简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

WikiFX Scam Alert: Beware of Winnex-Prime Markets!!!

Abstract:The British regulator FCA issued a warning against Winnex-Prime Markets on September 6th!!!

Investors who are still trading forex at Winnex-prime Markets had better quit trading ASAP!!! Investors who have been deceived by this broker please contact WikiFX to help you recover your funds!!!

To make things straight from the very beginning, on our next screenshot you may check the recent warning on September 6th issued against Winnex-prime Markets (winnex-primemarkets.online) by the Financial Conduct Authority (FCA) in the UK. Take a look (source: https://www.fca.org.uk/news/warnings/winnex-primemarkets-online):

FCA believes that Winnex-prime Markets may be providing financial services or products in the UK without its authorization. Winnex-prime Markets is not authorized by FCA and is targeting people in the UK. Clients will not have access to the Financial Ombudsman Service or be protected by the Financial Services Compensation Scheme (FSCS), so you are unlikely to get your money back if things go wrong!

WikiFX also paid a visit to the broker‘s official website to learn more. Winnex-prime Markets claims to be based in the UK – one of the top locations for forex trading. The country’s financial authority, the FCA, is one of the strictest and most well-respected in the world. However, Winnex-prime Markets is an officially exposed scam! It was blacklisted by the FCA, confirming its unauthorized, meaning that all services advertised by Winnex-prime Markets are practically illegal!

According to the home page, Winnex-Prime Markets is a multi regulated broker, holding licenses from the FCA, ASIC, and the FSCA in South Africa.

The FCA license is obviously a lie, as has been discussed above. WikiFX made the effort to check the registers of ASIC and FSCA, but in vain – no company or broker by the name of Winnex-Prime Markets was to be found there:

Then we read the following on the footer of the website: “This website is not directed at any jurisdiction and is not intended for any use that would be contrary to local law or regulation.”, which is basically a smart way for Winnex-Prime Markets to say that it is not regulated anywhere. Moreover, it is in direct oppositions to the previous regulatory statements. And so, there is no doubt that Winnex-Prime Markets is unlicensed and a risk to all! Do not invest here!

