Score

AxeCap

Belize|2-5 years|

Belize|2-5 years| https://www.axecap.co/

Website

Rating Index

Contact

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

Contact number

Other ways of contact

Broker Information

More

AxeCap Limited

AxeCap

Belize

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

WikiFX Verification

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:500 |

| Minimum Deposit | $25,000 |

| Minimum Spread | 1.5 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:500 |

| Minimum Deposit | $10,000 |

| Minimum Spread | 1.8 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

| Benchmark | -- |

|---|---|

| Maximum Leverage | 1:500 |

| Minimum Deposit | $1,000 |

| Minimum Spread | 2.0 |

| Products | -- |

| Currency | -- |

|---|---|

| Minimum Position | -- |

| Supported EA | |

| Depositing Method | -- |

| Withdrawal Method | -- |

| Commission | -- |

- Fundamental Item(A)

- Total Supplementary Items(B)

- Debt Amount(C)

- Non-Fixed Capital(A)+(B)-(C)=(D)

- Relative amount of risk(E)

- Market Risk

- Transaction Risk

- Underlying Risk

Capital

$(USD)

Users who viewed AxeCap also viewed..

XM

MultiBank Group

CPT Markets

Neex

AxeCap · Company Summary

General Information

Registered in Belize, AxeCap is an offshore online forex broker offering a series of trading instruments, such as Forex, Stocks, Commodities, Indices through the advanced MT4 trading platform. Investors may choose from three different trading accounts on the Nation FX platform, and the maximum leverage available is up to 1:500.

Is AxeCap safe to trade with?

AxeCap has let us down when it comes to enforcing rules and regulations. This broker has been confirmed to be outside of the purview of any regulatory bodies. In light of this lack of licensing, WikiFX has assigned it a regulatory status of “No License” and an overall quality rating of 1.18/10.

Please be aware of the considerable risk associated with trading with an offshore, unregulated forex broker.

Market Instruments

AxeCap claims that it offers over 150 trading instruments. Four classes of trading assets can be traded, which include Foreign Exchange, Futures, Indices, Bonds.

Account Types

Three trading accounts are available with theAxeCap platform, namely the Standard, Premium and Platinum. The minimum deposits required by this brokerage are quite high in comparison to its peers. To open a Standard account, the most basic one, you need to fund at least $1,000, which is too much for most regular traders to afford.

The Premium and Platinum accounts are designed professional and experienced traders, asking for an initial deposit of $10,000 and $25,000 respectively.

Spreads & Commissions

Commissions are not disclosed, and spreads are set in the end by trading accounts. Typical spreads in the Standard account, the Premium account, and the Platinum account are from 2.0 pips, 1.8 pips, and 1.5 pips, respectively.

Leverage

When it comes to leverage, a key red flag with AxeCap is that it permits traders to use leverage of up to 1:500, which is significantly higher than the levels regarded appropriate by many regulators. This is a common practice for offshore companies, and Nation FX just engages in it to increase its client base.

Trading Platform

AxeCap offers its clients the access to popular MT4 trading platform that can be available for Desktop, Mobile and Web terminals.

Traders can quickly analyze market activity, place trades, and integrate automated systems thanks to this powerful platform's convenient workspace (Expert Advisors). Everything you need to begin trading on the financial markets, including all of the above features, is available in a single, convenient interface.

Educational Resources

AxeCap offers some trading tools and educational resources to help traders get familiar with forex trading, which include Economic Calendar, Trading Calculators, Widget, Markets News, Trading Ideas, Economic Insight, Newsletter, Live Broadcast.

Customer Support

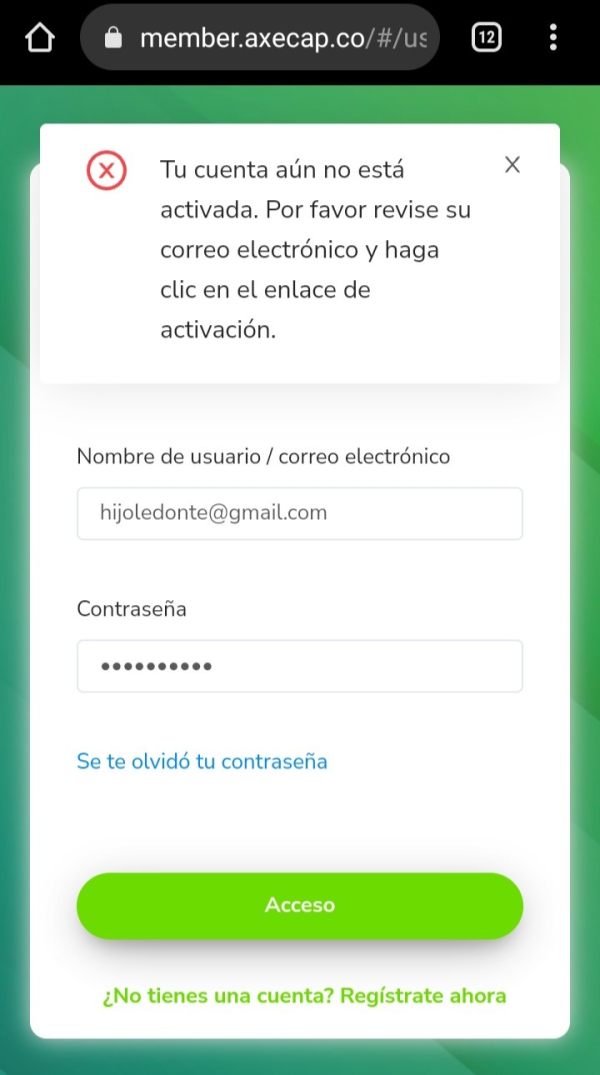

The AxeCap website is multilingual and traders can reach out to AxeCap about any questions or concerns they may have about their accounts or their trading through the following methods:

Email: support@AxeCap.co

Company Address: New Horizon Building, Ground Floor, 3 1/2 Miles Philip S.W. Golden Highway, Belize City, Belize

Risk Warning

There is a level of danger that comes with trading on the financial markets. As sophisticated instruments, foreign exchange, futures, CFDs, and other financial contracts are typically traded using margin, which significantly increases the inherent risks involved. Therefore, you should consider carefully whether or not this sort of investment activity is right for you.

The information presented in this article is intended solely for reference purposes.

News

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now