简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Dollar Calm ahead of the U.S. Election

Zusammenfassung:Todays U.S. election is likely to keep financial markets relatively calm until its conclusion. The Japanese Yen is expected to have a direct influence by the result of the U.S. election. Gold is strug

Todays U.S. election is likely to keep financial markets relatively calm until its conclusion.

The Japanese Yen is expected to have a direct influence by the result of the U.S. election.

Gold is struggling at near the $2730 mark ahead of the U.S. election.

Market Summary

Todays U.S. presidential election is set to be a pivotal event, with polls indicating a tight race that could delay the final vote count and heighten market volatility. Analysts suggest that a Kamala Harris win could bring stability to the dollar, while a Trump re-election may boost its strength. The Japanese Yen is also in focus, as a Trump victory could lead to a Yen slump, given historical trends in safe-haven flows.

In other central bank news, the Reserve Bank of Australia (RBA) is scheduled to announce its interest rate decision today, with markets expecting no change to the current 13-year high rate. This may lend some support to the struggling Aussie dollar.

In commodities, gold is steady at above $2,730, awaiting clarity from the election. Meanwhile, oil prices ticked higher in response to OPEC+s decision to extend production curbs. Rising tensions in the Middle East, including Iran's warning of a “crushing response” to adversaries, also lend support to oil prices amid potential regional instability.

Current rate hike bets on 7th November Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (4.4%) VS -25 bps (95.6%)

Market Movements

DOLLAR_INDX, H4

The Dollar Index held steady as investors awaited further U.S. election results amid a tight race. The diminishing likelihood of a Republican sweep has been noted, with Harris gaining ground in polls and betting markets. Trumps policies on tariffs and immigration are expected to raise inflation, potentially boosting long-term Treasury yields and the dollar, though they could weaken other currencies. Nonetheless, with election details still unknown, global traders should closely monitor developments to gauge potential market movements.

The Dollar Index is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 47, suggesting the index might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 104.20, 104.60

