简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Broker Assessment Series | FX Choice: Is It Trustworthy?

Abstract:In this article, we'll look in-depth at FX Choice, examining its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service.

In this article, we'll look in-depth at FX Choice, examining its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX aims to provide you with the information you need to make an informed decision about using this platform.

Background:

Established in 2010, FX Choice Limited is a NDD broker headquartered in Belize, with registration number 000003992 and a registered address at New Horizon Building, Ground Floor, 3 1/2 Miles Philip S.W. Goldson Highway, Belize City. The company claims to be duly authorized by the Financial Services Commission of Belize (FSC).

FX Choice offers a few trading instruments, including currency pairs, shares, commodities, and global indices. Accounts can be denominated in USD, EUR, GBP, AUD, CAD, and Gold, allowing users to conveniently top up accounts while minimizing conversion fees. The broker provides various account options, offering leverage up to 1000 times.

It is important to note that FX Choice does not provide services to residents of jurisdictions where it would be contrary to local laws or regulations. This includes countries such as Afghanistan, Cuba, Iran, North Korea, Syria, the United States, and others listed in their policy.

Types of Accounts:

FX Choice presents a diverse array of account options, including the Classic Account, Optimum Account, and Pro Account.

The Classic Account is a commission-free option, demanding a minimum deposit of 100 USD, featuring spreads starting from 0.5 pips.

The Optimum Account, also commission-free, necessitates a minimum deposit of 10 USD, offering spreads starting from 1.5 pips.

For those seeking a spread-free experience, the Pro Account demands a minimum deposit of 100 USD and applies a commission of USD 3.5 per side.

Detailed information on each account can be found in the attached images below:

Deposit and Withdrawals:

When it comes to funding options, FX Choice offers a variety of payment methods, which is a significant advantage.

The account currency options include USD, EUR, GBP, AUD, CAD, and Gold.

The minimum deposit requirement is set at 10 USD. It's important to note that the availability of deposit and withdrawal methods may vary by country. Certain methods listed may not be accessible in specific regions.

Please refer to the screenshots below for more information:

Trading Platforms:

FX Choice offers traders the versatility of both MetaTrader 4 and 5 platforms, available in various versions, including WebVersion, Desktop Platform, and Apps.

The MetaTrader 4 platform serves as an ideal avenue for international clients engaging in CFD trading across Forex, Indices, Commodities, Crypto, and Shares. Boasting compatibility with Expert Advisors, an extensive selection of crucial symbols, and a comprehensive array of analytical tools, MetaTrader 4 is known for its user-friendly interface, multi-lingual support, and efficient chart analysis tools.

On the other hand, MetaTrader 5, released in 2010 as the successor to MT4, introduces innovative features such as stop limit orders, market depth display, professional charting tools, support for both netting and hedging options, an expanded indicator selection (80+), EA compatibility, and a robust EA testing environment. According to Metaquotes, MT5 is not merely a revamped MT4 but an entirely new platform with distinctive attributes.

