Score

ATC Brokers

United Kingdom|10-15 years|

United Kingdom|10-15 years| https://atcbrokers.co.uk/

Website

Rating Index

MT4/5 Identification

MT4/5

Full License

ATCBrokers-Demo 1

Influence

C

Influence index NO.1

United Arab Emirates 4.73

United Arab Emirates 4.73MT4/5 Identification

MT4/5 Identification

Full License

United States

United StatesInfluence

Influence

C

Influence index NO.1

United Arab Emirates 4.73

United Arab Emirates 4.73Contact

Licenses

Licenses

Single Core

1G

40G

1M*ADSL

- The number of the complaints received by WikiFX have reached 15 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

Basic Information

United Kingdom

United Kingdom

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed ATC Brokers also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

atcbrokers.com

Server Location

United States

Website Domain Name

atcbrokers.com

Website

WHOIS.GODADDY.COM

Company

GODADDY.COM, LLC

Domain Effective Date

2006-06-29

Server IP

162.242.174.150

Company Summary

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

| ATC Review Summary in 10 Points | |

| Founded | 2005 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA |

| Market Instruments | Forex, metals, and CFDs |

| Demo Account | Available |

| Leverage | 30:1 |

| EUR/USD Spread | 0.3 pips |

| Trading Platforms | MT Pro, MT4, MT4 Mobile |

| Minimum deposit | $/€/£5,000 |

| Customer Support | live chat, phone, email, and contact request |

What is ATC?

ATC is a forex trading brokerage company that provides online trading solutions for retail and institutional clients in the forex trading industry. ATC was launched in 2005, headquartered in London, UK, authorized and regulated by the Financial Conduct Authority (FRN 591361). ATC follows an STP model, offering forex and CFDs instruments.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

ATC offers several advantages as a regulated broker, providing a range of trading instruments and competitive spreads. The segregation of client funds and multiple deposit/withdrawal methods enhance the security and convenience of trading.

However, reports of withdrawal issues and potential scams raise concerns, and the high minimum account balance may restrict accessibility for some traders. It's crucial for individuals to exercise caution and conduct thorough research before deciding to trade with ATC.

| Pros | Cons |

| • FCA-regulated | • Reports of issues related to withdrawal and potential scams |

| • Segregates client funds | • High minimum deposit requirement of $5,000 |

| • Wide range of trading instruments | • Shares trading not offered |

| • MT4 trading platform supported | • Limited accepted currencies |

| • Competitive spreads | • No additional tools |

| • Supports multiple deposit and withdrawal methods | • Lack of clear information about educational resources and materials |

| • Multi-channel customer support |

ATC Alternative Brokers

ActivTrades - A reliable broker with a wide range of trading instruments and platforms, suitable for both beginner and experienced traders.

Darwinex - A unique social trading platform that allows investors to allocate capital to successful traders, offering a diverse range of trading strategies to choose from.

ForexChief - A broker with competitive trading conditions and a user-friendly platform, suitable for traders of all levels, particularly those focused on forex trading.

There are many alternative brokers to ATC depending on the specific needs and preferences of the trader. Some popular options include:

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is ATC Safe or Scam?

As ATC is regulated by the Financial Conduct Authority (FCA, License No. 591361) and follows the practice of segregating client funds, it suggests a level of legitimacy and adherence to regulatory standards. However, reports of difficulties with withdrawals and scams raise concerns about the reliability and trustworthiness of the broker. It is crucial to exercise caution and conduct thorough research before engaging with ATC or any other broker, especially when it comes to your funds and financial transactions.

Market Instruments

ATC offers various popular financial products, mainly including Forex, metals, and CFDs (Contracts for Difference). Forex trading allows clients to engage in currency pair trading, taking advantage of fluctuations in exchange rates. The availability of metals, such as gold and silver, provides an opportunity for traders to diversify their portfolios and speculate on the price movements of these valuable commodities.

Additionally, ATC offers CFDs, which allow traders to participate in the price movements of various financial instruments without owning the underlying assets. These market instruments provide ATC clients with a diverse set of options to explore and potentially capitalize on market opportunities.

Accounts

ATC offers two types of accounts: demo and live accounts. The demo account allows traders to practice their strategies and familiarize themselves with the platform without risking real money. It provides a simulated trading environment with virtual funds, enabling traders to gain experience and test their trading skills. Everyone can get a 20-day free test of platforms.

On the other hand, the live account is for real trading with actual funds. To open a live account with ATC, a minimum account balance of $/€/£5,000 is required. Indeed, the amount is way too high for most regular traders. So investors should take caution with trading on this platform.

By offering both demo and live accounts, ATC caters to traders at different experience levels, providing them with options to hone their trading skills in a risk-free environment or engage in real trading with capital at stake.

Leverage

ATC provides leverage options for traders, allowing them to amplify their trading positions. The leverage offered by ATC varies depending on the instrument being traded. For major currency pairs, the leverage is set at 30:1, which means that traders can control a position that is 30 times larger than their account balance. Non-major currency pairs, gold, and major indices have a leverage of 20:1, providing traders with the opportunity to control larger positions relative to their account size. For silver and other commodities, the leverage is set at 10:1.

Leverage can be a double-edged sword, as while it allows traders to potentially generate larger profits, it also amplifies the risk of losses. Therefore, it is important for traders to understand the risks associated with leverage and use it wisely according to their risk tolerance and trading strategy.

Spreads & Commissions

ATC offers competitive spreads and commission structures for trading various instruments. The spreads are variable and differ across different trading instruments. For the popular EUR/USD currency pair, the average spread is as low as 0.3 pips, which indicates a tight and competitive pricing.

When it comes to commissions, ATC charges a round turn commission based on the contract size. For a mini contract (10,000 lot size), the commission is set at $0.6, while for a standard contract (100,000 lot size), the commission is $6. It's worth noting that the commission is denominated in USD, and if you are trading pairs that are not in USD, the commission amount will vary based on the prevailing market conversion rate.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission (Round Turn) |

| ATC | 0.3 pips | $6 (standard contract) |

| ActivTrades | 0.5 pips | $1.50 |

| Darwinex | 0.2 pips | $5 (raw spread account) |

| ForexChief | 0.2 pips | $15 (standard account) |

Please note that the provided information is subject to change and may vary depending on account types, trading conditions, and market fluctuations. It's always recommended to refer to the official websites of the brokers for the most up-to-date and accurate information regarding spreads and commissions.

Trading Platforms

ATC provides its clients with a range of trading platforms to cater to their diverse needs. The flagship platform offered by ATC is MT Pro, which is a powerful and advanced trading platform designed for experienced traders. It offers a comprehensive suite of trading tools, advanced charting capabilities, and customizable features to enhance the trading experience.

Additionally, ATC also supports the widely popular MetaTrader 4 (MT4) platform, known for its user-friendly interface, extensive technical analysis tools, and automated trading capabilities. MT4 Mobile is available for traders who prefer to access the markets on their mobile devices, providing convenience and flexibility.

With these trading platforms, ATC ensures that traders have access to robust technology and a seamless trading experience, empowering them to make informed decisions and execute trades efficiently.

See the trading platform comparison table below:

| Broker | Trading Platforms |

| ATC | MT Pro, MT4, MT4 Mobile |

| ActivTrades | ActivTrader, MetaTrader 4, MT5 |

| Darwinex | Darwinex Web Platform, MT4, MT5 |

| ForexChief | MT4, MT5 |

Please note that the availability of trading platforms may vary based on the broker and account type. It's always recommended to visit the official websites of the brokers for the most up-to-date and accurate information regarding their trading platforms.

Deposits & Withdrawals

ATC offers several convenient methods for depositing and withdrawing funds from trading accounts. Clients can choose to deposit funds through bank wire transfers, Visa, MasterCard, Skrill Wallet, and Union Pay.

These options provide flexibility and ease of use for clients in different regions. The accepted currencies for deposits and withdrawals are USD, EUR, and GBP, allowing traders to transact in their preferred currency. The minimum deposit requirement is $/€/£5,000.

