简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

The investor accused HOTFOREX of asking for extra money.

Abstract:An investor has come forward to accuse the popular online trading platform, HOTFOREX, of allegedly demanding additional funds before allowing the withdrawal of his hard-earned money.

About HOTFOREX

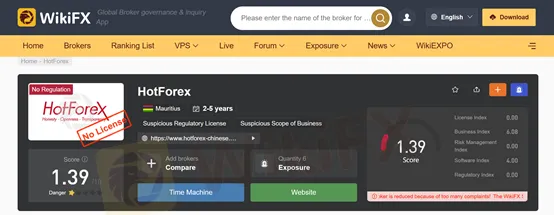

Hot Forex is registered in Mauritius, with its corporation information not disclosed to all. There is no regulatory information displayed on its website. Therefore, it can be sure that this Hot Forex is an unregulated scam broker. Trading asset choices offered by this Hot Forex include Forex, cryptocurrencies, metals, indices, shares, energies, commodities, and bonds. WikiFX has given this broker a low score of 1.39/10. But why?

Is it Legit?

HOTFOREX is not a regulated broker based on what we see on WikiFX. We advise you to be aware of the risk.

Case Description in Brief

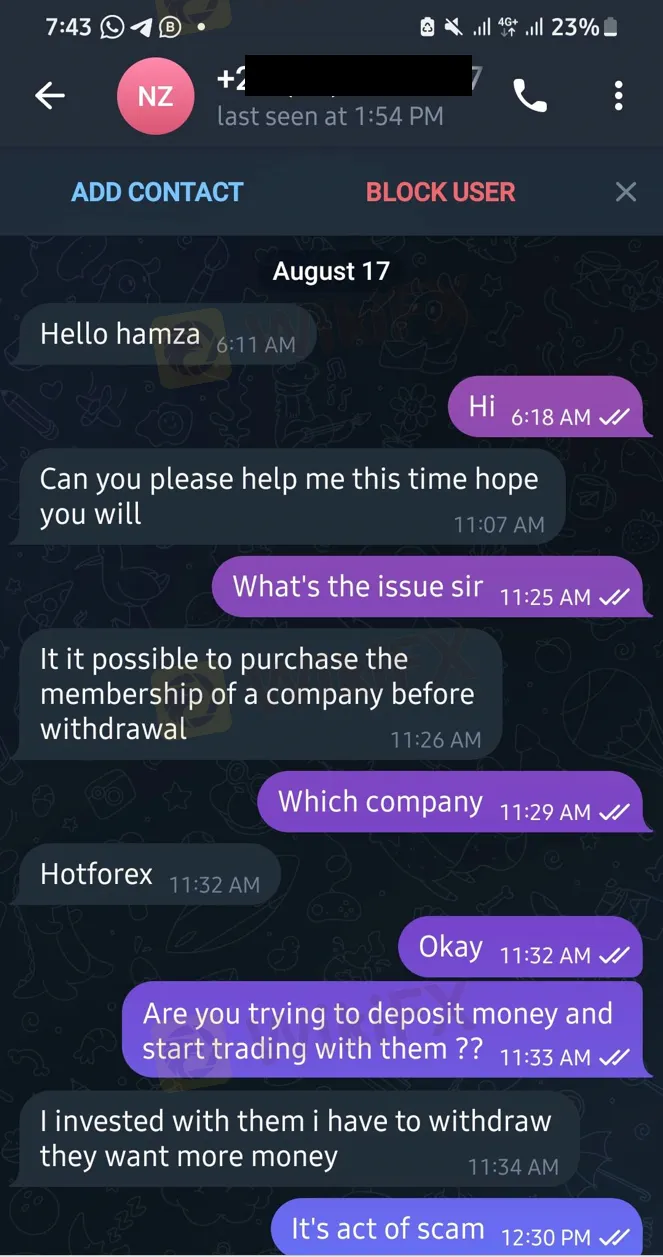

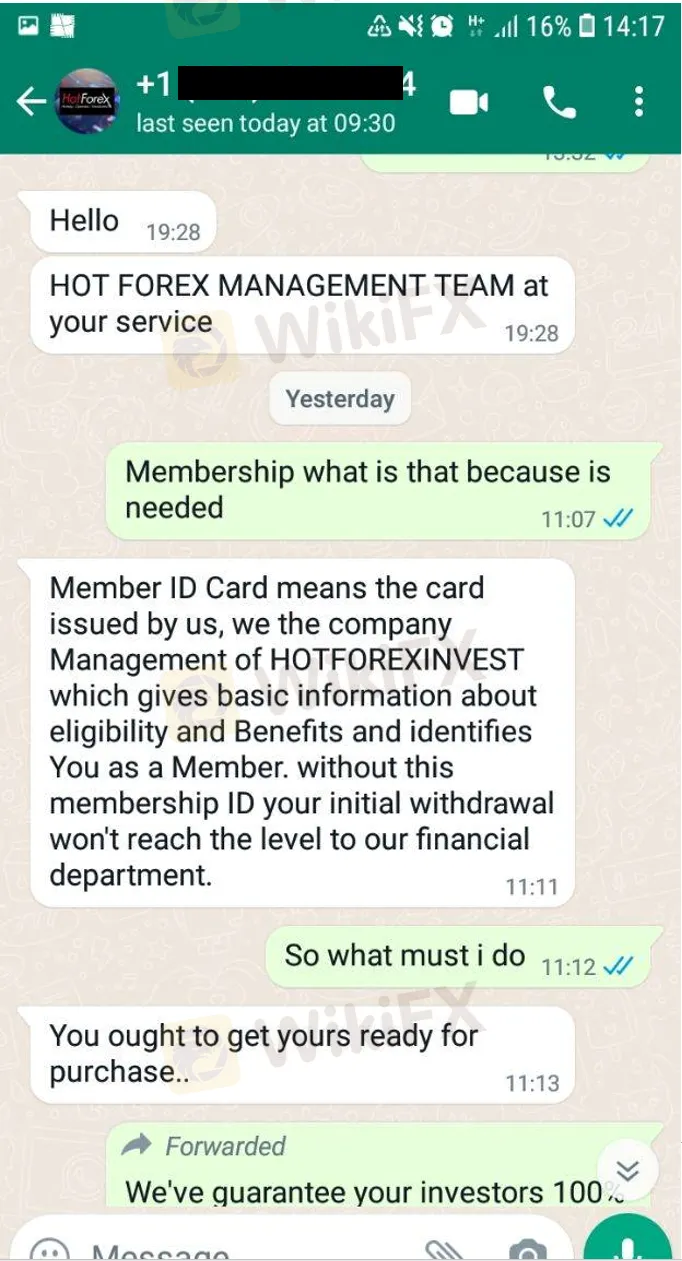

