简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Trading Platform OctaFX Is Added By BNM To The Financial Consumer Alert List

Abstract:The foreign exchange (forex) trading platform OctaFX has been added to Bank Negara Malaysia's (BNM) list of Financial Consumer Alerts. By doing this, the central bank has made it clear that the platform is neither authorized nor permitted by BNM's regulations.

Bank Negara Malaysia (BNM) has updated its Financial Consumer Alert list to include foreign exchange (forex) trading platform OctaFX. With this, the central bank has clarified that the platform is neither authorised nor approved under the regulations administered by BNM.

In its statement, BNM noted that OctaFX‘s website, as well as official accounts on social media platforms have all been added into the Financial Consumer Alert list. These include the platform’s Facebook, Twitter, Instagram, YouTube, and LinkedIn accounts.

BNM also explained that the Financial Consumer Alert list acts as a guide for investors, so that they are aware of entities and schemes that “may have been wrongly perceived or represented as being licensed or regulated by BNM”. Additionally, the list is updated based on information that is shared by members of the public, with necessary assessments conducted on the reported entities and schemes.

Aside from BNM, the Securities Commission Malaysia (SC), too, had previously added OctaFX to its own Investor Alert List. It was listed based on the justification that the platform had been carrying out capital market activities of dealing in derivatives without a licence, and for operating a recognised market without authorisation from the SC.

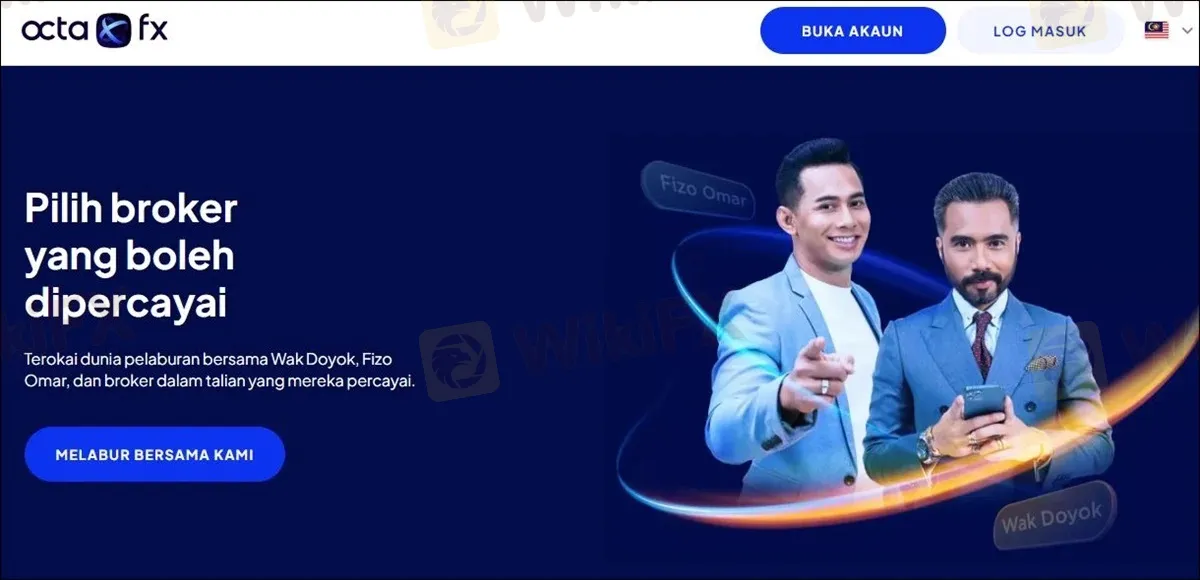

Meanwhile, OctaFX is an international forex broker with presence in over 100 countries globally. Within Malaysia, it has been gradually gaining interest and traction among investors due to its extensive advertisement campaigns, with celebrities such as Fizo Omar and Wak Doyok appearing as “ambassadors”. At the time of writing, the website for OctaFX is still live, along with its social media accounts (such as Facebook).

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Italian Regulator Warns Against 5 Websites

The Italian regulator, CONSOB has issued a warning against five websites offering unauthorized financial services. This regulatory action aims to protect the public from fraudulent activities.

Trader Exposes Unethical Practices by STP Trading

A recent allegation against STP Trading has cast doubt on the firm's business practices, highlighting the potential risks faced by retail traders in an increasingly crowded and competitive market.

What Makes Cross-Border Payments Easier Than Ever?

Cross-border payments are now faster, cheaper, and simpler! Explore fintech, blockchain, and smart solutions to overcome costs, delays, and global payment hurdles.

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

The UK Financial Conduct Authority (FCA) has issued a public warning regarding a fraudulent entity impersonating Admiral Markets, a legitimate and authorised trading firm. The clone firm, operating under the name Admiral EU Brokers and the domain Admiraleubrokerz.com, has been falsely presenting itself as an FCA-authorised business.

WikiFX Broker

Latest News

Hackers Charged for $11M Crypto Theft Using SIM-Swaps

Role of Central Banks in the FX Market

FCA Alerts Against Sydney FX

What Makes Cross-Border Payments Easier Than Ever?

Trader Exposes Unethical Practices by STP Trading

Bitcoin Nears $100,000: A Triumph of Optimism or a Warning Sign?

Malaysian Man Loses RM113,000 in Foreign Currency Investment Scam

Mastercard Partners with JPMorgan for B2B Cross-Border Payments

FCA Identifies Clone Firm Exploiting Admiral Markets' Credibility

Coinbase Under Scrutiny Amid Wrapped Bitcoin Delisting Controversy

Currency Calculator