简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

10 Forex Day Trading Strategies for Beginners

Abstract:This article provides a detailed explanation of the concept of forex day trading. How could those who are just starting out in forex day trading use strategies that are tailored to their own needs? Ten strategies of day trading that are utilized most frequently. You may learn something that will be of great assistance to you in your currency trading through this article.

Overview

1. What is forex day trading?

2. Is forex day trading popular?

3. What should you need to know before starting day trading?

4. How to choose the best forex trading strategy?

5. 10 Most commonly used forex day trading strategies for beginners

6. Conclusion

A Brief Introduction

This article provides a detailed explanation of the concept of forex day trading. How could those who are just starting out in forex day trading use strategies that are tailored to their own needs? Ten strategies of day trading that are utilized most frequently. You may learn something that will be of great assistance to you in your currency trading through this article.

What is forex day trading?

A trading strategy can be defined as a series of rules that that direct a trader in determining when to enter a transaction, how to manage it, and when to close it. The complexity of a trader's trading strategy can range from very simple to quite sophisticated depending on various traders.

Day trading, also known as intra-day trading, is not for the casual investor because it necessitates a substantial investment of time, attention, and effort. It requires rapid decision-making and performing a large number of trades for a modest profit at a time. As a rule, it's seen as a counterpoint to most investment methods, which aim to profit from long-term price swings.

Is forex day trading popular?

Enormous variety of currency pairings to trade and the high market liquidity – the simplicity with which currencies can be bought and sold – the foreign exchange market is a popular choice for day traders just starting out. Forex day trading is commonly utilized to eliminate the fees involved with rolling over positions and to prevent being exposed to overnight market fluctuations.

What should you need to know before starting day trading?

Evaluating a few crucial considerations before beginning to day trade forex or any other market is essential, as it requires more time than the traditional buy and hold strategy. It requires more time than the traditional buy and hold strategy.

Investing is more concerned with long-term market trends, the daily fluctuations in the market have minimal bearing on the overall picture. But when it comes to day trading, the focus is on the market's day-to-day activity. Among them are:

Liquidity

When it comes to trading, a market's liquidity is measured by the ease with which positions can be taken and exited. High liquidity is crucial for day traders because they are likely to execute many trades during the day.

Volatility

Day traders need pay close attention to an asset's volatility, or how quickly the price changes. Volatility during the day might generate many opportunities for short-term earnings if it is projected to be high.

Trading volume

For a particular period, trade volume measures how often an asset is bought or sold. It is useful to identify entry and exit point when there is a significant volume of trading activity.

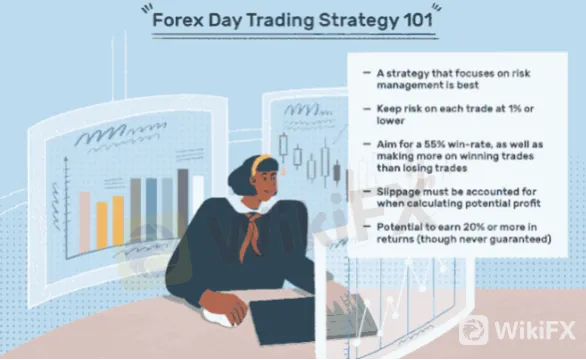

How to choose the best forex trading strategy?

Most forex traders don't immediately discover a winning technique. Backtesting and a demo trading account will be used extensively by the majority of traders. In this way, you are able to run your testing in a risk-free and secure manner.

There is little chance that a trader will stay to the same strategy for a lengthy period of time, even if they have found a technique that works well and feels appropriate to them. Markets always change, and traders must adapt to them.

Inexperienced players may find it easier to adhere to simple methods. Many beginner traders make the mistake of trying to incorporate too many technical indicators into their strategy, which results in a jumbled picture and signals that are difficult to read. Use what you've learned from backtesting and demo trading to make adjustments to your strategy as you go.

10 Most Common Forex Trading Strategies for Beginners

Day trading is more of a trading style than a method, as it merely requires that you not leave a trade open overnight. Many popular day trading tactics can be employed, whether on the forex market or any other market, including

1. Trend Trading

The goal of a trend trader is to profit by examining the price movement of an asset and then purchasing or selling in accordance with the trend's direction.

Traders will take a long position and buy an asset if the trend is up and prices are setting higher highs. Traders would enter a short position by selling if prices were trending downward and made successive lower lows.

Day traders aren't the only ones who engage in trend trading; in fact, you can keep your position open for as long as the trend persists. The one and only exception to this rule is if you are solely interested in intra-day trading.

2. Swing trading

Swing trading is founded on the premise that prices seldom move in a straight line during a trend, and hence it seeks to take advantage of short-term price patterns. Swing trading is all about making both up and down swings in a short amount of time.

Short-term price swings are more important to swing traders than long-term price movements are to trend traders. They try to anticipate these reversals and trade to profit from the lesser market fluctuations that result from them.

3. Scalping

As a short-term approach, scalping tries to achieve high success rates while taking small but regular profits. A large trading account can be created by taking tiny profits over and over again, instead than trying to lock in profits over the long run. A tight exit strategy is necessary for scalping because losses might quickly counteract the gains. Most scalpers will exit their positions before the end of the day since overnight funding charges quickly erode the modest profit margins each trade.

4. Position Trading

In position trading, the idea is to profit from long-term trends while avoiding the daily noise. Positions may be held for weeks, months, or even years by traders who employ this strategy.

It is one of the more difficult trading styles, alongside scalping. It necessitates a trader who is self-disciplined, cool under pressure, and able to ignore the noise in the market.

