简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Fusion Markets Levelled Up!

Abstract:Fusion Markets levelled up its trustworthiness alongside its newly obtained Financial Commission membership.

The Financial Commission has recently welcomed Fusion Markets as its newest member, effective March 6th, 2024. This development underscores Fusion Markets' commitment to upholding high standards of dispute resolution and customer service within the forex and CFD trading industry.

The approval of Fusion Markets' membership application by the Financial Commission assures traders that they will receive services of superior quality in line with the commission's standards.

As a new member, Fusion Markets gains access to a range of benefits and services, including the potential protection of their customers for up to €20,000 per submitted complaint.

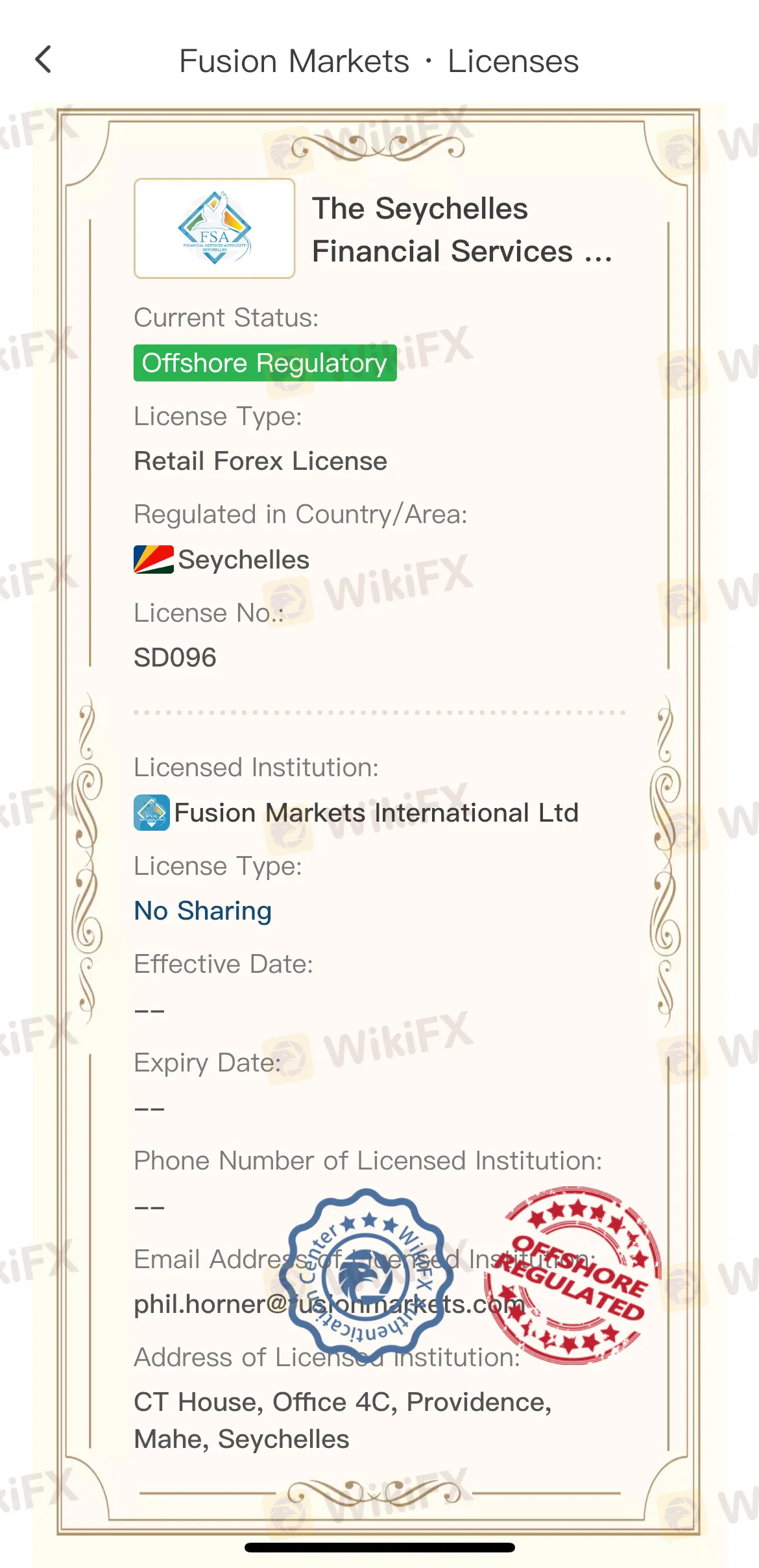

Fusion Markets was established in Melbourne, Australia, in 2017. It has become a trusted and affordable option for traders worldwide. Fusion Markets is known as a low-cost forex broker and provides services for trading in forex, commodities, indices, cryptocurrencies, and stock CFDs. It operates under FMGP Trading Group Pty Ltd, regulated by the Australian Securities and Investments Commission (ASIC) with Australian Financial Services License No. 385620. Additionally, it is also regulated by the Financial Services Authority of Seychelles with license number SD096.

View WikiFXs evaluation on Fusion Markets here: https://www.wikifx.com/en/dealer/4631413251.html

The Financial Commission operates as an independent international service, specializing in resolving trader-broker conflicts. Supported by the Dispute Resolution Committee (DRC), comprised of recognized industry professionals, it provides a streamlined resolution process compared to traditional regulatory channels like arbitration or local court systems. All clients of Financial Commission members are protected by the Compensation Fund, serving as an insurance policy. Furthermore, the Financial Commission issues execution certifications for approved brokers, with the aim of reducing the number of execution-related disputes before escalating into formal complaints.

The Financial Commission's ongoing expansion of its membership reflects the increasing demand for independent and unbiased dispute resolution in the financial trading sector. In line with this, the regulator has released case studies from 2023, providing insights into key themes and outcomes in disputes between traders and financial service providers.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

StoneX Financial Secures General Clearing Membership with ECC

StoneX Group Inc. has announced that its subsidiary, StoneX Financial Limited, has been granted General Clearing Member (GCM) status by European Commodity Clearing AG (ECC).

easyMarkets Kicks Off the Start of Its Trade with the Champions Competition

easyMarkets has launched its Trade with the Champions competition. The event will run from 2 December 2024 to 15 January 2025. It is open to both new and existing traders, offering them a chance to compete and win prizes.

Philippine Peso Could Hit P60 in Early 2025, DBS Says

DBS forecasts the Philippine peso to hit P60 per dollar in early 2025, with factors like US monetary policy and Trump’s trade tariffs affecting the outlook.

MAS Imposes $2.4M Fine on JPMorgan Chase for Misconduct

JPMorgan Chase is fined $2.4 million by MAS for overcharging clients on OTC bond trades, misrepresenting spreads, and unethical actions by relationship managers.

WikiFX Broker

Latest News

Ontario launches major US ad campaign amid Trump's tariff threat

Capital.com Collaborated with Amazon in the UAE

ActivTrades Gains Regulatory License in Mauritius

Ripple’s RLUSD Stablecoin Expected to Launch in NY by Dec. 4

Apple Pay, Google Pay Eyeing Launch in the Philippines

easyMarkets Kicks Off the Start of Its Trade with the Champions Competition

Oil Prices Mixed Amid Accusations of Ceasefire Violations Between Israel and Hezbollah

India's Rs 6,000 Crore Ponzi scam

Philippines Warns Public of Get-Rich-Quick Scams This Christmas

Know Ins & Outs of Prop Trading Firms

Currency Calculator