Support level: 103.80, 103.05

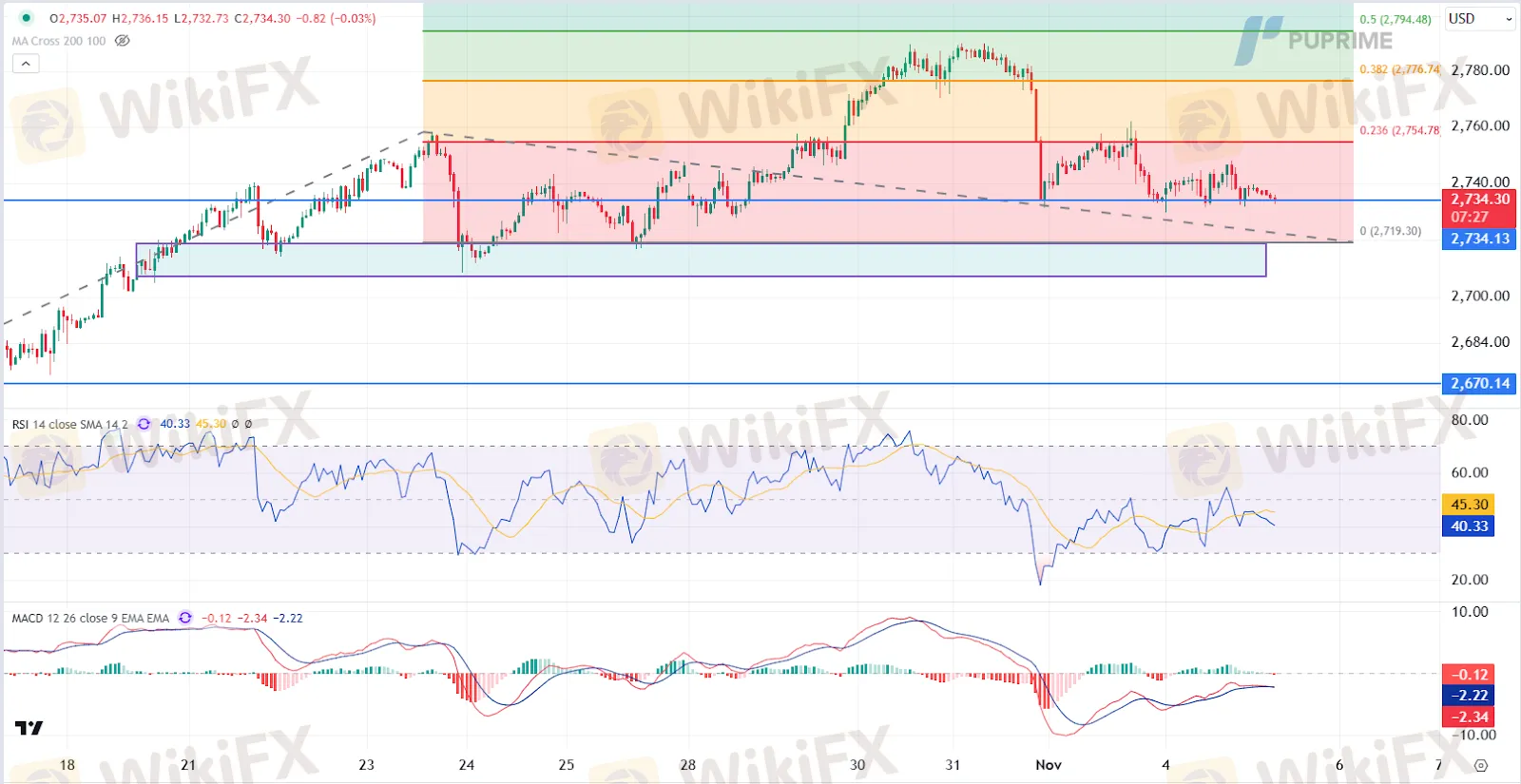

XAU/USD, H1

Gold prices remained steady as investors adopted a wait-and-see approach leading up to the U.S. election. Although the long-term outlook for gold remains supportive, underpinned by potential political uncertainties and tariff concerns, some participants opted for profit-taking after recent record highs. The current caution is likely a reflection of the markets wait-and-see sentiment. As further clarity on election results unfolds, investors are advised to closely monitor developments for potential market-entry signals in gold.

Gold prices are trading flat while currently testing the support level. MACD has illustrated increasing bearish momentum, while RSI is at 41, suggesting the commodity might edge lower since the RSI stays below the midline.

Resistance level: 2755.00, 2775.00

Support level: 2735.00, 2720.00

CL OIL, H4

Oil prices rebounded following OPEC+ announced an extension of its production cut by 2.2 million barrels per day (bpd) through December, as previously planned increases were delayed due to low demand and falling prices. Initially scheduled for a gradual increase of 180,000 bpd in December, OPEC+ opted to maintain output cuts to stabilize the market amid persistent demand concerns. Despite short-term adjustments, OPEC Secretary General Haitham Al Ghais expressed optimism for both short-term and long-term oil demand, highlighting the organization's positive outlook for 2024 and beyond.

Oil prices are trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 62, suggesting the commodity might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 72.60, 74.75

Support level: 69.90, 68.45

Haftungsausschluss:

Die Ansichten in diesem Artikel stellen nur die persönlichen Ansichten des Autors dar und stellen keine Anlageberatung der Plattform dar. Diese Plattform übernimmt keine Garantie für die Richtigkeit, Vollständigkeit und Aktualität der Artikelinformationen und haftet auch nicht für Verluste, die durch die Nutzung oder das Vertrauen der Artikelinformationen verursacht werden.

WikiFX-Broker

Aktuelle Nachrichten

Personalticker Law: Hengeler Mueller ernennt elf neue Partner

Aktien, Immobilien oder Anleihen? Bei diesem Investment erwarten Analysten von JPMorgan die besten Renditen

Russland könnte 3 Öl-Giganten fusionieren – und zum zweitgrößten Produzenten der Welt aufsteigen

Stationen bei Mercedes, Porsche und Rivian: Dieser Manager soll das VW-Geschäft in den USA ankurbeln

Dieses große Samsung-Smartphone ist bei Aldi bald im Angebot – die Ersparnis beträgt 100 Euro

Vergesst Nvidia: Die Aktie dieses deutschen Unternehmens übertrifft den KI-Star um 80 Prozent

Die Leiterin von Russlands Zentralbank sagt, die Wirtschaft des Landes befinde sich an einem „Wendepunkt

Shiba Inu-Besitzer ziehen 1,67 Billionen SHIB-Token von der Börse ab

Solana-Kurs gibt nach: Widerstand bei $250 bremst die Rallye aus

Ethereum (ETH) mit Kursplus: Rally auf 3.350 USD – Der Weg zu 4.522 USD?

Wechselkursberechnung