简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

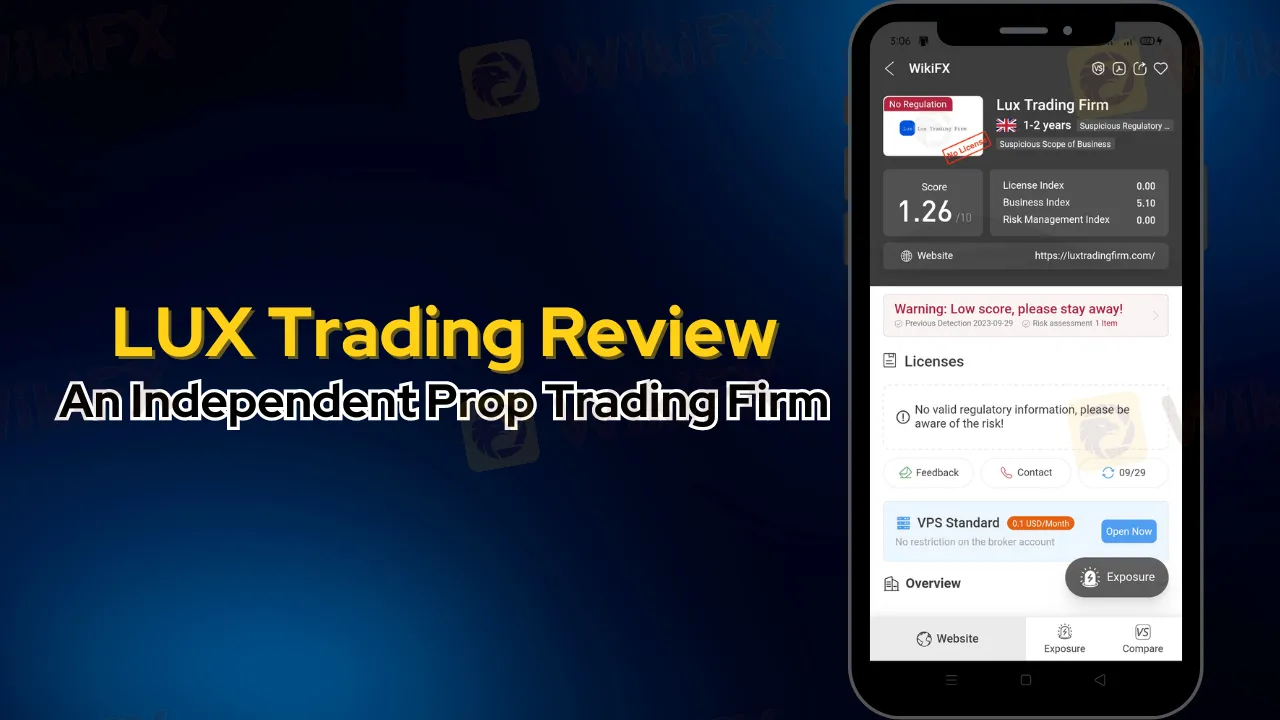

LUX Trading Review: An Independent Prop Trading Firm

Abstract:Discover LUX Trading Firm: A model of transparent and responsible prop trading. Gain access to live capital, dedicated risk management, and an upcoming proprietary trading platform. Join a reliable partner in your trading journey.

In today's ever-evolving world of trading, finding a reliable and sustainable business model is crucial. The trading industry has witnessed a surge in traders seeking quick gains, often lured by unrealistic promises and aggressive marketing tactics. But not all trading firms are created equal, and it's essential to separate the wheat from the chaff.

Introduction

In this review, we'll delve into LUX Trading Firm, an independent prop trading firm that stands out in the crowded trading landscape. LUX Trading Firm is dedicated to transparency, risk management, and providing a unique trading experience for its members. We'll explore its origins, business model, benefits, and unique selling points, while also discussing the challenges faced by the firm and the future of the prop trading industry.

The Birth of LUX Trading Firm

LUX Trading Firm has deep roots in the trading world, with its founders boasting over 30 years of experience in asset management and traditional brick-and-mortar prop trading. They've witnessed firsthand what it takes to nurture successful traders and keep them profitable. With the advent of the internet, trading went digital, allowing traders worldwide to participate without the need for a physical office. This transition inspired the birth of LUX Trading Firm.

