简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Alert: FXPrimus Withdrawal Issues Increasing

Abstract:Alert: Rising FXPrimus withdrawal issues reported by traders. Learn about the risks and trader experiences with this online trading platform.

In the world of online trading, the safety and security of investments are paramount. Unfortunately, recent developments have raised serious concerns regarding FXPrimus, a company that has been marketed aggressively to traders worldwide. This article aims to shed light on the alarming trend of withdrawal issues associated with FXPrimus, urging traders to exercise caution and vigilance.

Concerned Cases

Case 1: Denied Withdrawals and Severed Communication

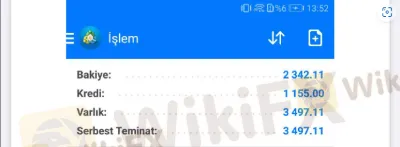

A troubling account comes from a trader who has deposited funds with FXPrimus twice, only to find their account balance lower than the initial deposit. Despite attempts to withdraw the remaining funds, FXPrimus has not only refused the withdrawal but also ceased all communication with the trader. This behavior points to a disturbing pattern of unresponsiveness and potential fraud, especially considering similar complaints from numerous investors in Turkey.

The Sad Reality

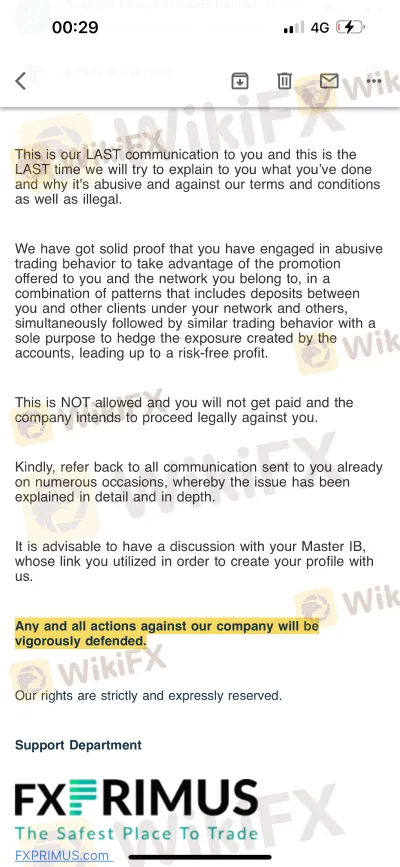

Adding insult to injury, FXPrimus sent an email to the trader, unashamedly stating their decision to discontinue any communication. This action reveals a blatant disregard for client welfare and a clear indication of the company's reluctance or refusal to return funds to its clients.

Case 2: Unresolved Withdrawal Requests

Another case echoes the same sentiment: a trader unable to retrieve their funds from FXPrimus, calling for intervention in what they describe as a blatant fraud. This case is not isolated, as WikiFX Support has also reported multiple instances where FXPrimus has halted withdrawal requests, further substantiating the claims of unfair practices.

Related Article:

Broader Implications

The increasing reports of withdrawal issues with FXPrimus are not just individual cases of dissatisfaction but indicative of a larger, more systemic problem within the company. Such practices not only jeopardize the financial security of traders but also undermine the trust and integrity crucial to the online trading community.

For traders, especially those who are currently engaged with or considering FXPrimus as their trading platform, these revelations are a red flag. The core of any financial service should be reliability and transparency, particularly when it involves the handling of personal funds. The increasing number of withdrawal-related complaints against FXPrimus suggests a significant deviation from these principles.

Recommendations for Traders

Vigilance and Research: Always conduct thorough research into a trading platforms history, customer reviews, and regulatory status before investing.

Diversification: Avoid putting all your funds in one platform. Diversification can help mitigate risks associated with any single company.

Regular Monitoring: Keep a close watch on your account balance and any discrepancies that may arise.

Legal Consultation: In cases of suspected fraud or financial misconduct, seeking legal advice can provide guidance on how to proceed.

Bottom Line

The increasing number of withdrawal issues reported against FXPrimus paints a concerning picture for traders. These cases highlight a potential pattern of misconduct and lack of accountability by FXPrimus, urging traders to exercise extreme caution. As the online trading environment continues to evolve, the importance of choosing a reliable and transparent trading platform cannot be overstated. Traders are advised to stay informed, vigilant, and proactive in safeguarding their investments.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Alleged Concerns with TradeEU.global's Trading Practices

An individual trader has come forward with allegations of an unfavourable experience while using the services of the broker TradeEU.global.

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

A 49-year-old e-hailing driver in Malaysia fell victim to a fraudulent investment scheme, losing RM218,000 in a matter of weeks. The scheme, which falsely promised returns of 3 to 5 per cent within just three days, left the individual financially devastated.

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

SEC fines three broker-dealers $275K for filing deficient Suspicious Activity Reports, highlighting the importance of compliance with SAR filing regulations.

Mastercard's 2030 Vision: Biometric-Driven, Tokenized Payments

Mastercard’s tokenized future will eliminate card numbers and passwords by 2030, ensuring seamless, secure, and biometric-driven online shopping experiences.

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Italian Regulator Warns Against 5 Websites

Mastercard's 2030 Vision: Biometric-Driven, Tokenized Payments

SFC Freezes $91M in Client Accounts Amid Fraud Probe

Currency Calculator