简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

【MACRO Insight】Rebound After Market Turmoil - The Bank of Japan's Interest Rate Hike and the Global Financial Market's Chain Reaction

Sommario:After the sharp decline in the stock market on Monday, the global market has rebounded, but this turbulence has also brought challenges to central bank decision-making. The Bank of Japan's decision to raise interest rates has sparked extensive discussions among the market and analysts, and the Federal Reserve's interest rate policy is also closely watched. Despite market uncertainties, most analysts and central bank officials, including former European Central Bank President Trichet, believe tha

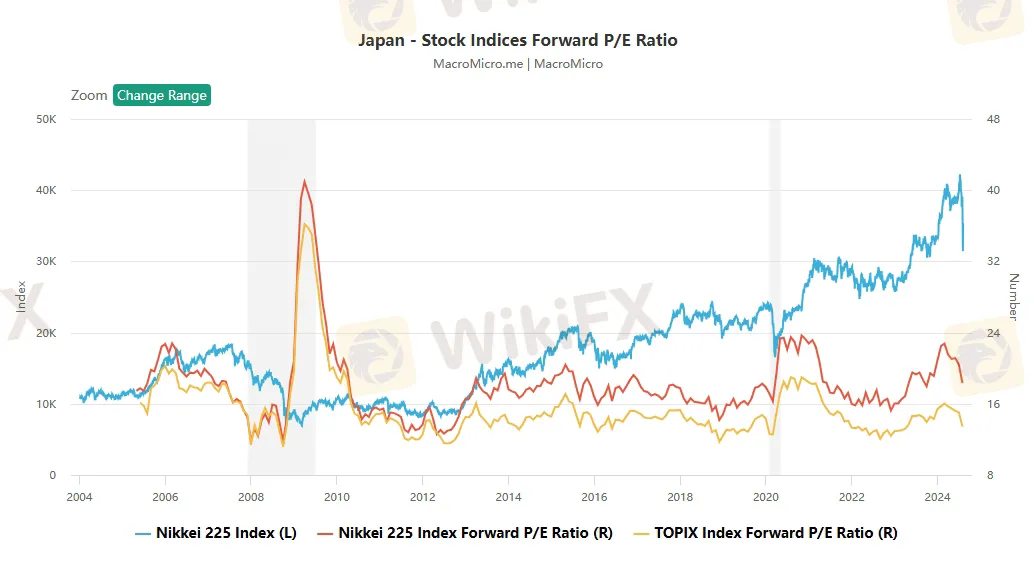

After the dramatic stock market crash on Monday, the market experienced a sharp rebound. On Tuesday, the Japanese Nikkei 225 index recouped its losses with a 10.2% increase, the South Korean KOSPI index rose by 5.6%, and U.S. stock index futures rebounded after a significant decline on Monday. However, the market's violent fluctuations have posed considerable challenges for central bank decision-making.

