简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

ThinkMarkets Going Public Via a Merger

Abstract:ThinkMarkets plans to merge with FG Acquisition Corp, aiming to become publicly traded, with a $160 million valuation.

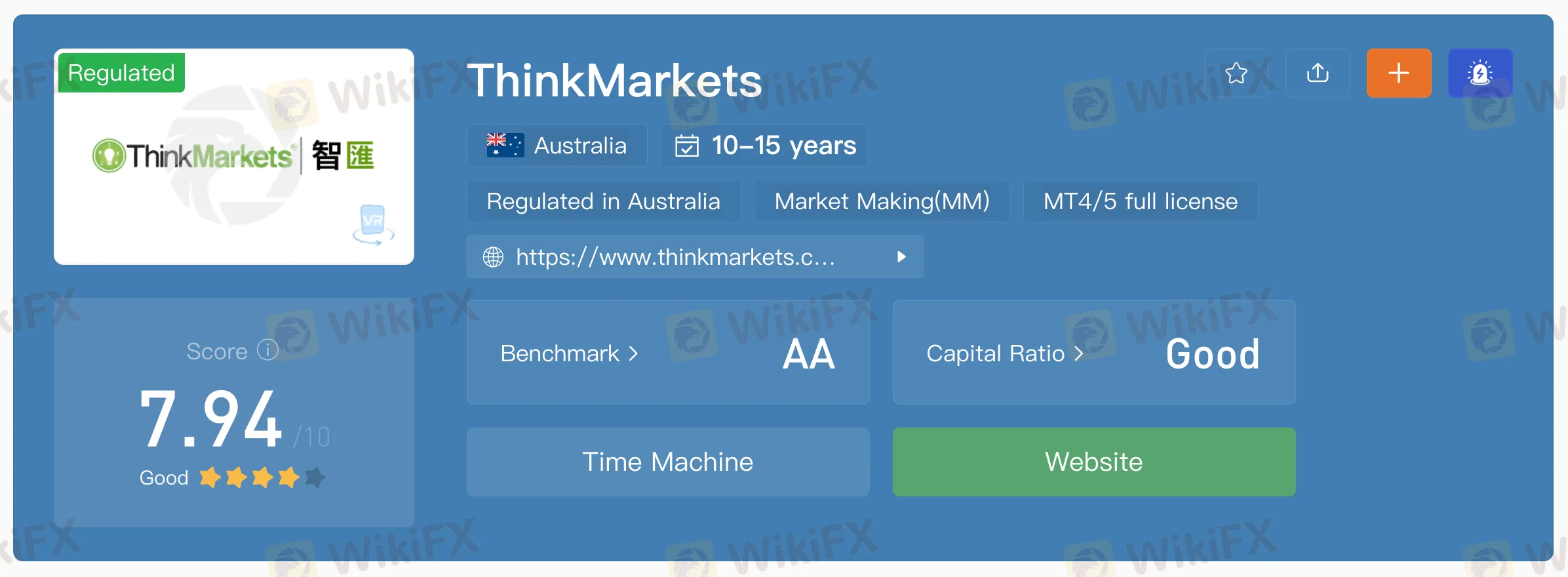

ThinkMarkets, an Australian-based broker operated by Think Financial Group Holdings Limited, has revealed its intention to undergo a merger with Canadian blank check company FG Acquisition Corp, with the aim of becoming a publicly traded entity. This move follows ThinkMarkets' expansion into the Asia Pacific region through acquiring a local forex company in Japan and obtaining a license in New Zealand earlier this year.

FG Acquisition Corp, listed on the Toronto Stock Exchange, is owned by Larry G. Swets Jr., a casualty insurance executive. The business will be known as ThinkMarkets Group Holdings Limited after the merger. The co-founders of ThinkMarkets, Nauman Anees and Faizan Anees, along with the existing management team, will assume the positions of Chief Executive Officer and President, respectively. The board of directors for the merged entity will consist of Symon Brewis-Weston, Julian Babarczy, Larry G. Swets Jr., Faizan Anees, Nauman Anees, and Faizan Anees.

The completion of the merger is anticipated in July 2023.

Since its establishment, ThinkMarkets has accumulated a substantial client base of 138,500 traders hailing from 165 countries. The company offers retail forex trading services and operates an institutional presence through a liquidity provisioning platform.

According to reports, ThinkMarkets' revenues experienced a notable increase, rising from USD 35 million in 2019 to over USD 62 million in 2022. As of March 2023, the user base of ThinkMarkets reached 138,500 approved clients, a significant growth from 17,200 at the end of 2015.

Based on its pre-money valuation, ThinkMarkets has been valued at $160 million in the reverse merger agreement, with an estimated pro forma enterprise value of approximately $190 million. As a result of the merger, ThinkMarkets will become a wholly-owned subsidiary of the Special Purpose Acquisition Company (SPAC) and hold the majority of the issued and outstanding Common Shares.

In addition, the SPAC intends to raise $20 million through a private placement of convertible debentures to support its expansion strategy, working capital, and general business needs.

The transaction will result in ThinkMarkets becoming a publicly traded company and receiving up to $125 million in net cash proceeds, which will be utilized to pursue the company's growth strategy in new markets and with new products. FG Acquisition Corp's IPO funds, currently held in escrow, amount to approximately $117 million. Furthermore, the parties have initiated a USD 20 million private placement of convertible debentures as part of the agreement, with investment bank Canaccord Genuity serving as the lead agent for the Private Placement.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Italian Regulator Warns Against 5 Websites

The Italian regulator, CONSOB has issued a warning against five websites offering unauthorized financial services. This regulatory action aims to protect the public from fraudulent activities.

Trader Exposes Unethical Practices by STP Trading

A recent allegation against STP Trading has cast doubt on the firm's business practices, highlighting the potential risks faced by retail traders in an increasingly crowded and competitive market.

What Makes Cross-Border Payments Easier Than Ever?

Cross-border payments are now faster, cheaper, and simpler! Explore fintech, blockchain, and smart solutions to overcome costs, delays, and global payment hurdles.

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

The UK Financial Conduct Authority (FCA) has issued a public warning regarding a fraudulent entity impersonating Admiral Markets, a legitimate and authorised trading firm. The clone firm, operating under the name Admiral EU Brokers and the domain Admiraleubrokerz.com, has been falsely presenting itself as an FCA-authorised business.

WikiFX Broker

Latest News

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Bitcoin Nears $100,000: A Triumph of Optimism or a Warning Sign?

Malaysian Man Loses RM113,000 in Foreign Currency Investment Scam

Mastercard Partners with JPMorgan for B2B Cross-Border Payments

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

Coinbase Under Scrutiny Amid Wrapped Bitcoin Delisting Controversy

Currency Calculator