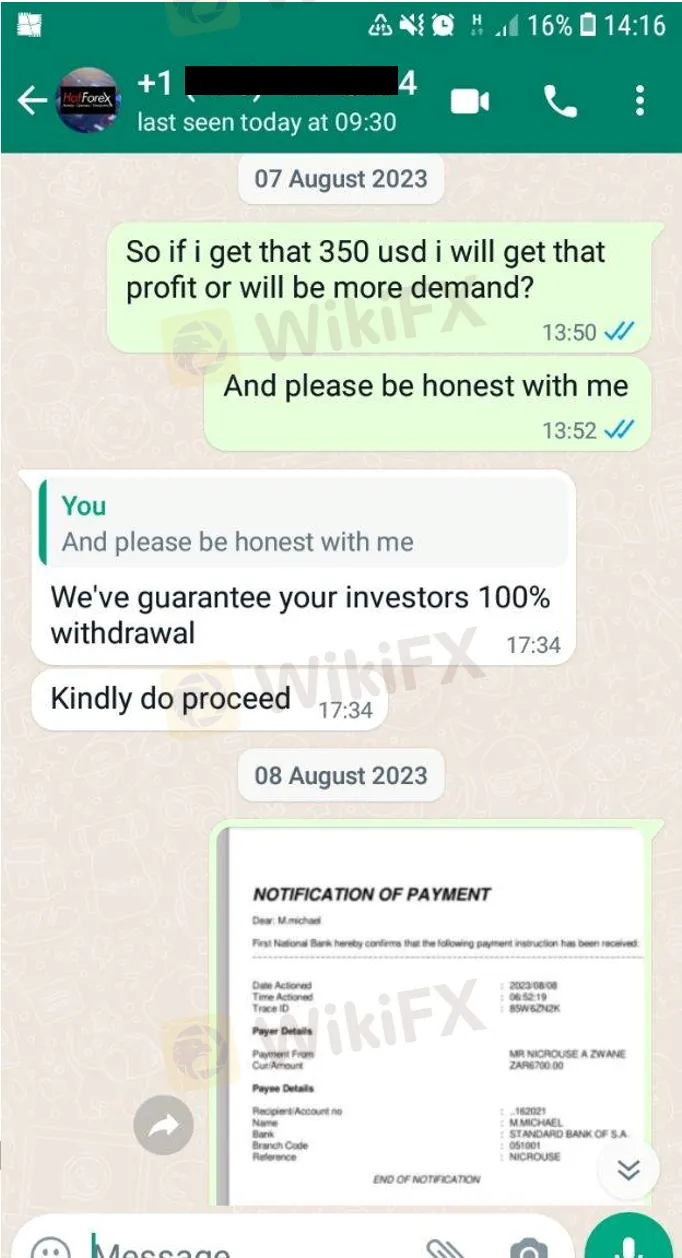

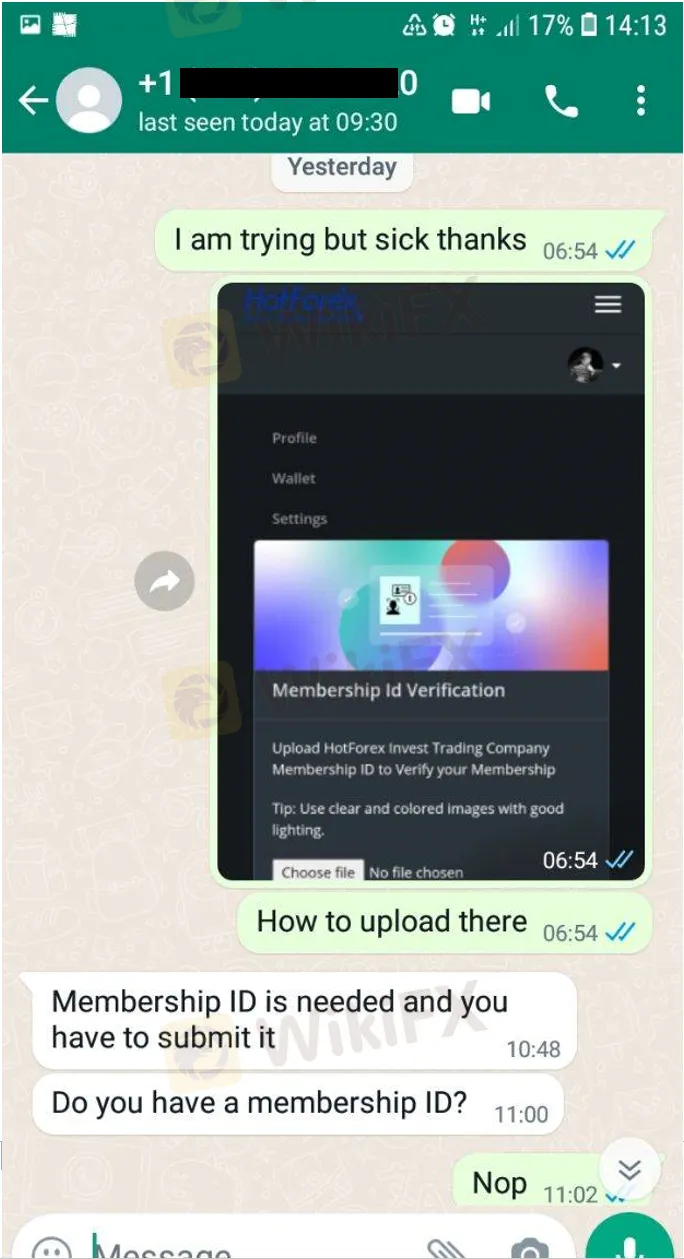

An investor has come forward to accuse the popular online trading platform, HOTFOREX, of allegedly demanding additional funds before allowing the withdrawal of his hard-earned money. The investor claims that he had deposited a substantial amount into the platform with the intention of trading and eventually withdrawing his profits. However, the demand for an extra $340 by the broker's customer service team has left him baffled and frustrated.

