简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Wall Street Advances Ahead of CPI

Sommario:The equity markets continued their upward momentum, driven by the easing of the Japanese Yen's strength. The Yen was pressured by a dovish tone from Japanese authorities, signalling that the Bank of Japan (BoJ) might keep its monetary policy unchanged amid rising global economic uncertainties.

Equity market edge higher as Yen carry trade jitters eases.

U.S. dollar standing pat ahead of the key U.S. inflation gauge.

Oil bullish as geopolitical tension heightened and oil supply dwindling on Libya oil production close-down.

Market Summary

The equity markets continued their upward momentum, driven by the easing of the Japanese Yen's strength. The Yen was pressured by a dovish tone from Japanese authorities, signalling that the Bank of Japan (BoJ) might keep its monetary policy unchanged amid rising global economic uncertainties. However, attention is now shifting to the upcoming U.S. Consumer Price Index (CPI) reading later this week, which is expected to be a key driver for both the equity markets and the U.S. dollar.

The U.S. dollar is currently trading flat after rebounding from its recent low near the $102 mark. Traders are cautious ahead of the U.S. CPI release, which could significantly impact the dollar's trajectory.

In the Oceania region, the New Zealand dollar and the Australian dollar are in focus. The Reserve Bank of New Zealand (RBNZ) is set to announce its interest rate decision, with expectations of a hawkish stance due to the strong labour market. Additionally, the Australian job data, due on Thursday, could serve as a catalyst for further strengthening of the Aussie dollar.

In the commodity markets, gold remains buoyed at its recent high levels as investors monitor ongoing developments in the Middle East and the continuous conflict in Eastern Europe. Oil prices continue to trend upwards, supported by multiple bullish factors, including reduced oil supply due to the closure of Libya's largest oil field and positive oil inventory data from the U.S.

Current rate hike bets on 18th September Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (88.5%) VS -25 bps (11.5%)

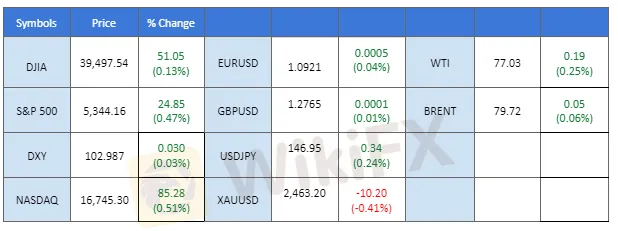

Market Overview

Prices as of 03:00 EET

Economic Calendar

(MT4 System Time)SD

N/A

Source: MQL5

Market Movements

DOLLAR_INDX, H4

The Dollar Index, which tracks the USD against a basket of six major currencies, remained flat but under pressure ahead of a key inflation report due later this week. The July CPI data is expected to show a slowdown in inflation, edging closer to the Federal Reserves 2% annual target. With major economic events on the horizon, including speeches from Fed officials like Atlanta Fed President Raphael Bostic, Philadelphia Fed President Patrick Harker, and Chicago Fed President Austan Goolsbee, investors are in a cautious wait-and-see mode. The dollar is struggling to find a clear direction as the market anticipates further clues from the upcoming data and Fed statements.

The Dollar Index is trading flat while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 48, suggesting the index might trade lower since the RSI stays below the midline.

Resistance level: 103.35, 104.05

Support level: 102.40, 101.40

XAU/USD, H4

Gold prices extended their gains, driven by expectations of rate cuts from the Federal Reserve and rising geopolitical tensions, particularly in the Middle East and the ongoing conflict between Russia and Ukraine. The increased geopolitical risks have prompted a shift toward safe-haven assets like gold. On the geopolitical front, Ukrainian President Volodymyr Zelenskiy acknowledged a surprise offensive into Russian territory, intensifying the conflict and further fueling demand for gold as a safe-haven asset.

Gold prices are trading higher while currently testing the resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 56, suggesting the commodity might experience technical correction since the RSI retreated sharply from overbought territory.

Resistance level: 2425.00, 2450.00

Support level: 2425.00, 2355.0

GBP/USD,H4

The Pound Sterling is trading near its recent highs against the U.S. dollar, even as it remains entrenched in a broader downtrend, having declined nearly 2% over the past three weeks. Traders are closely watching tomorrow's UK employment data, which is expected to show signs of a cooling labour market. Additionally, Wednesday's CPI release could serve as a key catalyst for the currency's strength, potentially impacting Sterling's trajectory in the coming days.