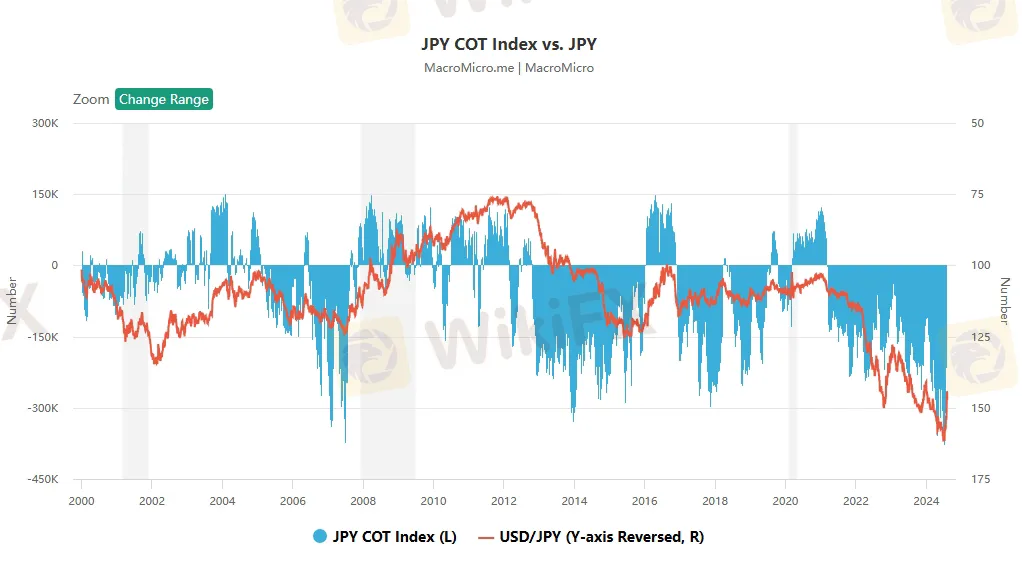

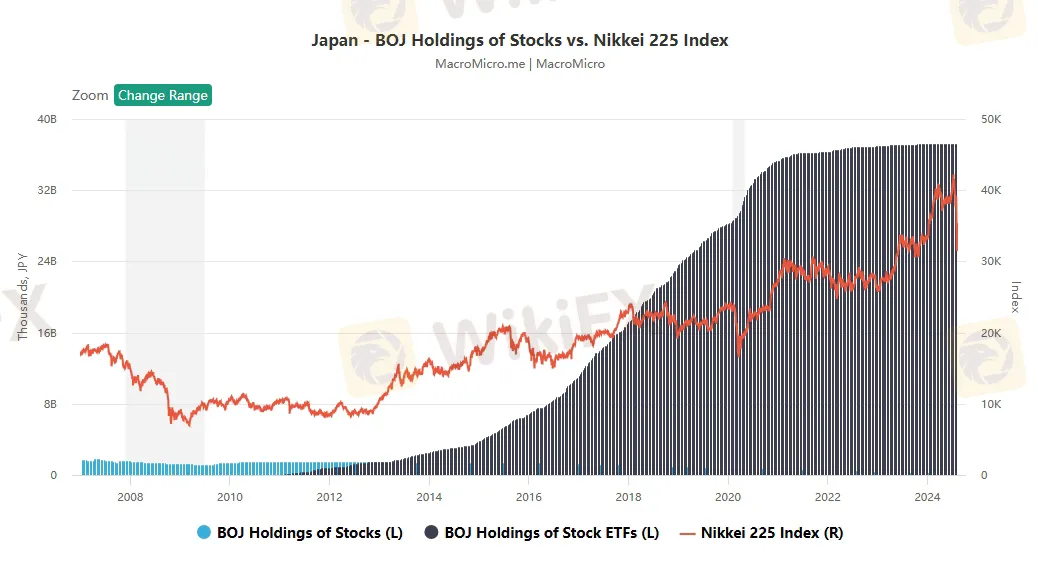

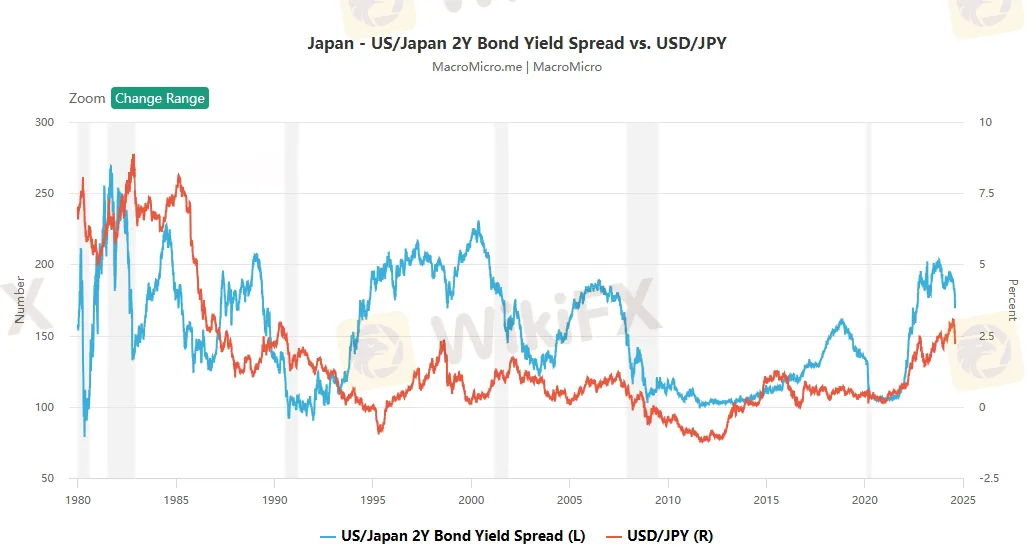

The reasons behind the market turmoil are complex, including poor earnings from tech giants and a weak U.S. July non-farm employment report. After the Bank of Japan raised interest rates to their highest level in 15 years, the yen's rise disrupted a series of global carry trade transactions, drawing widespread attention. This move not only triggered a market plunge but also faced strict scrutiny and criticism from the market. Some analysts suspect that the Bank of Japan's rate hike might have been influenced by political pressure to support the yen. Vishnu Varathan, Chief Economist for Asia at Mizuho Bank, pointed out in a report that the central bank's actions have intensified risk-avoiding trades.

Against the backdrop of global market volatility, the interest rate decisions of the Bank of Japan and the Federal Reserve are particularly important. The Federal Reserve decided to keep interest rates unchanged last week, and coupled with the weak non-farm employment report, investors are uneasy. The market is now worried that the Federal Reserve may have inadvertently made a policy mistake of maintaining high interest rates for a long time. Nevertheless, some voices suggest that the Federal Reserve should urgently cut interest rates to deal with market pressure and volatility, but Kyle Rodda, a senior market analyst at Capital.com, believes that it is too early to discuss interest rate cuts.

In the meantime, the Bank of Japan's interest rate hike has sparked extensive discussion about its timing and policy. A Bloomberg survey shows that the majority of economists expect the Bank of Japan to raise interest rates from 0.25% by the end of the year. Despite market turmoil, economists generally believe that the Bank of Japan will adhere to its existing interest rate policy. However, the yen's appreciation and the stock market's decline after the rate hike have put the central bank at risk when assessing these impacts. 71% of analysts believe that the central bank may have to make concessions in policy.