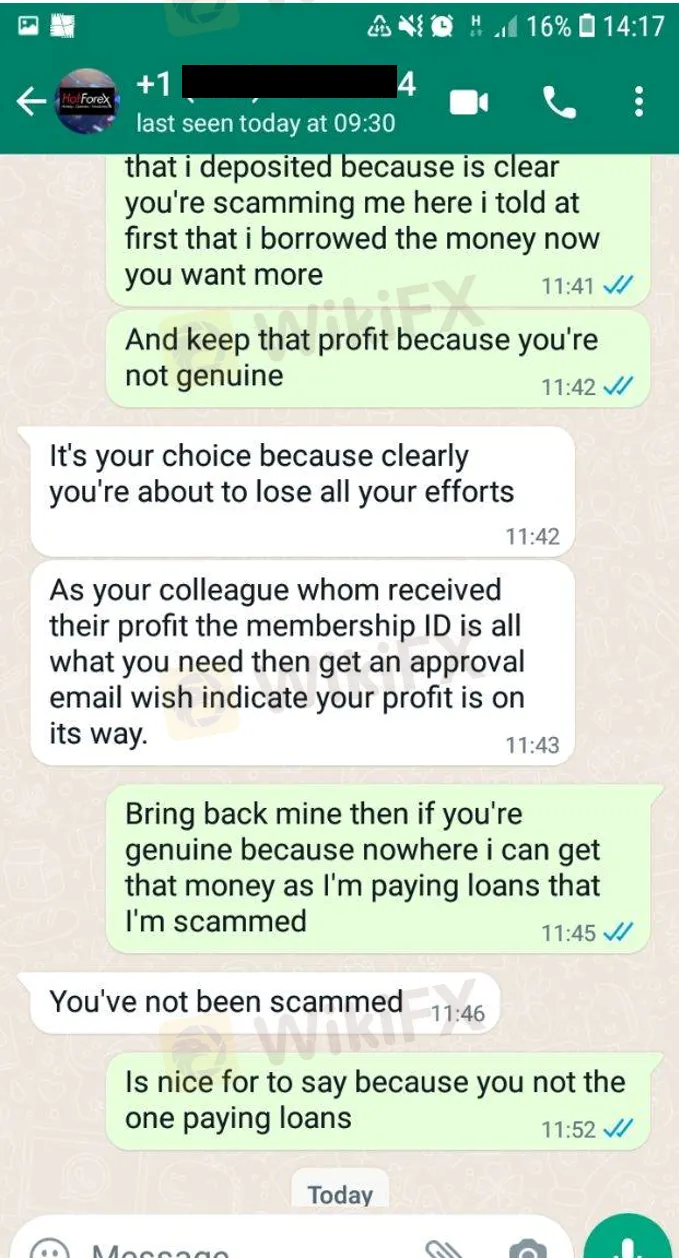

According to the investor's account, he had initially deposited a significant sum of money into his HOTFOREX trading account, hoping to take advantage of the platform's trading services. He reportedly engaged in various trades and managed to generate profits over time. As the investor sought to withdraw his earnings, he was taken aback when he received a communication from HOTFOREX's customer service team. The message purportedly demanded an additional $340 as a requirement for processing the withdrawal request.