GBP/USD is trading sideways, followed by a technical rebound. The RSI has rebounded from near the oversold zone, while the MACD has a bullish cross and is edging upward, suggesting that bullish momentum might be forming.

Resistance level: 1.2850, 1.2910

Support level: 1.2700, 1.2630

USD/JPY,H1

The USD/JPY pair remained bearish as the US Dollar weakened on expectations of Fed rate cuts, while the Japanese Yen strengthened. Market participants are pricing in a 56.5% chance of a 50 basis point rate cut by the Fed in December. Meanwhile, the Bank of Japan (BoJ) may consider further rate hikes this year, as indicated by the Banks Summary of Opinions (SoP), where several officials acknowledged the need for more rate increases. This divergence in monetary policy expectations between the Fed and BoJ is keeping the USD/JPY under pressure.

USD/JPY is trading lower following the prior retracement from the resistance level. However, MACD has illustrated increasing bullish momentum, while RSI is at 53, suggesting the pair might experience technical correction since the RSI stays above the midline.

Resistance level: 147.55, 149.40

Support level: 145.85, 143.80

EUR/USD, H4

The EUR/USD is currently in a tight sideways range, struggling to surpass its recent high, which indicates a lack of bullish momentum. The pair seems to be in a holding pattern, awaiting a key economic indicator to drive its next move. The upcoming Eurozone GDP report, due this Wednesday, is anticipated to show signs of improvement, potentially acting as a bullish catalyst for the pair.

The pair lacks a catalyst and trade signs. Signs of a lack of bullish catalyst exert downside pressure on the pair. The RSI is gradually moving downward, while the MACD is edging toward the zero line from above, suggesting a bearish momentum is forming.

Resistance level: 1,0940, 1.0985

Support level: 1.0895, 1.0852

NZD/USD, H4

The NZD/USD pair is forming a higher-high price pattern, indicating a potential trend reversal from its previous downtrend. The recent rebound was driven by upbeat job data released last week, which is likely to influence the Reserve Bank of New Zealand's interest rate decision scheduled for this Wednesday. Expectations of a hawkish stance from the RBNZ are adding upward momentum to the pair.

The pair is currently resisting at its near resistance level at 0.6025, awaiting a catalyst to break above. The RSI has been flowing close to the overbought zone, while the MACD is flowing in the upper region, suggesting that the bullish momentum remains intact with the pair.

Resistance level: 0.6080, 0.6150

Support level: 0.5960, 0.5910

BTC/USD, H4

Bitcoin slid over 3% in the last session, pressured by demand concerns that weighed heavily on its price. The continued net outflows from BTC-spot ETFs, totaling $219.7 million last week, exacerbated the downward pressure. Additionally, the ongoing repayment process from Mt. Gox further intensified selling activity, driving BTC prices below the $60,000 mark.

BTC after is consolidated at near $60500 range and edge lower suggest a bearish signal for BTC. The RSI is dropping toward the oversold zone while the MACD has a bearish cross, suggesting the bullish momentum is vanishing.

Resistance level: 61250.00, 64860.00

Support level: 57060.00, 52530.00

CL OIL, H4

Crude oil prices continued their upward momentum, supported by expectations of rate cuts from the Federal Reserve and the escalating conflict in the Middle East, which is raising supply concerns. Fears of a global recession have subsided somewhat, as the global equity markets began to rebound, improving risk appetite and supporting oil demand. Additionally, the possibility of retaliatory strikes by Iran against Israel is stoking concerns over oil supply from the world's largest producing region, adding to the bullish sentiment.

Oil prices are trading higher following the prior breakout above the previous resistance level. MACD has illustrated increasing bullish momentum, while RSI is at 64, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 78.55, 80.90

Support level: 75.40, 72.50

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

FXTM

IQ Option

Pepperstone

FP Markets

GO MARKETS

VT Markets

FXTM

IQ Option

Pepperstone

FP Markets

GO MARKETS

VT Markets

WikiFX Trader

FXTM

IQ Option

Pepperstone

FP Markets

GO MARKETS

VT Markets

FXTM

IQ Option

Pepperstone

FP Markets

GO MARKETS

VT Markets

Rate Calc