Despite the historical turmoil in the market, the Japanese stock market rebounded sharply on Tuesday, and some of the yen's gains against the US dollar were erased. Analysts pointed out that political factors may be one of the reasons for the rate hike, especially after two senior lawmakers made unusual remarks on monetary policy. The remarks by Japan's Deputy Governor of the Central Bank, Shinichi Uchida, helped stabilize the stock market, but the market is still in a state of violent fluctuations.For investors, dealing with market uncertainty is crucial. Some analysts suggest that investors should focus on high-quality stocks as a means of hedging volatility. Long-term investors are reminded not to worry too much about short-term fluctuations, which help investors stay rational.

The Japanese government and the central bank are closely monitoring the development of the economy and financial markets to deal with violent market fluctuations. After three consecutive days of market crashes, the Japanese stock market has shaken the global market, with a market value shrinkage of about 1.1 trillion US dollars, setting a historical record. Although the market has rebounded, there is still uncertainty about the future, and the central bank's decision will have a profound impact on the financial market. After the violent fluctuations in the market, global financial indices have experienced a significant rebound. During the Asian trading session on Wednesday, the Nikkei 225 index and the Tokyo Stock Exchange index both rose sharply by more than 3%, and the US dollar's exchange rate against the yen also reported a 1.8% increase, showing a positive trend. In addition, South Korea's KOSPI index, China's three major A-share indices, the Hang Seng Technology Index, the Hang Seng Index, and Taiwan's weighted index all recorded varying degrees of gains.

Japan's Deputy Governor of the Central Bank, Shinichi Uchida, injected confidence into the market with his remarks, stating that the central bank will not take interest rate hikes during market instability and will adjust the degree of monetary policy looseness according to the economic outlook. Uchida pointed out that Japan's current commitment to loose policy is firm, and he expects the US economy to achieve a soft landing, maintaining confidence in the economic fundamentals of both Japan and the United States.Traders are assessing whether the recent global sell-off has overreacted to weak US economic data. Data from Goldman Sachs show that some hedge funds took the opportunity to buy stocks during the market crash, and the strength of the yen is seen as a reflection of the US economic outlook. Kyle Rodda, a senior market analyst at Capital.com, emphasized that if the US dollar's exchange rate against the yen can maintain stability or rise, it will help the recovery of the Nikkei index.