Confusion and Frustration

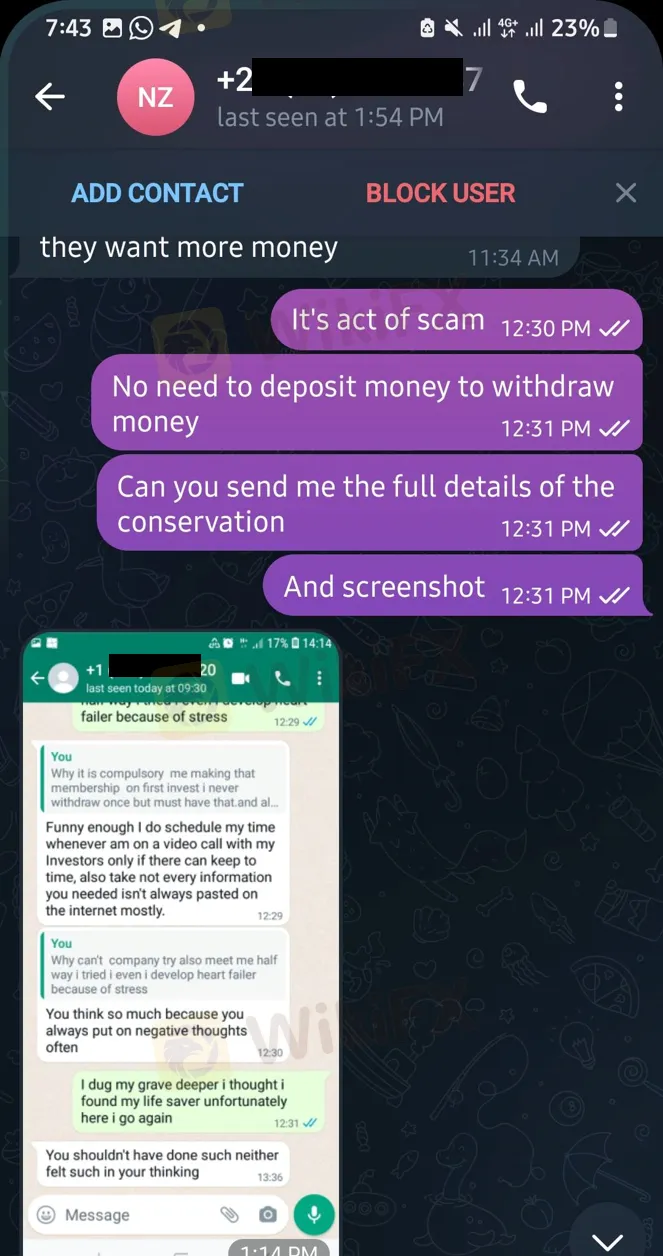

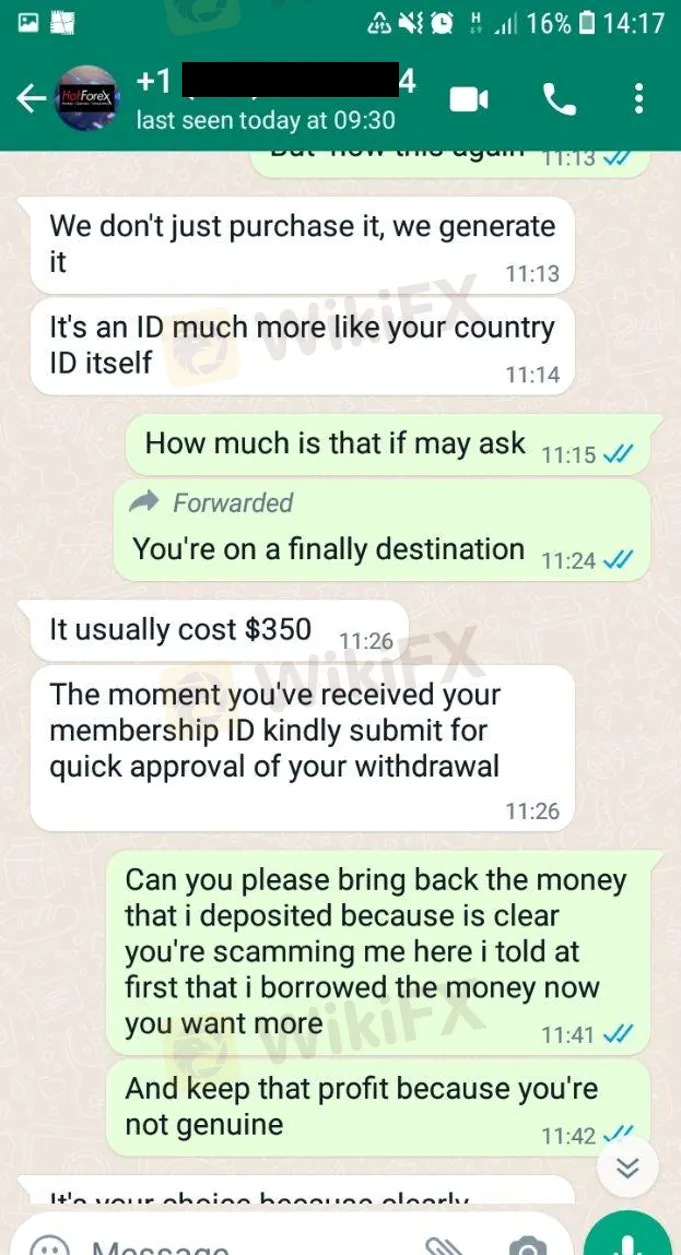

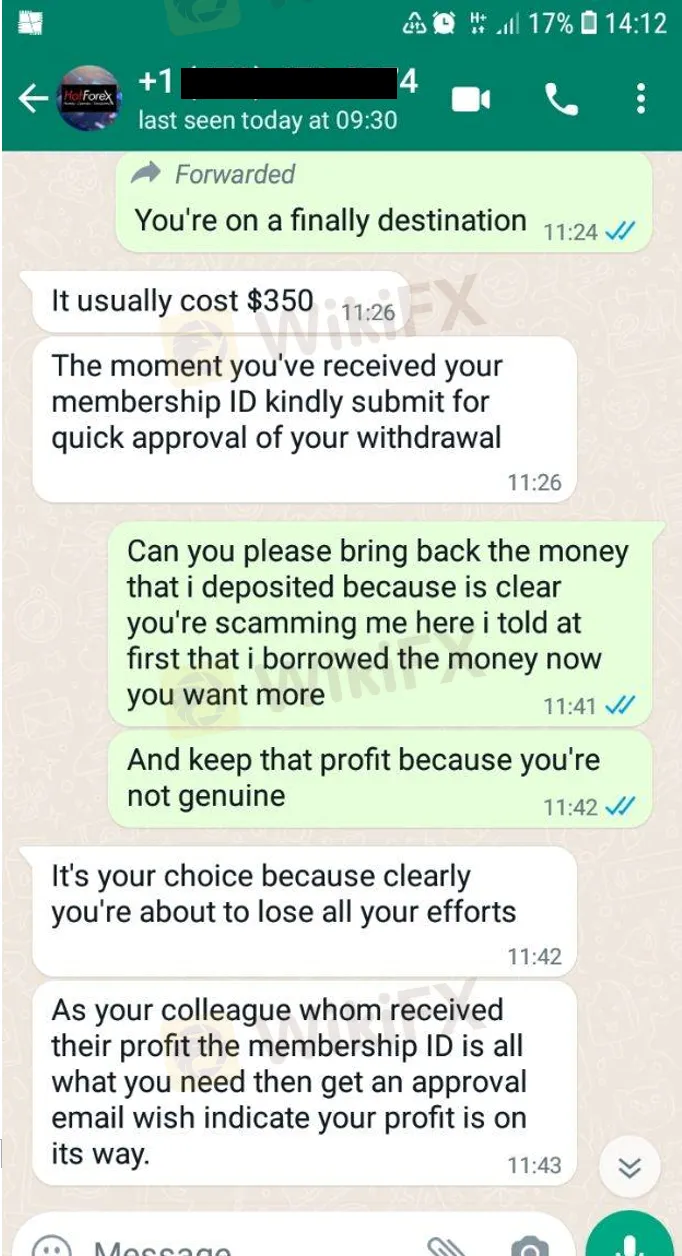

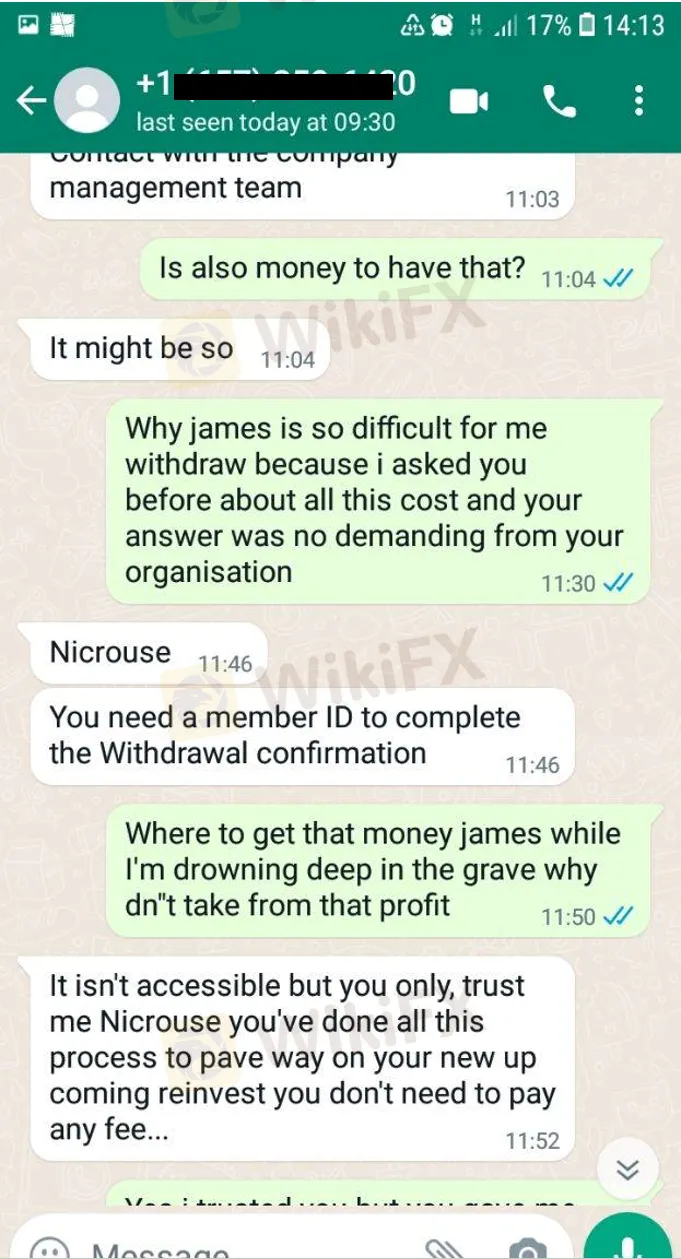

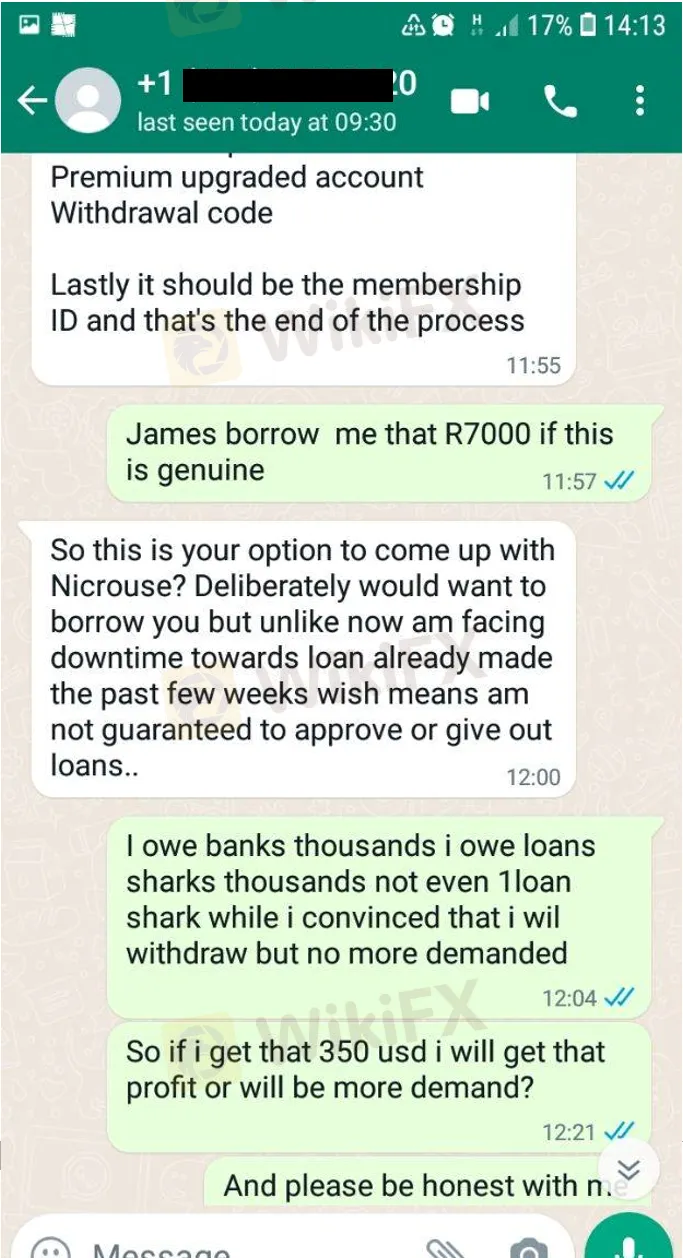

Naturally, the investor found himself in a state of disbelief and confusion. The concept of having to pay extra money in order to access his own funds seemed counterintuitive and suspicious. He questioned the legitimacy of the request and sought clarification from HOTFOREX's customer service representatives. Their response, as reported by the investor, offered little explanation beyond stating that the fee was necessary to cover certain “processing costs.”

