简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Best High Leverage Forex Brokers for 2023

Abstract:Forex leverage provides traders with the ability to manage larger positions using a smaller capital investment.

It involves borrowing funds to trade a greater volume of currency than what would be feasible with one's own funds alone.

The leverage amount accessible to a trader is typically determined by their chosen broker. Different forex brokers offer varying levels of leverage, with some providing high leverage options and others offering lower leverage. Selecting a broker that offers an appropriate level of leverage aligned with your trading experience and risk tolerance is crucial.

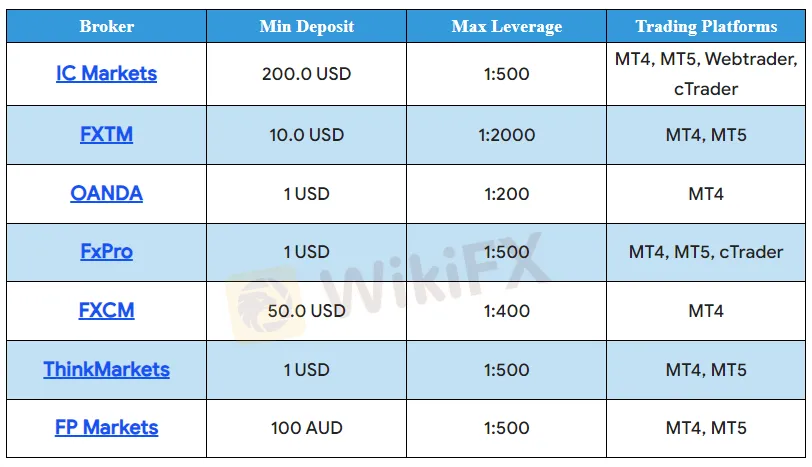

Comparison of the Best Forex Brokers With High Leverage for 2023

In this comprehensive guide, we present a detailed comparison of the top high leverage brokers for the year 2023. Discover the finest brokers that offer high leverage, competitive fees, and support for a wide range of markets. Explore the benefits of trading with high leverage, which allows traders to enter positions without having to fully cover the value of the assets. This feature is particularly advantageous for various trading strategies, including day trading.

What is Leverage in Forex Trading?

Leverage is a widely used term in the Forex market and plays a significant role in shaping investors' decisions when selecting a suitable FX broker. It refers to the ability to leverage one's account balance, essentially borrowing funds from the broker to place trades. This allows traders to control larger positions with a relatively small investment.

To illustrate, suppose you possess a $100 account and employ a leverage ratio of 100:1. With this leverage, you have the ability to control a position worth $10,000. Consequently, for every $1 movement in your favor within the market, you can potentially earn a profit of $100.

While Forex leverage presents an opportunity to potentially increase profits, it's important to remember that it can also amplify losses. The leverage ratio determines how much a trader can increase their position size. Different Forex brokers offer varying levels of leverage, and it is crucial for traders to fully grasp the associated risks. It is advisable to choose an appropriate leverage ratio that aligns with their risk tolerance and trading strategy. By doing so, traders can make informed decisions and navigate the Forex market more effectively.

The Essence of High Leverage Trading

High leverage forex trading offers traders the opportunity to enhance trading volume and potential profits by accessing borrowed funds from their broker. By utilizing high leverage, traders can control larger positions in the market while making a relatively small initial investment. This advantage is particularly beneficial for active traders who aim to capitalize on market fluctuations and explore various trading prospects.

However, it is crucial to acknowledge that high leverage also comes with increased risk. Losses can be amplified in line with the leverage ratio, making it essential for traders to exercise caution.

Successful engagement in high leverage forex trading necessitates a comprehensive understanding of leverage, the implementation of effective risk management strategies, and a commitment to continuous learning to stay abreast of the dynamic forex market. By prioritizing these factors, traders can navigate the market with greater confidence and optimize their trading outcomes.

Whats the Highest Leverage Available by Regulation?

The highest leverage currently offered in the global forex trading market is 3000:1, although it is important to note that this level of leverage is not commonly available and is often provided by offshore brokers. The specific leverage available to traders depends on the broker they are using and the regulatory framework under which they operate. The table below provides an overview of the leverage options available in various major jurisdictions.

In general, leverage in forex trading typically ranges from 50:1 to 400:1. However, certain regulators impose stricter limitations on leverage. For instance, in regions such as the UK, EU, and Australia, non-professional traders are subject to a maximum leverage of 30:1.

Whats the Difference Between Leverage for Retail & Institutional Traders?

The leverage options for retail and institutional traders differ in terms of capital accessibility, regulations, and limitations.

Retail forex traders are individuals who participate in forex trading through retail brokerage accounts. While they can access the forex market, their leverage options are often restricted and subject to regulatory limitations.

Retail traders typically have a maximum leverage ratio, such as 50:1 in the United States, meaning they can control up to 50 times their capital in trading volume. Compared to institutional traders, retail traders often possess lower capital resources and are subjected to stricter regulations, including the pattern day trader rule which restricts the number of intraday trades they can make with smaller accounts.

On the other hand, institutional forex traders consist of larger entities such as banks, hedge funds, and asset management firms. They operate under different trading arrangements compared to retail traders. Institutional traders generally have access to higher leverage ratios and larger capital resources.

They are not bound by the same regulations as retail traders, which grants them greater flexibility in their trading strategies. Moreover, institutional traders have the advantage of trading in larger quantities, potentially influencing currency prices. However, they may also have investment mandates and specific restrictions to adhere to.

It is worth noting that the gap between retail and institutional forex trading has diminished in recent years due to technological advancements. Retail traders now have access to derivative products like Contracts for Difference (CFDs), which were originally utilized by institutional traders. Nevertheless, the leverage and capital requirements for retail traders continue to be subject to regulatory limitations.

