简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

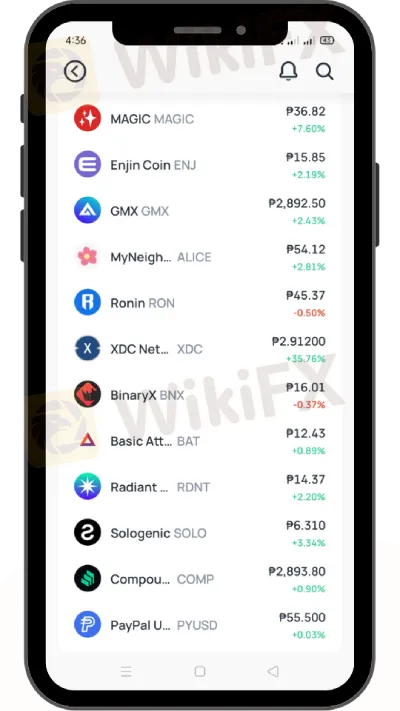

Coins.ph Added Paypal Stablecoin as Traded Assets

Abstract:Coins.ph, a leading Filipino cryptocurrency exchange, has integrated PayPal's stablecoin, $PYUSD, into its platform. $PYUSD, launched by PayPal in 2023 and pegged to the U.S. dollar, is designed to provide stability in digital transactions, particularly for cross-border transfers. This integration offers Coins.ph's 18 million users a seamless way to conduct international transactions with zero trading fees for the PYUSD/PHP pair. The process involves simple steps for buying, receiving, and cashing out $PYUSD. This move highlights a significant advancement in blockchain technology and its practical application in financial transactions.

In a significant move to enhance the capabilities of digital transactions and remittances, Coins.ph, a renowned Filipino cryptocurrency exchange platform, has proudly introduced the integration of PayPal's stablecoin, $PYUSD, into its services. This integration marks a major advancement in the field of blockchain technology, especially for cross-border transfers.

Transforming Digital Transactions with $PYUSD

$PYUSD, also known as PayPalUSD, is a stablecoin pegged to the U.S. dollar, launched by PayPal in 2023. This digital currency is designed to provide stability and reliability in digital transactions, making it an ideal choice for cross-border transfers. Developed in collaboration with Paxos, a leader in digital asset issuance, $PYUSD operates on the Ethereum blockchain and is specifically tailored for digital payments and web3 applications.

Benefits for Coins.ph Users

The integration of $PYUSD into Coins.ph offers its 18 million Filipino users an incredibly seamless and efficient way to perform cross-border transfers. This initiative is particularly beneficial for those who regularly engage in international transactions. To further support this development, Coins.ph has announced the removal of trading fees for the PYUSD/PHP trading pair, enabling users to buy and sell $PYUSD with zero trading fees through the platform's Convert and Pro features.

Coins.ph has streamlined the process of buying $PYUSD. Users first need to register and verify their account with a valid ID. Following account verification, they can easily cash in through various banks and e-wallets to start purchasing $PYUSD. The process involves simple steps on both Coins.ph and Coins Pro platforms, ensuring a user-friendly experience.

Receiving and Cashing Out $PYUSD

Receiving $PYUSD from PayPal to Coins.ph is straightforward. Users simply select $PYUSD in PayPals crypto section, enter the amount, and specify their Coins wallet address for the transfer. Similarly, cashing out $PYUSD involves converting it to PHP and then transferring the funds to banks or e-wallets through Instapay or PesoNet.

The launch of $PYUSD has drawn attention from U.S. regulators, concerned about the potential impact of a major tech platform‘s token on financial stability. In response, PayPal has been actively communicating with the U.S. SEC’s Division of Enforcement to ensure compliance and transparency.

A Step Forward in Blockchain Technology

Coins.ph's adoption of $PYUSD represents a significant leap forward in utilizing blockchain technology for practical, everyday financial transactions. This move not only enhances the user experience for its Filipino users but also sets a precedent for the integration of stablecoins in mainstream financial transactions.

For more information about this exciting development and to start using $PYUSD on Coins.ph, please visit our website or contact our support team.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

What Makes Cross-Border Payments Easier Than Ever?

Cross-border payments are now faster, cheaper, and simpler! Explore fintech, blockchain, and smart solutions to overcome costs, delays, and global payment hurdles.

Coinbase Under Scrutiny Amid Wrapped Bitcoin Delisting Controversy

Coinbase has come under fire after announcing its decision to delist Wrapped Bitcoin (wBTC), a move critics claim could be driven by competitive interests. The delisting, set to take effect on 19 December, has sparked allegations of market manipulation and concerns about fairness in the cryptocurrency ecosystem.

Solana Soars to All-Time High, Hits $264 on Coinbase

Solana hits $264 on Coinbase, breaking its 3-year high with an 11% daily surge. Learn what’s driving SOL's meteoric rise and the crypto market rally.

Mastercard Partners with JPMorgan for B2B Cross-Border Payments

Mastercard and JPMorgan's Kinexys Digital Payments join forces to enhance B2B cross-border payments, promising faster settlements and greater transparency.

WikiFX Broker

Latest News

Webull Partners with Coinbase to Offer Crypto Futures

eToro Expands Nationwide Access with New York Launch

Why Is UK Inflation Rising Again Despite Recent Lows?

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Google Warns of New Deepfake Scams and Crypto Fraud

Currency Calculator