简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

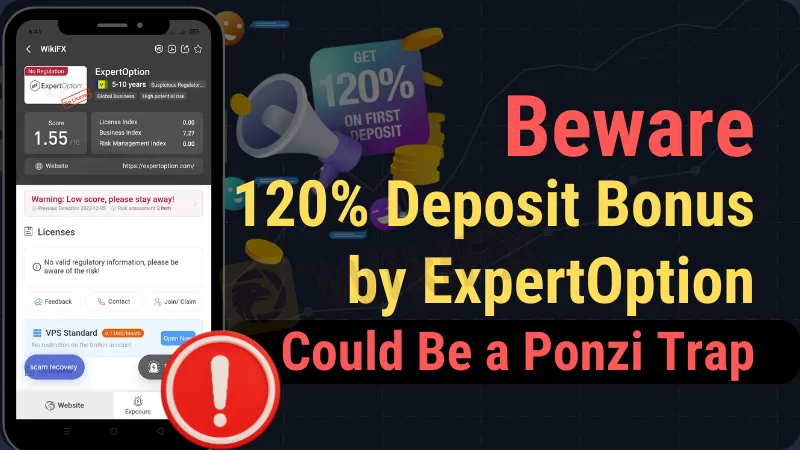

Beware: 120% Deposit Bonus by ExpertOption, Could Be a Ponzi Trap

Abstract:Warning: ExpertOption's 120% Deposit Bonus - Unregulated Broker Risks Uncovered! Protect Your Investments Immediately!

Online trading can be a risky endeavor, especially when an unregulated broker offers an enticing bonus. The eye-catching 120% deposit bonus presented by ExpertOption has been making waves on social media and is being promoted by individuals involved in online trading. What is very confusing is that you can only access this bonus through a referral link provided by a registered individual. This situation may seem suspicious, so let's dive into the possibilities behind ExpertOption's strategy.

ExpertOption Overview and Regulatory Status

ExpertOption is an online trading platform that offers Social Trading with access to over 100+ assets to be traded. When it comes to assessing the legitimacy of this broker, their official website does not mention any affiliation with a specific regulatory body. Instead, they proudly state that their office is located in St. Vincent and the Grenadines, a country that has recently prohibited all trading activities and brokerage as of February 3, 2022. According to the WikiFX App database, ExpertOption has never been regulated by any known regulatory authority.

Possible Risks of Investing with an Unregulated Broker like ExpertOption

Investing with an unregulated broker carries inherent risks that every trader should be aware of. Here are some of the potential dangers associated with trading on platforms like ExpertOption:

Lack of Investor Protection: Regulatory bodies exist to safeguard the interests of investors. When you trade with an unregulated broker, you are left without the protections that come with regulated platforms. In case of disputes or issues, you may have limited recourse.

Fund Safety Concerns: Unregulated brokers may not adhere to strict financial standards and safeguards, putting your deposited funds at risk. There is no guarantee that your money is safe with such brokers.

Transparency Issues: Transparency is crucial in the trading world. Unregulated brokers may not disclose important information about their operations, making it difficult to assess their trustworthiness.

Risk of Fraud and Scams: Unregulated brokers are more susceptible to fraudulent activities and scams. Traders may encounter unfair practices, including manipulation of prices and delayed withdrawals.

How to Avoid Falling into a Potential Trap

To protect yourself from the risks associated with unregulated brokers like ExpertOption, here are some steps to follow:

Research Thoroughly: Before choosing a trading platform, conduct extensive research. Look for brokers with a solid reputation and a history of regulatory compliance.

Check for Regulation: Verify if the broker is regulated by a recognized authority. Regulated brokers are held to higher standards and are subject to regular audits.

Read User Reviews: Seek out reviews and feedback from other traders who have used the platform. Their experiences can provide valuable insights into the broker's reliability.

Avoid Unrealistic Promotions: Be cautious of brokers offering bonuses and promotions that seem too good to be true, like the 120% deposit bonus from ExpertOption. Such offers may be bait to lure unsuspecting traders.

Use Caution with Referral Links: If a referral link is required to access a bonus, be sure to verify the legitimacy of the person providing it. Only use referral links from trusted sources.

Conclusion

In the world of online trading, caution is paramount. The 120% deposit bonus offered by ExpertOption may seem tempting, but it is essential to consider the risks associated with unregulated brokers. Lack of regulatory oversight can leave traders vulnerable to various pitfalls, including fraud and loss of funds. To safeguard your investments, prioritize due diligence, opt for regulated brokers, and exercise vigilance when evaluating offers that appear too generous to be true. Remember that protecting your investments is key to a successful trading experience.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

What Makes Cross-Border Payments Easier Than Ever?

Cross-border payments are now faster, cheaper, and simpler! Explore fintech, blockchain, and smart solutions to overcome costs, delays, and global payment hurdles.

Solana Soars to All-Time High, Hits $264 on Coinbase

Solana hits $264 on Coinbase, breaking its 3-year high with an 11% daily surge. Learn what’s driving SOL's meteoric rise and the crypto market rally.

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

The UK Financial Conduct Authority (FCA) has issued a public warning regarding a fraudulent entity impersonating Admiral Markets, a legitimate and authorised trading firm. The clone firm, operating under the name Admiral EU Brokers and the domain Admiraleubrokerz.com, has been falsely presenting itself as an FCA-authorised business.

Malaysian Man Loses RM113,000 in Foreign Currency Investment Scam

A 57-year-old Malaysian man recently fell victim to a fraudulent foreign currency investment scheme, losing RM113,000 in the process. The case was reported to the Commercial Crime Investigation Division in Batu Pahat, which is now investigating the incident.

WikiFX Broker

Latest News

Webull Partners with Coinbase to Offer Crypto Futures

eToro Expands Nationwide Access with New York Launch

Why Is UK Inflation Rising Again Despite Recent Lows?

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Google Warns of New Deepfake Scams and Crypto Fraud

Currency Calculator