ATC minimum deposit vs other brokers

| ATC | Most other | |

| Minimum Deposit | $/€/£5,000 | $/€/£100 |

For deposits, wire transfer requires no fees, debit cards and Skrill e-wallets charge 2.9% transaction fees; For withdrawals, international wire transfer charges $40/€30/£25, debit card requiring no fees, and Skrill e-wallets charge 1.0% transaction fee, Faster Payment charges £10 (only for UK residents). The withdrawal request will be processed within 1-2 working days.

Customer Service

ATC is committed to providing excellent customer service to its clients. They offer multiple channels for customer support, including live chat, phone, email, and contact request, ensuring that clients can reach out for assistance through their preferred method. The live chat feature allows for real-time communication, enabling quick responses to queries and concerns.

Additionally, clients can access the Help Center and FAQ section on the ATC website, which provides comprehensive information and answers to commonly asked questions. This self-help resource can be particularly useful for clients seeking immediate assistance or looking for guidance on various topics.

With a dedicated customer service team, ATC strives to deliver timely and knowledgeable support to ensure a smooth and satisfactory trading experience for its clients.

| Pros | Cons |

| • Responsive and helpful customer support | • No 24/7 support |

| • Multiple contact methods | • Limited languages supported |

| • Professional and knowledgeable staff | |

| • Live chat support | |

| • Help Center and FAQ offered |

Please note that the information provided is based on general knowledge and may not reflect the experience of every customer. It's recommended to assess customer service based on individual needs and preferences and consider other factors such as personal experiences and reviews.

