简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

【MACRO Insight】The U.S. Market is Full of Bumps! Can It Achieve a "Soft Landing"? The Focus Will Be on Inflation and the Unveiling of Earnings Reports!

Sommario:the U.S. economy and stock market are facing a series of challenges, including inflation pressure, a slowdown in consumer spending, and uncertainty about the future economic outlook. Investors and analysts are closely watching the release of economic data and corporate earnings reports to determine whether American families face greater economic pressure. At the same time, market volatility and concerns about the future economic outlook will continue to affect investors' decisions. In such a con

Recently, uncertainty in the U.S. economy and stock market has increased significantly, attracting widespread attention from market participants. Wall Street is uneasy about the health of the U.S. economy, and American families also feel the pressure. This tension was reflected in the stock market, especially last Friday, when the U.S. stock market ended a turbulent week, with major stock indexes failing to completely reverse the week's decline. Specifically, the S&P 500 index fell by less than 0.1% last week, the Nasdaq Composite index fell by 0.2%, and the Dow Jones Industrial Average fell by 0.6% during the same period.

Despite the significant fluctuations in the global market recently, Morgan Stanley still maintains its expectation for the U.S. economy to achieve a “soft landing” and reaffirms its forecast that the Federal Reserve will cut interest rates by 25 basis points in September. The bank's economists believe that although the market has reacted strongly to the recent decision of the Bank of Japan to raise interest rates and the unexpected decline in U.S. non-farm employment data, these events do not mark a fundamental change in the economic fundamentals.

Morgan Stanley pointed out that the market reacted calmly to the Bank of Japan's unexpected decision to raise the short-term policy interest rate to 0.25%, but the central bank governor's subsequent remarks about the possibility of further rate hikes took the market by surprise, intensifying concerns about U.S. economic growth. At the same time, the decline in U.S. non-farm employment data in July also affected market sentiment. However, in their report, Morgan Stanley's economists insist that the resilience shown by the U.S. economy, such as the 2.6% GDP growth rate and 2.3% consumer spending growth rate in the second quarter of 2024, and the still healthy 4.3% unemployment rate despite a slight increase, are positive signs that the U.S. economy is heading towards a soft landing rather than a recession.

The report also emphasizes that although the market remains vigilant for any signs that the economy may further weaken, the current data does not show that the economic situation is deteriorating rapidly. Morgan Stanley expects the interaction between the Federal Reserve's interest rate cut and the Bank of Japan's rate hike expectations to support the yen. Nevertheless, the bank's economists maintain their initial forecast that the Bank of Japan will raise interest rates in January 2024, noting that even so, Japan's real interest rates are expected to remain negative until the end of 2025.

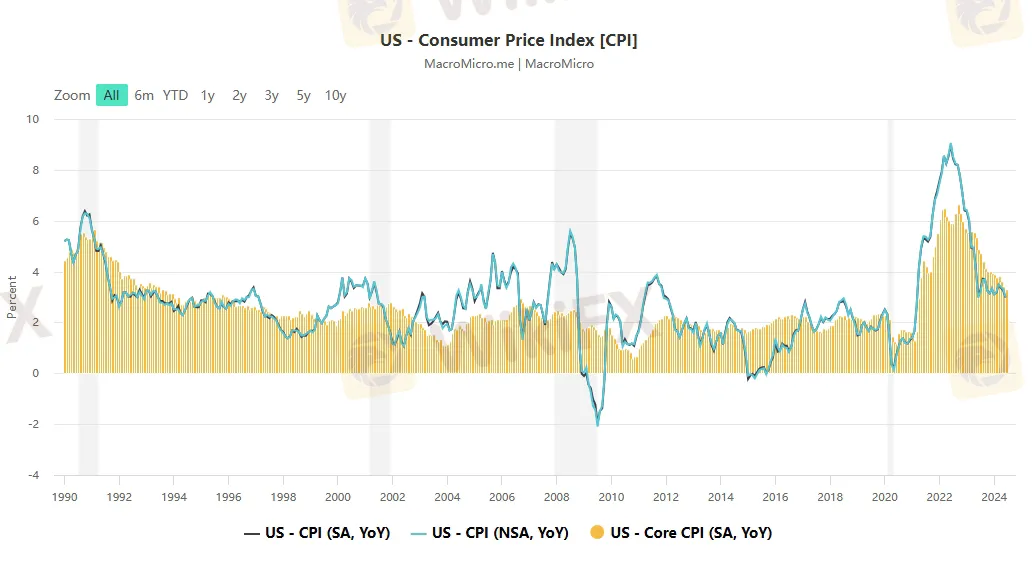

From Morgan Stanley's current public stance, they remain optimistic about the prospects of the U.S. economy and believe that despite facing challenges, the U.S. economy has enough resilience to achieve a soft landing. At the same time, the market's focus has turned to a series of new U.S. economic indicators to be released soon, especially the July Consumer Price Index (CPI) report and the earnings of some top U.S. retailers. These data are crucial for assessing whether American families face greater pressure from intensifying inflation and rising interest rates. Economists generally expect the overall inflation rate for July to remain stable at an annual rate of 3%, and the core CPI is expected to slow down from 3.3% in June to 3.2%. However, Brian Weinstein, Global Head of Investment Management at Morgan Stanley, pointed out that since it is very rare for the CPI to stabilize below 2% historically, the inflation rate may remain above the Federal Reserve's target for some time.

