简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

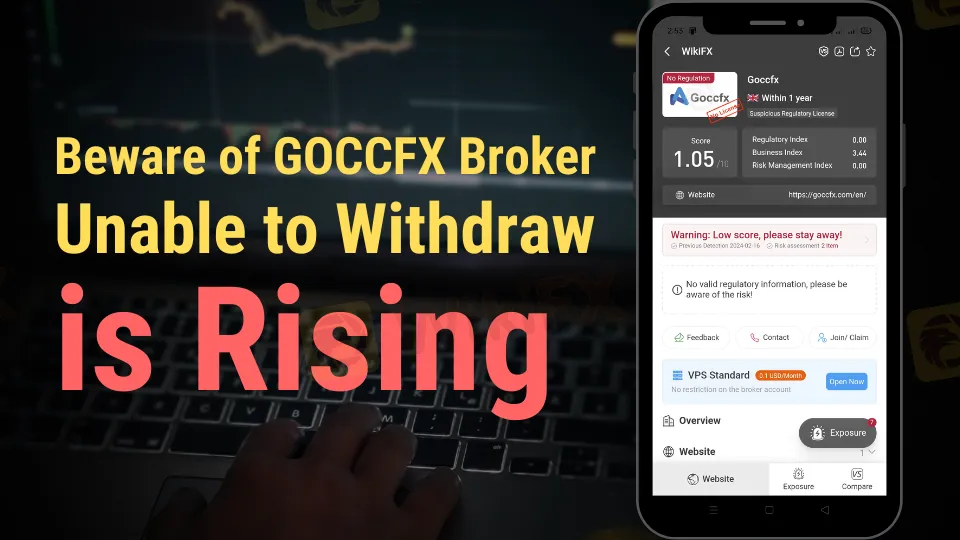

Beware of GOCCFX Broker: Unable to Withdraw is Rising

Abstract:Warning: Goccfx cases highlight risks of unlicensed brokers. Essential to verify broker regulation, understand terms, and approach with caution.

In the fast-paced world of online trading, where chances seem to be endless, the promise of immediate rewards may sometimes mislead investors to possible hazards. This caution becomes much more important when dealing with unlicensed brokers, as shown by the concerning situations involving Goccfx. As of February 15, 2024, two important cases have appeared, underscoring the critical need for trader knowledge and prudence, particularly among those who want anonymity.

The Cases

The first scenario concerns an investor attempting to withdraw cash. After a successful withdrawal, the funds did not appear in their Binance app. Following up with Goccfx, the investor was advised of a hold on their account due to the large withdrawal amount, as well as a demand for a $4,200 charge. Despite paying the money, the investor received a disturbing silence from the system and the helper. This issue raises major concerns regarding Goccfx's operational reliability and customer support response.

In the second situation, an investor had difficulty withdrawing a large sum of over $250,000. After investing for more than two months, the abrupt stop in the withdrawal procedure was unsettling. Though Goccfx's support service ultimately responded, promising to remedy the problem, the lack of prompt action and clarification is alarming. This issue not only jeopardizes the investor's cash but also calls into question the trustworthiness of Goccfx's systems and procedures.

Understanding the Risks of Unregulated Brokers

These incidents highlight the inherent dangers connected with unlicensed brokers such as Goccfx. Due to the absence of regulatory monitoring, such platforms are not subject to the severe norms and standards that safeguard investors in regulated contexts. This lack of regulation may result in improper practices, including but not limited to:

- Lack of Transparency: Unregulated brokers often use opaque operating procedures, making it difficult for investors to comprehend the actual nature of their transactions and the dangers involved.

- Withdrawal Issues: As seen in the examples above, withdrawal issues are a regular problem, often resulting in considerable financial losses for investors.

- Unexpected Costs: Investors may face unannounced or unreasonable costs, as was the case with the $4,200 charge in the first instance.

- Poor Customer Help: Unregulated brokers may provide insufficient customer help, leaving investors with unsolved concerns and little recourse.

- Fraud Danger: Because these platforms are unregulated, there is a higher danger of fraudulent activity, such as scam operations designed to defraud unwary investors.

Caution and Diligence

Given these hazards, investors should take care and do extensive due diligence before dealing with any trading platform, particularly unregulated ones like Goccfx. Here are a few steps to consider:

- Verify Regulatory Status: Always ensure that a broker is regulated by a respectable financial body. This information is usually accessible on the broker's website or via financial regulatory agencies.

- Read Review and Testimonials: Look for reviews and testimonials from other investors to determine the broker's reputation and dependability.

- Understand the terms and conditions. Examine all terms and conditions, paying close attention to withdrawal procedures and cost structures.

- Start with small investments: If you decide to continue, try making a small deposit to evaluate the platform's stability and withdrawal procedures.

- Seek professional advice. Consult with a financial specialist or adviser to help you understand the risks and make educated choices.

To summarize, although the attraction of huge profits might be appealing, the Goccfx instances serve as a clear warning of the hazards hiding in the realm of unregulated internet trading. Investors are advised to access such platforms with care and vigilance, always preferring the safety of their hard-earned money above the questionable promises of unlicensed brokers.

You may access GOCCFX Page for more exposures

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Funded Trader: Reactivates Accounts with Revised Payout Structure

Proprietary trading firm The Funded Trader has detailed its financial recovery efforts following a turbulent period marked by an unsustainable payout model. Addressing these challenges publicly, the firm outlined the steps being taken to resolve outstanding obligations and ensure operational sustainability.

Doo Group Broadens Global Footprint with Indonesian Broker Acquisition

Doo Group has announced its acquisition of PT Prima Tangguharta Futures, a Jakarta-based broker specialising in online derivatives trading. This move represents a significant step in Doo Group's regional expansion strategy and reinforces its growing presence in Southeast Asia.

Google Warns of New Deepfake Scams and Crypto Fraud

Google exposes deepfake scams, crypto fraud, and app cloning trends. Learn how to spot these threats and safeguard your data with expert tips and advice.

Why Is UK Inflation Rising Again Despite Recent Lows?

October inflation rises to 2.3%, driven by energy costs. Renters face 8% annual hikes, while house price inflation climbs. Interest rates stay elevated.

WikiFX Broker

Latest News

WikiEXPO Global Expert Interview: The Future of Financial Regulation and Compliance

DFSA Warns of Fake Loan Approval Scam Using Its Logo

Consob Sounds Alarm: WhatsApp & Telegram Users Vulnerable to Investment Scams

CySEC Revokes UFX Broker Licence as Reliantco Halts Global Operations

GCash, Government to Launch GBonds for Easy Investments

eToro Expands Nationwide Access with New York Launch

Webull Partners with Coinbase to Offer Crypto Futures

Why Is UK Inflation Rising Again Despite Recent Lows?

Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Find Regulated Brokers from A to Z on WikiFX

Currency Calculator