简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

KVB Market Analysis | 18 Nov: Strong Dollar Sentiment Keeps USD/JPY on the Rise

Sommario:Product: EUR/USDPrediction: DecreaseFundamental Analysis:The EUR/USD pair is trading around 1.0550 during Mondays Asian session, close to its yearly low of 1.0496 reached on November 14. Downside risk

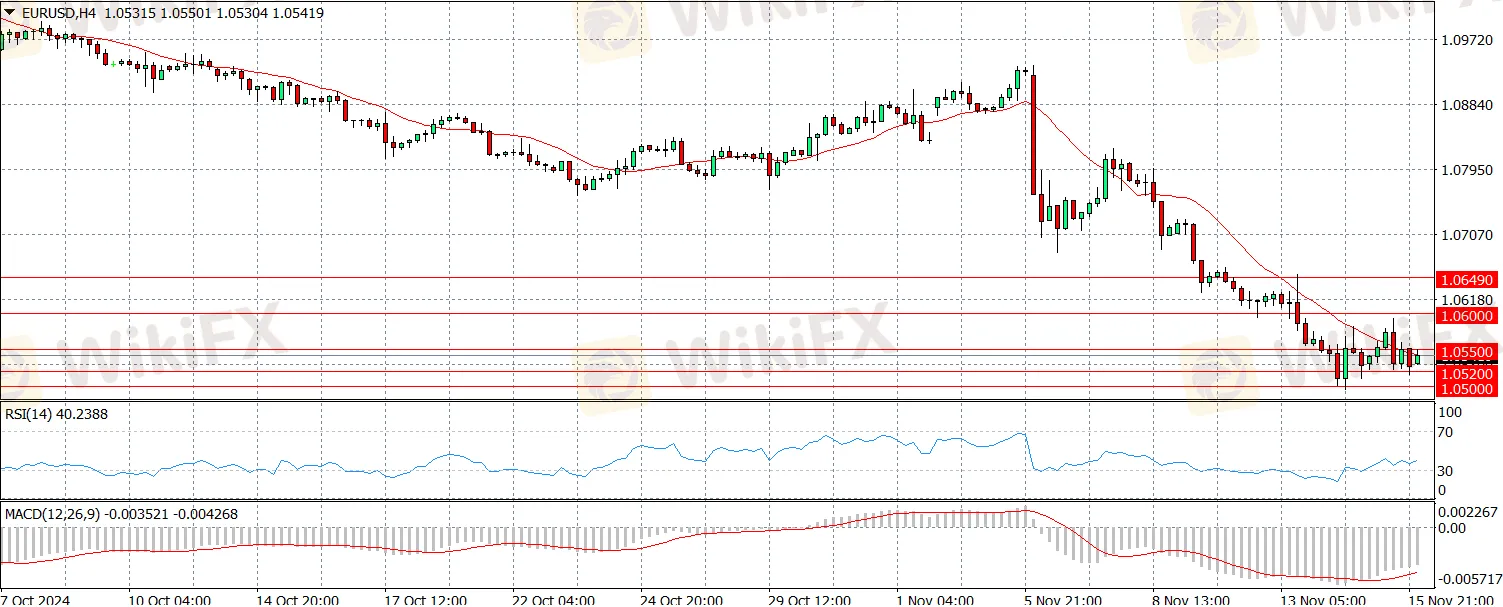

Product: EUR/USD

Prediction: Decrease

Fundamental Analysis:

The EUR/USD pair is trading around 1.0550 during Mondays Asian session, close to its yearly low of 1.0496 reached on November 14. Downside risks have increased due to cautious remarks from Federal Reserve officials and stronger-than-expected U.S. Retail Sales data, which support the U.S. Dollar.

Last week, Fed Chair Jerome Powell lowered expectations for quick rate cuts, highlighting the economy's strength, a solid labor market, and ongoing inflation. He noted, "The economy is not signaling that we need to rush to lower rates."

The CME FedWatch Tool shows nearly a 60% chance of a 25-basis-point rate cut by the Fed in December. The U.S. Census Bureau reported a 0.4% increase in Retail Sales for October, beating the 0.3% forecast. Additionally, the NY Empire State Manufacturing Index unexpectedly rose to 31.2, compared to a predicted decline of 0.7, indicating strong manufacturing growth.