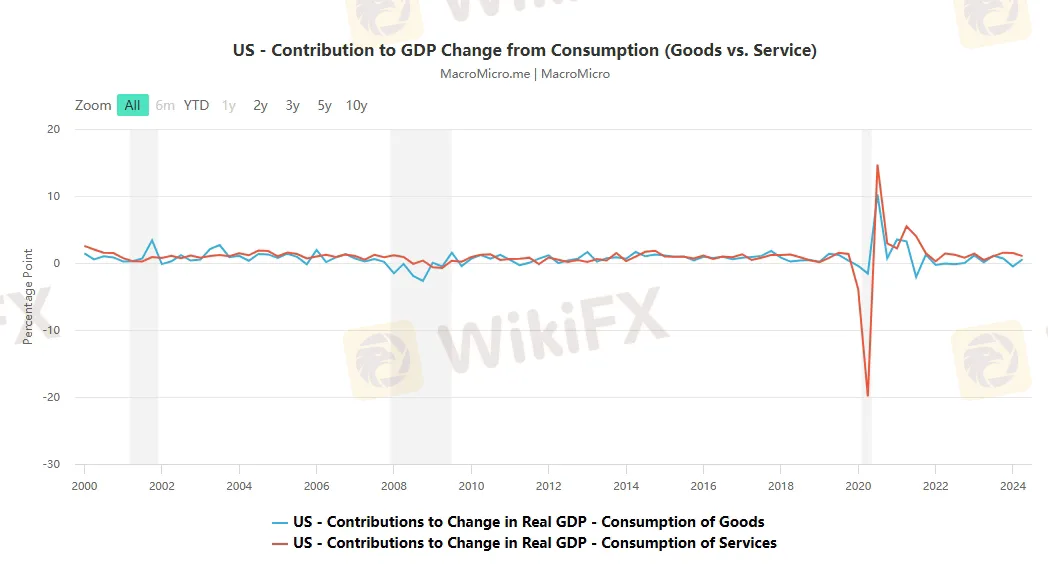

American families' savings accumulated during the pandemic have been squeezed, and the continuous inflation and the Federal Reserve's monetary tightening cycle have forced many consumers to become more selective in purchasing products and places of consumption. Consumer-facing companies, such as Starbucks and McDonald's, have issued profit warnings, showing early signs of a slowdown in consumer spending. The luxury group LVMH's business in China saw a decline in sales in the second quarter, and McDonald's financial report shows that inflationary pressures make consumers more selective about how to spend money. In addition, the vacation rental platform Airbnb expects leisure travel to slow down, as consumers will hold off on booking overnight stays in the face of an uncertain economic outlook.

Nevertheless, some economic data show growth signals. For example, the service industry economy rebounded in July, and the number of Americans applying for unemployment benefits last week fell to 233,000, falling from a one-year high, indicating that although the July employment report was weak, the labor market may still be in good condition. However, stock market volatility still exists, and the market may fall into a slump for any signs of economic slowdown and insufficient softening of inflation.

In this context, Morgan Stanley strategists Michael Wilson and the team led by Mislavy Matjaka are cautious about the stock market outlook. Wilson expects the S&P 500 index to fluctuate between 5,000 and 5,400 points, with the upper limit of this range meaning that the S&P 500 index will only rise by 1% from the current level, and the lower limit means a decline of 6.4%. Wilson has been one of the most famous bearish voices in the U.S. stock market before last year. In addition, Wilson wrote in a report that due to seasonal weakness, the number of analysts who lower profit expectations is expected to exceed the number of increases, which is one of the reasons why the third quarter is usually the most challenging.

Despite the optimistic performance of the second quarter earnings season, growth concerns have weakened market optimism. S&P 500 index companies are expected to achieve a profit growth of 13%, which is the strongest growth since 2021. However, the proportion of companies that exceed sales expectations is the lowest since 2019, intensifying concerns about the resilience of profit margins. Wilson said that although the bond market has adjusted to reflect the risk of the Federal Reserve “lagging behind the curve,” stock market valuations have not fully reflected this risk. The strategist reiterated his preference for so-called defensive stocks, which have a solid profit outlook and a strong balance sheet.

As one of the few persistent bearish voices in the stock market this year, the strategist team of J.P. Morgan also said that they expect the stock market outlook to be mixed in the coming months. The team led by Mislavy Matjaka wrote in a report: “The Federal Reserve will start to cut interest rates, but this may not drive a sustained rise in the stock market, as these cuts may be seen as reactive and lagging behind changes in the economic situation.”

Overall, the U.S. economy and stock market are facing a series of challenges, including inflation pressure, a slowdown in consumer spending, and uncertainty about the future economic outlook. Investors and analysts are closely watching the release of economic data and corporate earnings reports to determine whether American families face greater economic pressure. At the same time, market volatility and concerns about the future economic outlook will continue to affect investors' decisions. In such a context, investors need to be more cautious, closely monitor market dynamics, and be prepared to deal with possible market fluctuations.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

XM

EC Markets

FOREX.com

Vantage

Pepperstone

TMGM

XM

EC Markets

FOREX.com

Vantage

Pepperstone

TMGM

WikiFX Trader

XM

EC Markets

FOREX.com

Vantage

Pepperstone

TMGM

XM

EC Markets

FOREX.com

Vantage

Pepperstone

TMGM

Rate Calc