One of the critical lessons learned from traditional trading is the paramount importance of risk management. LUX Trading Firm places risk management at the forefront of its philosophy, understanding that it's the key to trader success. To this end, they've introduced a unique program where every trader receives the support of a dedicated risk manager, akin to what professional traders at banks or hedge funds enjoy. This support allows traders to focus on managing their risks, eliminating the pressure to achieve unrealistic profit percentages each month.

The LUX Trading Model

The heart of LUX Trading Firm's sustainability lies in its business model. Unlike some prop trading firms that rely on pyramid schemes or operate as B-book brokers, LUX Trading Firm adheres to a model built on transparency and responsible risk management. They exclusively trade with real money, provide risk disclosures for their traders, and maintain KPMG-audited track records, ensuring complete transparency.

Furthermore, LUX Trading Firm uses A-book brokers, a critical component of its model. This choice guarantees that profits come directly from the market, and traders can trust that the firm's interests are aligned with theirs. This approach creates a sustainable ecosystem where the firm's success is directly linked to the traders' profitability.

Benefits of LUX Trading Firm

Live Trading Capital: One of the most significant advantages of joining LUX Trading Firm is access to live capital. Unlike many prop firms, LUX Trading Firm provides traders with the opportunity to trade real money, a rare and valuable benefit.

Dedicated Risk Management: Every trader at LUX Trading Firm is assigned a dedicated risk manager. This personalized support ensures that traders stay within predefined risk limits, protecting their capital.

Comprehensive Education: LUX Trading Firm offers an extensive educational platform with mentors, economists, and trading experts. Traders, regardless of their prior knowledge, can receive the necessary training to succeed.

Trading Platform: LUX Trading Firm is on the verge of launching its proprietary trading platform, Deluxe Trader. This web-based platform utilizes premium TradingView charting, ensuring a familiar and robust trading experience. Traders also benefit from direct connectivity to liquidity providers, resulting in tighter spreads and reduced commissions.

Challenges and the Path Forward

While LUX Trading Firm's model offers a unique and sustainable trading environment, it faces challenges from traders with unrealistic expectations. Many traders are enticed by the allure of quick riches and often neglect risk management. Educating traders about the importance of risk management and setting realistic expectations is an ongoing challenge.

Looking ahead, the prop trading industry is at a crossroads. The proliferation of firms making extravagant promises necessitates regulatory intervention to ensure a fair playing field for traders. LUX Trading Firm is positioned well within the regulatory framework, given its commitment to transparency and responsible trading practices.

Conclusion

LUX Trading Firm stands as a beacon of transparency and responsible trading in an industry clouded by excessive promises and risk. With its unique business model, access to live capital, dedicated risk management, and an upcoming proprietary trading platform, LUX Trading Firm offers a refreshing and sustainable approach to prop trading. For traders seeking a reliable partner in their trading journey, LUX Trading Firm represents a promising choice, grounded in realism and dedicated to success through risk management. Remember, in trading, it's not just about making profits; it's about protecting your capital.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Trader Exposes Unethical Practices by STP Trading

A recent allegation against STP Trading has cast doubt on the firm's business practices, highlighting the potential risks faced by retail traders in an increasingly crowded and competitive market.

What Makes Cross-Border Payments Easier Than Ever?

Cross-border payments are now faster, cheaper, and simpler! Explore fintech, blockchain, and smart solutions to overcome costs, delays, and global payment hurdles.

Solana Soars to All-Time High, Hits $264 on Coinbase

Solana hits $264 on Coinbase, breaking its 3-year high with an 11% daily surge. Learn what’s driving SOL's meteoric rise and the crypto market rally.

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

The UK Financial Conduct Authority (FCA) has issued a public warning regarding a fraudulent entity impersonating Admiral Markets, a legitimate and authorised trading firm. The clone firm, operating under the name Admiral EU Brokers and the domain Admiraleubrokerz.com, has been falsely presenting itself as an FCA-authorised business.

WikiFX Broker

Latest News

Webull Partners with Coinbase to Offer Crypto Futures

eToro Expands Nationwide Access with New York Launch

Why Is UK Inflation Rising Again Despite Recent Lows?

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Google Warns of New Deepfake Scams and Crypto Fraud

Currency Calculator