简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

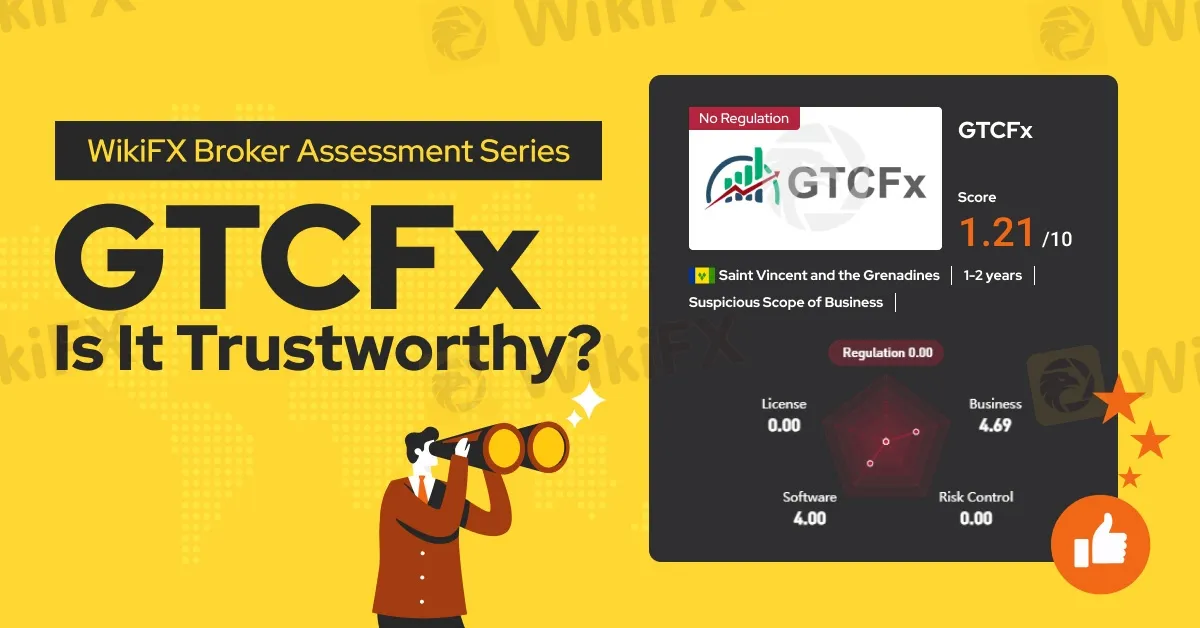

WikiFX Broker Assessment Series | GTCFx: Is It Trustworthy?

Abstract:In this article, we will conduct a comprehensive examination of GTCFx, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Background:

Founded in 2023, GTCFx Markets (referred to as “GTCFx”) is an online brokerage based at Griffith Corporate Centre, PO Box 1510, Beachmont Kingstown, St Vincent and the Grenadines.

GTCFx provides a diverse range of over 70 tradable assets, covering currency pairs, share CFDs, cryptocurrency CFDs, commodities, metals, and global indices.

GTCFx offers a social trading service facilitating money managers and traders to enhance efficiency, profitability, and generate passive income via copy-trading.

Additionally, GTCFx features an introducing broker (IB) program, enabling individuals and businesses to earn commissions by referring new clients to the company. Commissions or rebates are determined by the referees trading volume transactions.

Meanwhile, GTCFx offers a loyalty program with commission-free accounts that have monthly charges, available in three account options. Refer to the image below for further details:

Types of Accounts:

GTCFx offers three account options: the Classic Account, the Pro Account, and the ECN Account. Please refer to the attached image below for more detailed information on each corresponding account.

Deposits and Withdrawals:

GTCFx offers a range of payment options, including Visa, Mastercard, AMEX, Stripe, cryptocurrencies, and additional methods. No further specifications regarding GTCFxs deposit and withdrawal methods are listed on the website, such as the fees and corresponding processing times. This could indicate a lack of transparency by the broker.

Trading Platforms:

GTCFx only offers the MetaTrader 5 (MT5) trading platform, available on PC, mobile, and web. In general, the MT5 platform includes six types of pending orders, 38 technical indicators, 44 analytical objects, and 21 timeframes, allowing for a customizable trading experience with various online tools for integration. The platform also features quick order execution, an economic calendar for tracking global macroeconomic news, one-click trading, mobile trading capabilities, and market search and grouping functionality.

Research and Education:

GTCFx seems to be deficient in educational resources, which poses a notable disadvantage for traders, particularly newcomers or those aiming to expand their trading expertise. The absence of tutorials, webinars, or educational articles may impede clients from gaining essential skills and insights crucial for making well-informed trading choices.

That said, GTCFx provides three commonly utilized trading tools designed for the convenience of traders: the forex market cross rates checker, the forex calculator and the economic calendar.

The forex market cross rates checker is a crucial resource for traders aiming to compare and analyse currency pairs. By offering real-time exchange rates for multiple currency pairs, the tool ensures traders have the most current information for informed decision-making. It covers a wide range of currency pairs, enabling traders to monitor and compare cross rates from various regions and markets effectively.

The forex calculator is a versatile tool that assists traders in calculating essential trading parameters such as margin, profit, and pip value. This tool helps traders manage their positions more effectively by providing precise calculations based on real-time market data, thereby aiding in risk management and strategic planning.

The economic calendar is another valuable resource, offering a comprehensive schedule of upcoming economic events and announcements. This tool enables traders to stay informed about key economic indicators, such as interest rate decisions, employment reports, and GDP releases, which can significantly impact the financial markets. By integrating this information into their trading strategies, traders can make more informed decisions and anticipate market movements.

Customer Service:

GTCFx's official website lacks a “Contact Page,” phone number, and details about the operating hours of their customer service team. Clients can reach the broker through its messaging service or via email at support@gtcfxmarket.com. Additionally, clients have the option to contact GTCFx through Facebook, Instagram, and Telegram.

Conclusion:

To summarize, here's WikiFX's final verdict:

WikiFX, a global forex broker regulatory platform, has assigned GTCFx a WikiScore of 1.21 out of 10.

Upon examining GTCFxs licenses, WikiFX found that the broker is not regulated, despite its claim on the website that it is a member of the Financial Commission.

Therefore, WikiFX urges our users to opt for a broker with a higher WikiScore that is legitimately regulated for better protection.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Trader Exposes Unethical Practices by STP Trading

A recent allegation against STP Trading has cast doubt on the firm's business practices, highlighting the potential risks faced by retail traders in an increasingly crowded and competitive market.

What Makes Cross-Border Payments Easier Than Ever?

Cross-border payments are now faster, cheaper, and simpler! Explore fintech, blockchain, and smart solutions to overcome costs, delays, and global payment hurdles.

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

The UK Financial Conduct Authority (FCA) has issued a public warning regarding a fraudulent entity impersonating Admiral Markets, a legitimate and authorised trading firm. The clone firm, operating under the name Admiral EU Brokers and the domain Admiraleubrokerz.com, has been falsely presenting itself as an FCA-authorised business.

Malaysian Man Loses RM113,000 in Foreign Currency Investment Scam

A 57-year-old Malaysian man recently fell victim to a fraudulent foreign currency investment scheme, losing RM113,000 in the process. The case was reported to the Commercial Crime Investigation Division in Batu Pahat, which is now investigating the incident.

WikiFX Broker

Latest News

eToro Expands Nationwide Access with New York Launch

Webull Partners with Coinbase to Offer Crypto Futures

Why Is UK Inflation Rising Again Despite Recent Lows?

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Google Warns of New Deepfake Scams and Crypto Fraud

Currency Calculator