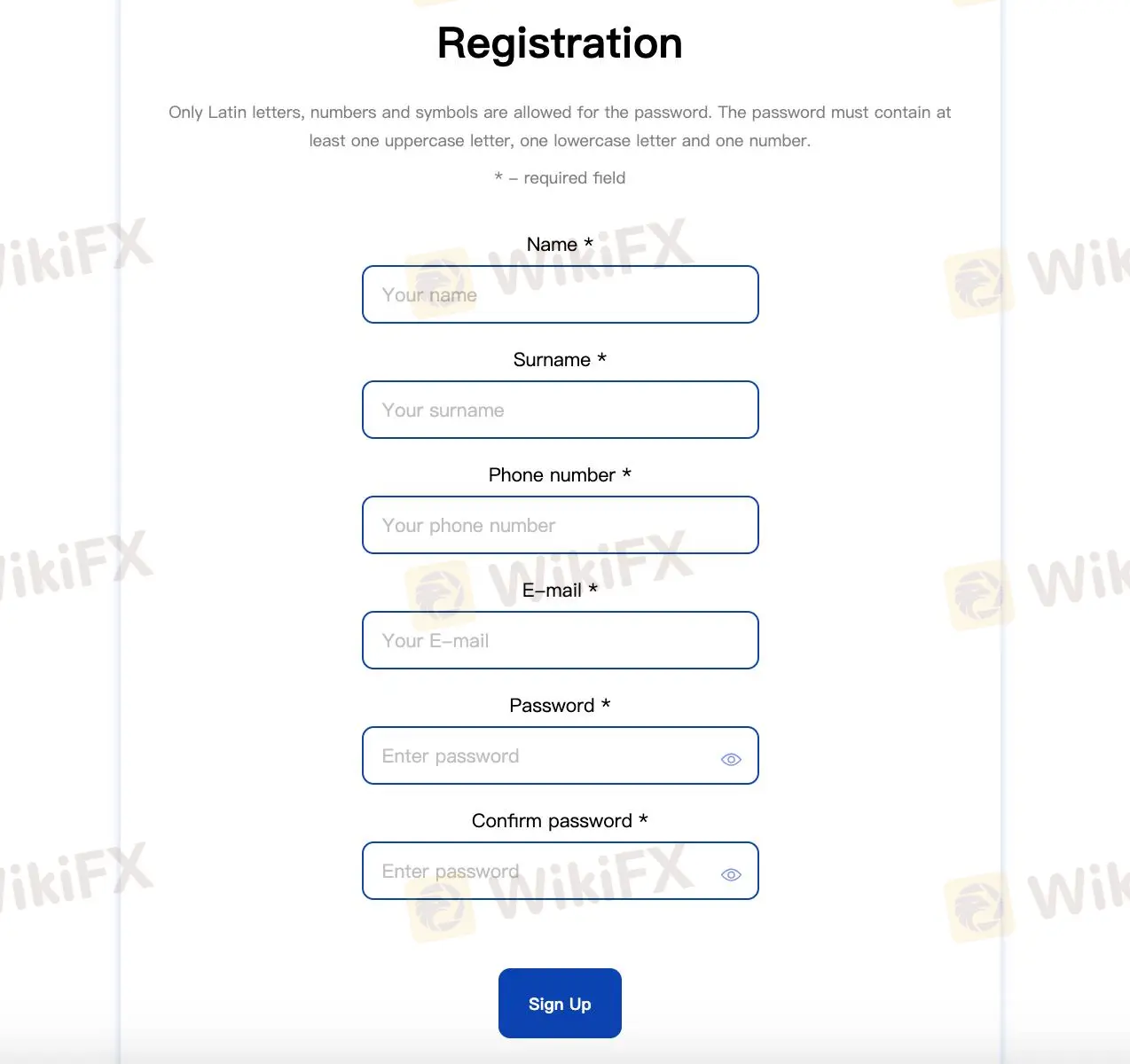

Visit the Website: Go to the JSS Investment official website.

Click on “Register”: Locate and click on the “Register” button on the homepage.

Fill Out the Registration Form: Complete the registration form with your personal information, including your name, email address, phone number, and other required details.

Verify Your Identity: Submit necessary documents for identity verification, such as a government-issued ID and proof of address.

Fund Your Account: Choose a funding method and deposit the required minimum amount into your account.

Start Trading: Once your account is verified and funded, you can log in and start trading with JSS Investment.

Leverage

JSS Investment offers a maximum leverage of 1:500 to its users. This leverage ratio allows traders to control a larger position with a smaller amount of capital, potentially amplifying both profits and losses.