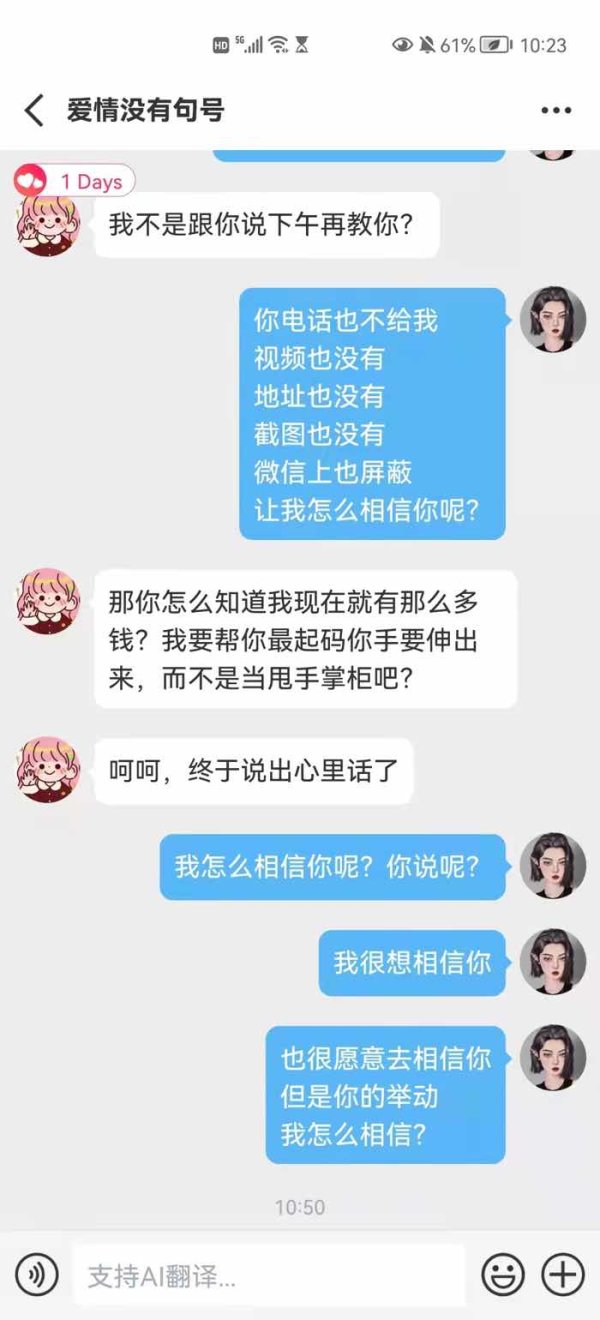

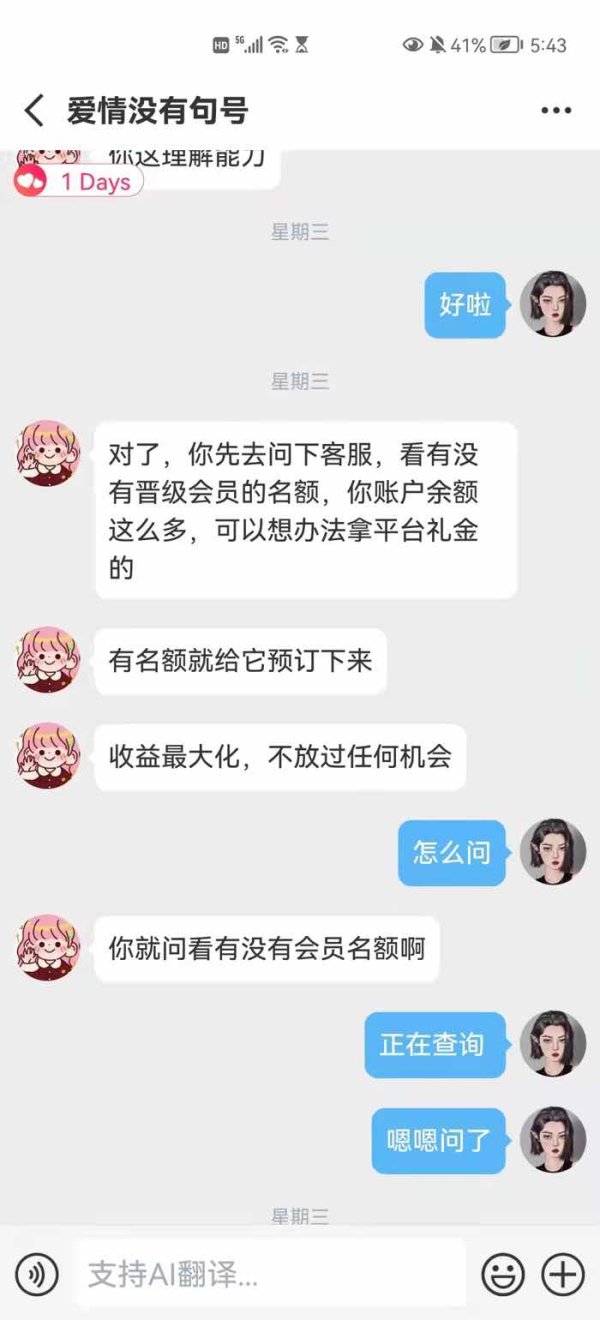

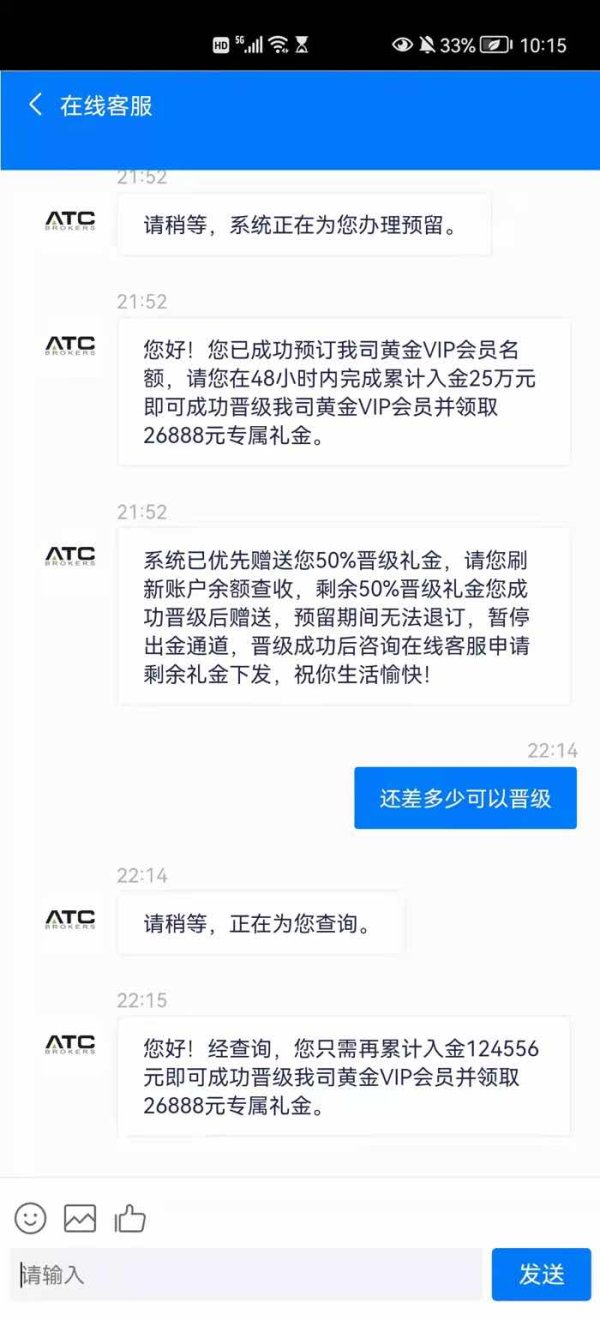

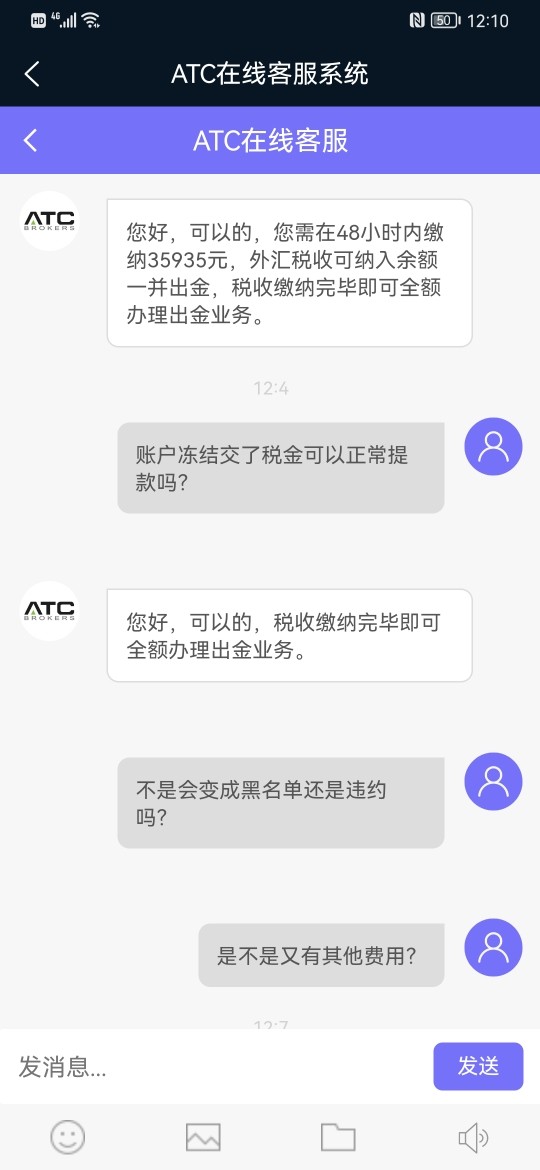

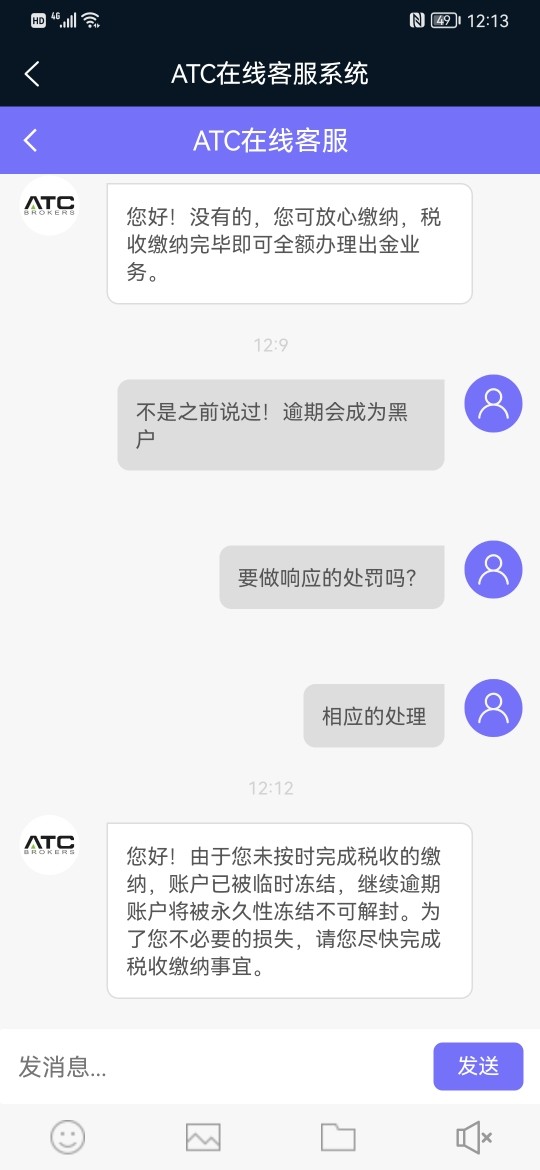

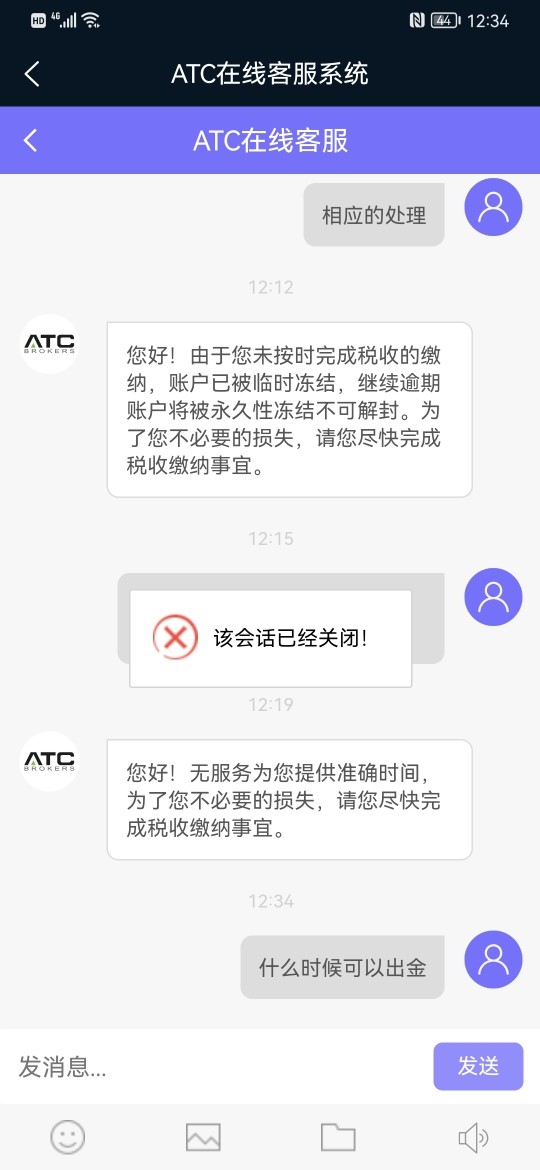

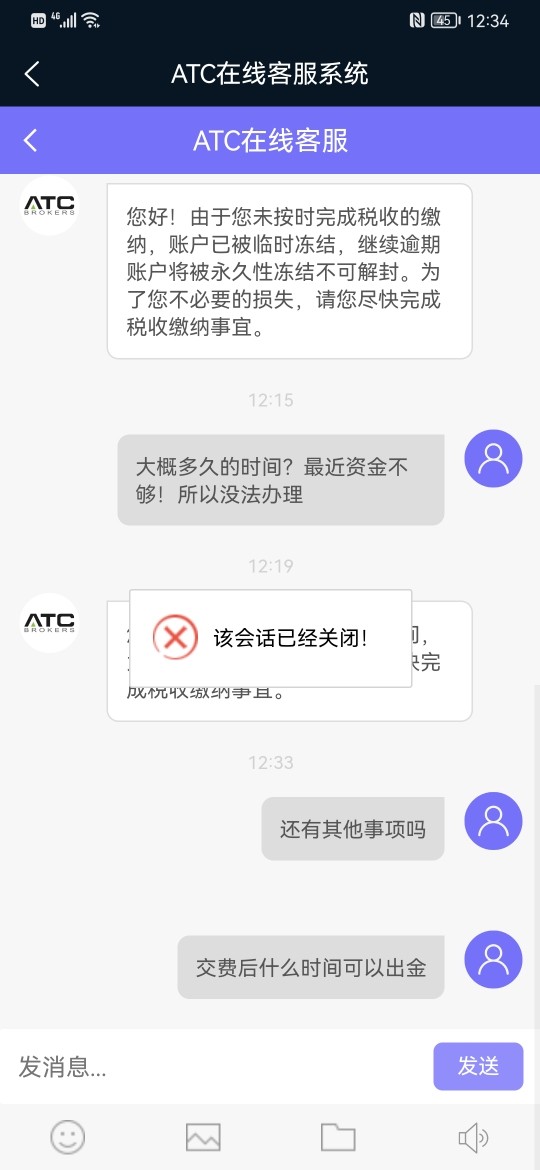

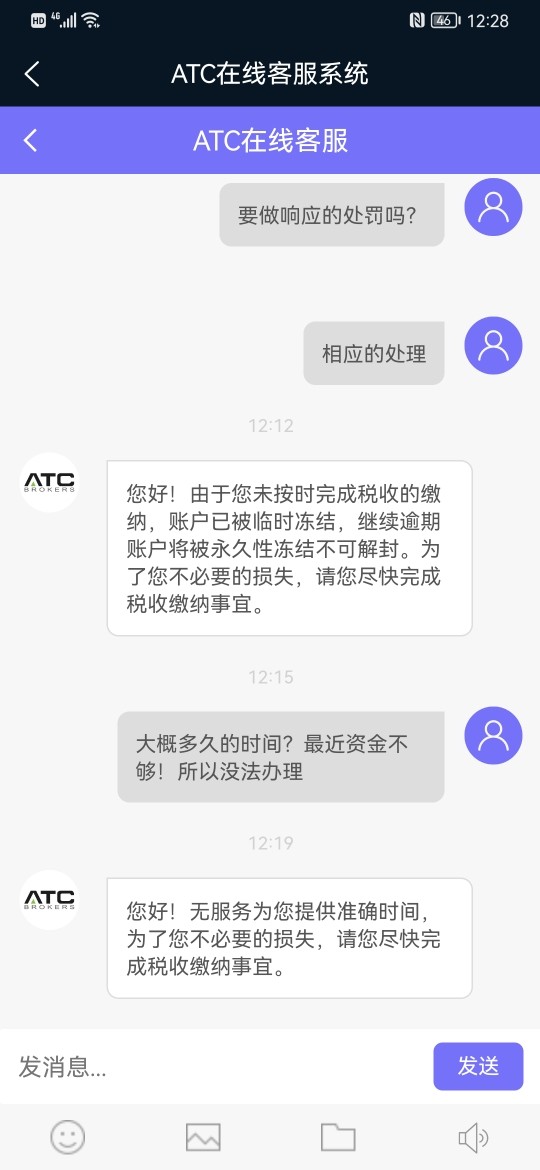

User Exposure on WikiFX

On our website, you can see that reports of unable to withdraw and scams. Before making any investment decisions, it is recommended to gather as much information as possible and consider the experiences and feedback of other traders. Our platform provides valuable resources and information to help you make informed choices. If you encounter fraudulent brokers or become a victim of one, please report it in the Exposure section so that our team of experts can investigate and assist you in resolving the issue.

Conclusion

In conclusion, ATC is a regulated broker offering a variety of trading instruments with competitive spreads. However, there have been reports of withdrawal issues and potential scams, which raise concerns about the reliability of the platform. The high minimum account balance requirement and limited accepted currencies may also pose challenges for some traders. While ATC provides access to popular trading platforms and offers customer support, the availability of educational resources could be improved. It is important for individuals to carefully consider these factors and exercise caution when deciding to trade with ATC.

Frequently Asked Questions (FAQs)

| Q 1: | Is ATC regulated? |

| A 1: | Yes. It is regulated by Financial Conduct Authority FCA, License No. 591361) in the United Kingdom. |

| Q 2: | Does ATC offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does ATC offer the industry leading MT4 & MT5? |

| A 3: | Yes. It supports MT Pro, MT4, and MT4 Mobile. |

| Q 4: | What is the minimum deposit for ATC? |

| A 4: | The minimum account balance to open is $/€/£5,000. |

| Q 5: | Is ATC a good broker for beginners? |

| A 5: | No. Though it is regulated well, there are some reports of unable to withdraw and scams, and the minimum deposit requirement of $/€/£5,000 is too high for beginners. |

Keywords

- 10-15 years

- Regulated in United Kingdom

- Regulated in Cayman Islands

- Market Making(MM)

- Common Financial Service License

- MT4 Full License

- United States Common Financial Service License Unauthorized

- Suspicious Overrun

- High potential risk

- Offshore Regulated

Review 22

Content you want to comment

Please enter...

