简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Watch List: 5 Growing Stocks to Buy During Debt Ceiling Negotiations

Abstract:This article suggests five growing stocks to invest in during debt ceiling negotiations. These include Cantaloupe (CTLP), Betterware de Mexico (BWMX), ARB IOT Group (ARBB), AudioEye (AEYE), and Aurinia Pharmaceuticals (AUPH). Each company exhibits growth potential and resilience amidst economic volatility.

The debt ceiling negotiation period often brings about considerable market volatility, stirring investor anxieties about the potential impacts on their portfolios. However, it's during these times of perceived crisis that astute investors can find golden opportunities. In this article, we will introduce you to “Watch List: 5 Growing Stocks to Buy during Debt Ceiling Negotiations”.

This piece has been carefully curated to highlight five promising stocks that are well-positioned to thrive amidst debt ceiling negotiations. These companies exhibit robust growth potential and strong fundamentals, making them potentially resilient during turbulent economic times. By strategically navigating these negotiations, you can unlock significant value and set your portfolio up for future success. Dive in as we explore these five prospective investment opportunities, offering insights into why they're worth considering during the current debt ceiling negotiations.

List Cheap Stocks To Buy

Investing in stocks doesn't always have to be a costly affair. Here are five inexpensive stocks you might want to consider adding to your portfolio.

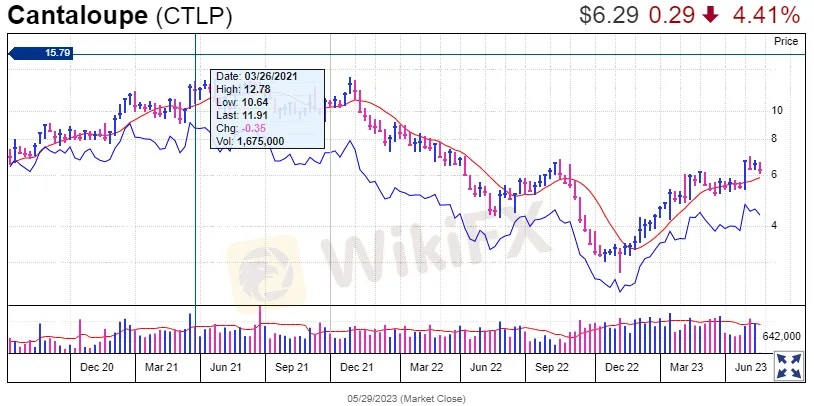

Cantaloupe: A Fruitful Investment?

Cantaloupe (CTLP) shares saw a 22% uptick in the week ending May 5th, despite a small dip on Thursday due to a decrease in volume. The buy point for this stock remains at 6.32, with shares trading within the ideal buy zone from 6.32 to 6.64.

While CTLP's rating has dropped slightly, its strong performance against the S&P 500 is encouraging. Despite its name, the Pennsylvania-based company is not in the fruit business. Instead, Cantaloupe provides hardware and software for the self-service business sector, offering products like Three Square Market and Seed Live software.

Cantaloupe recently reported a 200% increase in fiscal second-quarter earnings, which propelled its shares even higher.

Betterware de Mexico: A Tidy Investment

Replacing Luna Innovations in this list is Betterware de Mexico (BWMX), which has seen its stock surge by up to 106% this year. It is currently attempting to retake its buy point at 12.49.

BWMX recently announced Q1 results, including a 21% dip in earnings but a significant 93% increase in sales. Despite a recent downturn, Betterware de Mexico remains in a strong position with a promising base and valid buy point. The Mexican stock market has been thriving, providing further support for BWMX's position.

The company, which specializes in selling housewares and home cleaning products, has reversed a previous downward trend in sales, now boasting year-over-year gains of up to 56%.

ARB IOT Group: Riding the Tech Wave

ARB IOT Group (ARBB) joined the Nasdaq in early April and has seen some significant fluctuation in its short history. Despite a downturn in its Composite Rating, it remains within its current trading range.

This Malaysia-based company, which serves clients in the Internet of Things (IoT) market, reported robust earnings growth during 2021 and the first half of 2022. While ARBB stock has yet to form a proper IPO base, there are indications that a potential entry point could emerge at 5.50.