At the same time, Arindam Sandilya, co-head of Goldman Sachs' Global Foreign Exchange Strategy, mentioned that speculative investors' yen carry trade unwinding activities have been completed by more than half. George Smith from LPL Financial reminded investors that historically, significant stock price declines are a normal and healthy part of a bull market, and encouraged investors to remain patient and not panic due to short-term fluctuations.Hiroyuki Ueno, a strategist from SuMi TRUST, believes that despite the recent sharp decline in the Japanese stock market, the market is expected to return to an upward trend in the long run, based on strong corporate earnings and signs of improvement in the domestic economy. He suggested that Japanese companies may use their cash for stock buybacks, which, if true, will have a positive impact on market sentiment.

Analysts generally believe that the market is eager to hear the moderate rhetoric of central bank officials, which helps to soothe investors and make them believe that policymakers can properly respond to the global economic situation. However, some also pointed out that although the decline of the yen has reduced the risk of new carry trade unwinding, the challenges faced by fund managers in adjusting risk weights, as well as the market's reaction to upcoming data, may still indicate that risk assets are difficult to rise steadily.

In the face of market uncertainty, the moderate rhetoric and clear policy guidance of central bank officials are crucial for stabilizing investor sentiment. Although the market may continue to face fluctuations in the short term, the long-term market is expected to gradually return to stability based on economic fundamentals and central bank policy decisions. Faced with the global market turmoil, former European Central Bank President Jean-Claude Trichet, in the “Squawk Box Europe” program on CNBC, stated that the rapid appreciation of the yen should not cause panic but can be seen as a healthy adjustment to the long-term imbalance of the market. He believes that the shift in the Bank of Japan's monetary policy, geopolitical tensions in the Middle East, and poor U.S. employment data are the main factors causing market shocks.

Trichet pointed out that the yen's exchange rate has been undervalued for a long time, and carry trade is prevalent, so the current adjustment is necessary. He emphasized that although the market has been corrected, there are still positive factors in the U.S., European, and global economies, so there is no reason to panic excessively. Trichet also specifically mentioned that the U.S. PMI index in July still shows growth momentum, indicating that the economic fundamentals are still robust. Although the July employment report did not meet expectations, causing concerns about a U.S. economic recession, Trichet believes that the current data does not support the U.S. economy entering a recession phase. He also said that although the market expects the Federal Reserve to cut interest rates at the meeting in September, there is currently no sufficient reason to support emergency interest rate cuts.

He believes that although the Federal Reserve may hesitate on the extent of interest rate cuts, more economic data in the coming weeks will provide a clearer direction for the market. He also mentioned that although the inflation rates in the United States and the eurozone are still higher than the target, the recent anti-inflation trend is commendable and should be attributed to the effective policies of central banks. Trichet concluded in the end, the market sometimes has some unpredictable fluctuations, which can be seen as part of the market's self-adjustment. Nevertheless, he remains cautious and emphasizes that it is crucial to remain calm and rational in the current market environment.

After the sharp decline in the stock market on Monday, the global market has rebounded, but this turbulence has also brought challenges to central bank decision-making. The Bank of Japan's decision to raise interest rates has sparked extensive discussions among the market and analysts, and the Federal Reserve's interest rate policy is also closely watched. Despite market uncertainties, most analysts and central bank officials, including former European Central Bank President Trichet, believe that there is currently no reason to panic and emphasize the need to remain calm and focus on fundamental factors. Trichet specifically pointed out that although the rapid appreciation of the yen and poor U.S. employment data have caused market shocks, the U.S. and European economies still have positive factors, and the anti-inflation trend should be attributed to central bank policies. Ultimately, market expectations will become clearer based on economic data in the coming weeks, and the moderate rhetoric and policy guidance of central bank officials will play a key role in stabilizing investor sentiment.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

VT Markets

HFM

IC Markets Global

ATFX

FP Markets

FBS

VT Markets

HFM

IC Markets Global

ATFX

FP Markets

FBS

WikiFX Trader

VT Markets

HFM

IC Markets Global

ATFX

FP Markets

FBS

VT Markets

HFM

IC Markets Global

ATFX

FP Markets

FBS

Rate Calc