Technical Analysis:

The Euro is under continued downward pressure as the European Central Bank adopts a dovish approach, with a policy rate cut anticipated at the December meeting. Headline inflation in the Euro Area is expected to drop sharply to 2.4% in 2024, down from 5.4% in 2023, and gradually ease to 2.1% in 2025 and 1.9% in 2026.

The European Commission's Autumn 2024 forecast maintains a 0.8% growth estimate for the Euro Area in 2024, but the 2025 growth forecast has been slightly lowered to 1.3% from 1.4%. The Eurozone is projected to grow by 1.6% in 2026. EU Economy Commissioner Paolo Gentiloni mentioned that as inflation declines and private consumption and investment pick up, along with record-low unemployment, growth is expected to gradually increase over the next two years.

Product: XAU/USD

Prediction: Increase

Fundamental Analysis:

Gold prices have bounced back to around $2,570, ending a six-day losing streak during early Asian trading on Monday. However, the strength of the U.S. Dollar may limit further gains for the precious metal.

The Dollar's rise following Donald Trump's election victory could create selling pressure on USD-denominated gold. Expectations of higher inflation next year due to Trumps policies have reduced anticipated rate cuts.

Additionally, traders have lowered their expectations for rate decreases in December after Fed Chair Jerome Powell indicated that the central bank is not in a hurry to cut rates, highlighting the economy's strong performance. Higher interest rates typically make gold less attractive, as it does not yield returns.

Technical Analysis:

Gold recently fell below the October 10 swing low of $2,603, deepening losses past $2,600 and briefly hitting a two-month low of $2,536, just below the 100-day Simple Moving Average at $2,545. However, the failure of sellers to push prices down to $2,500 has created a chance for a rebound.

The first resistance level is $2,600. If buyers reclaim this level, they may aim for the 50-day SMA at $2,651, with additional resistance around $2,700. Surpassing this could lead to the November 7 high of $2,710.

The Relative Strength Index has moved away from its neutral line, suggesting bearish momentum that may lead to further declines in XAU/USD.

Product: USD/JPY

Prediction: Increase

Fundamental Analysis:

USD/JPY is holding above the 154.00 level at the start of the new week, stalling its pullback from Friday's high, the highest since July 23. Speculation about possible intervention and hints from BoJ Governor Kazuo Ueda regarding a potential rate hike in December provide some support for the Japanese Yen. However, the pair's downside appears limited due to strong bullish sentiment for the U.S. Dollar.

The JPY ended a four-day losing streak on Friday but faced pressure after Japan's Q3 Gross Domestic Product report. The GDP grew by 0.2% quarter-on-quarter, down from 0.5% in the previous quarter, while annual growth was 0.9%, slightly above expectations. Finance Minister Katsunobu Kato plans to act against excessive currency fluctuations, emphasizing the need for stability. Economy Minister Ryosei Akazawa expects modest recovery, though he warns of potential global economic risks.

Technical Analysis:

USD/JPY is trading around 156.50 on Friday. Analysis of the daily chart shows a strong bullish trend, with the pair moving upward within an ascending channel. The 14-day Relative Strength Index sits just below 70, which supports a positive outlook. If the RSI breaks above 70, it could signal overbought conditions, possibly leading to a downward correction.

The pair may target the upper boundary of the channel near 159.70. A breakout above this level would strengthen the bullish sentiment and could push the pair toward its four-month high of 161.69 from July 11.

On the downside, support is at the nine-day Exponential Moving Average around 154.65, followed by the channel's lower boundary at 153.90.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

Pepperstone

VT Markets

STARTRADER

FxPro

FP Markets

ATFX

Pepperstone

VT Markets

STARTRADER

FxPro

FP Markets

ATFX

WikiFX Trader

Pepperstone

VT Markets

STARTRADER

FxPro

FP Markets

ATFX

Pepperstone

VT Markets

STARTRADER

FxPro

FP Markets

ATFX

Rate Calc