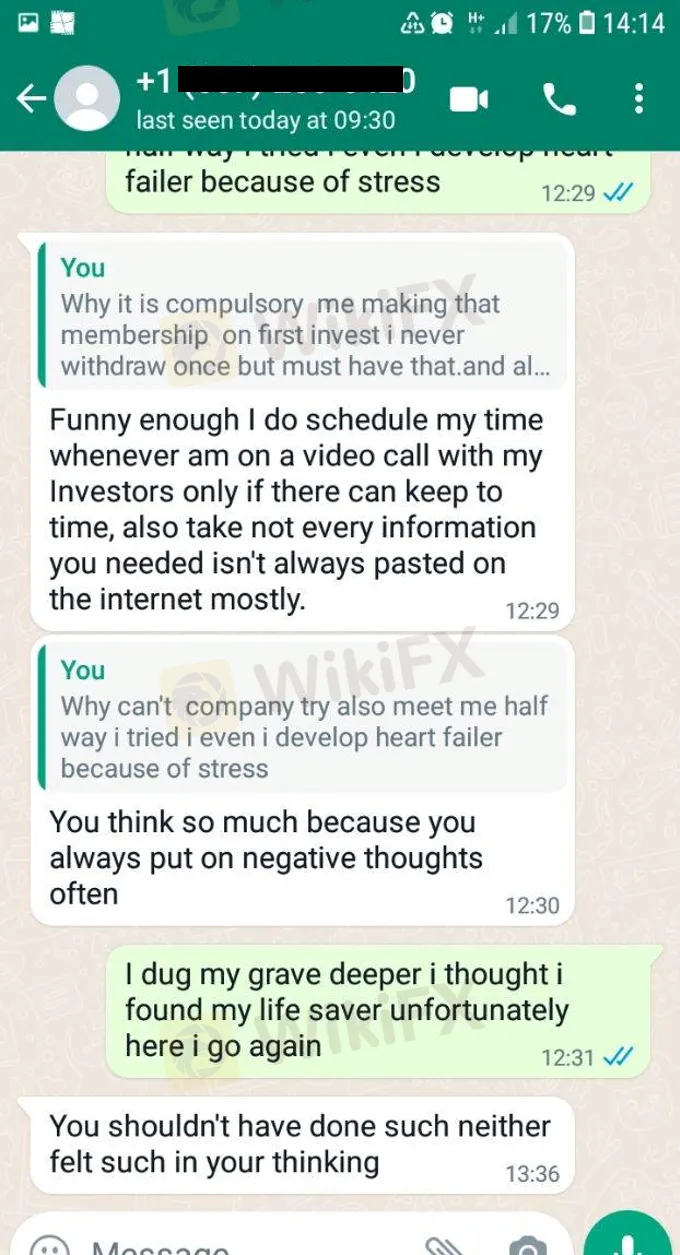

The investor's frustration mounted as he struggled to reconcile the idea of being asked to pay for the privilege of withdrawing his own funds. He felt that this went against the fundamental principles of fair trading practices and raised concerns about the transparency and integrity of the platform.

Conclusion

Demanding extra funds for withdrawal raises questions about the intentions of the platform and its commitment to serving the best interests of its investors.

Industry standards dictate that withdrawal processes should be straightforward and devoid of hidden fees. Any deviation from this standard not only erodes investor confidence but also tarnishes the reputation of the platform.

While it's essential to approach such allegations with an open mind and gather all relevant information, this case serves as a reminder that both traders and platforms need to adhere to the highest ethical and professional standards. If you want more information about certain brokers' reliability, you can open our website (https://www.WikiFX.com/en). Or you can download the WikiFX APP to find your most trusted broker.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Italian Regulator Warns Against 5 Websites

The Italian regulator, CONSOB has issued a warning against five websites offering unauthorized financial services. This regulatory action aims to protect the public from fraudulent activities.

Trader Exposes Unethical Practices by STP Trading

A recent allegation against STP Trading has cast doubt on the firm's business practices, highlighting the potential risks faced by retail traders in an increasingly crowded and competitive market.

What Makes Cross-Border Payments Easier Than Ever?

Cross-border payments are now faster, cheaper, and simpler! Explore fintech, blockchain, and smart solutions to overcome costs, delays, and global payment hurdles.

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

The UK Financial Conduct Authority (FCA) has issued a public warning regarding a fraudulent entity impersonating Admiral Markets, a legitimate and authorised trading firm. The clone firm, operating under the name Admiral EU Brokers and the domain Admiraleubrokerz.com, has been falsely presenting itself as an FCA-authorised business.

WikiFX Broker

Latest News

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Italian Regulator Warns Against 5 Websites

Currency Calculator