Review 22

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

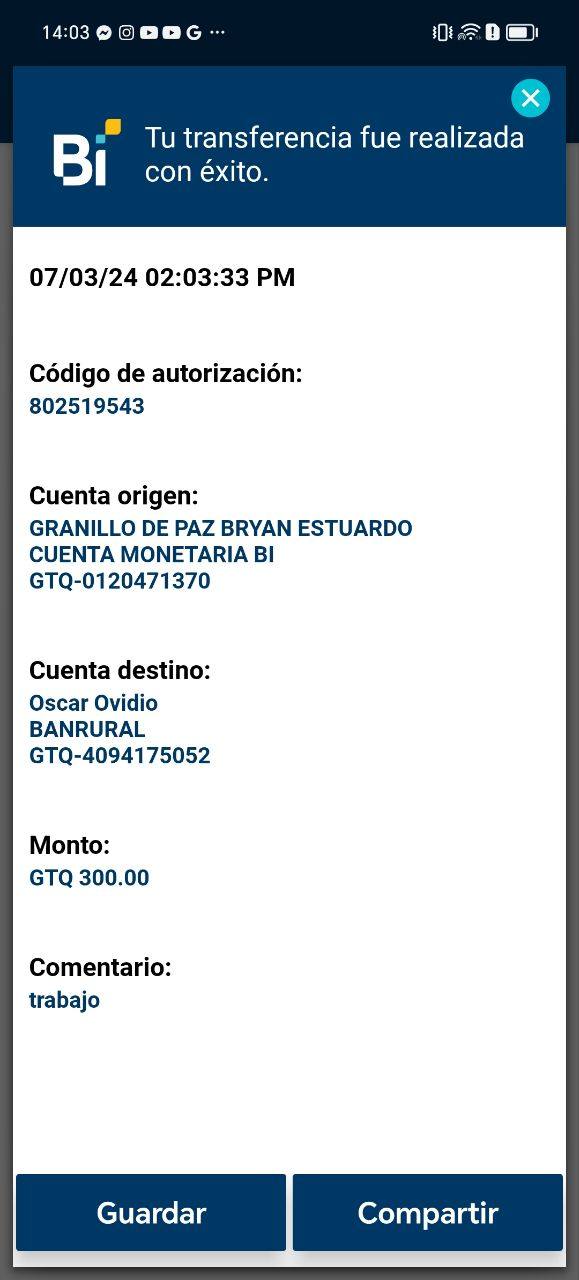

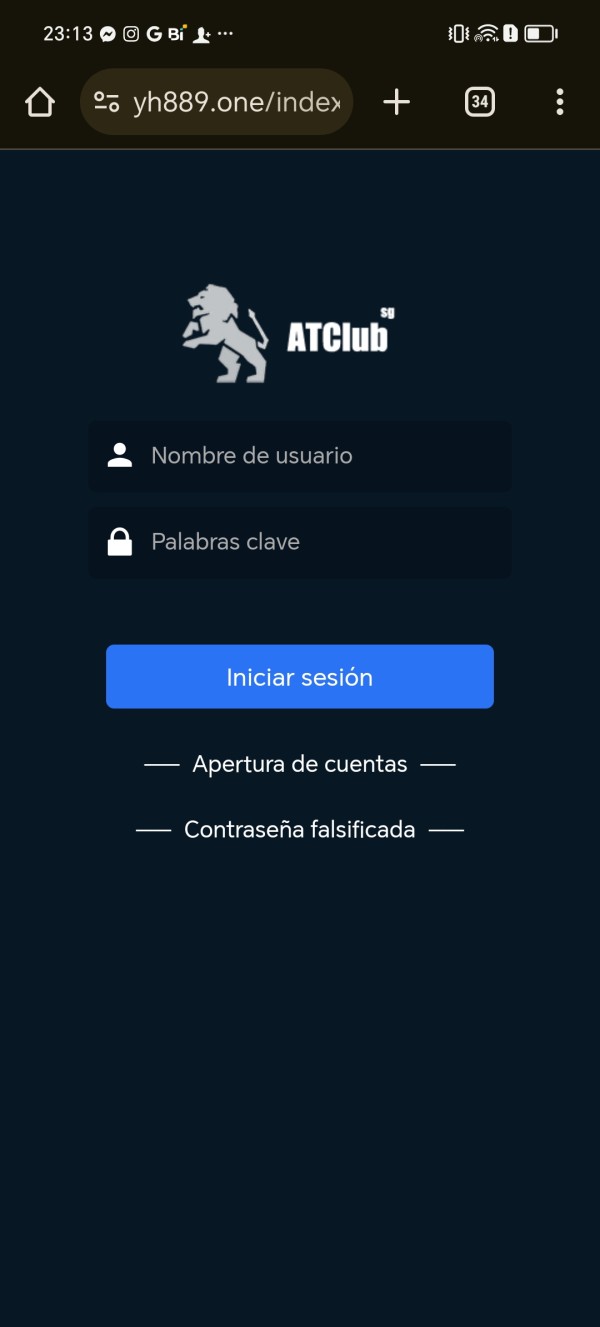

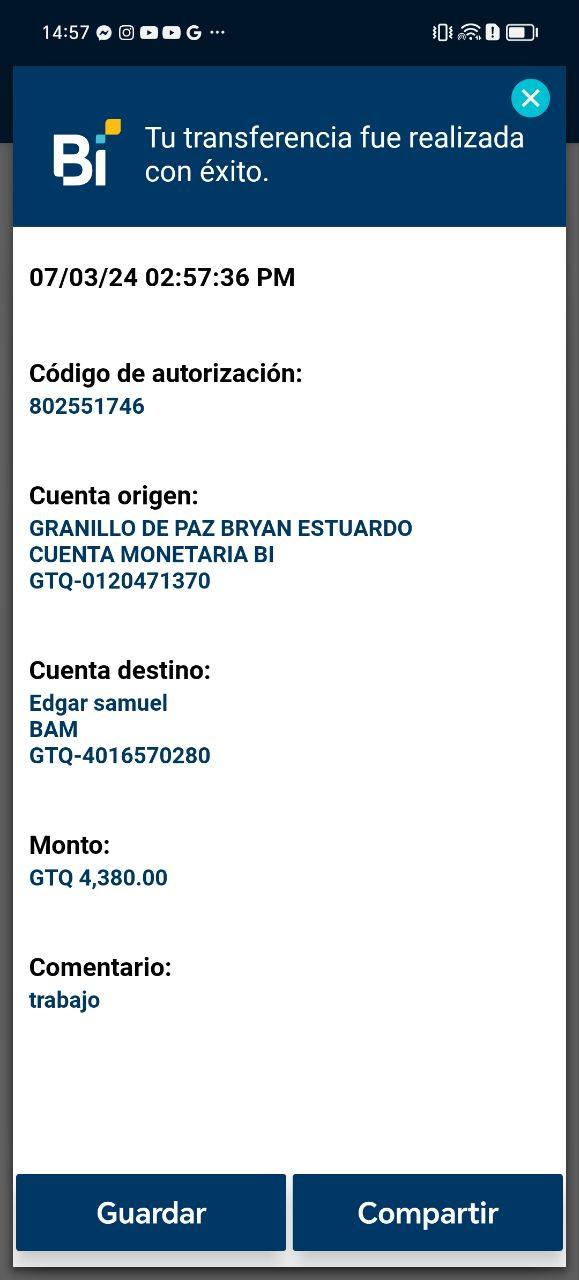

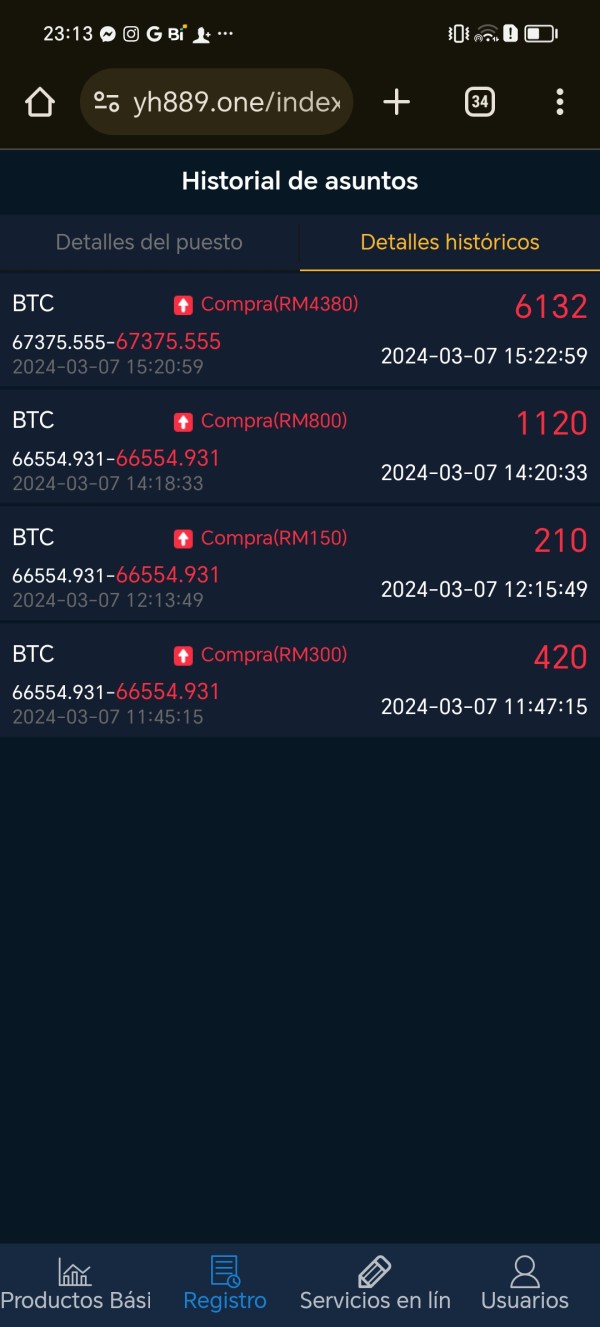

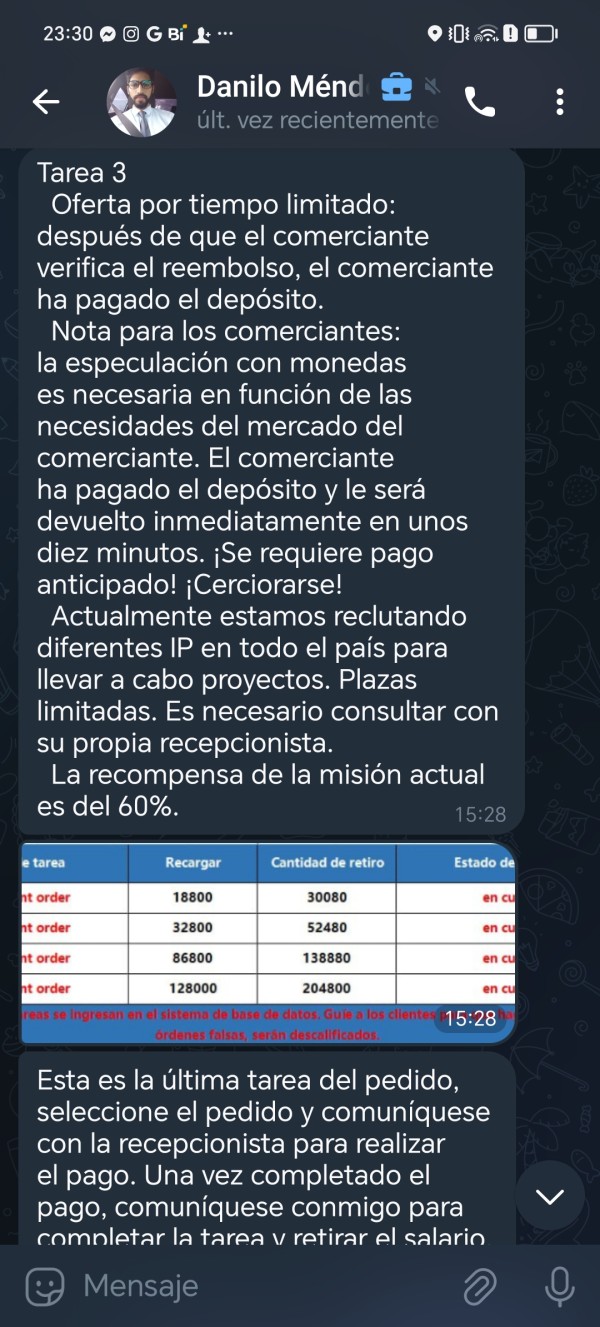

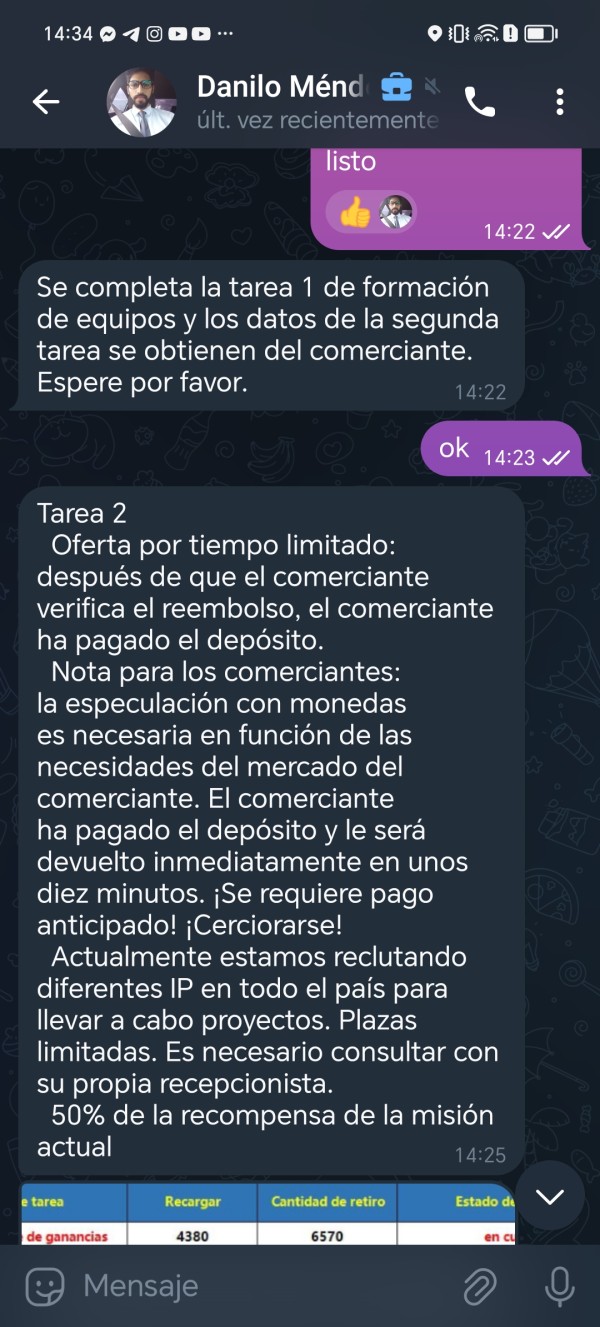

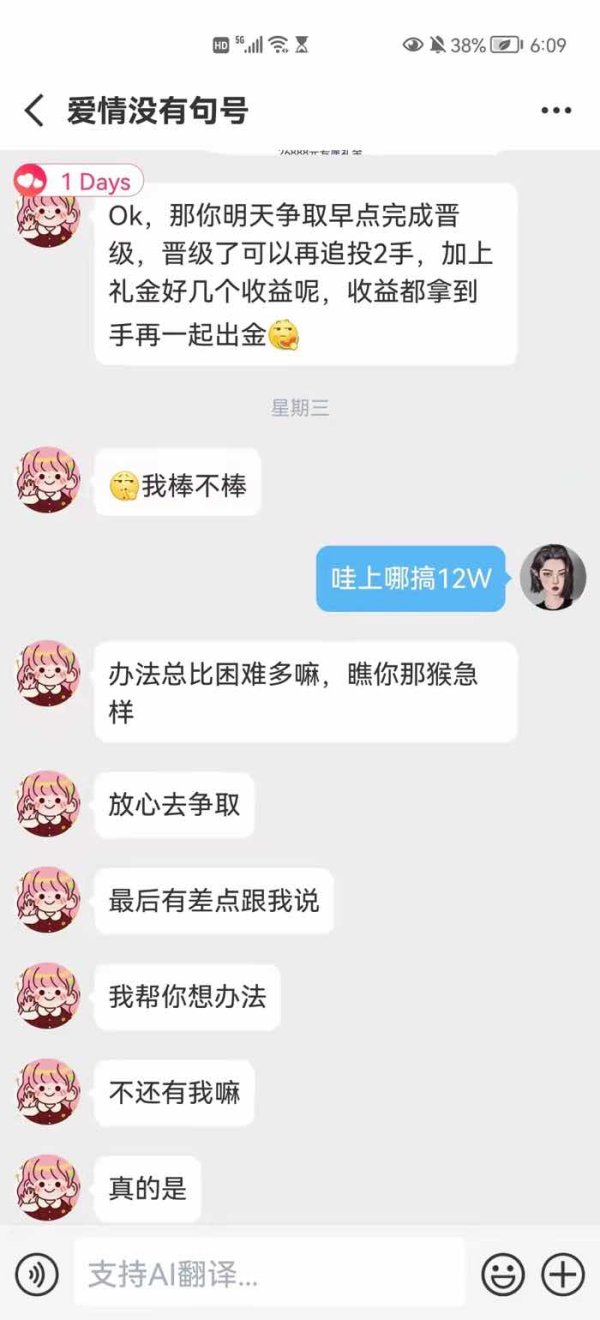

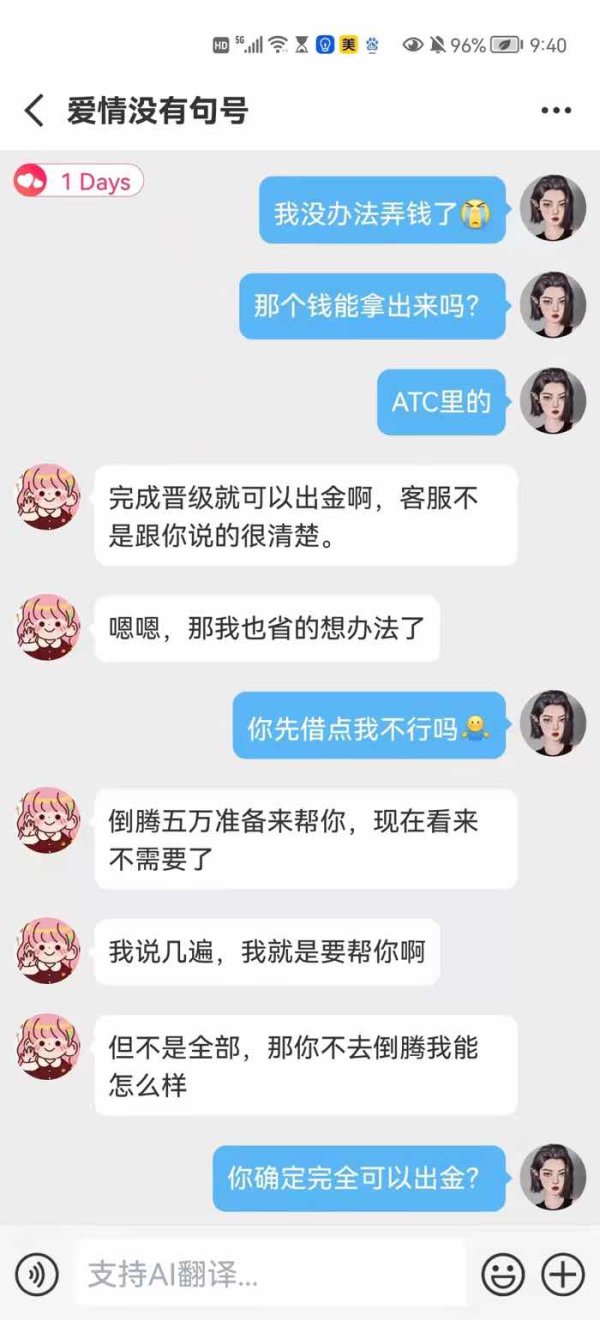

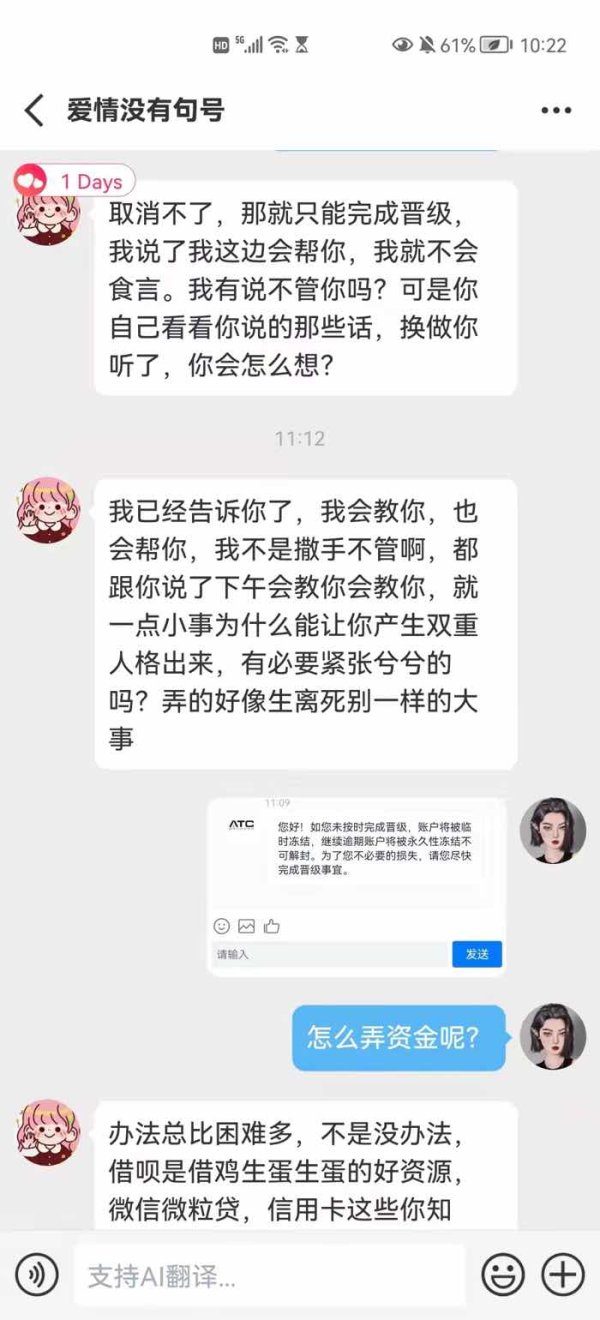

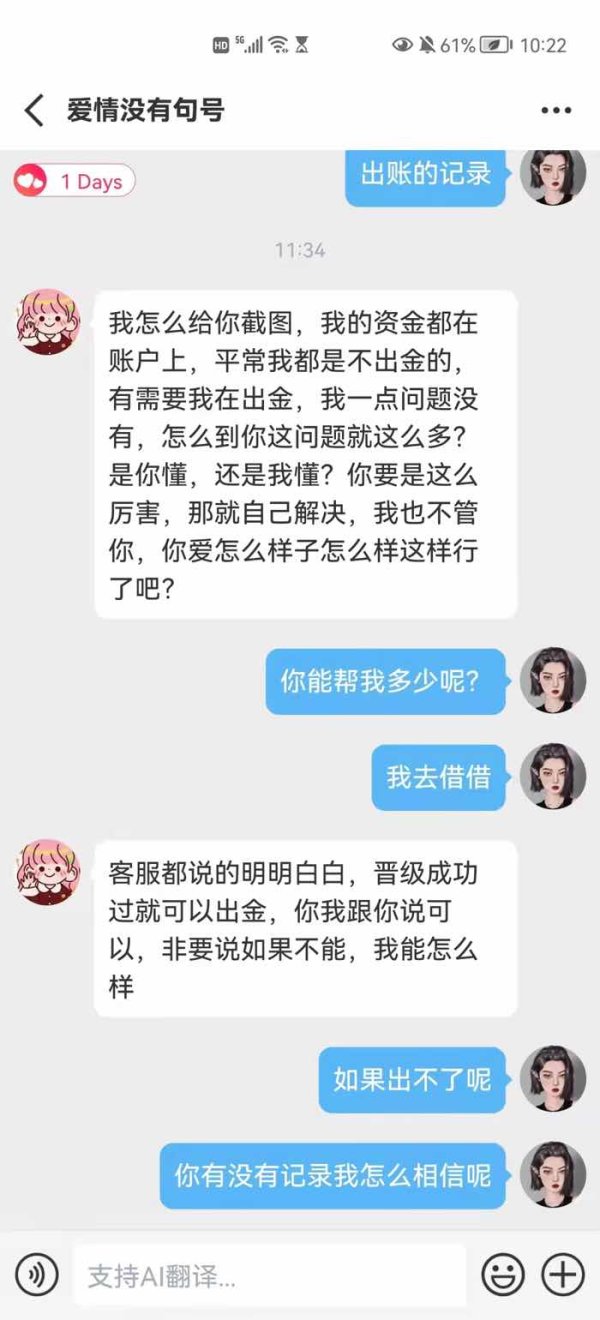

Bryan484

Guatemala

They called them tasks, at first they told me that I had to deposit 300 and that they would return 420. Then they told me that task 2 was to deposit 150 and they would return 210. I was doing it and well, they were returning the money to which, well, I was excited then the next task was to deposit 800 and they returned 1,040 then the next task was to deposit 4,380 to which I lent to a friend to be able to reach that amount since I had invested 5,690 money that I never received back, then they told me that they were going to return me 7,252 for everything I had invested but before they returned that to me I had to deposit them 18,880 and they would return me the entire amount and the extra that I had supposedly earned, but I do not have the amount of 18,000 To which I told them to give me the money back because I didn't have that amount but they told me that if I didn't deposit the 18,000 they couldn't give me anything back, and supposedly I had already won 7,250 but they never gave it to me. I wanted to see if you could give me back. help in some way to give me the amount they told me I was supposed to win or at least get my money back🙏🏿

