简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Beware of RIF-Capital: A Scam Broker Manipulation Exposed

Abstract:Uncover the truth about RIF-Capital, an unregulated broker scam manipulating trades and denying withdrawals. Protect your investments by choosing regulated brokers.

The attraction of rapid profits in the always-growing field of online trading may sometimes trap gullible investors in the hands of dishonest brokers. A concerning instance involving RIF-Capital, a trading platform with a documented track record of unethical behavior, has come to light, highlighting the perils associated with conducting business with unlicensed financial institutions.

Traders have reported many concerning events involving RIF-Capital, which bills itself as a registered and reliable broker on its website, https://rif-capital.com/index. In the latest instance, a trader was subjected to serious trading manipulation and blatant extortion. The trader had the dread of every investor after trading for a few weeks, earning some profits, and then choosing to stop: the broker erased the winnings and denied access to the deposit. RIF-Capital sternly told the trader that the original investment was unavailable in addition to the earnings being lost when the withdrawal was requested.

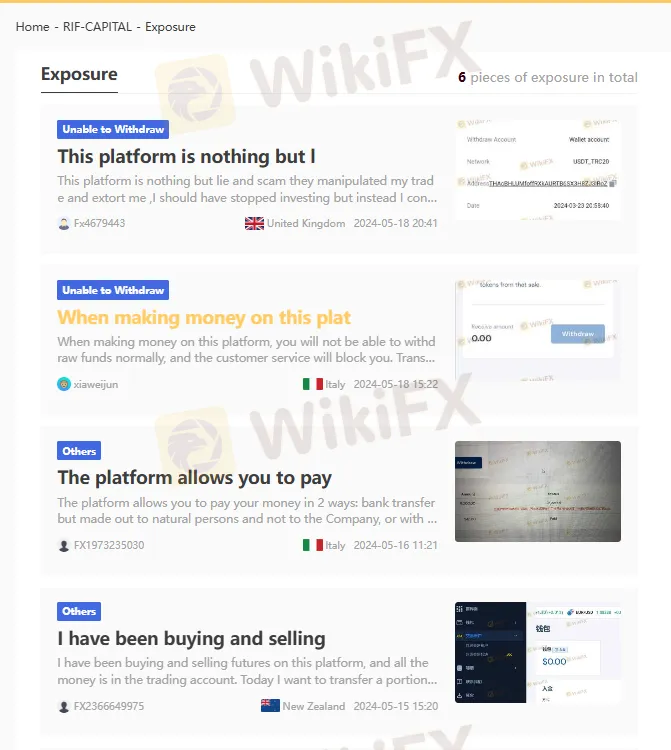

There have been more incidents like this one. An obvious warning sign in forex trading scams, the inability to withdraw money has been the subject of several complaints filed with financial supervision organizations such as WikiFX. Such actions highlight the need to check a broker's regulatory standing before investing.

Using Regulated Brokers: The Value

For some reason, dealing with a licensed broker is essential. First of all, capital adequacy regulations and other stringent financial criteria that authorized brokers must follow assist in guaranteeing their solvency and safeguarding traders' money. Their frequent audits, open operations, and the requirement to keep client money in separate accounts all contribute to the creation of a safer trading environment.

Additionally, merchants who conduct business with a regulated organization are more likely to obtain redress in the event of disputes or anomalies. Unregulated brokers lack the extra degree of protection that regulatory authorities give by their ability to step in, arbitrate, and, if needed, discipline the broker.

Conclusion

The RIF-Capital case drives home the risks that are present in the unregulated areas of the financial markets. It emphasizes the significance of conducting in-depth research and choosing brokers who are subject to reputable organizations' regulations. Your money should be your priority as an investor, and selecting a registered broker is a crucial first step in preventing fraud and manipulation of your assets.

You may access more of RIF-Capital reported cases here:

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Solana Soars to All-Time High, Hits $264 on Coinbase

Solana hits $264 on Coinbase, breaking its 3-year high with an 11% daily surge. Learn what’s driving SOL's meteoric rise and the crypto market rally.

Malaysian Man Loses RM113,000 in Foreign Currency Investment Scam

A 57-year-old Malaysian man recently fell victim to a fraudulent foreign currency investment scheme, losing RM113,000 in the process. The case was reported to the Commercial Crime Investigation Division in Batu Pahat, which is now investigating the incident.

Mastercard Partners with JPMorgan for B2B Cross-Border Payments

Mastercard and JPMorgan's Kinexys Digital Payments join forces to enhance B2B cross-border payments, promising faster settlements and greater transparency.

FCA Alerts Traders to New List of Unregulated and Clone Brokers

Protect your investments! Learn about unregulated firms flagged by the FCA and discover how WikiFX helps traders avoid scams and choose legitimate brokers.

WikiFX Broker

Latest News

Webull Partners with Coinbase to Offer Crypto Futures

eToro Expands Nationwide Access with New York Launch

Why Is UK Inflation Rising Again Despite Recent Lows?

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Google Warns of New Deepfake Scams and Crypto Fraud

Currency Calculator