简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

【MACRO Alert】Political bets and market trends: Bitcoin and gold prices in anticipation of Trump's re

Sommario: Bitcoin has risen about 13% in the past seven days, far outperforming global stock indexes and gold. The rise is partly due to investors predicting that Republican candidate Trump, who supports cr

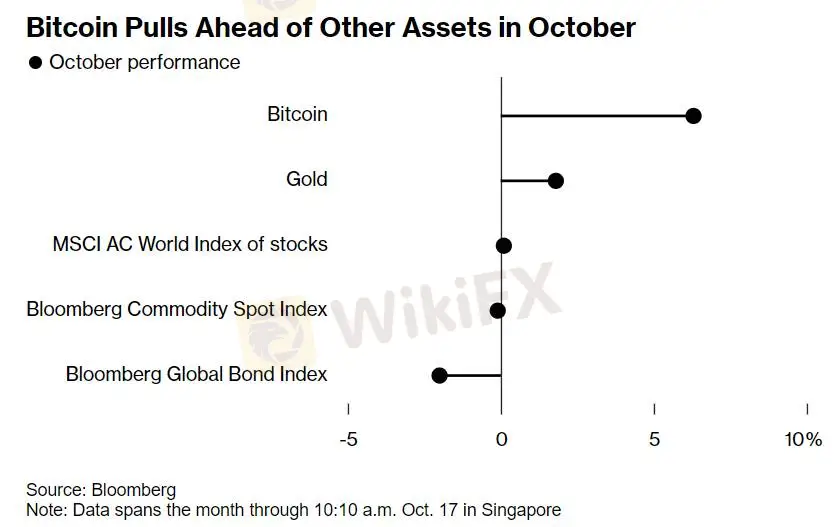

Bitcoin has risen about 13% in the past seven days, far outperforming global stock indexes and gold. The rise is partly due to investors predicting that Republican candidate Trump, who supports cryptocurrency, will win the US presidential election. Billionaire Stan Druckenmiller believes that the cryptocurrency's movement is a market pricing reaction to Trump's victory.

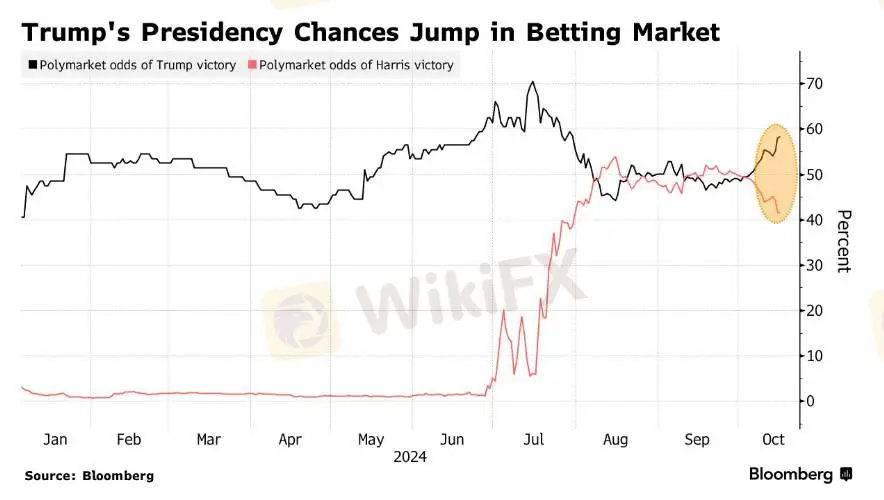

Trump‘s promise to make the U.S. the global capital of cryptocurrency if he’s elected has led to Bitcoin being categorized as a “Trump trade,” a set of investments based on his likely victory. Meanwhile, on Polymarket and PredictIt prediction markets, Trump‘s odds of winning jumped to 58% and 54%, respectively, while Democratic candidate Harris’ odds dropped to 41% and 49%.

Arisa Toyosaki, co-founder of Cega, a cryptocurrency derivatives service provider, pointed out that the excitement in the prediction market has pushed up the implied volatility and spot price of Bitcoin. In addition, more than a dozen Bitcoin ETFs in the United States have seen net inflows of more than $1.6 billion since October 11. Although the prediction market is tilted in favor of Trump, the approaching election day means that anything can happen, and polls show that the gap in support for the two candidates is within the margin of error.

Harris has taken a more neutral stance on cryptocurrencies, pledging to support a regulatory framework for digital assets and to support industry growth with appropriate safeguards.Meltem Demiros, general partner at Crucible Capital, said the emergence of cryptocurrency as an election issue has driven a lot of attention to Bitcoin and the broader crypto asset class, which is translating into capital flows.Trump once called the digital asset industry a scam, but later changed his attitude to support the industry. Digital asset companies have become influential players in elections by making large donations to political action committees in pursuit of friendlier rules. Druckenmiller observed that over the past 12 days, the market seemed "very confident" that Trump would win, as evidenced by the performance of bank stocks and cryptocurrencies.

Gold, on the other hand, is expected to continue setting new all-time highs in the coming year, but according to a survey at the London Metals Market Association (LBMA) event in Miami, the price of gold is not expected to break the $3,000 mark. Delegates expect gold prices to rise to $2,917.40 per ounce by the end of October next year, about 10% higher than current levels. Gold is one of the best performing commodities in 2024, and its appeal as a safe-haven asset, as a diversified investment to protect wealth, and central bank purchases have kept it setting new records.

Last month, gold hit a record high of $2,685 after the Federal Reserve shifted to rate cuts. In a low interest rate environment and geopolitical turmoil, zero-yield gold is often the "first choice" of investors. Investors are also increasingly focused on the U.S. presidential election in a few weeks. In an interview, Trump defended plans to significantly increase tariffs and promised more direct consultations with the Federal Reserve.

It is worth noting that LBMA representatives significantly underestimated the potential of gold last year, with the October 2023 survey predicting that gold prices will reach around $1,990 per ounce in 2024. LBMA Chairman Paul Fisher pointed out that gold prices have risen by a third compared to last year's meeting in Barcelona, Spain. He added that the background of the rise in gold prices is that the US economy remains relatively healthy, inflation is rising, and the labor market shows resilience.

Market participants are waiting for more U.S. economic data to determine the number of rate cuts the Fed may implement in the near term. "The start of easing policy in the U.S. has changed the rules of the game for gold prices, and it has laid the foundation for investment demand," said Soni Kumari, commodity strategist at ANZ Bank. Investors are watching the upcoming U.S. retail sales, industrial production and weekly initial jobless claims data for the latest clues about the Fed's monetary easing cycle. Currently, traders expect the Fed to cut interest rates by 25 basis points in November with a 97.2% probability.

Atlanta Fed President Bostic said he updated his forecast from last month's meeting to see only another 25 basis point cut this year. The LBMA survey showed that silver could perform better, rising more than 40% to $45 an ounce in the coming year. At the same time, 37% of representatives believe that gold will become the industry's top asset; platinum ranks third, with only 16% of representatives expecting platinum to shine next year; and only 2% of participants expect palladium to outperform the market.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

FXTM

Pepperstone

STARTRADER

Octa

HFM

Tickmill

FXTM

Pepperstone

STARTRADER

Octa

HFM

Tickmill

WikiFX Trader

FXTM

Pepperstone

STARTRADER

Octa

HFM

Tickmill

FXTM

Pepperstone

STARTRADER

Octa

HFM

Tickmill

Rate Calc