简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

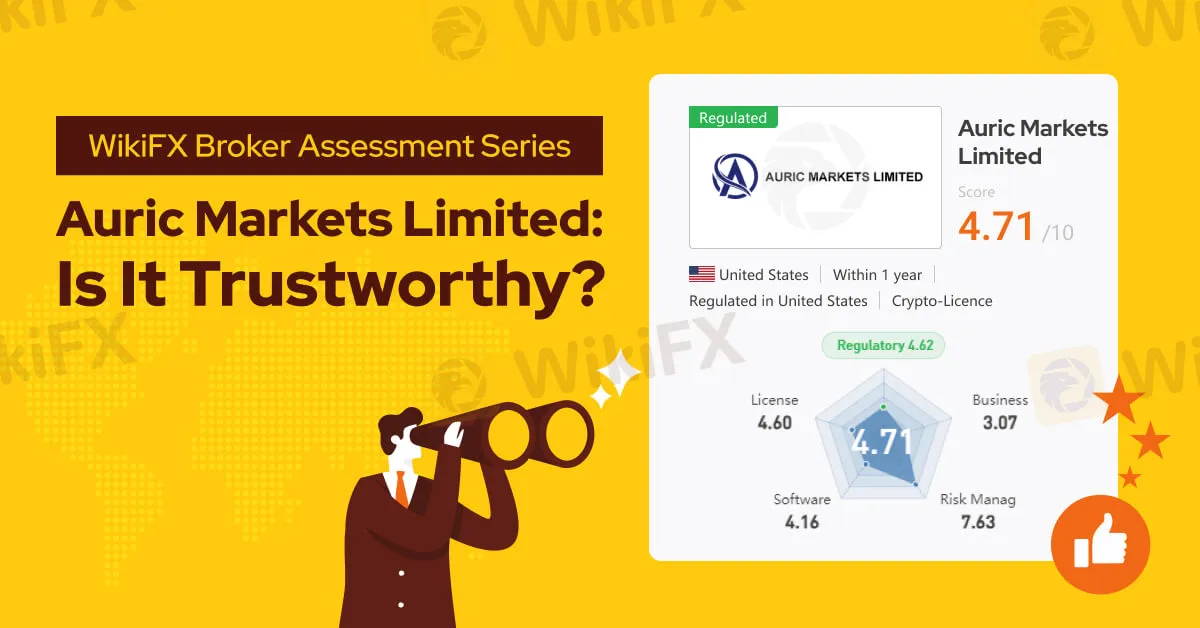

WikiFX Broker Assessment Series | Auric Markets Limited: Is It Trustworthy?

Abstract:In this article, we will conduct a comprehensive examination of Auric Markets Limited, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

In this article, we will conduct a comprehensive examination of Auric Markets Limited, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Background:

Founded in 2023, Auric Markets Limited operates as an online brokerage specializing in the trading of exchange-traded CFDs.

Auric Markets Limited provides a diverse range of tradable assets, covering 62 currency pairs, precious metals (gold and silver), cryptocurrencies (BTC, ETH, BCH, ETC, DASH, and ETC), stock indices, and crude oil.

Upon initial observation, Auric Markets Limited's official website may seem to have a simple and user-friendly design; however, closer examination reveals a lack of critical information, suggesting a lack of full transparency and candour from this broker.

Types of Accounts:

The official website of Auric Markets Limited lacks a detailed breakdown of the offered account types, as well as their corresponding spreads, charges, trading commissions, margin calls, or stop-out levels. Instead, there is only an 'open real account' button located at the top corner of the website.

Deposits and Withdrawals:

No information about the deposit and withdrawal methods offered is found on Auric Markets Limited's official website.

This omission could indicate a lack of transparency because these details are essential for potential clients to make informed decisions about using the platform. Deposit and withdrawal methods are crucial aspects of any trading platform, directly impacting users' ability to fund their accounts and access their funds. Without clear information on these methods, clients may be left in the dark about how they can deposit funds into their accounts or withdraw their profits. This lack of transparency can lead to confusion, frustration, and ultimately erode trust in the platform and its services.

Trading Platforms:

Auric Markets Limited offers the ST5 trading platform, known for its real-time capabilities and comprehensive features. This platform provides traders with concise, flexible, and stable dynamic quote analysis, along with the ability to set technical indicators and utilize an intelligent trading system. With a wide range of functionalities, including customizable indicators and scripts, traders of all levels can implement various trading strategies effectively. ST5 ensures super-fast order execution through interconnected servers to ECN, making it an ideal environment for both manual and automated trading. Moreover, its true ECN connectivity guarantees fair trading conditions, with institutional-grade liquidity and super low spreads, even during volatile market conditions. Additionally, traders benefit from reliable leverage options and customizable trading volumes to suit their individual preferences and trading styles.

Research and Education:

Auric Markets Limited's official website does not offer information on research and educational resources.

Customer Service:

Auric Markets Limited provides 24/5 customer service support in multiple languages, including English, Japanese, Portuguese, Dutch, Thai, Vietnamese, and Chinese. Clients can reach out to Auric Markets Limited via email at support@auricvip.com. The office address stated on the brokers official site is 75 Wall Street, New York, United States. However, no contact number is provided by the broker. Additionally, when WikiFX attempted to contact Auric Markets Limited via its live customer support, it was found that the service was inaccessible.

Conclusion:

To summarize, here's WikiFX's final verdict:

WikiFX, a global forex broker regulatory platform, has assigned Auric Markets Limited a WikiScore of 4.71 out of 10.

Upon examination of Auric Markets Limiteds licenses, WikiFX discovered that the public information on the official website indicates regulation by the Financial Crimes Enforcement Network (FinCEN) with an MSB number of 31000265967159 and by the National Futures Association (NFA) of the USA with an NFA ID of 0562588. WikiFX has verified the legitimacy of the FinCEN license.

However, it was determined that the broker‘s NFA license is unauthorized due to the nature of Auric Markets Limited’s business.

Therefore, WikiFX encourages our users to choose brokers with a higher WikiScore to bolster their protection. We advise investors to opt for brokers known for their transparency, strong regulation, and reputable track record in investment and trading activities to minimize potential asset losses.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Alleged Concerns with TradeEU.global's Trading Practices

An individual trader has come forward with allegations of an unfavourable experience while using the services of the broker TradeEU.global.

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

A 49-year-old e-hailing driver in Malaysia fell victim to a fraudulent investment scheme, losing RM218,000 in a matter of weeks. The scheme, which falsely promised returns of 3 to 5 per cent within just three days, left the individual financially devastated.

SFC Freezes $91M in Client Accounts Amid Fraud Probe

SFC freezes $91M in client accounts at IBHK, SBI, Monmonkey, and Soochow over suspected hacking and market manipulation during unauthorized online trades.

Italian Regulator Warns Against 5 Websites

The Italian regulator, CONSOB has issued a warning against five websites offering unauthorized financial services. This regulatory action aims to protect the public from fraudulent activities.

WikiFX Broker

Latest News

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

Italian Regulator Warns Against 5 Websites

Mastercard's 2030 Vision: Biometric-Driven, Tokenized Payments

SFC Freezes $91M in Client Accounts Amid Fraud Probe

Bybit Launches Gold & FX Treasure Hunt with Real Gold Rewards

Currency Calculator