Trading Platform

The latest information indicates that JSS Investment lacks trading software.

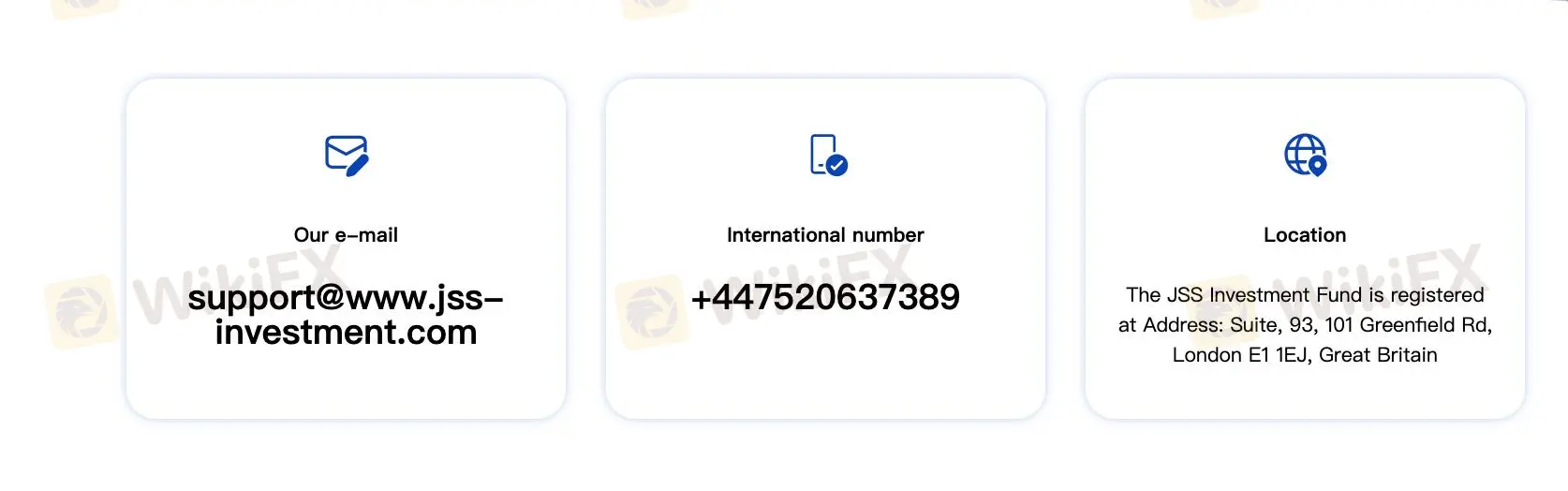

Customer Support

JSS Investment provides customer support via email and international phone number.

For assistance, users can reach out tosupport@www.jss-investment.com. The international contact number is +447520637389. The company is registered at Suite, 93, 101 Greenfield Rd, London E1 1EJ, Great Britain. Customers can contact them for inquiries, account support, or any assistance needed regarding their investment activities.

Conclusion

In conclusion, while JSS Investment offers a wide range of market instruments and boasts high leverage and round-the-clock customer support, its unregulated status raises significant risks.

The absence of regulatory oversight exposes investors to elevated risks of fraud and misconduct, undermining trust and confidence in the platform.

Additionally, the lack of transparency in account types, minimum deposits, spreads, and trading platforms further detracts from its appeal, hindering users' ability to make informed decisions.

Furthermore, the absence of educational resources limits traders' opportunities for learning and skill development, potentially leaving them ill-equipped to navigate the complexities of the financial markets.

FAQs

Question: What market instruments does JSS Investment offer?

Answer: JSS Investment offers a wide range of instruments including currencies, metals, stocks, commodities, indices, and cryptocurrencies.

Question: Is JSS Investment regulated by any financial authority?

Answer: No, JSS Investment is not regulated by any financial authority, which may pose risks for investors due to the lack of oversight.

Question: What is the maximum leverage ratio offered by JSS Investment?

Answer: JSS Investment offers a maximum leverage ratio of 1:500, allowing traders to control larger positions with a smaller amount of capital.

Question: Does JSS Investment provide educational resources for traders?

Answer: No, JSS Investment does not offer educational resources, which may limit traders' opportunities for learning and skill development.

Question: What are the customer support options available at JSS Investment?

Answer: JSS Investment offers 24/7 customer support via email and an international phone number for assistance with queries or issues.

Keywords

- 1-2 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Content you want to comment

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now