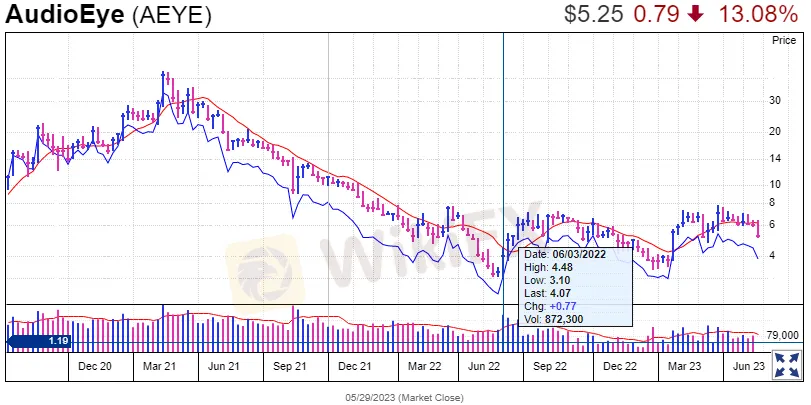

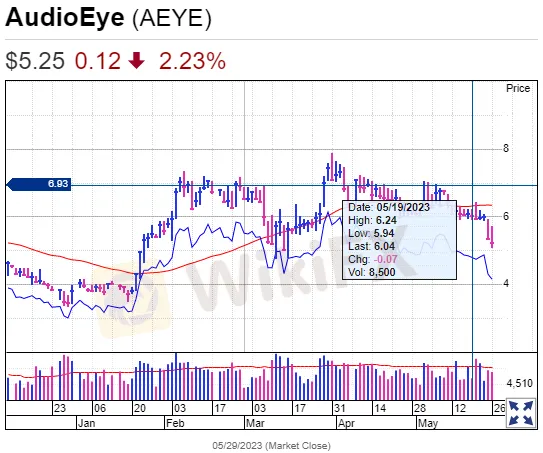

AudioEye: Listening to Market Trends

AudioEye (AEYE) has seen some setbacks in recent weeks, with its shares dipping below the 200-day moving average and a relative strength line on the decline. Despite these red flags, a new entry point has emerged at 7.99.

AudioEye, which provides web accessibility solutions for businesses, has demonstrated consistent sales growth over the past eight quarters. However, liquidity risk is a factor to consider, as this micro-cap stock typically trades fewer than 25,000 shares per day.

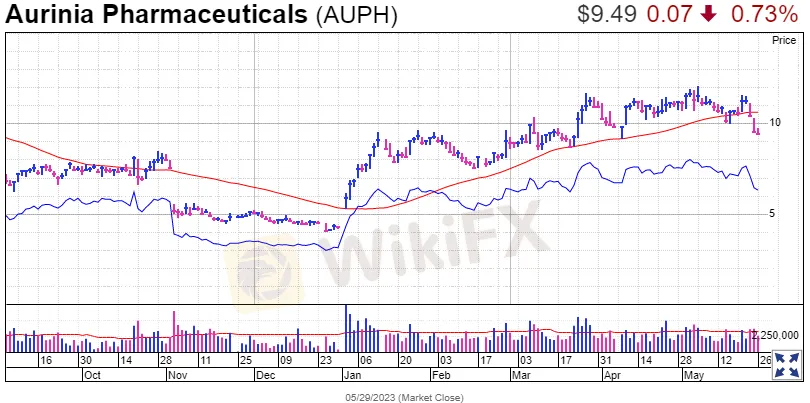

Aurinia Pharmaceuticals: A Pillar of Strength?

Finally, replacing Ardelyx on this list is Aurinia Pharmaceuticals (AUPH), which recently cleared a nine-month entry before falling back. Despite a significant drop on Thursday, Aurinia remains within the consideration zone for potential investors.

Aurinia faces a crucial test of support at the 50-day moving average, and its performance in the coming weeks will determine its continued presence on this list.

Final Thoughts

These low-priced stocks offer an opportunity for those looking to invest in diverse sectors without breaking the bank. However, as with any investment, thorough research and careful consideration are vital before diving in.

Get the WikiFX App on your phone to keep up with the newest market updates. You can download the app from this link: https://social1.onelink.me/QgET/px2b7i8n

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

Read more

Alleged Concerns with TradeEU.global's Trading Practices

An individual trader has come forward with allegations of an unfavourable experience while using the services of the broker TradeEU.global.

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

A 49-year-old e-hailing driver in Malaysia fell victim to a fraudulent investment scheme, losing RM218,000 in a matter of weeks. The scheme, which falsely promised returns of 3 to 5 per cent within just three days, left the individual financially devastated.

SFC Freezes $91M in Client Accounts Amid Fraud Probe

SFC freezes $91M in client accounts at IBHK, SBI, Monmonkey, and Soochow over suspected hacking and market manipulation during unauthorized online trades.

Italian Regulator Warns Against 5 Websites

The Italian regulator, CONSOB has issued a warning against five websites offering unauthorized financial services. This regulatory action aims to protect the public from fraudulent activities.

WikiFX Broker

Latest News

Saxo & Portuguese Bank Partnership

SEC Fines Broker-Dealers $275K for Incomplete SAR Filings

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Lured by False Promises: Malaysian Driver Lost RM218K to an Investment Scam

FTX Sets March 2025 Timeline for Creditor Payouts: What It Means for Investors

What is an Economic Calendar? How it works

Italian Regulator Warns Against 5 Websites

Mastercard's 2030 Vision: Biometric-Driven, Tokenized Payments

SFC Freezes $91M in Client Accounts Amid Fraud Probe

Currency Calculator