简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Crypto Exchange BKEX Halts Withdrawal

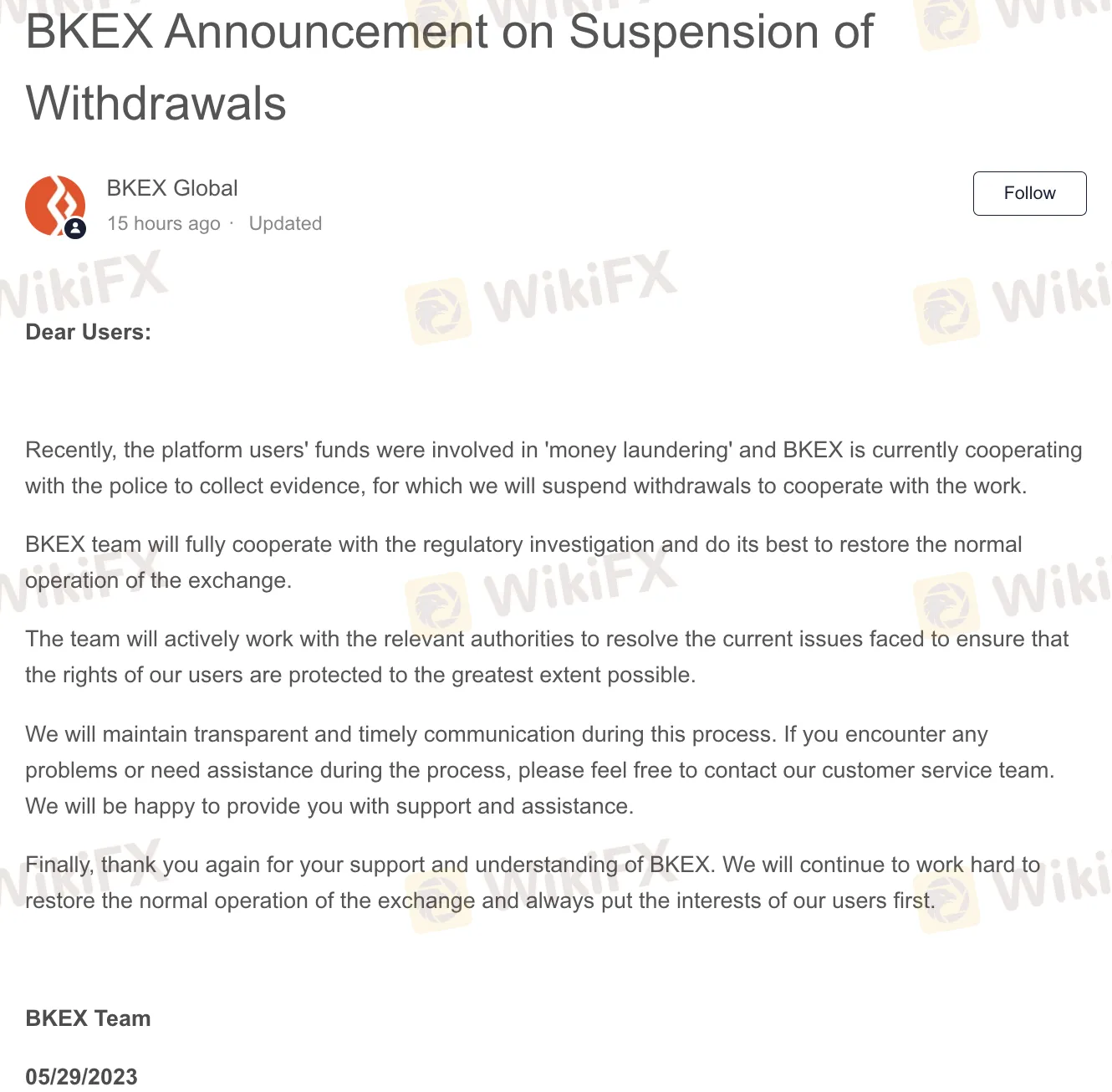

Abstract:BKEX, a cryptocurrency exchange, has temporarily suspended customer withdrawals to assist authorities in an investigation into alleged money laundering.

BKEX, a cryptocurrency exchange platform has taken the decision to suspend customer withdrawals on its platform as part of its collaboration with a police investigation into suspected money laundering activities involving some of its users. In a recent blog post, the exchange expressed its proactive commitment to assisting the relevant authorities in gathering evidence and ensuring the protection of user rights.

BKEX emphasized its determination to restore normal operations on the exchange, and it currently offers a range of cryptocurrency, derivatives, and margin trading features to its user base. As reported by CoinMarketCap, BKEX was established in June 2018 and has amassed a user community of over 8 million individuals from more than 100 countries across Asia, Europe, Latin America, and other regions.

The investigation into money laundering allegations at BKEX follows a similar incident that occurred several months ago when Bulgarian law enforcement, in collaboration with international agents, conducted raids on the local offices of Nexo, a cryptocurrency lending firm. During this operation, a total of 15 offices of the company were subjected to search and seizure.

Reports suggest that prosecutors have initiated an international endeavour to examine BKEX's potential involvement in financial misconduct, particularly regarding deficiencies in its anti-money laundering protocols and facilitation of transactions that contravene international sanctions against Russia.

Siika Mileva, the Prosecutor General of Bulgaria, communicated through a spokesperson that one of the firm's clients has links to financial terrorism. Additionally, it was revealed by local media that the crypto firm has processed over €94 billion in transactions over the past five years.

However, Nexo responded to these developments with a Twitter post, where the company accused the prosecutors of hasty actions without proper inquiry. Nexo asserted its unwavering adherence to rigorous anti-money laundering and know-your-customer policies, emphasizing their commitment to maintaining high standards.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Coinbase Under Scrutiny Amid Wrapped Bitcoin Delisting Controversy

Coinbase has come under fire after announcing its decision to delist Wrapped Bitcoin (wBTC), a move critics claim could be driven by competitive interests. The delisting, set to take effect on 19 December, has sparked allegations of market manipulation and concerns about fairness in the cryptocurrency ecosystem.

Solana Soars to All-Time High, Hits $264 on Coinbase

Solana hits $264 on Coinbase, breaking its 3-year high with an 11% daily surge. Learn what’s driving SOL's meteoric rise and the crypto market rally.

Bitcoin Nears $100,000: A Triumph of Optimism or a Warning Sign?

Bitcoin’s meteoric rise continues to capture global attention as its price recently surpassed the $99,000 mark, briefly approaching the $100,000 milestone. This unprecedented rally has led market sentiment to reach a state of “extreme greed,” according to the Fear and Greed Index. Analysts suggest that the market may be entering overheated territory, raising questions about sustainability amidst ongoing enthusiasm.

FCA Alerts Traders to New List of Unregulated and Clone Brokers

Protect your investments! Learn about unregulated firms flagged by the FCA and discover how WikiFX helps traders avoid scams and choose legitimate brokers.

WikiFX Broker

Latest News

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Italian Regulator Warns Against 5 Websites

Currency Calculator