简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Keep Alert: More investors exposed the Ponzi scheme GMG to WikiFX

Abstract:More investors exposed the Ponzi scheme GMG to WikiFX. Here is what we want to show you.

More investors exposed the Ponzi scheme GMG to WikiFX. Here is what we want to show you.

If you want to know more about GMG, make sure to check the article below.

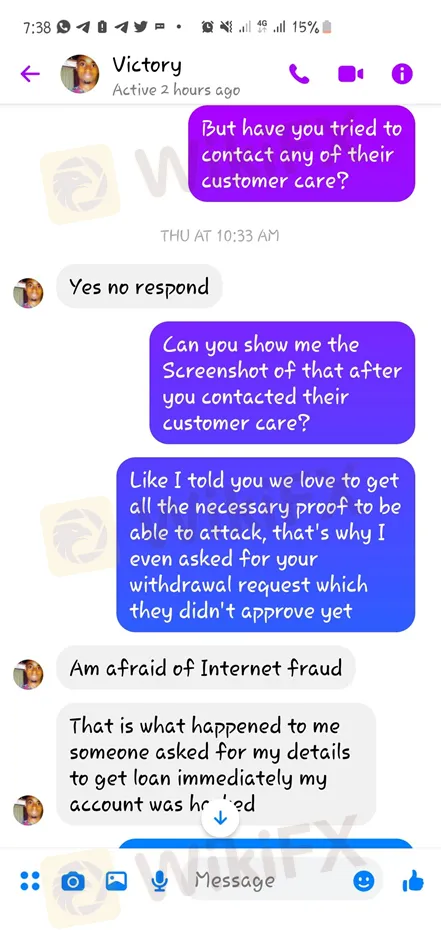

Case: The victim called Victory cannot withdraw his money from GMG, WikiFX tried to help him. See below:

Conclusion

Protecting the legitimate rights and interests of forex traders are always the primary concern of WikiFX. WikiFX exposed this case to the public to remind all traders of the potential risks. After all, what happened to Mr. Victory could happen to any of us. All traders should be vigilant when investing in a broker.

WikiFX is actively reaching out to the victim and other traders hoping to find more evidence.

WikiFX keeps track of developments, providing instant updates on individual traders and helping investors avoid unscrupulous brokers. If you want to know whether a broker is safe or not, be sure to open WikiFXs official website (https://www.WikiFX.com/en) or download the WikiFX APP through this link (https://www.wikifx.com/en/download.html) to evaluate the safety and reliability of this broker!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Google Warns of New Deepfake Scams and Crypto Fraud

Google exposes deepfake scams, crypto fraud, and app cloning trends. Learn how to spot these threats and safeguard your data with expert tips and advice.

Former Director Sentenced for Share Disclosure Breach

Former Copper Strike director convicted for undisclosed shares. Sentenced to 6 months in jail, fined $2,000, and banned from managing companies for 5 years.

DFSA Warns of Fake Loan Approval Scam Using Its Logo

The DFSA warns the public of a fraudulent loan approval letter featuring its logo, aimed at scamming individuals into paying a fake loan fee.

RM900,000 Scammed: The Hidden Dangers of Online Investment Schemes

A 53-year-old factory manager from Malaysia has fallen victim to an online investment scam, losing over RM900,000 of her savings. This case underscores the growing threat of online scams preying on unsuspecting individuals.

WikiFX Broker

Latest News

WikiEXPO Global Expert Interview: The Future of Financial Regulation and Compliance

DFSA Warns of Fake Loan Approval Scam Using Its Logo

Consob Sounds Alarm: WhatsApp & Telegram Users Vulnerable to Investment Scams

CySEC Revokes UFX Broker Licence as Reliantco Halts Global Operations

GCash, Government to Launch GBonds for Easy Investments

eToro Expands Nationwide Access with New York Launch

Webull Partners with Coinbase to Offer Crypto Futures

Why Is UK Inflation Rising Again Despite Recent Lows?

Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Find Regulated Brokers from A to Z on WikiFX

Currency Calculator