Exposure

2024-03-08

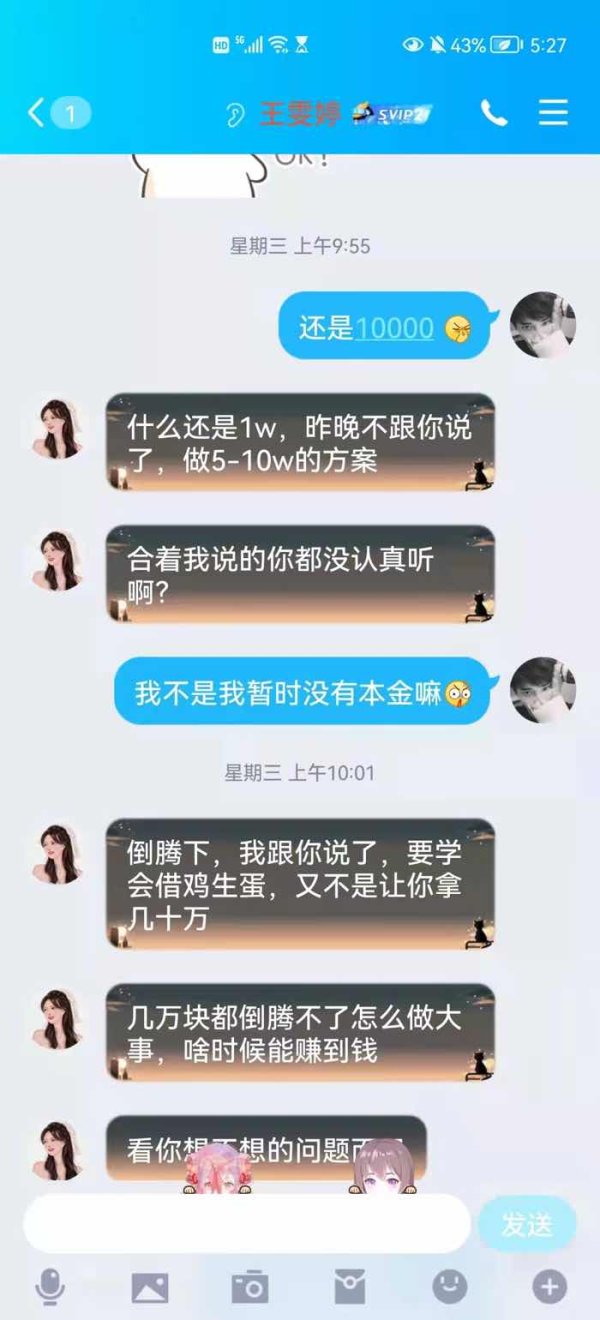

兔子91620

Hong Kong

Feelings, scam money with two hands. Deceive money by feelings. I had been deceived for thirty grands and I took it. Hope to solve this forex through laws and regulations. I want get the money back. I hope! I hope that others will not be deceived again and don’t believe in emotional scammers. I had encounter too many of them. Can’t guard against it.

Exposure

2021-12-04

Hong Kong

Under the name of forex, ATC BROKERS is step by step to induce the deposit fund to 1000000 by saything that the investment investment income is low for the first time, but later set a threshold and say that it will be added to 250,000 to withdraw funds. Otherwise the original 100,000 principal will also be frozen. I implore people who have similar experiences to help me. It also reminds others who want to invest to be cautious and don't be deceived!

Exposure

2021-11-26

独品゛

Hong Kong

Fraud platform. It required 10% margin because my account information was wrong. I changed another bank account but it was still wrong. I just copied and pasted it, which should be right. Beware of it. Do not be cheated again.

Exposure

2021-10-14

SRL

Hong Kong

Unable to log in the platform.

Exposure

2021-09-26

SRL

Hong Kong

Unable to withdraw. It required 20.6% tax and other fees.

Exposure

2021-09-23

SRL

Hong Kong

The customer service did not approve withdrawal. Fraud platform.

Exposure

2021-09-22

熊猫小姐

Hong Kong

It blocked accounts without any reason. The customer service did not solve it. Please help.

Exposure

2021-09-22

SRL

Hong Kong

It rejected my withdrawal for many reasons and told me to pay 19800 yuan for additional fee. Beware.

Exposure

2021-09-20

FX4227474762

Hong Kong

Is there anybody knowing the two people

Exposure

2021-03-21

FX4227474762

Hong Kong

Ask u to top up with various reasons. Unable to withdraw without reaching 90 of the credot score.

Exposure

2021-03-21

FX4227474762

Hong Kong

Freeze your funds. Unable to withdraw. Keep asking u to pay more. The credit score should reach 90 to withdraw funds

Exposure

2021-03-21

FX1260289772

Hong Kong

Some lawbreakers scammed using your band. They tell you that your card number was wrong when you were going to witdhaw funds. Please handle this issue.

Exposure

2021-03-08

Allen chien

Taiwan

I was induced to deposit and know I can’t withdraw without paying margin. I suspect it’s a fake ATC.

Exposure

2020-09-01

Junny_Duan

Hong Kong

The gold price decreased to 1216 in ATC when the market was open.The customer service claimed that was because the bank straddled them.As there are so many forex platforms, why the bank only choose you?

Exposure

2019-11-29

FX1666575326

Peru

I read a lot of reviews that creating an account takes some time, couple of days. In my case it went really smooth, in a day I had am approved account, the other day the money was in. However, uploading documents and detecting them wasn't smooth, it was buggy, but on chat I got the right help.

Neutral

2024-04-23

Zebedee Pucklechurch

Nigeria

My experience with ATC has been a bit of a mixed bag. On one hand, they're regulated, but on the other hand, there are troubling reports of withdrawal issues and potential scams, which definitely raises some red flags. The minimum deposit requirement of $5,000 is quite steep, making it less accessible for many traders. The absence of shares trading and limited accepted currencies can be limiting. Also, the lack of clear information about educational resources and tools is a downside. It's a platform with pros and cons, and traders should approach it with caution and thorough research.

Neutral

2023-12-06

Evangeline Whittington

Kazakhstan

I've been trading with ATC for some time now, and there are definitely some positive aspects. Being regulated by the Financial Conduct Authority (FCA) provides a sense of security, and the segregation of client funds adds an extra layer of protection. The range of trading instruments and competitive spreads make it attractive for diverse trading strategies. The multiple deposit and withdrawal methods contribute to the convenience of managing funds. The choice of trading platforms, especially MT Pro and MT4, caters to both experienced and novice traders.

Neutral

2023-12-05

дн顺顺顺

Singapore

I have to say that the ATC in the past was really good, at least my first impression was very good, I felt that the whole team was very professional and the customer service was very patient. But for some reason, now they seem to be going downhill, getting worse and worse, and it's really surprising to see so many bad reviews on the Internet, alas.

Neutral

2023-02-13

枫林听雨说

Taiwan

I suggest that everyone check on wikifx before choosing a broker, which can avoid a large part of fraud! For example, ATC seems to be a good company, but if you look it up on wikifx, you will see a lot of complaints from people...

Neutral

2022-12-14