简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How To Spot Forex Scammers: Usual Traits During Profit Withdrawal

Abstract:Learn to spot Forex scammers during profit withdrawals. Protect your investments with insights and tips. Trust WikiFX App for safer trading.

Introduction

In the fast-paced world of Forex trading, with its vast potential for profits, there's an equally significant risk of falling prey to scams. With the digital age well and truly upon us, it's easier than ever for malevolent actors to portray themselves as legitimate, drawing in unsuspecting victims. This article delves deep into understanding the usual traits of such scammers, especially during the delicate process of profit withdrawal.

The Story of a Victim

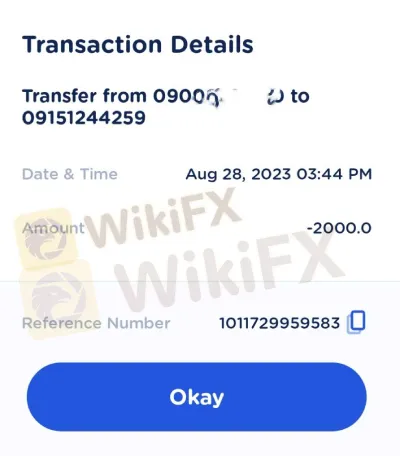

On August 27, 2023, an unsuspecting trader found herself entangled with a scammer. The scammer presented herself as a customer support/marketer at a seemingly regulated forex broker. Intrigued, the victim started her journey by depositing 1000 PHP. As the allure of getting bigger profits, the victim was tempted into depositing an additional 10,000 PHP over the subsequent days, bringing his total to 11,000 PHP. However, the big revelation took place when he attempted to withdraw her profits. The scammer introduced yet another deposit requirement, leaving the victim's funds hanging. With every plea for help to withdraw the profit, the scammer only pushed for more money. A haunting question lingers: Would the victim be able to withdraw his funds even after the desired deposit?

The Difficult Part

Many scammers deftly hide behind the mask of anonymity. With fake social media profiles and fabricated details, tracing them can be a daunting task. Always be wary and remember, “Once a scammer, always a scammer.”

Related news:

FAQs

Is there a way that a victim can reclaim all of his funds from his scam trading account?

While it can be challenging, victims should contact local law enforcement or the cyber-crime division and report the scam. Sharing all the details, including account information, correspondence, and transaction records, can assist the authorities.

What are the necessary ways for a victim to have a chance to reclaim all his funds from the scammer?

Report immediately to the bank or payment provider.

Document all interactions and transactions with the scammer.

Report to cybercrime units and engage legal counsel if necessary.

How to avoid such questionable practices?

Do thorough research on any broker before making a deposit.

Check for verified reviews and be wary of overly positive or promotional reviews.

Trust but verify. Reach out to regulatory agencies if a broker claims to be registered with them.

How does WikiFX App help in avoiding landing on scammers in the Forex Market?

WikiFX App is a reliable tool that provides detailed insights into various forex brokers, their regulatory statuses, user reviews, and other crucial information. Using such apps can greatly reduce the risk of falling for scams.

Related news:

Awareness

Stay informed and vigilant. Scammers exploit the unaware and the uninformed. Constantly update your knowledge about the market, and latest scamming methods, and always double-check every new platform or broker you decide to engage with.

Conclusion

Forex trading, with its countless opportunities, comes with pitfalls. While there's no foolproof method to entirely evade scams, being informed and cautious can greatly avoid the risks or if you are curious make sure that you only invest that you can afford to lose. Use tools like the WikiFX App as your shield in this journey. Remember, an informed trader is a safe trader. Always prioritize your financial safety.

Download the WikiFX App here: https://www.wikifx.com/en/download.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Alleged Concerns with TradeEU.global's Trading Practices

An individual trader has come forward with allegations of an unfavourable experience while using the services of the broker TradeEU.global.

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

A 49-year-old e-hailing driver in Malaysia fell victim to a fraudulent investment scheme, losing RM218,000 in a matter of weeks. The scheme, which falsely promised returns of 3 to 5 per cent within just three days, left the individual financially devastated.

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

SEC fines three broker-dealers $275K for filing deficient Suspicious Activity Reports, highlighting the importance of compliance with SAR filing regulations.

Mastercard's 2030 Vision: Biometric-Driven, Tokenized Payments

Mastercard’s tokenized future will eliminate card numbers and passwords by 2030, ensuring seamless, secure, and biometric-driven online shopping experiences.

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Italian Regulator Warns Against 5 Websites

Mastercard's 2030 Vision: Biometric-Driven, Tokenized Payments

SFC Freezes $91M in Client Accounts Amid Fraud Probe

Bybit Launches Gold & FX Treasure Hunt with Real Gold Rewards

What Are the Latest Trends and Strategies in Philippine Gold Trading?

Currency Calculator