简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

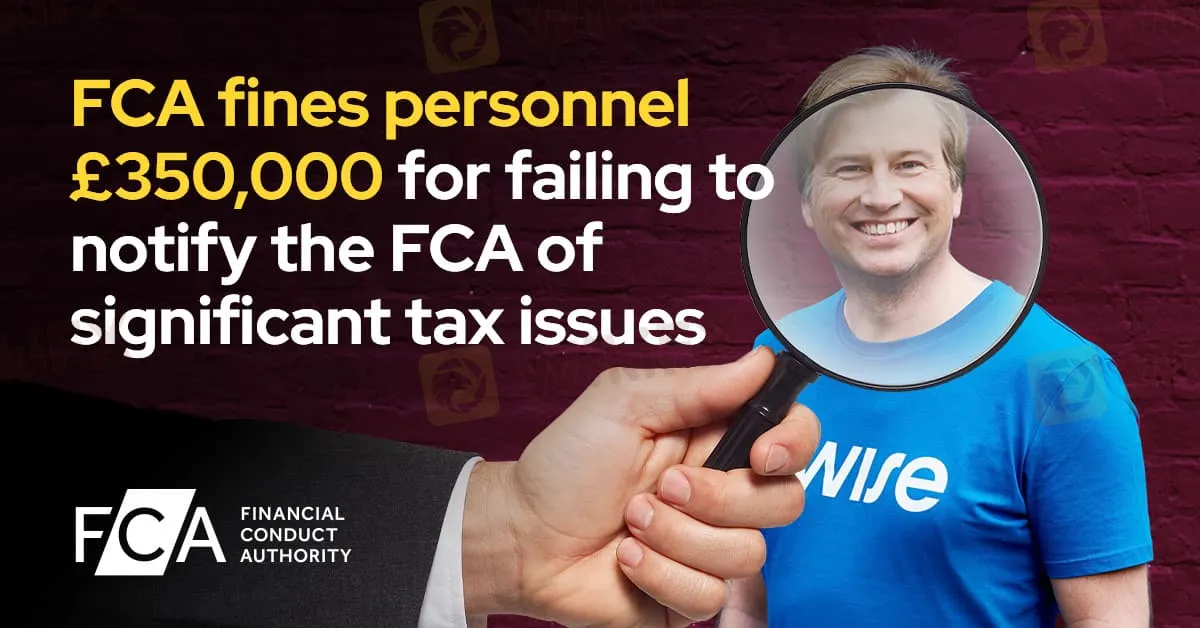

FCA fines personnel £350,000 for failing to notify the FCA of significant tax issues

Sommario:This fine, a result of Mr. Käärmann's breach of a senior manager conduct rule, underlines the regulatory expectation that leaders within financial services uphold high ethical standards and transparency in their dealings.

In a recent move emphasizing regulatory transparency and accountability, the Financial Conduct Authority (FCA) imposed a £350,000 fine on Kristo Käärmann, CEO of Wise plc and senior manager at Wise Assets UK Ltd. This fine, a result of Mr. Käärmann's breach of a senior manager conduct rule, underlines the regulatory expectation that leaders within financial services uphold high ethical standards and transparency in their dealings.

The penalty originates from tax-related issues dating back to 2017, when Mr. Käärmann sold shares worth £10 million, incurring a capital gains tax liability. However, he failed to notify HM Revenue & Customs (HMRC) of this liability, a move deemed “deliberate” by HMRC. In February 2021, Mr. Käärmann paid a substantial fine of £365,651 to HMRC, and in September 2021, he was added to HMRC's public tax defaulters list.

According to the FCA, the period between February and September 2021 was critical in its assessment of Mr. Käärmann's “fitness and propriety” as a senior manager. The FCA determined that he failed to appropriately assess the significance of these tax issues and did not inform the FCA, despite his knowledge of the matter for over seven months. Such a lapse, the FCA stated, highlights a failure to maintain the level of accountability expected of senior executives in financial institutions.

Therese Chambers, Joint Executive Director of Enforcement and Oversight at the FCA, underscored this sentiment, stating, “We, and the public, expect high standards from leaders of financial firms, including being frank and open. It should have been obvious to Mr. Käärmann that he needed to tell us about these issues which were highly relevant to our assessment of his fitness and propriety.”

At the time, Mr. Käärmann held significant roles across Wise entities regulated by the FCA, including his position as CEO of Wise plc and as both Chief Executive (SMF1) and Executive Director (SMF3) of Wise Assets UK Ltd. The FCA noted that the original fine was set at £500,000, yet Mr. Käärmanns willingness to resolve the matter early qualified him for a 30% reduction, resulting in the final fine of £350,000.

This penalty underscores the FCAs commitment to ensuring that senior figures within regulated financial firms adhere to rigorous standards of conduct, especially concerning transparency with both tax obligations and regulatory oversight.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

Vantage

Pepperstone

TMGM

FP Markets

IC Markets Global

Tickmill

Vantage

Pepperstone

TMGM

FP Markets

IC Markets Global

Tickmill

WikiFX Trader

Vantage

Pepperstone

TMGM

FP Markets

IC Markets Global

Tickmill

Vantage

Pepperstone

TMGM

FP Markets

IC Markets Global

Tickmill

Rate Calc