简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

CMA License Has Been Acquired By Ingot Brokers To Expand its Presence In Kenya

Abstract:INGOT expands its reach on the African continent shortly after obtaining the FSCA license in South Africa.

On Tuesday, November 1, 2022, the Capital Markets Authority (CMA) of the Republic of Kenya granted a license to INGOT Africa Ltd. (INGOT Brokers).

Under the Capital Markets Act (Cap 485 A of the laws of Kenya) and the Capital Markets (Online Foreign Exchange Trading) Regulations, 2017, the license would enable INGOT Brokers to operate as a Non-Dealing Online Foreign Exchange Broker.

The CMA license solidifies INGOT Brokers' efforts to strengthen its presence in Africa and provide premium trading services to all investors, building on the milestone achieved in September when INGOT RSA (PTY) LTD received the official Financial Sector Conduct Authority (FSCA) license in South Africa.

INGOT Africa Ltd is committed to empowering youth in Kenya and neighboring nations in both urban and rural regions by delivering free financial literacy education via INGOT Academy, which is meant to educate and train young people on investing and trading financial markets.

The academy also focuses on identifying, educating, and training Introducing Brokers (IBs) and affiliates to help them grow their online trading services and maximize their potential returns by providing them with access to INGOT Brokers' resources such as educational materials, webinars, seminars, and personal training sessions.

INGOT Africa Limited

INGOT Africa Ltd is a premium multi-asset brokerage business that aims to make financial markets open to all traders.

As it offers traders an award-winning platform, good training conditions, tremendous liquidity, and access to financial markets, the firm has established and maintained a world-class trading environment with the greatest quality of online financial services.

It regularly provides a one-of-a-kind trading experience. These include commodities, equities, indices, ETFs, and currencies, among other financial derivatives and CFD instruments.

Furthermore, the INGOT Brokers staff goes above and above to assist customers regardless of their degree of expertise.

What is the CMA, and why do forex brokers need one?

The Capital Markets Authority (CMA) was established in 1989 as a legislative entity under Cap 485A of the Capital Markets Act. Its primary purpose is to regulate and build orderly, fair, and efficient capital markets in Kenya in order to promote market integrity and investor trust.

According to the Act and the rules, the Authority's regulatory tasks include: licensing and regulating all capital market intermediaries; ensuring compliance with the legal and regulatory framework by all market players; Regulating public offerings of securities like shares and bonds, as well as the issuing of other capital market goods like collective investment schemes; Promoting market growth via research on new products and services; In order to adapt to market developments, the legislative framework is being reviewed. Promoting investor education and public awareness, as well as protecting the interests of investors

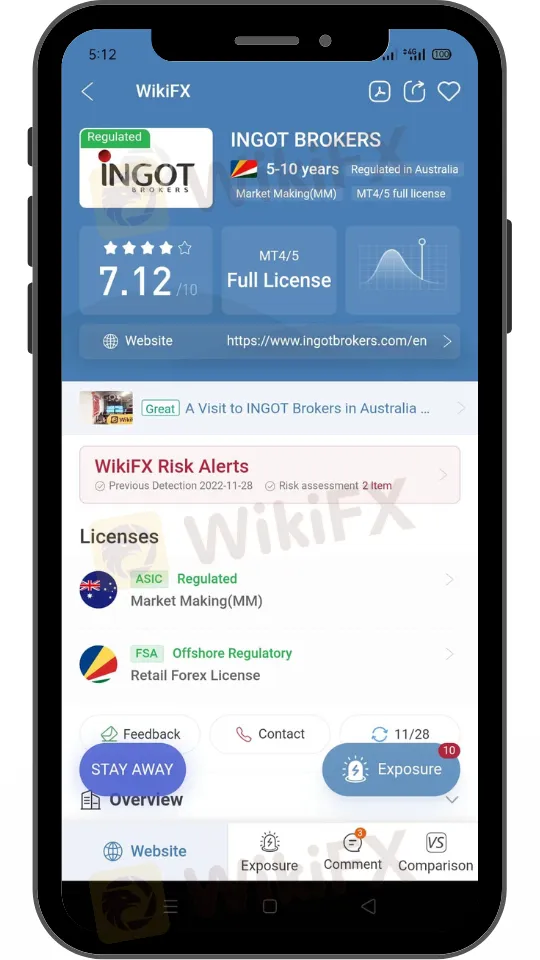

More information about Ingot Brokers may be found at https://www.wikifx.com/en/dealer/2801529700.html.

Stay tuned for more Forex Broker News.

Download the WikiFX App from the App Store or Google Play Store to stay updated on the latest news.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Doo Group Broadens Global Footprint with Indonesian Broker Acquisition

Doo Group has announced its acquisition of PT Prima Tangguharta Futures, a Jakarta-based broker specialising in online derivatives trading. This move represents a significant step in Doo Group's regional expansion strategy and reinforces its growing presence in Southeast Asia.

Webull Partners with Coinbase to Offer Crypto Futures

Webull partners with Coinbase Derivatives to offer crypto futures, providing US investors access to Bitcoin and Ethereum contracts with lower entry barriers.

eToro Expands Nationwide Access with New York Launch

eToro launches in New York, offering fractional stock, ETF, and options trading nationwide. Discover innovative features like copy trading and free education.

Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Interactive Brokers introduces tax-advantaged PEA accounts, offering French clients low-cost access to European stocks and ETFs for diversified savings.

WikiFX Broker

Latest News

WikiEXPO Global Expert Interview: The Future of Financial Regulation and Compliance

DFSA Warns of Fake Loan Approval Scam Using Its Logo

Consob Sounds Alarm: WhatsApp & Telegram Users Vulnerable to Investment Scams

CySEC Revokes UFX Broker Licence as Reliantco Halts Global Operations

GCash, Government to Launch GBonds for Easy Investments

eToro Expands Nationwide Access with New York Launch

Webull Partners with Coinbase to Offer Crypto Futures

Why Is UK Inflation Rising Again Despite Recent Lows?

Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Find Regulated Brokers from A to Z on WikiFX

Currency Calculator