5. Carry trade strategy

Carry trading is a strategy used by currency traders to profit on the difference in interest rates between the two currencies that make up a currency pair. Interest-rate trading is the practice of purchasing and selling currencies with various rates.

Trading involves buying and selling currencies with different interest rates. Because of Australia's historically high interest rates and Japan's historically low interest rates, the AUD/JPY is a popular illustration of this strategy. Trader's position size determines the interest rate they will be paid.

In the case of a carry trade technique, you might make a lot of interest just by maintaining a position. Of course, this will only work if the market conditions are favorable. A negative PnL will not be offset by interest payments if AUD/JPY is in a strong downturn and you have an open long position in it.

The AUD/JPY chart below shows a time when the currency pair performed exceptionally well, making a carry trade a logical choice.

6. Breakout Trading

The goal of a breakout strategy is to get into a trade as soon as the price breaks out of its range. For traders, a big breakout is a signal to enter a position and profit from a subsequent market movement.

Traders can place buy and sell stop orders, or they can enter positions at the market, in which case they must actively monitor price movement. In most cases, they'll set their stop just below or over the previous resistance or support level. Traders can use classic support/resistance levels to determine their exit targets.

7. Retracement trading

Trades that take advantage of a brief shift in an asset's price action are known as 'retracement trades.' It's important to distinguish between retracements and reversals, as retracements are simply transitory dips in the trend. Retracements are still trading in the direction of the trend, thus it's still a good idea to trade them. Short-term price reversals inside a long-term trend are what you're aiming to take advantage of here.

Retracements can be traded in a variety of ways. You could, for example, utilize trendlines. Below is a chart of the US500 index.

An uptrend has been established, and the rising trendline may have been used as a purchasing opportunity (if the price tests the true trendline).

Fibonacci retracements, notably the 38.2%, 61.8%, and 78.6% levels, are another popular method for trading retracements.

8. Grid trading

Grid trading involves placing numerous orders above and below a predetermined price, with the goal to profit from price fluctuations by placing buy and sell orders at regular intervals above and below the designated price level (for example, every 9 pips above and below).

As price rises in one way, the size of your position and your floating PnL grow in response to that movement. False breakouts or a quick reversal are of course possible consequences.

9. News Trading

To profit from market movements sparked by important news events, traders employ news trading. From a meeting of the Federal Reserve and economic data releases to an unanticipated incident, this category includes it all (natural disaster or geopolitical tensions escalating).

Due to market volatility, trading after the release of new information can be exceedingly dangerous. Additionally, the spreads on the impacted trading instruments may widen dramatically. Your trade may be performed at a substantially worse price than intended or you may have difficulty exiting your trade at the level you had in mind if liquidity evaporates as a result of your trading.

10. Range Trading

Traders using a range trading technique look for trading instruments that are consolidating within a specific range. A 20-pip spread can be as high as several hundred pips, depending on the timeframe you're trading on. What the trader seeks are stable support and resistance levels, i.e. price bounces off the support level and price rejection at the resistance level.

The EUR/SEK currency pair, which is now in a range, is shown below. This price has frequently bounced back off of the 10.00/04 support area while failing to break through the 10.27 to 10.30 resistance area, as can be seen from the low readings of the ADX.

Conclusion

Some traders may find that day trading is a good fit for them, but as their trading careers progress, they may realize that switching to other trading strategies is a better fit. Traders' tastes and the market environment are both continually evolving processes, and this is nothing new.

Therefore, If you want to find out which trading strategies work best for you, you should practice them on a virtual trading account first. When you have a good idea of which one works best for you, you may try it out in the real world.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Singapore Businessman Faces Trial in $1.1 Billion Investment Scam

A 37-year-old Singaporean businessman, Ng Yu Zhi, is currently on trial for allegedly orchestrating one of the largest investment frauds in the country's history. The scheme reportedly defrauded more than 900 investors of SGD1.5 billion (approximately US$1.1 billion) between 2016 and 2021.

Two Victims Lose Over RM660K in Investment Scams

Two individuals recently fell victim to fraudulent investment schemes in Malaysia, losing a combined total of RM660,000. Both cases highlight the persistent threat of online financial scams and the need for caution when engaging with unverified platforms.

Five Reasons Every Trader Needs WikiFX on Their Phone

In the fast-paced world of forex trading, staying informed is essential. Traders need reliable tools to make better decisions and avoid costly mistakes. WikiFX is one such tool that every trader should consider. This application offers a range of features designed to enhance trading safety and provide valuable insights. Here are five reasons why WikiFX is a must-have for traders.

StoneX Financial Secures General Clearing Membership with ECC

StoneX Group Inc. has announced that its subsidiary, StoneX Financial Limited, has been granted General Clearing Member (GCM) status by European Commodity Clearing AG (ECC).

WikiFX Broker

Latest News

Capital.com Collaborated with Amazon in the UAE

Businessman Pleads Guilty to $5.9M Ponzi Scheme

Apple Pay, Google Pay Eyeing Launch in the Philippines

easyMarkets Kicks Off the Start of Its Trade with the Champions Competition

Hurry up!! Octa's New Year Promotion Begins

India Currency Note Scam: Victim Lose ₹3.17 Lakh

Coinbase Integrates Apple Pay for Easy Crypto Onramping

India's Major iX Global & TP Global FX Scam

Why the WikiFX App Should Be Installed on Everyone's Phone

Five Reasons Every Trader Needs WikiFX on Their Phone

Currency Calculator