How to Choose A High Leverage Forex Broker?

When selecting a high leverage forex broker, there are several important factors to take into consideration.

1. Conduct thorough research

Begin by conducting thorough research to identify reputable forex brokers that offer high leverage options. Look for brokers that are regulated by recognized authorities and have a strong reputation in the industry.

2. Evaluate leverage options

Pay close attention to the leverage ratios offered by brokers. Different brokers may offer varying leverage ratios, so it is crucial to compare and choose a broker that offers leverage ratios that align with your trading strategy and risk tolerance. Keep in mind that higher leverage can magnify both profits and losses.

3. Ensure regulatory compliance

Different countries have different regulatory authorities that impose rules and regulations on brokers. These regulations include leverage levels, minimum capital requirements, reporting obligations, and investor protection measures. It is crucial to be aware of the regulations specific to your jurisdiction and ensure that the broker you choose complies with these regulations.

4. Assess trading platforms

Take the time to assess the trading platforms offered by different brokers. Look for platforms that are user-friendly and offer a wide range of features and tools to assist you in your trading activities. Additionally, consider choosing a broker that provides a mobile trading app for convenient trading on the go.

5. Review fees and commissions

Carefully review the fees and commissions charged by each broker. Some brokers may have higher fees or wider spreads, so it is crucial to understand the cost structure and how it aligns with your trading style.

What is the Relationship Between Leverage and Margin Requirements?

The correlation between leverage and margin requirements is tightly linked within the realm of trading. Leverage represents the augmented trading capability that becomes accessible when utilizing a margin account. Conversely, margin requirements signify the monetary sum that traders are obligated to deposit as collateral for initiating and sustaining leveraged positions.

The degree of leverage ratio directly impacts the trading power and risk involved. As the leverage ratio increases, so does the trading power, but the risk factor also escalates. Margin requirements are calculated as a percentage of the total position value, mandating traders to deposit a specific amount as collateral. For instance, if a broker enforces a 1% margin requirement, a trader would need to deposit $1,000 to open a position valued at $100,000. The margin requirement acts as a protective measure for brokers and safeguards against potential losses.

To summarize, leverage materializes as a consequence of utilizing margin, empowering traders to control larger trade sizes. Meanwhile, margin requirements ascertain the collateral funds that traders must deposit to initiate and sustain leveraged positions. Understanding the relationship between leverage and margin requirements is pivotal for traders to effectively manage risk and make well-informed trading decisions.

Why Leveraged Trading is Beneficial?

Leveraged forex trading offers numerous advantages to traders. By utilizing leverage, traders can control larger positions using a smaller amount of capital, leading to the potential for significant profits even with small price movements. Moreover, leveraged trading provides access to markets that typically require substantial initial investments, particularly in the forex market where leverage ratios tend to be higher compared to other financial instruments. This allows traders to participate in larger trading opportunities and potentially capitalize on market movements.

Another benefit of leveraged trading is the ability to profit from both rising and falling markets. By going short, traders can take advantage of downward price movements and potentially generate profits even in bearish market conditions.

Furthermore, leverage empowers traders by increasing their purchasing power and enabling them to trade larger positions than their account balance would typically allow. This expanded trading capacity not only enhances flexibility in executing trading strategies but also opens up additional trading opportunities that may have been inaccessible otherwise.

What is Considered a Good Leverage Amount in Forex Trading?

In the realm of forex trading, leverage ratios tend to be substantially higher than those in other financial instruments. It is not uncommon to encounter leverage ratios of 50:1 to 100:1, or even higher, in the forex market.

However, determining the suitable leverage amount hinges on factors such as a trader's risk tolerance, experience level, and preferred trading strategy. Novice traders, in particular, are often advised to exercise caution and start with lower leverage ratios, gradually increasing them as they accumulate more experience and confidence.

It is of utmost importance to thoroughly contemplate the potential risks and rewards associated with leverage, while also implementing effective risk management techniques when utilizing leverage in forex trading.

Forex Spreads and Trading Costs

When executing trades, traders must carefully consider leverage and trade costs as they play crucial roles. Leverage empowers traders to control larger positions with a smaller capital investment, while trade costs encompass the fees paid to brokers for executing trades.

The relationship between leverage and trade costs is multifaceted and influenced by various factors, including trade type, trade size, and the chosen leverage ratio. In general, higher leverage ratios tend to result in higher trade costs. This is because brokers assume greater risk when traders utilize leverage, leading them to charge higher fees to compensate for this heightened risk exposure.

To mitigate the impact of leverage on trade costs, there are a few strategies that traders can employ. One approach is to opt for a lower leverage ratio, reducing the level of risk assumed by the broker and subsequently leading to lower fees. Another way to minimize the impact of leverage on trade costs is to choose a market maker broker. Market makers typically charge lower fees compared to other types of brokers, making them a potentially cost-effective option.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

WikiEXPO Dubai 2024 is coming soon

3 Days Left!

Trader Exposes Unethical Practices by STP Trading

A recent allegation against STP Trading has cast doubt on the firm's business practices, highlighting the potential risks faced by retail traders in an increasingly crowded and competitive market.

What Makes Cross-Border Payments Easier Than Ever?

Cross-border payments are now faster, cheaper, and simpler! Explore fintech, blockchain, and smart solutions to overcome costs, delays, and global payment hurdles.

WikiEXPO Dubai 2024 is set to open!

4 Days Left

WikiFX Broker

Latest News

Webull Partners with Coinbase to Offer Crypto Futures

eToro Expands Nationwide Access with New York Launch

Why Is UK Inflation Rising Again Despite Recent Lows?

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Google Warns of New Deepfake Scams and Crypto Fraud

Currency Calculator