简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

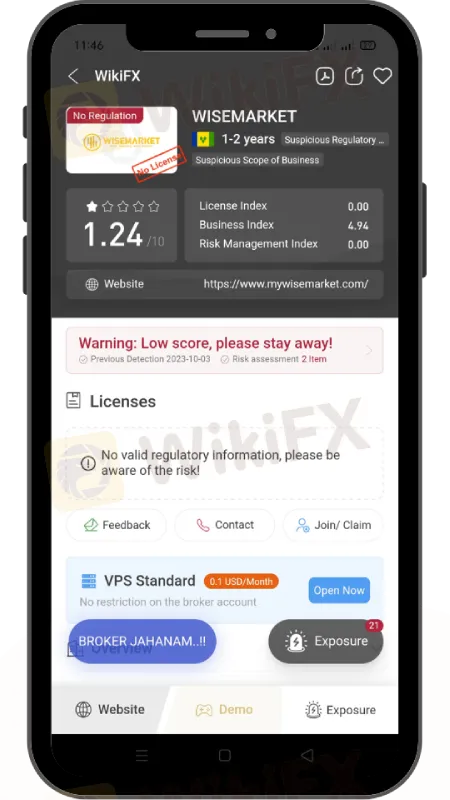

Beware of WiseMarket: Scam Concerns Grow as Investors Face Withdrawal Issues

Abstract:Beware of WiseMarket's withdrawal issues! Learn how to avoid scams with WikiFX. Get broker verification, user reviews, and educational resources to protect your forex investments.

Online trading can be a promising venture, but recent disturbing reports surrounding WiseMarket, a popular CFD trading broker in Malaysia, have raised red flags. This article aims to provide a clear and informative account of the escalating withdrawal problems plaguing WiseMarket users and highlights the importance of avoiding unregulated brokers.

In recent times, a disconcerting trend has emerged within the WiseMarket community. Several investors have come forward to share their harrowing experiences with withdrawal issues, leaving them anxious and frustrated. The first victim, eager to receive their approved withdrawal, was left in suspense as the funds failed to materialize in their bank account. Despite their repeated attempts to contact WiseMarket, all they received were generic responses, sparking fears of falling victim to a scam.

A similar narrative unfolded for a second victim who withdrew a substantial sum, only to witness it deducted from her trading account without ever reaching her bank account. Desperate for assistance, she sought support from WiseMarket but found none. The third victim, after obtaining withdrawal approval, found his bank account empty, adding to the growing list of grievances against WiseMarket. These unsettling stories paint a grim picture, leaving users grappling with seemingly insurmountable withdrawal problems.

As these complaints continue to surface, the pressing question remains: How will WiseMarket address these concerns, and can users trust them with their hard-earned money? In light of these alarming reports, potential investors are strongly advised to exercise caution and conduct thorough research before engaging with platforms like WiseMarket. It's crucial to resist the allure of tempting deposit bonuses and prioritize safety over fleeting gains in the digital realm.

While online trading offers exciting opportunities, it also presents pitfalls. The ongoing withdrawal issues at WiseMarket serve as a cautionary tale, underscoring the importance of vigilance, research, and prompt action in all online financial activities.

Insights: How WikiFX Can Safeguard New Investors in Forex Trading

For aspiring investors or traders looking to try their luck in the world of forex trading, avoiding scams and unregulated brokers is paramount. In this digital age, having a trustworthy resource to verify the legitimacy of trading platforms is invaluable. That's where WikiFX comes in.

WikiFX, a comprehensive forex broker review platform, offers a wealth of information to help new investors navigate the forex market safely and avoid falling victim to scams. Here's how WikiFX can be a valuable ally for those venturing into forex trading:

Broker Verification: WikiFX provides detailed information about forex brokers, including their regulatory status, license details, and contact information. This allows users to verify the legitimacy of a broker before investing.

User Reviews: The platform hosts user-generated reviews and ratings for brokers. These reviews offer valuable insights into the experiences of other traders, helping newcomers make informed decisions.

Risk Assessment: WikiFX assesses the risk associated with each broker and assigns a risk rating. This rating helps users gauge the safety of a particular broker and make risk-aware choices.

Comprehensive Data: Users can access a wide range of data on brokers, including their trading conditions, deposit and withdrawal methods, and customer support quality. This comprehensive information empowers traders to choose brokers that align with their needs and expectations.

Educational Resources: WikiFX offers educational materials and articles to help users understand forex trading concepts, strategies, and risk management. This knowledge equips new investors with the tools they need to trade responsibly.

Alerts and Updates: WikiFX keeps users informed about the latest developments in the forex industry, including regulatory changes and scam alerts. This timely information ensures that traders stay updated and protected.

In conclusion, WiseMarket's growing scam concerns should not be taken lightly. Investors must be wary and informed, steering clear of unregulated brokers that pose a risk to their financial security. Your hard-earned money deserves protection, so stay cautious and conduct thorough research before diving into the world of online trading. WikiFX plays a vital role in safeguarding new investors in forex trading by providing essential information, user reviews, risk assessments, and educational resources. By using WikiFX as a trusted guide, individuals can make well-informed decisions, steer clear of scams, and embark on their forex trading journey with confidence. Stay updated on the latest news and install the WikiFX App on your smartphone for a reliable ally in your forex trading endeavors.

Access WiseMarket dealer page to check out all the complaints reported.

Link: https://www.wikifx.com/en/dealer/2699104886.html

Download the WikiFX App to access this invaluable resource and protect your investments in the ever-evolving forex market.

Download the App here: https://www.wikifx.com/en/download.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Alleged Concerns with TradeEU.global's Trading Practices

An individual trader has come forward with allegations of an unfavourable experience while using the services of the broker TradeEU.global.

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

A 49-year-old e-hailing driver in Malaysia fell victim to a fraudulent investment scheme, losing RM218,000 in a matter of weeks. The scheme, which falsely promised returns of 3 to 5 per cent within just three days, left the individual financially devastated.

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

SEC fines three broker-dealers $275K for filing deficient Suspicious Activity Reports, highlighting the importance of compliance with SAR filing regulations.

Mastercard's 2030 Vision: Biometric-Driven, Tokenized Payments

Mastercard’s tokenized future will eliminate card numbers and passwords by 2030, ensuring seamless, secure, and biometric-driven online shopping experiences.

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Italian Regulator Warns Against 5 Websites

SFC Freezes $91M in Client Accounts Amid Fraud Probe

Bybit Launches Gold & FX Treasure Hunt with Real Gold Rewards

Currency Calculator