简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

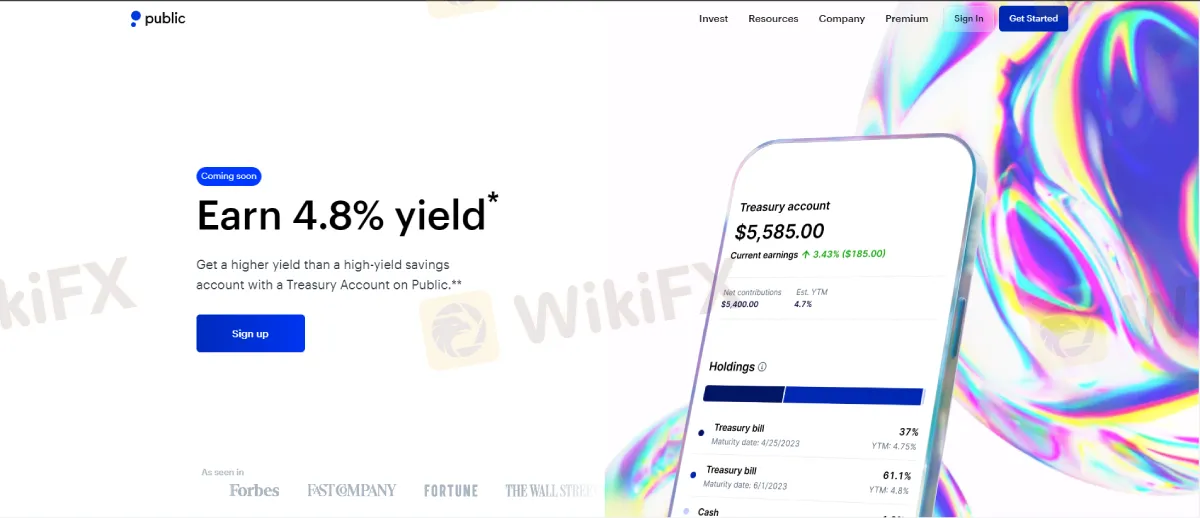

Public.com Will Launch Treasury Accounts

Abstract:Public.com, an online trading platform, intends to provide traders a 4.8% return with a Treasury Account on Public.

Traders who deposit funds in a Treasury Account on Public will get a safe, consistent yield of Treasury bills. The US Treasury issues these short-term securities, which normally provide a greater rate than regular and high-yield savings accounts.

Traders may secure their rate in three easy steps:

Move your funds: By connecting a bank account or making a deposit with your debit card, you may easily transfer your savings to Public.

Make a Treasury Account: After you've transferred your money, you may buy and manage Treasury bills from a single account.

Secure your rate: Treasury bills are fixed-income investments, which implies that their interest rate is established at the moment of purchase.

Jiko Securities, Inc., a licensed broker-dealer and member of FINRA and SIPC provides Treasury bills to the Public. Traders who are Public members may invest in Treasuries for as low as $100 and watch their yield overtime via the app. Furthermore, kids may manage their investments alongside your stocks, ETFs, cryptocurrency, and other assets.

Jiko charges a fixed management fee of 5 basis points per month based on the average daily amount of your Treasury account in exchange for management, trading, and custody of Treasury services. This sum will be debited monthly from your Treasury account. As a referral fee, the public gets a percentage of the management fee.

Download and install the WikiFX App on your mobile phone using the link provided below.

Download link: https://www.wikifx.com/en/download.html

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

What Makes Cross-Border Payments Easier Than Ever?

Cross-border payments are now faster, cheaper, and simpler! Explore fintech, blockchain, and smart solutions to overcome costs, delays, and global payment hurdles.

Coinbase Under Scrutiny Amid Wrapped Bitcoin Delisting Controversy

Coinbase has come under fire after announcing its decision to delist Wrapped Bitcoin (wBTC), a move critics claim could be driven by competitive interests. The delisting, set to take effect on 19 December, has sparked allegations of market manipulation and concerns about fairness in the cryptocurrency ecosystem.

Solana Soars to All-Time High, Hits $264 on Coinbase

Solana hits $264 on Coinbase, breaking its 3-year high with an 11% daily surge. Learn what’s driving SOL's meteoric rise and the crypto market rally.

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

The UK Financial Conduct Authority (FCA) has issued a public warning regarding a fraudulent entity impersonating Admiral Markets, a legitimate and authorised trading firm. The clone firm, operating under the name Admiral EU Brokers and the domain Admiraleubrokerz.com, has been falsely presenting itself as an FCA-authorised business.

WikiFX Broker

Latest News

Webull Partners with Coinbase to Offer Crypto Futures

eToro Expands Nationwide Access with New York Launch

Why Is UK Inflation Rising Again Despite Recent Lows?

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Google Warns of New Deepfake Scams and Crypto Fraud

Currency Calculator