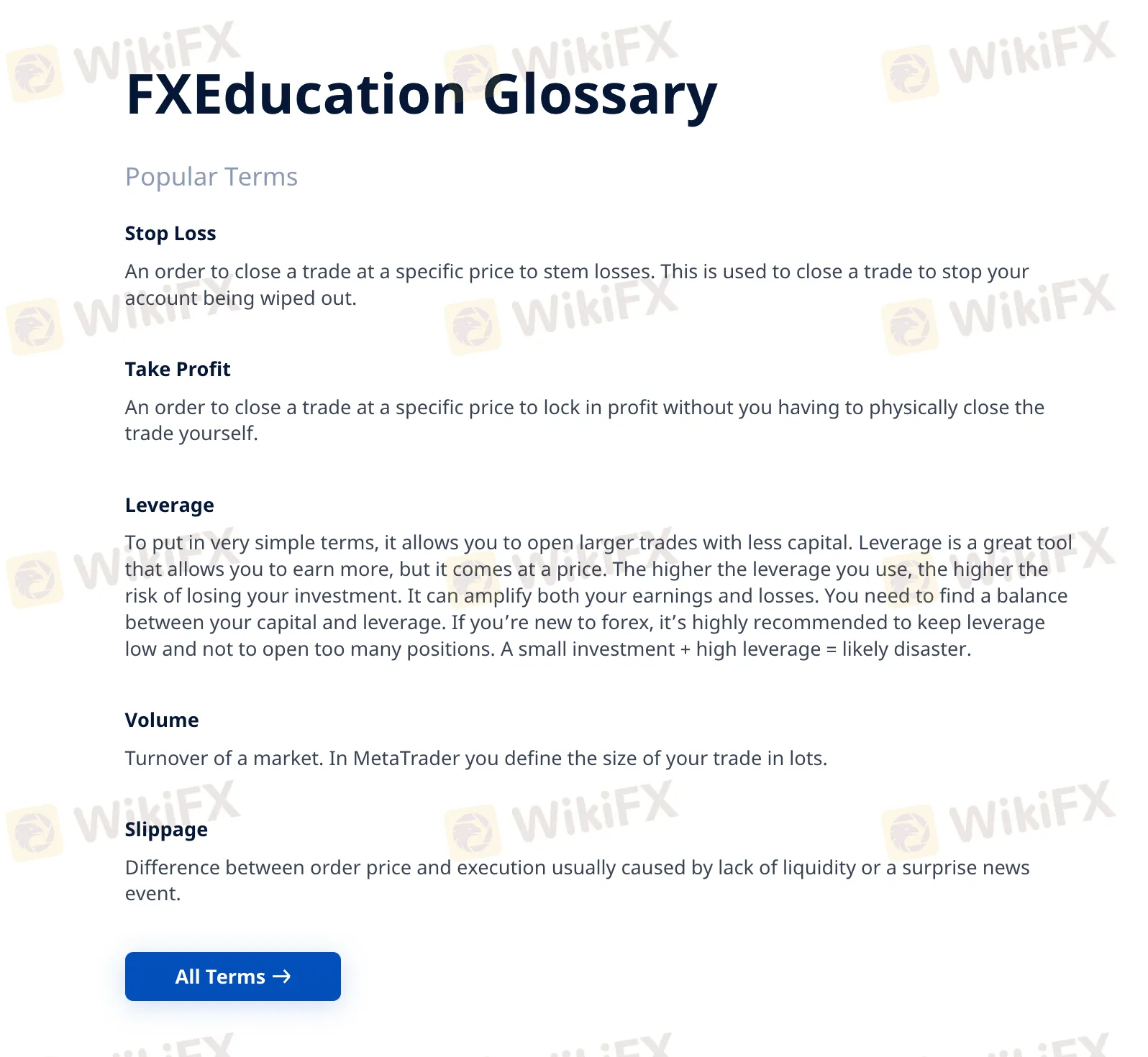

Research & Education:

While FX Choice does provide a dedicated “Research Centre,” it falls short in terms of educational and research materials, offering only fundamental information. In comparison to its industry peers, FX Choice's resources in research and education appear relatively limited.

Customer Service:

FX Choice offers 24/5 customer service support in several foreign languages through its live chat messenger application, including French, English, Portuguese, Arabic, Spanish, Thai, Mandarin and Japanese.

Clients can also contact the broker via email at info@myfxchoice.com, by phone at +52 556 826 8868, or by submitting an inquiry through the broker's question form.

Conclusion:

To summarize, here‘s WikiFX’s final verdict:

WikiFX, a global forex broker regulatory platform, has given FX Choice a WikiScore of 3.32 out of 10, indicating that it is not a highly reliable broker in the forex trading industry.

Despite FX Choice operating under the regulatory oversight of the Financial Services Commission of Belize, it's important to note that this regulatory authority does not hold the status of a tier-1 financial watchdog. Tier-1 regulatory bodies, often associated with major financial markets, are typically characterized by more stringent regulatory standards and higher levels of oversight.

Therefore, traders should be aware that the regulatory framework may not be as comprehensive as those under tier-1 authorities, potentially impacting the level of investor protection and regulatory scrutiny.

It is advisable for investors to carefully consider the regulatory environment and conduct thorough due diligence when choosing a financial services provider.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

The Funded Trader: Reactivates Accounts with Revised Payout Structure

Proprietary trading firm The Funded Trader has detailed its financial recovery efforts following a turbulent period marked by an unsustainable payout model. Addressing these challenges publicly, the firm outlined the steps being taken to resolve outstanding obligations and ensure operational sustainability.

Doo Group Broadens Global Footprint with Indonesian Broker Acquisition

Doo Group has announced its acquisition of PT Prima Tangguharta Futures, a Jakarta-based broker specialising in online derivatives trading. This move represents a significant step in Doo Group's regional expansion strategy and reinforces its growing presence in Southeast Asia.

Webull Partners with Coinbase to Offer Crypto Futures

Webull partners with Coinbase Derivatives to offer crypto futures, providing US investors access to Bitcoin and Ethereum contracts with lower entry barriers.

eToro Expands Nationwide Access with New York Launch

eToro launches in New York, offering fractional stock, ETF, and options trading nationwide. Discover innovative features like copy trading and free education.

WikiFX Broker

Latest News

Webull Partners with Coinbase to Offer Crypto Futures

eToro Expands Nationwide Access with New York Launch

GCash, Government to Launch GBonds for Easy Investments

WikiEXPO Global Expert Interview: The Future of Financial Regulation and Compliance

DFSA Warns of Fake Loan Approval Scam Using Its Logo

Consob Sounds Alarm: WhatsApp & Telegram Users Vulnerable to Investment Scams

CySEC Revokes UFX Broker Licence as Reliantco Halts Global Operations

Why Is UK Inflation Rising Again Despite Recent Lows?

Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Find Regulated Brokers from A to Z on WikiFX

Currency Calculator