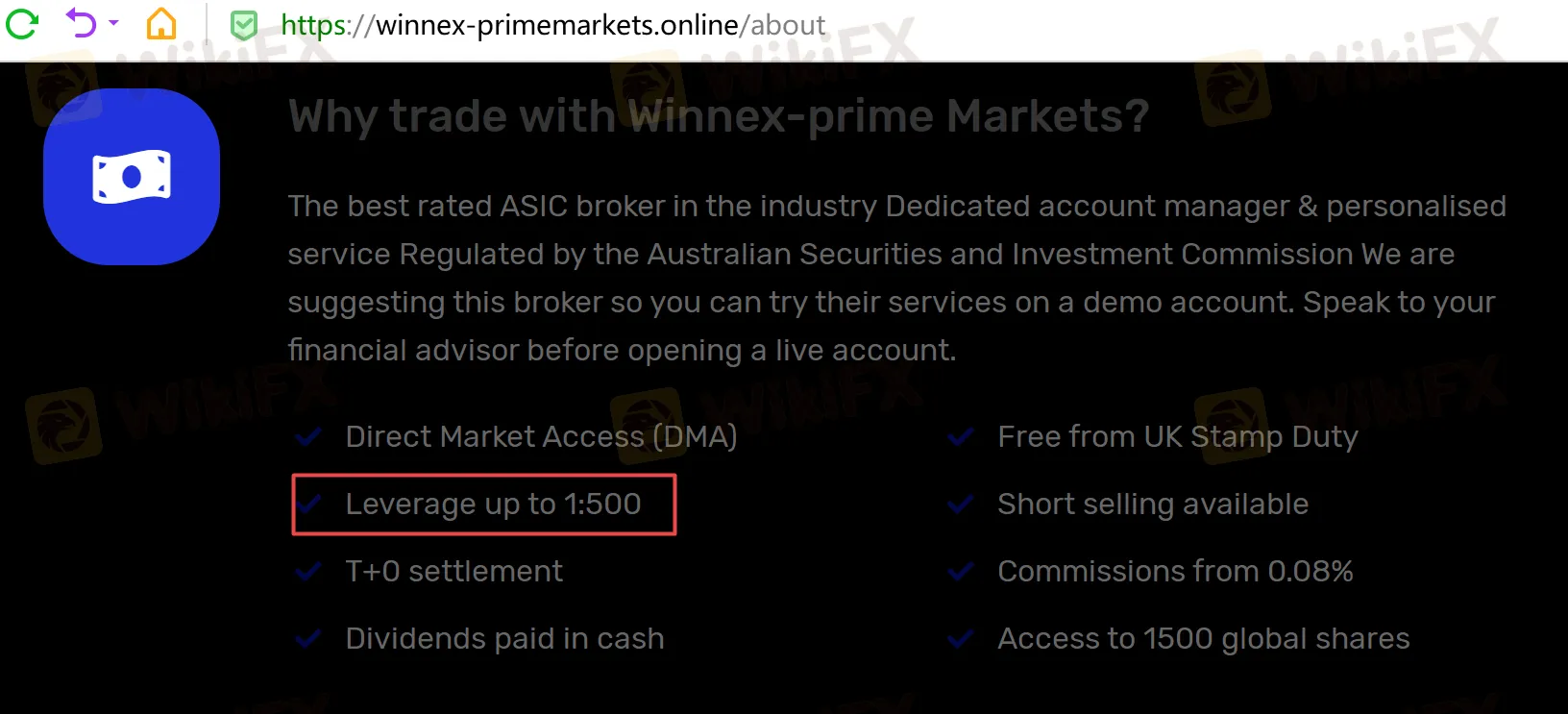

Furthermore, the leverage the broker claims, one of up to 1:500 is too much for the retail client. The Australian regulator ASIC has limited the leverage available to retail clients to up to 1:30. Despite this, Winnex-Prime Markets offers them amounts of up to 1:500, which means it cannot be ASIC-compliant.

As far as the minimum deposit with Winnex-Prime Markets is concerned, the firm sets that to $250, which is incredibly high. Legitimate brokers nowadays instead open accounts for no more than $10 – the so-called micro account. The reason scammers have high deposits, however, is because they wish to get their hands on all of the money you will throw their way! Therefore, a high entry cost could be a scam sign as well.

Now let's search “Winnex-Prime Markets” on WikiFX APP to find out more about this broker. WikiFX is an authoritative global inquiry platform providing basic information inquiry and regulatory license inquiry. WikiFX can evaluate the safety and reliability of more than 36,000 global forex brokers. WikiFX gives you a huge advantage while seeking the best forex brokers.

As you can see, based on information given on WikiFX (https://www.wikifx.com/en/dealer/1646318978.html), Winnex-Prime Markets currently has no valid regulatory license and the score is rather negative - only 0.99/10! WikiFX gives brokers a score from 0 to 10. The higher the score is, the more reliable the broker is.

Investors are advised to search relevant information on WikiFX APP about the broker you are inclined to trade with before finally deciding whether to make investment or not. Compared with official financial regulators which might lag behind, WikiFX is better at monitoring risks related to certain brokers - the WikiFX compliance and audit team gives a quantitative assessment of the level of broker regulatory through regulatory grading standards, regulatory actual values, regulatory utility models, and regulatory abnormality prediction models. If investors use WikiFX APP before investing in any broker, you will be more likely to avoid unnecessary trouble and thus be prevented from losing money! The importance of being cautious and prudent can never be stressed enough.

In a nutshell, it's not wise to invest in Winnex-Prime Markets. The so-called brokerage is nothing more than an outright scam, which is in the spotlight of a recent investigation by the British financial authorities, who have already blacklisted the website for targeting UK customers without proper authorization.

WikiFX reminds you that forex scam is everywhere, you'd better check the broker's information and user reviews on WikiFX before investing. You can also expose forex scams on WikiFX. WikiFX will do everything in its power to help you and expose scams, warn others not to be scammed.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Italian Regulator Warns Against 5 Websites

The Italian regulator, CONSOB has issued a warning against five websites offering unauthorized financial services. This regulatory action aims to protect the public from fraudulent activities.

Trader Exposes Unethical Practices by STP Trading

A recent allegation against STP Trading has cast doubt on the firm's business practices, highlighting the potential risks faced by retail traders in an increasingly crowded and competitive market.

What Makes Cross-Border Payments Easier Than Ever?

Cross-border payments are now faster, cheaper, and simpler! Explore fintech, blockchain, and smart solutions to overcome costs, delays, and global payment hurdles.

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

The UK Financial Conduct Authority (FCA) has issued a public warning regarding a fraudulent entity impersonating Admiral Markets, a legitimate and authorised trading firm. The clone firm, operating under the name Admiral EU Brokers and the domain Admiraleubrokerz.com, has been falsely presenting itself as an FCA-authorised business.

WikiFX Broker

Latest News

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Bitcoin Nears $100,000: A Triumph of Optimism or a Warning Sign?

Malaysian Man Loses RM113,000 in Foreign Currency Investment Scam

Mastercard Partners with JPMorgan for B2B Cross-Border Payments

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

Coinbase Under Scrutiny Amid Wrapped Bitcoin Delisting Controversy

Currency Calculator