简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

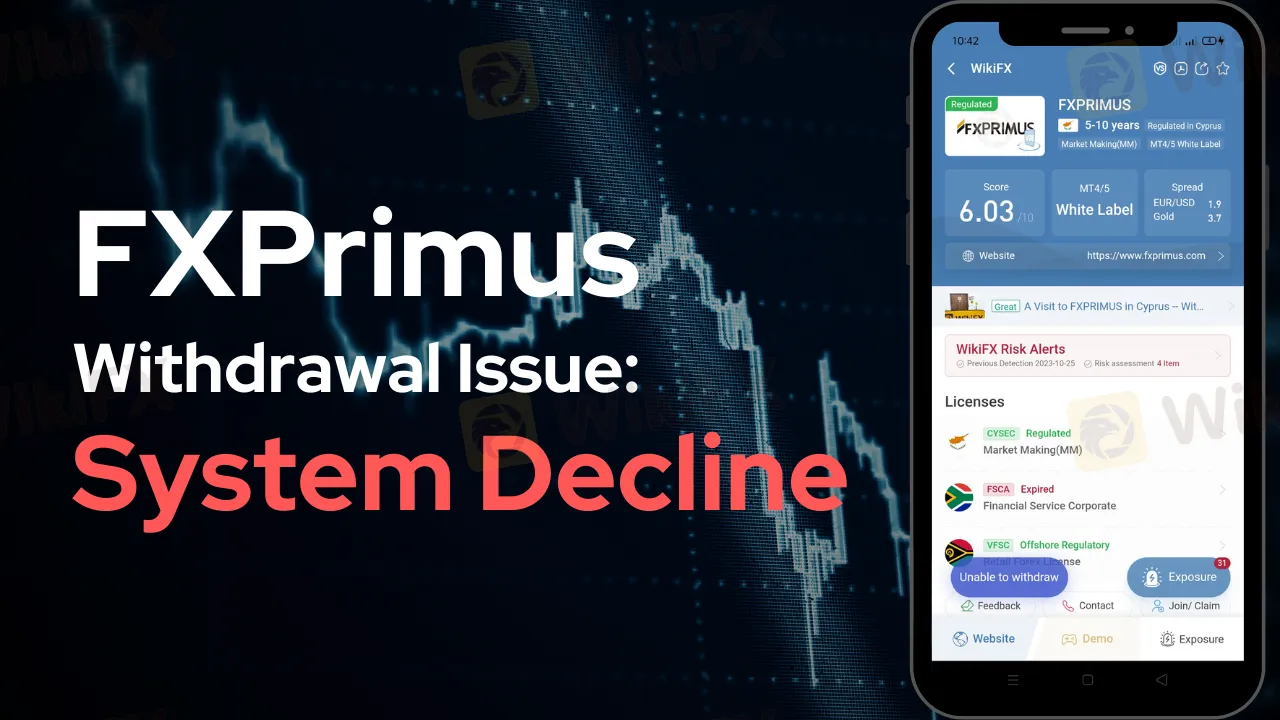

FXPrimus Withdrawal Issue: System Decline

Abstract:An anonymous trader alleges FXPrimus is withholding a profit of $8870, citing issues with the customer panel. This raises concerns about the broker's reliability despite its regulatory status and market reputation. Such incidents can impact trust within the trading community. Prompt resolution is crucial for both the trader's rightful earnings and FXPrimus's market standing.

In the intricate world of online forex trading, numerous concerns often arise among traders, both experienced and new. At the heart of these is the necessity for reliable brokers that uphold the trust and confidence of their users. FXPrimus is one such name in the industry that has built a reputation for itself. However, even the most esteemed entities can sometimes face issues that can potentially tarnish their image. One such concern has recently come to light.

The Concern

An anonymous trader has reached out, drawing attention to an unsettling experience with FXPrimus. They claim that the broker is holding back a considerable amount - 8870 USD to be precise. This amount was profited from an investment the trader made on their account with the login number 4614490. The trader expected a smooth withdrawal process, given FXPrimus's regulatory status and positive reputation in the market. However, contrary to expectations, they encountered a hurdle when they were informed of a problem with the customer panel, making it impossible for them to access and withdraw their funds.

“[...] FXPrimus company does not pay the 8870 USD profit I earned after the investment I made to my account with login number 4614490. I would be glad if you could help me withdraw my money by saying there is a problem with the customer panel.” - Anonymous Trader

What Does This Mean for FXPrimus?

Given their status in the market, this issue has the potential to dent FXPrimus's reputation. Trust and reliability are paramount in the trading world, especially when significant amounts of money are involved. FXPrimus, being a regulated broker, is bound by several regulatory guidelines and has an obligation to its customers.

Traders put their hard-earned money into these platforms, anticipating not just profit but also seamless service, which includes hassle-free withdrawals. Anomalies, like the one stated, can lead to skepticism among potential and current users.

What's Next?

It is essential for both parties involved - the trader and FXPrimus - to address this situation promptly. For the trader, it's about retrieving their rightfully earned profit. For FXPrimus, it's a matter of upholding their trust and standing in the market.

We really hope that the concerned trader and FXPrimus can reach an agreement. Brokers must understand that each event, no matter how isolated, has repercussions for the worldwide trading community. At the same time, we encourage traders to maintain detailed records of their transactions and interactions to ensure they have the appropriate proof in the event of a dispute.

Note: We encourage traders to do their own research, stay informed, and never hesitate to bring such issues to light. It not only helps them but also contributes to a transparent and reliable trading ecosystem.

You may access all the complaints sent by FXPrimus traders.

Link: https://www.wikifx.com/en/dealer/4051155469.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Alleged Concerns with TradeEU.global's Trading Practices

An individual trader has come forward with allegations of an unfavourable experience while using the services of the broker TradeEU.global.

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

A 49-year-old e-hailing driver in Malaysia fell victim to a fraudulent investment scheme, losing RM218,000 in a matter of weeks. The scheme, which falsely promised returns of 3 to 5 per cent within just three days, left the individual financially devastated.

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

SEC fines three broker-dealers $275K for filing deficient Suspicious Activity Reports, highlighting the importance of compliance with SAR filing regulations.

Mastercard's 2030 Vision: Biometric-Driven, Tokenized Payments

Mastercard’s tokenized future will eliminate card numbers and passwords by 2030, ensuring seamless, secure, and biometric-driven online shopping experiences.

WikiFX Broker

Latest News

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Italian Regulator Warns Against 5 Websites

Mastercard's 2030 Vision: Biometric-Driven, Tokenized Payments

SFC Freezes $91M in Client Accounts Amid Fraud Probe

Currency Calculator